Form 8038 Rev September Information Return for Tax Exempt Private Activity Bond Issues 2022

What is the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

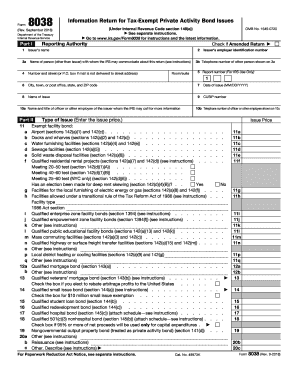

The Form 8038 Rev September is an essential document used by issuers of tax-exempt private activity bonds in the United States. This form serves as an information return that provides the Internal Revenue Service (IRS) with details about the bond issue, ensuring compliance with federal tax regulations. It is specifically designed for private activity bonds, which are issued to finance projects that benefit the public but are primarily used by private entities. The accurate completion of this form is crucial for maintaining the tax-exempt status of the bonds and for reporting the necessary information to the IRS.

Steps to complete the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

Completing the Form 8038 Rev September involves several key steps to ensure accuracy and compliance. First, gather all relevant information about the bond issue, including the purpose of the bonds, the issuer's details, and the amount of bonds issued. Next, fill out the form by providing specific details in each section, such as the date of issue, the type of bond, and the expected use of proceeds. It is important to verify that all information is accurate and complete before submission. Finally, review the completed form for any errors and ensure it is signed by an authorized representative of the issuer.

How to obtain the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

The Form 8038 Rev September can be obtained directly from the IRS website or through authorized tax professionals. The IRS provides the form in a downloadable PDF format, which can be printed and filled out manually. Additionally, tax software that supports IRS forms may also include the Form 8038, allowing for electronic completion and submission. It is advisable to ensure that you are using the most recent version of the form to comply with current regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8038 Rev September are critical for compliance. Generally, the form must be filed within a specific period after the bond issue date, typically within 30 days. It is important to keep track of these deadlines to avoid penalties and maintain the tax-exempt status of the bonds. Issuers should also be aware of any changes in IRS regulations that may affect filing timelines and requirements, as these can vary based on the type of bond and the specific circumstances surrounding the issuance.

Legal use of the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

The legal use of the Form 8038 Rev September is governed by federal tax laws that dictate the reporting requirements for tax-exempt private activity bonds. This form must be filed to ensure that the bonds qualify for tax-exempt status under the Internal Revenue Code. Failure to file the form correctly or on time can result in the loss of tax-exempt status, leading to significant financial implications for the issuer. Therefore, it is essential for issuers to understand the legal obligations associated with this form and to consult with legal or tax professionals if needed.

Key elements of the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

The Form 8038 Rev September includes several key elements that must be accurately reported. These elements typically include the issuer's name, address, and Employer Identification Number (EIN), as well as details about the bond issue, such as the date of issue, the type of bonds, and the purpose of the financing. Additionally, the form requires information on the expected use of proceeds and any relevant compliance with federal tax laws. Each section must be carefully completed to ensure that the form meets IRS requirements and accurately reflects the bond issuance.

Create this form in 5 minutes or less

Find and fill out the correct form 8038 rev september information return for tax exempt private activity bond issues

Create this form in 5 minutes!

How to create an eSignature for the form 8038 rev september information return for tax exempt private activity bond issues

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues?

The Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues is a tax form used by issuers of tax-exempt private activity bonds to report information to the IRS. This form ensures compliance with federal tax regulations and provides essential details about the bond issue.

-

How can airSlate SignNow help with the Form 8038 Rev September Information Return?

airSlate SignNow streamlines the process of preparing and submitting the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues. Our platform allows users to easily fill out, eSign, and send the form securely, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all tailored to assist with the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues. These tools simplify the management of tax forms and enhance collaboration among stakeholders.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion and submission of the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues, ensuring a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your workflow. This integration allows for efficient handling of the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues alongside your existing tools.

-

What are the benefits of using airSlate SignNow for tax-exempt bond issues?

Using airSlate SignNow for tax-exempt bond issues, including the Form 8038 Rev September Information Return, provides numerous benefits such as increased efficiency, reduced errors, and enhanced security. Our platform simplifies the documentation process, allowing you to focus on your core business activities.

-

How secure is the information submitted through airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure data storage to protect all information submitted, including the Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues, ensuring that your sensitive data remains confidential.

Get more for Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

- Personal income tax and non resident employees nycgov form

- Instructions for form ct 3 a department of taxation and

- Instructions for forms c 3 s new york s corporation franchise tax

- Wwwuslegalformscomform librarytaxny dtf ct 34 i 2020 2021 fill out tax template onlineus

- Wwwtaxnygovpdfcurrentformsform nyc 210 claim for new york city school tax credit tax

- Form it 201 x new york amended resident income tax

- Form it 216 ampquotclaim for child and dependent care credit

- Wwwirsgovbusinessessmall businesses selffaqs for disaster victimsinternal revenue irs tax forms

Find out other Form 8038 Rev September Information Return For Tax Exempt Private Activity Bond Issues

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement