Form Excise Tax 2015

What is the Form Excise Tax

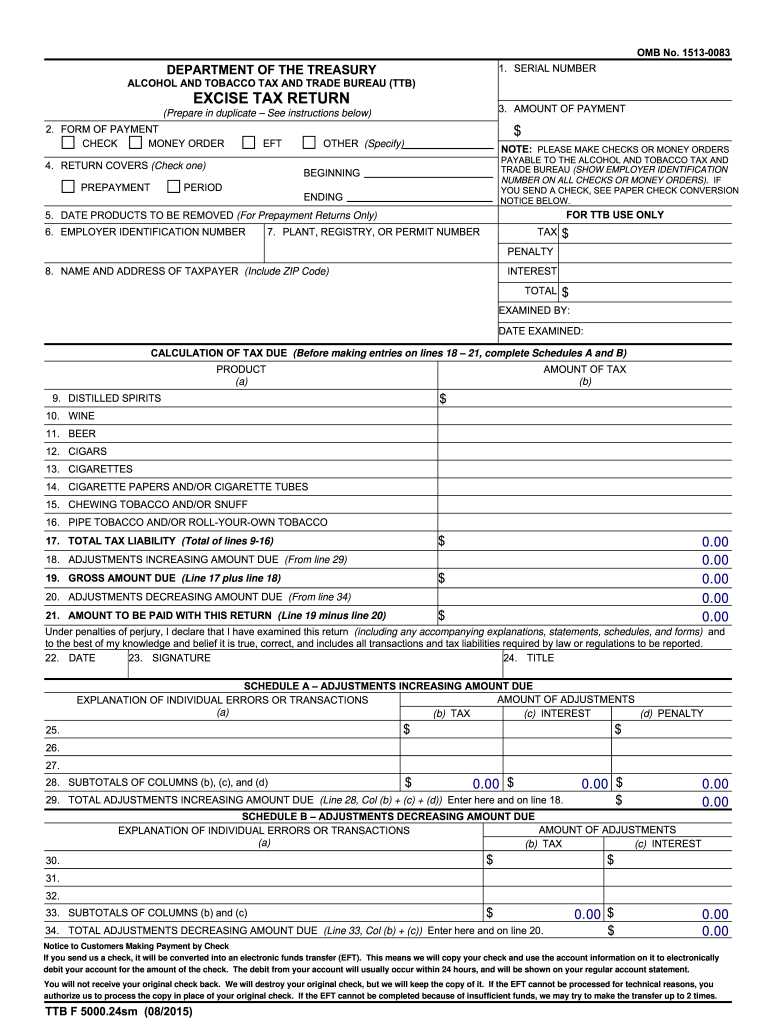

The Form Excise Tax is a tax form used by businesses and individuals in the United States to report and pay excise taxes. Excise taxes are imposed on specific goods, services, and activities, such as fuel, alcohol, tobacco, and certain environmental pollutants. This form is essential for compliance with federal tax regulations and is typically submitted to the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is crucial for anyone involved in industries subject to excise taxes.

How to obtain the Form Excise Tax

To obtain the Form Excise Tax, individuals and businesses can visit the official IRS website, where the form is available for download. It is important to ensure that you are accessing the most current version of the form, as outdated forms may not be accepted by the IRS. Additionally, you can request a physical copy by contacting the IRS directly or visiting a local IRS office. Having the correct form is a vital first step in fulfilling your tax obligations.

Steps to complete the Form Excise Tax

Completing the Form Excise Tax involves several key steps:

- Gather necessary information: Collect all relevant data, including details about the goods or services subject to excise tax.

- Fill out the form: Carefully enter the required information in each section of the form, ensuring accuracy.

- Review for completeness: Double-check that all fields are completed and that you have included any necessary attachments.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Key elements of the Form Excise Tax

The Form Excise Tax includes several key elements that must be accurately completed:

- Taxpayer information: This section requires the name, address, and identification number of the taxpayer.

- Type of excise tax: Specify the type of excise tax being reported, such as fuel or alcohol.

- Tax calculation: Provide details on how the tax amount was calculated, including quantities and rates.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form Excise Tax vary depending on the specific type of excise tax being reported. Generally, the IRS requires that the form be filed quarterly or annually, depending on the taxpayer's circumstances. It is crucial to be aware of these deadlines to avoid penalties. Mark your calendar with the specific due dates for your excise tax submissions to ensure timely compliance.

