Form CR 4

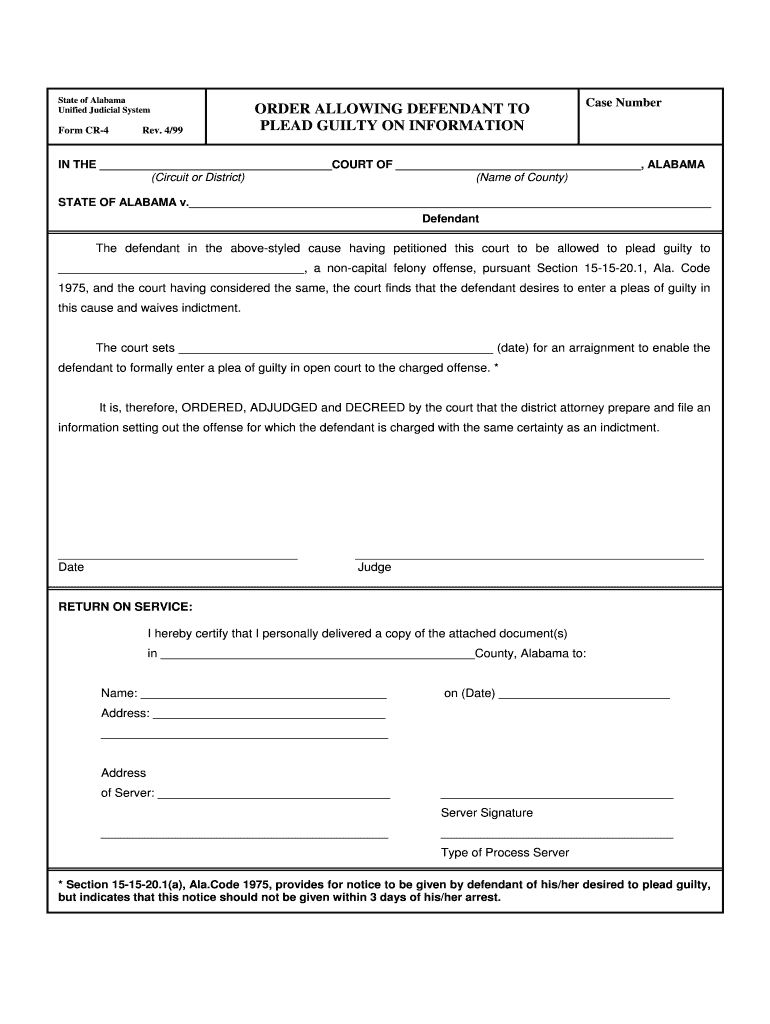

What is the Form CR 4

The CR 4 form is a specific document used in various legal and administrative contexts, primarily within the United States. It serves as a formal request or declaration, often required by governmental agencies or institutions. Understanding the purpose and function of the CR 4 form is essential for individuals and businesses to ensure compliance with regulations and to facilitate necessary processes.

How to use the Form CR 4

Using the CR 4 form involves several steps to ensure that it is completed accurately. First, gather all necessary information, including personal details and any relevant documentation required for the form. Next, fill in the form carefully, ensuring that all fields are completed as instructed. Once filled out, the form may need to be submitted either online, by mail, or in person, depending on the specific requirements of the issuing authority.

Steps to complete the Form CR 4

Completing the CR 4 form requires attention to detail. Follow these steps to ensure accuracy:

- Read the instructions carefully to understand the requirements.

- Gather all necessary information and documents.

- Fill out the form completely, ensuring that all fields are addressed.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission method.

Legal use of the Form CR 4

The CR 4 form is legally binding when completed according to established guidelines. It is crucial to adhere to all legal requirements to ensure that the form is recognized by relevant authorities. This includes providing accurate information, obtaining necessary signatures, and following submission protocols. Compliance with legal standards helps avoid potential disputes or penalties.

Key elements of the Form CR 4

Understanding the key elements of the CR 4 form is vital for successful completion. Important components typically include:

- Personal identification information

- Details relevant to the request or declaration

- Signature lines for all required parties

- Submission instructions and deadlines

Who Issues the Form

The CR 4 form is issued by specific governmental agencies or organizations, depending on its intended use. It is important to identify the correct issuing body to ensure that the form is valid and accepted. This can include state agencies, federal departments, or other regulatory organizations.

Quick guide on how to complete form cr 4

Effortlessly Prepare Form CR 4 on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly option to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any delays. Handle Form CR 4 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form CR 4 with ease

- Find Form CR 4 and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that function.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow manages all your needs in document management with just a few clicks from any chosen device. Edit and eSign Form CR 4 and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CR4 form and how can I use it?

The CR4 form is a legal document that allows you to report income from business activities. With airSlate SignNow, you can easily create, send, and eSign your CR4 form electronically, streamlining the document process and ensuring compliance.

-

How does airSlate SignNow enhance my experience with the CR4 form?

airSlate SignNow simplifies the process of handling your CR4 form by providing a user-friendly interface and reliable eSignature capabilities. This ensures that your documents are signed quickly and securely, improving your overall workflow.

-

What are the pricing options for using airSlate SignNow to handle my CR4 form?

airSlate SignNow offers several affordable pricing plans tailored to suit your needs, including options for individuals and businesses. By choosing a plan, you gain access to tools that help manage your CR4 form and other important documents efficiently.

-

Can I integrate airSlate SignNow with other applications for my CR4 form processing?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to access your CR4 form and related documents easily, creating a cohesive workflow across platforms.

-

Is airSlate SignNow secure for sending and signing my CR4 form?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your CR4 form during transmission and storage. You can trust that your documents are safe and secure.

-

What features does airSlate SignNow offer for managing the CR4 form?

airSlate SignNow provides a range of features for effectively managing your CR4 form, including templates, payment options, and automatic reminders for signatories. These tools help ensure that your document processes are smooth and efficient.

-

How can I track the status of my CR4 form using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your CR4 form in real-time. The platform allows you to see who has signed, who still needs to sign, and any actions taken, providing full transparency in the document workflow.

Get more for Form CR 4

- Michigan quitclaim deed from two individuals to one individual 4405973 form

- Idaho form 75

- Certificate of trust minnesota form

- Gate application form

- Landlord estoppel certificate form

- Hipaa consent form

- Il small estate affidavit st clair county circuit clerk form

- Form 29 541 certificate showing residence and heirs of

Find out other Form CR 4

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form