Wisconsin Form 5s

What is the Wisconsin Form 5s

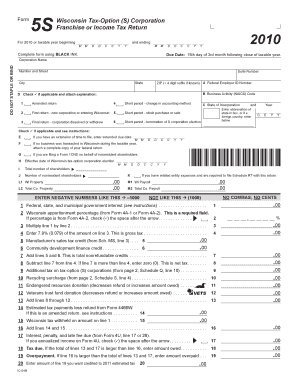

The Wisconsin Form 5s is a state-specific document used for reporting various tax-related information. This form is essential for businesses and individuals who need to comply with Wisconsin tax regulations. It is primarily utilized for income tax purposes and ensures that taxpayers accurately report their earnings and deductions to the state. Understanding the purpose of the Form 5s is crucial for maintaining compliance and avoiding potential penalties.

Steps to complete the Wisconsin Form 5s

Completing the Wisconsin Form 5s involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and receipts for deductions. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, and any other sources.

- List all applicable deductions and credits that you qualify for under Wisconsin tax law.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Each step is vital to ensure the form is filled out correctly and submitted on time.

Legal use of the Wisconsin Form 5s

The Wisconsin Form 5s is legally binding when completed accurately and submitted in accordance with state regulations. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the Wisconsin Department of Revenue. This includes providing truthful information and ensuring that all necessary signatures are included. Failure to comply with these regulations may result in penalties or legal repercussions.

Form Submission Methods

Taxpayers have several options for submitting the Wisconsin Form 5s. These methods include:

- Online Submission: Many taxpayers opt to file electronically through the Wisconsin Department of Revenue's online portal, which provides a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate tax office. Ensure that you use the correct address and include any necessary payment.

- In-Person: Some individuals may choose to submit the form in person at local tax offices for assistance and verification.

Choosing the right submission method can enhance the efficiency of the filing process.

Key elements of the Wisconsin Form 5s

Understanding the key elements of the Wisconsin Form 5s is essential for accurate completion. The main components include:

- Taxpayer Information: This section requires personal details, including name, address, and identification numbers.

- Income Reporting: Taxpayers must report all sources of income, ensuring completeness and accuracy.

- Deductions and Credits: This section allows taxpayers to claim eligible deductions and credits, potentially reducing their tax liability.

- Signature: A signature is required to certify that the information provided is accurate and complete.

Each element plays a crucial role in the overall integrity of the form.

How to obtain the Wisconsin Form 5s

Obtaining the Wisconsin Form 5s is straightforward. Taxpayers can access the form through the Wisconsin Department of Revenue's official website, where it is available for download in a fillable format. Additionally, hard copies of the form can be requested at local tax offices or through mail. Ensuring you have the most current version of the form is essential for compliance.

Quick guide on how to complete wisconsin form 5s

Effortlessly Prepare Wisconsin Form 5s on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your files quickly and without delays. Handle Wisconsin Form 5s on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-centric process today.

How to Modify and eSign Wisconsin Form 5s with Ease

- Obtain Wisconsin Form 5s and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Wisconsin Form 5s, ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form 5s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling Wisconsin Form 5S instructions 2023?

airSlate SignNow offers robust features like customizable templates, real-time collaboration, and advanced security measures that streamline the completion of Wisconsin Form 5S instructions 2023. These features ensure that your documents are completed accurately and securely, saving you both time and effort.

-

How can airSlate SignNow help me with the Wisconsin Form 5S instructions 2023 process?

By using airSlate SignNow, you can easily upload and manage Wisconsin Form 5S instructions 2023 documents. The platform simplifies the eSignature process, allowing multiple signers and enabling tracking of document statuses, which enhances efficiency and accountability.

-

Is there a free trial available for airSlate SignNow to test Wisconsin Form 5S instructions 2023 functionalities?

Yes, airSlate SignNow offers a free trial that allows you to explore its functionalities, including Wisconsin Form 5S instructions 2023. This trial period helps you assess the platform's usability and features before committing to a subscription.

-

What pricing plans does airSlate SignNow offer for Wisconsin Form 5S instructions 2023?

airSlate SignNow provides various pricing plans that cater to different business needs. These plans are designed to be affordable while offering comprehensive tools for completing Wisconsin Form 5S instructions 2023, ensuring you get great value for your investment.

-

Can I integrate airSlate SignNow with other tools for managing Wisconsin Form 5S instructions 2023?

Absolutely! airSlate SignNow allows for seamless integration with popular tools such as Google Drive, Salesforce, and more. These integrations facilitate smooth workflows when handling Wisconsin Form 5S instructions 2023 documents, enhancing your overall productivity.

-

What benefits does using airSlate SignNow provide for Wisconsin Form 5S instructions 2023?

Using airSlate SignNow for Wisconsin Form 5S instructions 2023 offers numerous benefits, such as improved document turnaround times, enhanced compliance, and reduced paper usage. With its user-friendly interface, you can signNowly reduce administrative burdens and streamline your workflow.

-

How secure is airSlate SignNow when processing Wisconsin Form 5S instructions 2023?

airSlate SignNow prioritizes security with industry-leading encryption and authentication methods. When processing Wisconsin Form 5S instructions 2023, your data is protected, ensuring that your documents are safe and compliant with legal standards.

Get more for Wisconsin Form 5s

- Pond management faqs pa fish and boat commission form

- Tmsm 30 illinois registration trademark or service mark form

- Form unit application

- Report of charter membership worksheet form

- This request for temporary total compensation c 84 is the application you complete to request temporary total form

- Form dbpr bcaib 1

- Fire code land use building review application form

- Daily license applicationauthorization california abc form

Find out other Wisconsin Form 5s

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship