CR 230 Exempt from FindForms Com

What is the CR 230 Exempt From FindForms com

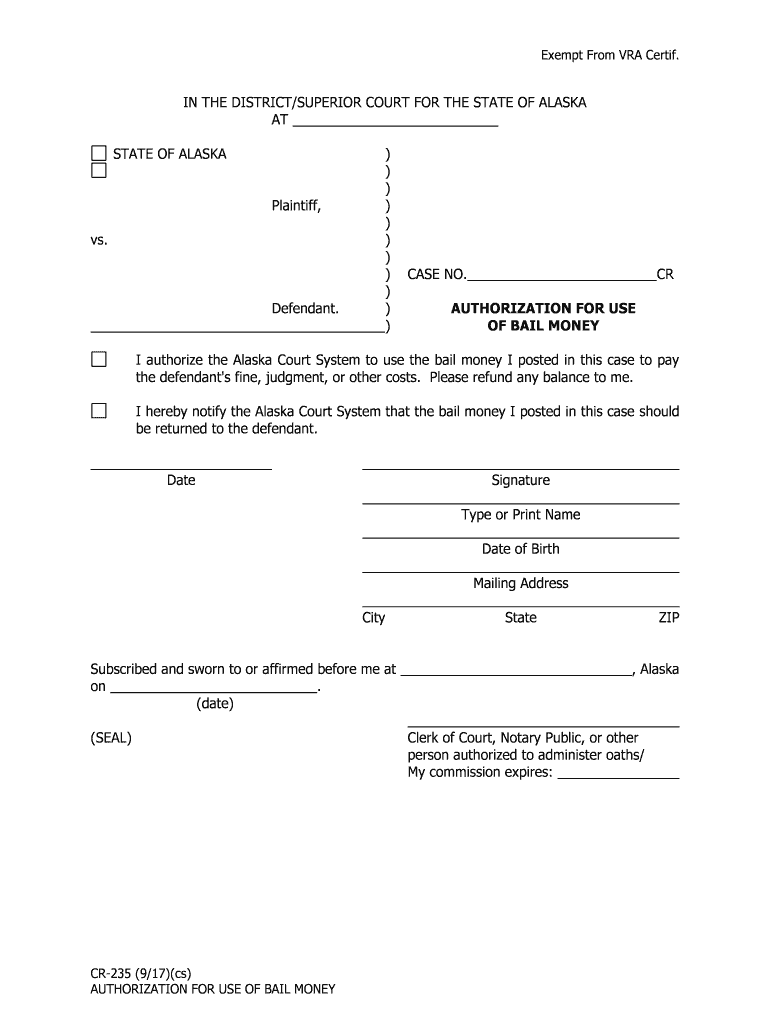

The CR 230 Exempt From FindForms com is a specific form utilized primarily for tax-related purposes in the United States. This form is designed to exempt certain entities or individuals from specific requirements under tax law, allowing for streamlined processing and compliance. It is particularly relevant for those who qualify under certain criteria, ensuring that they can manage their tax obligations effectively without unnecessary complications.

How to use the CR 230 Exempt From FindForms com

Using the CR 230 Exempt From FindForms com involves a straightforward process. First, ensure that you have the correct version of the form, which can typically be downloaded from official tax resources. Next, fill in the required information accurately, including personal details and any relevant exemptions. It is essential to review the form for completeness before submission. Once completed, the form can be submitted electronically, ensuring compliance with digital filing regulations.

Steps to complete the CR 230 Exempt From FindForms com

Completing the CR 230 Exempt From FindForms com involves several key steps:

- Download the form from a reliable source.

- Fill in your personal and financial information as required.

- Indicate the specific exemptions you are claiming.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, depending on your preference.

Legal use of the CR 230 Exempt From FindForms com

The legal use of the CR 230 Exempt From FindForms com is governed by specific tax regulations. To ensure that your submission is legally binding, it is crucial to adhere to all applicable laws regarding electronic signatures and document submissions. Utilizing a compliant eSignature platform, such as signNow, can enhance the legal validity of your form by providing necessary authentication and security measures.

Eligibility Criteria

Eligibility for using the CR 230 Exempt From FindForms com is determined by various factors, including your tax status and the nature of your business or personal finances. Generally, individuals or entities that meet specific criteria set forth by the IRS may qualify for exemptions. It is advisable to review the guidelines carefully to confirm your eligibility before proceeding with the form.

Form Submission Methods (Online / Mail / In-Person)

The CR 230 Exempt From FindForms com can be submitted through multiple methods, providing flexibility for users. The options typically include:

- Online submission via an authorized e-filing platform.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if applicable.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the CR 230 Exempt From FindForms com. These guidelines detail the necessary information required, deadlines for submission, and any supporting documentation that may be needed. Familiarizing yourself with these guidelines is essential to ensure compliance and avoid potential penalties.

Quick guide on how to complete free cr 230 exempt from findformscom

Effortlessly Prepare CR 230 Exempt From FindForms com on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage CR 230 Exempt From FindForms com on any device with airSlate SignNow apps for Android or iOS and enhance any document-related task today.

How to Edit and eSign CR 230 Exempt From FindForms com with Ease

- Find CR 230 Exempt From FindForms com and select Get Form to begin.

- Utilize the tools available to complete your form.

- Select important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as an ink signature.

- Review the information and click on the Done button to secure your adjustments.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign CR 230 Exempt From FindForms com to ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the CR 230 Exempt From FindForms com form?

The CR 230 Exempt From FindForms com form is a specific document designed for certain entities to claim an exemption from the registration requirements for business forms. By understanding this form, businesses can streamline their compliance processes and avoid unnecessary fees.

-

How does airSlate SignNow help with the CR 230 Exempt From FindForms com process?

airSlate SignNow simplifies the process of filling out and submitting the CR 230 Exempt From FindForms com form by providing an easy-to-use digital signing platform. This ensures that all necessary documents are completed accurately and shared securely, saving users time and effort.

-

Is there a cost associated with using airSlate SignNow for the CR 230 Exempt From FindForms com?

While airSlate SignNow offers various pricing plans, users can start with a free trial to assess the platform's features. Pricing is competitive and may depend on the volume of documents processed, making it a cost-effective choice for managing the CR 230 Exempt From FindForms com form.

-

What features does airSlate SignNow provide for eSigning the CR 230 Exempt From FindForms com?

airSlate SignNow provides essential features such as secure eSignatures, customizable templates, and document tracking to facilitate the signing process of the CR 230 Exempt From FindForms com form. These tools enhance the user experience and ensure that all documents are legally compliant.

-

Can airSlate SignNow integrate with other software for managing the CR 230 Exempt From FindForms com?

Yes, airSlate SignNow offers integration capabilities with various business applications. This means you can seamlessly connect your existing systems to streamline the management of your documents, including the CR 230 Exempt From FindForms com, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for my business regarding the CR 230 Exempt From FindForms com?

Using airSlate SignNow for your CR 230 Exempt From FindForms com needs provides a range of benefits, including enhanced security, improved efficiency, and the ability to manage documents from anywhere. These advantages help businesses maintain compliance and improve their workflow.

-

Is there customer support available for airSlate SignNow users dealing with the CR 230 Exempt From FindForms com?

Absolutely! airSlate SignNow offers robust customer support to assist users with any queries regarding the CR 230 Exempt From FindForms com. From live chat to comprehensive help resources, our support team is ready to ensure that your experience is smooth and efficient.

Get more for CR 230 Exempt From FindForms com

- Annual return form form vat xv a himachal pradesh forms himachalforms nic

- In 111 form

- Blue view vision out of network claim form anthem

- Trident tech transcript form

- The georgia high objective uniform state

- Pittsfield middle high school company profile form

- To view the dog registration form white mountain hotel amp resort

- Warranty claim form woodmans parts plus

Find out other CR 230 Exempt From FindForms com

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure