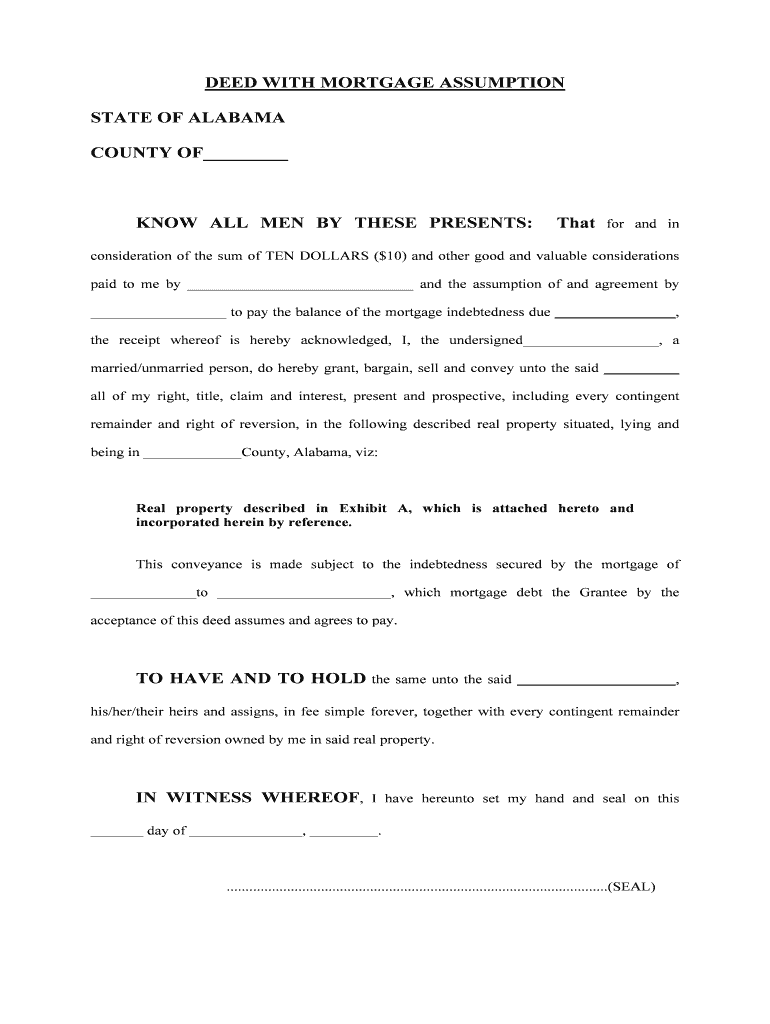

DEED with MORTGAGE ASSUMPTION Form

What is the deed with mortgage assumption?

The deed with mortgage assumption is a legal document that allows a buyer to take over the existing mortgage of a seller when purchasing a property. This arrangement can benefit both parties, as it often allows the buyer to take advantage of lower interest rates or favorable loan terms that the seller secured. In essence, the buyer assumes responsibility for the mortgage, which means they will make the remaining payments and adhere to the original loan terms. This type of deed is particularly useful in real estate transactions where the mortgage is assumable, meaning the lender permits the transfer of the loan to a new borrower.

Key elements of the deed with mortgage assumption

Several crucial components must be included in a deed with mortgage assumption to ensure its validity and effectiveness. These elements typically include:

- Identification of parties: The document must clearly identify the buyer and seller involved in the transaction.

- Description of the property: A detailed description of the property being transferred is necessary, including its address and any relevant legal descriptions.

- Loan details: Information about the existing mortgage, including the loan amount, interest rate, and remaining balance, should be included.

- Assumption clause: A statement indicating that the buyer agrees to assume the mortgage obligations is essential.

- Signatures: Both parties must sign the document to validate the agreement.

Steps to complete the deed with mortgage assumption

Completing a deed with mortgage assumption involves several steps to ensure that the process is smooth and legally binding. Here are the typical steps:

- Review the existing mortgage terms to confirm that it is assumable.

- Draft the deed with mortgage assumption, including all necessary elements.

- Obtain the lender's approval for the assumption of the mortgage.

- Have both parties sign the document in the presence of a notary public.

- File the deed with the appropriate county office to make it a matter of public record.

Legal use of the deed with mortgage assumption

In the United States, the deed with mortgage assumption is recognized as a legal instrument, provided it complies with state laws and the terms set forth by the lender. It is essential that both parties understand their rights and obligations under the agreement. The buyer assumes the mortgage, meaning they are responsible for making payments, while the seller may still be liable if the buyer defaults unless the lender releases them from the obligation. Consulting with a real estate attorney can help clarify these legal implications and ensure compliance with state-specific regulations.

How to obtain the deed with mortgage assumption

Obtaining a deed with mortgage assumption typically involves several steps. First, the buyer and seller should discuss the terms of the mortgage and whether it is assumable. If so, they can draft the deed using templates available online or through legal resources. It may also be beneficial to consult a real estate attorney to ensure the document meets all legal requirements. Once prepared, the deed should be signed by both parties and notarized. Finally, it must be filed with the local county recorder's office to ensure its legality and public record status.

State-specific rules for the deed with mortgage assumption

Each state in the U.S. may have unique rules governing the deed with mortgage assumption. These rules can affect how the document is drafted, executed, and filed. For instance, some states may require specific disclosures or additional documentation to accompany the deed. It is important for both buyers and sellers to familiarize themselves with their state's regulations regarding mortgage assumptions. Consulting with a local real estate attorney can provide guidance tailored to the specific jurisdiction, ensuring compliance and protecting the interests of both parties involved in the transaction.

Quick guide on how to complete deed with mortgage assumption

Complete DEED WITH MORTGAGE ASSUMPTION effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage DEED WITH MORTGAGE ASSUMPTION on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign DEED WITH MORTGAGE ASSUMPTION without any hassle

- Find DEED WITH MORTGAGE ASSUMPTION and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management with just a few clicks from any device of your choice. Modify and eSign DEED WITH MORTGAGE ASSUMPTION and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a DEED WITH MORTGAGE ASSUMPTION?

A DEED WITH MORTGAGE ASSUMPTION is a legal document that allows a buyer to take over the seller's existing mortgage. This document ensures that the buyer assumes the terms of the mortgage, making the transfer of property and debts clear and uncomplicated. Utilizing tools like airSlate SignNow makes the creation and signing of such deeds efficient and secure.

-

How does airSlate SignNow facilitate the signing of a DEED WITH MORTGAGE ASSUMPTION?

airSlate SignNow provides a streamlined platform for creating and signing essential legal documents, including a DEED WITH MORTGAGE ASSUMPTION. Users can easily upload their documents, customize them, and send them for electronic signatures. This eliminates the hassle of paperwork and enhances the efficiency of the transaction.

-

What are the benefits of using airSlate SignNow for DEED WITH MORTGAGE ASSUMPTION?

Using airSlate SignNow for your DEED WITH MORTGAGE ASSUMPTION offers several benefits, such as time savings, cost-effectiveness, and enhanced security. The platform ensures that your documents are legally binding and that all parties can easily access and sign them at their convenience. This simplifies the process of assuming a mortgage and speeds up the transaction.

-

Is there a cost associated with using airSlate SignNow for a DEED WITH MORTGAGE ASSUMPTION?

Yes, airSlate SignNow operates on a subscription-based pricing model, providing users with various plans to choose from based on their needs. Each plan offers features that cater to different levels of document management and electronic signing, making it a cost-effective solution for handling a DEED WITH MORTGAGE ASSUMPTION.

-

Can airSlate SignNow integrate with other tools for managing DEED WITH MORTGAGE ASSUMPTION?

Absolutely! airSlate SignNow offers integrations with numerous applications and systems, allowing users to streamline their workflows when managing a DEED WITH MORTGAGE ASSUMPTION. This capability ensures that you can easily combine document signing with CRM systems, accounting software, and other business tools for optimal efficiency.

-

How secure is airSlate SignNow for handling a DEED WITH MORTGAGE ASSUMPTION?

Security is a top priority for airSlate SignNow. The platform employs encryption and secure data handling practices to protect all documents, including DEED WITH MORTGAGE ASSUMPTION forms. Users can trust that their sensitive information will remain confidential and secure throughout the eSigning process.

-

What types of documents can be created and signed alongside a DEED WITH MORTGAGE ASSUMPTION?

In addition to a DEED WITH MORTGAGE ASSUMPTION, airSlate SignNow allows users to create and sign various legal and business documents. These can include purchase agreements, loan documents, and other contracts necessary for real estate transactions, providing a comprehensive solution for managing all related paperwork.

Get more for DEED WITH MORTGAGE ASSUMPTION

- Water cycle fill in the blank answer key form

- Catering certificate pdf 45386817 form

- Titmus v3 manual form

- Vaccination exemption pursuant to nevada revised 392 437 form

- Dr 0145 form

- I understand that my exposure to patients at hca healthcare facilities with the following vaccine preventable form

- Work schedule agreement template form

- Form cg 213 i new york state department of taxation and finance tax ny

Find out other DEED WITH MORTGAGE ASSUMPTION

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT