21 3 6 Forms and Information RequestsInternal Revenue

What is the 21 3 6 Forms And Information RequestsInternal Revenue

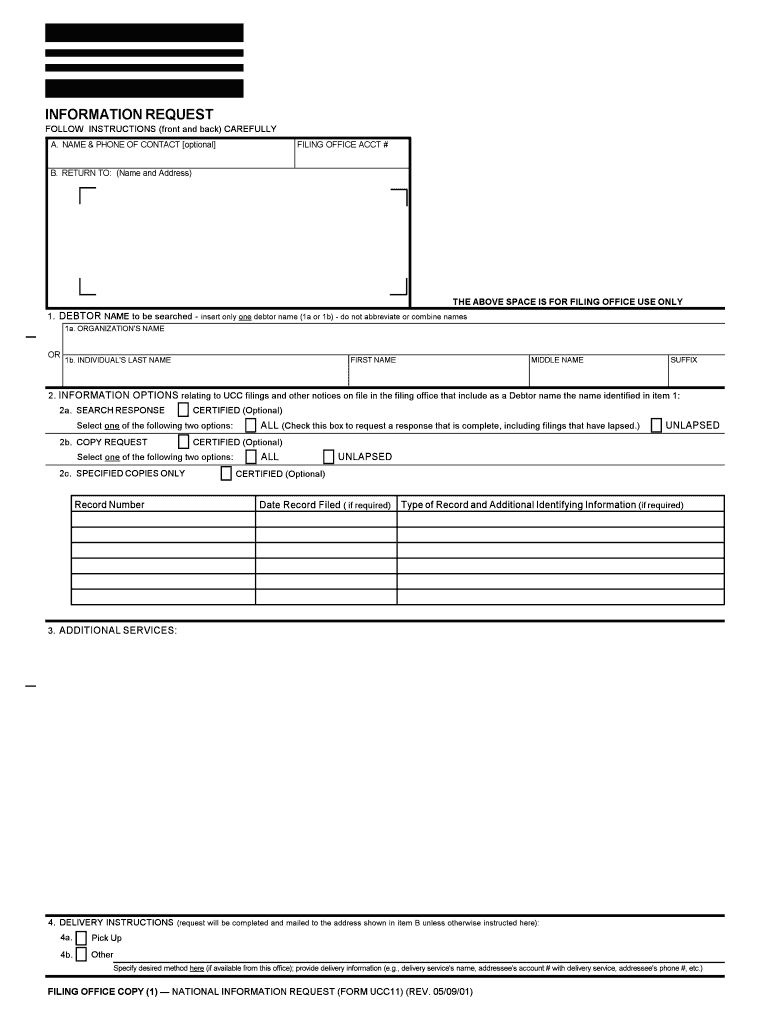

The 21 3 6 Forms And Information RequestsInternal Revenue is a specific set of documents utilized by the Internal Revenue Service (IRS) for various tax-related purposes. These forms facilitate the collection of information necessary for compliance with federal tax regulations. They are essential for individuals and businesses to report income, claim deductions, and fulfill other tax obligations. Understanding these forms is crucial for ensuring accurate reporting and avoiding potential penalties.

How to use the 21 3 6 Forms And Information RequestsInternal Revenue

Using the 21 3 6 Forms And Information RequestsInternal Revenue involves several steps. First, determine the specific form you need based on your tax situation. Next, gather all relevant financial documents, such as income statements and receipts for deductions. Once you have the necessary information, fill out the form accurately, ensuring all details are correct. After completing the form, you can submit it electronically or via mail, depending on the IRS guidelines for that particular form.

Steps to complete the 21 3 6 Forms And Information RequestsInternal Revenue

Completing the 21 3 6 Forms And Information RequestsInternal Revenue requires careful attention to detail. Here are the steps to follow:

- Identify the correct form based on your tax needs.

- Collect all necessary documentation, including income and deduction records.

- Carefully fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS submission guidelines, either online or by mail.

Legal use of the 21 3 6 Forms And Information RequestsInternal Revenue

The legal use of the 21 3 6 Forms And Information RequestsInternal Revenue is governed by federal tax laws. These forms must be completed and submitted in accordance with IRS regulations to ensure they are considered valid. Electronic submissions are legally recognized under the ESIGN Act, provided that the necessary security measures are in place. This includes using a reliable electronic signature solution that complies with federal guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the 21 3 6 Forms And Information RequestsInternal Revenue vary depending on the specific form and the taxpayer's situation. Generally, individual tax returns are due on April fifteenth each year, while business-related forms may have different deadlines. It is important to be aware of these dates to avoid late penalties. Keeping a calendar of important tax-related dates can help ensure timely submission.

Required Documents

To complete the 21 3 6 Forms And Information RequestsInternal Revenue, certain documents are typically required. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation relevant to specific deductions or credits claimed.

Quick guide on how to complete 2136 forms and information requestsinternal revenue

Complete 21 3 6 Forms And Information RequestsInternal Revenue seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Manage 21 3 6 Forms And Information RequestsInternal Revenue on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 21 3 6 Forms And Information RequestsInternal Revenue with ease

- Obtain 21 3 6 Forms And Information RequestsInternal Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you'd like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign 21 3 6 Forms And Information RequestsInternal Revenue and maintain exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 21 3 6 Forms and Information Requests Internal Revenue?

The 21 3 6 Forms and Information Requests Internal Revenue refer to specific forms and requests made to the IRS for tax-related information. Understanding these forms is essential for both individuals and businesses to ensure compliance and efficient tax management. Using airSlate SignNow, you can easily eSign and send these documents securely.

-

How can airSlate SignNow help with 21 3 6 Forms and Information Requests Internal Revenue?

airSlate SignNow streamlines the process for handling 21 3 6 Forms and Information Requests Internal Revenue by providing a simple interface to eSign and manage these documents. Our platform is designed to reduce turnaround time, making it easier for businesses to stay compliant with IRS requirements. Additionally, our document tracking feature ensures you know the status of your requests.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to different business needs. We provide flexible subscription options that allow you to choose the features most relevant to your use of 21 3 6 Forms and Information Requests Internal Revenue. You can explore our website for a detailed breakdown of pricing and included features.

-

Are there any features specific to tax forms like 21 3 6 Forms and Information Requests Internal Revenue?

Yes, airSlate SignNow includes features like customizable templates specifically designed for tax forms, including the 21 3 6 Forms and Information Requests Internal Revenue. This saves you time and ensures accuracy when preparing IRS submissions. The platform also enables real-time collaboration for multiple stakeholders.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software, making it easier to manage 21 3 6 Forms and Information Requests Internal Revenue alongside your other financial documents. Integrating your workflows can increase efficiency and reduce errors when handling tax-related documents.

-

What are the benefits of using airSlate SignNow for IRS forms?

Using airSlate SignNow for 21 3 6 Forms and Information Requests Internal Revenue translates to faster processing and improved security. The platform ensures your documents are encrypted and securely stored, minimizing the risks of data bsignNowes. Plus, eSigning eliminates the need for printing and mailing, making the whole process eco-friendly and efficient.

-

Is airSlate SignNow suitable for large organizations handling numerous tax documents?

Yes, airSlate SignNow is designed to cater to organizations of all sizes, including large businesses that deal with multiple 21 3 6 Forms and Information Requests Internal Revenue. Our scalable solution allows for managing bulk documents while maintaining high levels of security and compliance. Custom roles and permissions ensure that the right team members have access to essential documents.

Get more for 21 3 6 Forms And Information RequestsInternal Revenue

- North york general hospital ct scan requisition form

- Bharat scouts and guides national headquarters form

- Brittney field games4gains christmas color by number form

- California dlseform277

- Employment application pet extreme 00381470doc form

- Sworn statement to close form

- Fillable do not cut or separate forms on this page

- Form 8038 rev september information return for tax exempt private activity bond issues

Find out other 21 3 6 Forms And Information RequestsInternal Revenue

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document