Penalties for Non-Compliance

Failure to file the Form Excise Tax on time or inaccuracies in the form can result in significant penalties. The IRS may impose fines based on the amount of tax owed, and interest may accrue on unpaid taxes. Additionally, repeated non-compliance can lead to more severe consequences, including audits or legal action. Understanding these penalties emphasizes the importance of accurate and timely filing.

Quick guide on how to complete ttb f 500024sm excise tax return alcohol and tobacco tax and ttb

Unearth the simplest method to complete and endorse your Form Excise Tax

Are you still spending time crafting your official papers on physical forms instead of managing them online? airSlate SignNow presents a superior approach to finalize and sign your Form Excise Tax and equivalent forms for public service. Our intelligent electronic signature platform equips you with everything necessary to process documents swiftly and in line with official standards - robust PDF editing, managing, safeguarding, signing, and sharing tools are all readily available within a user-friendly design.

Only a few steps are needed to complete to finish and endorse your Form Excise Tax:

- Import the editable template to the editor using the Get Form button.

- Identify what details you need to include in your Form Excise Tax.

- Move through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the fields with your information.

- Update the material with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Conceal sections that are no longer relevant.

- Press Sign to create a legally acceptable electronic signature using any method you choose.

- Add the Date next to your signature and conclude your work with the Done button.

Store your completed Form Excise Tax in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our service also offers adaptable file sharing. There’s no requirement to print your forms when submitting them to the appropriate public office - accomplish this via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct ttb f 500024sm excise tax return alcohol and tobacco tax and ttb

FAQs

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the ttb f 500024sm excise tax return alcohol and tobacco tax and ttb

How to create an electronic signature for your Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb in the online mode

How to create an electronic signature for the Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb in Chrome

How to make an eSignature for putting it on the Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb in Gmail

How to make an eSignature for the Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb right from your smart phone

How to create an electronic signature for the Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb on iOS

How to make an eSignature for the Ttb F 500024sm Excise Tax Return Alcohol And Tobacco Tax And Ttb on Android devices

People also ask

-

What is a Form Excise Tax and why is it important?

A Form Excise Tax is a tax imposed on specific goods and services, and it is essential for businesses to accurately complete this form to comply with federal and state regulations. Using airSlate SignNow, you can efficiently manage and eSign your Form Excise Tax documents, ensuring that you meet all legal requirements without hassle.

-

How can airSlate SignNow help in completing a Form Excise Tax?

airSlate SignNow simplifies the process of completing a Form Excise Tax by providing an intuitive platform where you can easily fill out and eSign your documents. With its user-friendly interface, you can quickly gather necessary information and submit your Form Excise Tax without any delays, making compliance straightforward.

-

Is airSlate SignNow cost-effective for filing Form Excise Tax?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file their Form Excise Tax. With affordable pricing plans, you can access powerful features that streamline your document management process, ultimately saving you time and money when dealing with excise tax forms.

-

What features does airSlate SignNow provide for managing Form Excise Tax?

airSlate SignNow provides features like customizable templates, secure eSigning, and real-time tracking for managing your Form Excise Tax. These tools not only enhance efficiency but also improve accuracy, ensuring that your submissions are correct and timely.

-

Can I integrate airSlate SignNow with other software for Form Excise Tax management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, allowing you to streamline your Form Excise Tax management. This integration helps keep all your financial documents in sync, reducing the risk of errors and improving workflow.

-

What are the benefits of using airSlate SignNow for Form Excise Tax?

Using airSlate SignNow for your Form Excise Tax offers numerous benefits, including enhanced security for sensitive tax information and the ability to eSign documents from anywhere. Additionally, the platform ensures your forms are processed quickly, helping you avoid penalties for late submissions.

-

How secure is airSlate SignNow for handling Form Excise Tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Form Excise Tax documents. This ensures that your sensitive information remains confidential while you eSign and manage your tax forms online.

Get more for Form Excise Tax

- St 556 lse form

- W 5 nr form

- City of joliet water lien letter form

- Indiana child support services enrollment iara state forms

- Schedule lic pdf 13606 kb city of bloomington bloomington in form

- 1 power attorney form

- Indiana department of revenue power of attorney tax form

- Pub ks 1510 sales tax and compensating use tax booklet rev 12 20 this publication has been prepared by the kansas department of form

Find out other Form Excise Tax

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation