The Following Amount of the Future Earnings of the Debtors is Submitted to the Form

What is the following amount of the future earnings of the debtors is submitted to the

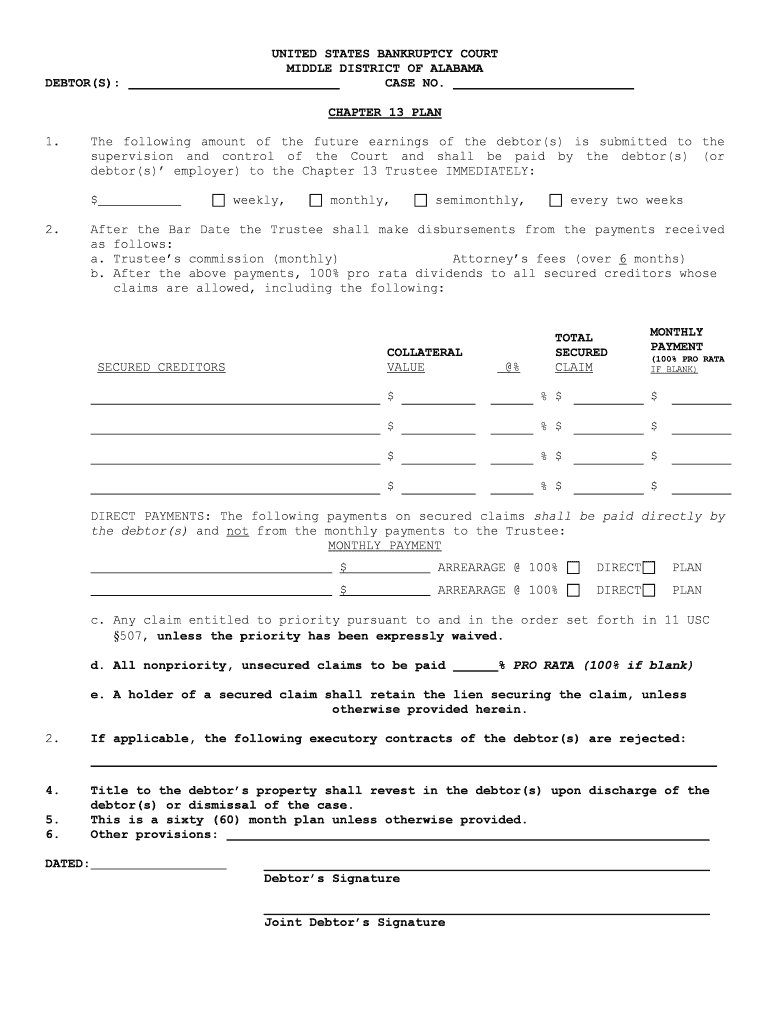

The following amount of the future earnings of the debtors is submitted to the form is a legal document often used in financial and legal contexts. It serves to outline the expected future earnings of a debtor, which can be crucial in various situations such as bankruptcy proceedings, loan agreements, or settlements. This form helps creditors assess the debtor's ability to repay debts based on anticipated income, ensuring transparency and informed decision-making.

Steps to complete the following amount of the future earnings of the debtors is submitted to the

Completing the following amount of the future earnings of the debtors is submitted to the form involves several key steps:

- Gather necessary financial documents, including income statements and tax returns.

- Clearly outline the expected future earnings, specifying amounts and sources of income.

- Provide accurate personal information, including the debtor's name, address, and identification details.

- Review the form for accuracy and completeness before submission.

- Sign and date the form, ensuring that all parties involved have acknowledged the information provided.

Legal use of the following amount of the future earnings of the debtors is submitted to the

The legal use of the following amount of the future earnings of the debtors is submitted to the form is significant in ensuring that the document holds up in court or during financial negotiations. For the form to be legally binding, it must be filled out accurately and signed by all relevant parties. Additionally, it should comply with applicable laws regarding financial disclosures and debtor-creditor relationships, ensuring that both parties are protected under the law.

Key elements of the following amount of the future earnings of the debtors is submitted to the

Several key elements must be included in the following amount of the future earnings of the debtors is submitted to the form to ensure its effectiveness:

- Debtor Information: Full name, address, and contact details of the debtor.

- Income Projections: Detailed breakdown of expected earnings, including any bonuses or additional income sources.

- Signatures: Required signatures from the debtor and any involved parties to validate the agreement.

- Date of Submission: The date when the form is completed and submitted.

How to use the following amount of the future earnings of the debtors is submitted to the

Using the following amount of the future earnings of the debtors is submitted to the form effectively requires understanding its purpose and implications. Begin by filling out the form with accurate financial projections and personal information. After completing the form, ensure that all parties involved review and sign it. This form can then be submitted to creditors or legal representatives as part of a broader financial agreement or negotiation process, serving as a formal acknowledgment of the debtor's future earning potential.

Examples of using the following amount of the future earnings of the debtors is submitted to the

There are various scenarios in which the following amount of the future earnings of the debtors is submitted to the form is utilized:

- In bankruptcy cases, it helps determine repayment plans based on future income.

- During loan applications, it provides lenders with insight into the debtor's ability to repay.

- In settlement negotiations, it can be used to establish fair terms based on anticipated earnings.

Required documents for the following amount of the future earnings of the debtors is submitted to the

To complete the following amount of the future earnings of the debtors is submitted to the form, several documents are typically required:

- Recent pay stubs or income statements.

- Tax returns from the previous year.

- Any documentation supporting additional income sources, such as rental agreements or investment statements.

Quick guide on how to complete the following amount of the future earnings of the debtors is submitted to the

Complete The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The with ease on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

Steps to modify and eSign The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The effortlessly

- Find The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or black out sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' mean in relation to airSlate SignNow?

In the context of airSlate SignNow, 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' refers to the handling of contractual agreements related to future earnings. SignNow enables businesses to create, send, and eSign these agreements effortlessly, ensuring legality and security.

-

How does airSlate SignNow ensure the security of documents related to 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The'?

airSlate SignNow employs robust security measures including encryption, secure password protection, and compliance with industry standards. This ensures that documents concerning 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' are safe from unauthorized access.

-

What features does airSlate SignNow offer for managing agreements on future earnings?

airSlate SignNow provides a variety of features including customizable templates, automated workflows, and real-time tracking. These features are essential for managing documents related to 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The', allowing for efficient handling of agreements.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, starting with a free trial option. This makes it accessible for companies looking to manage 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' without upfront investments.

-

Can airSlate SignNow integrate with other software for better management of future earnings documents?

Yes, airSlate SignNow supports integrations with numerous applications such as CRM systems and cloud storage services. This allows businesses to streamline processes related to 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' with their existing tools.

-

How can airSlate SignNow benefit small businesses in handling future earnings agreements?

Small businesses can greatly benefit from airSlate SignNow as it simplifies the eSigning process, saving time and resources. Managing documents like 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The' becomes easier and more efficient, allowing smaller teams to focus on growth.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile application that allows users to manage their documents on-the-go. This functionality is especially useful for dealing with agreements related to 'The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The', ensuring that users can eSign and send documents from anywhere.

Get more for The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The

- Mc 371 100062728 form

- Qut application form

- In the know developing top notch cna form

- Nhss1 14315477 form

- Form 8863 instructions 1560088

- Willingboro high school transcript request form

- Application for readmission southern union state community form

- Temple university student health services philadelphia pa form

Find out other The Following Amount Of The Future Earnings Of The Debtors Is Submitted To The

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online