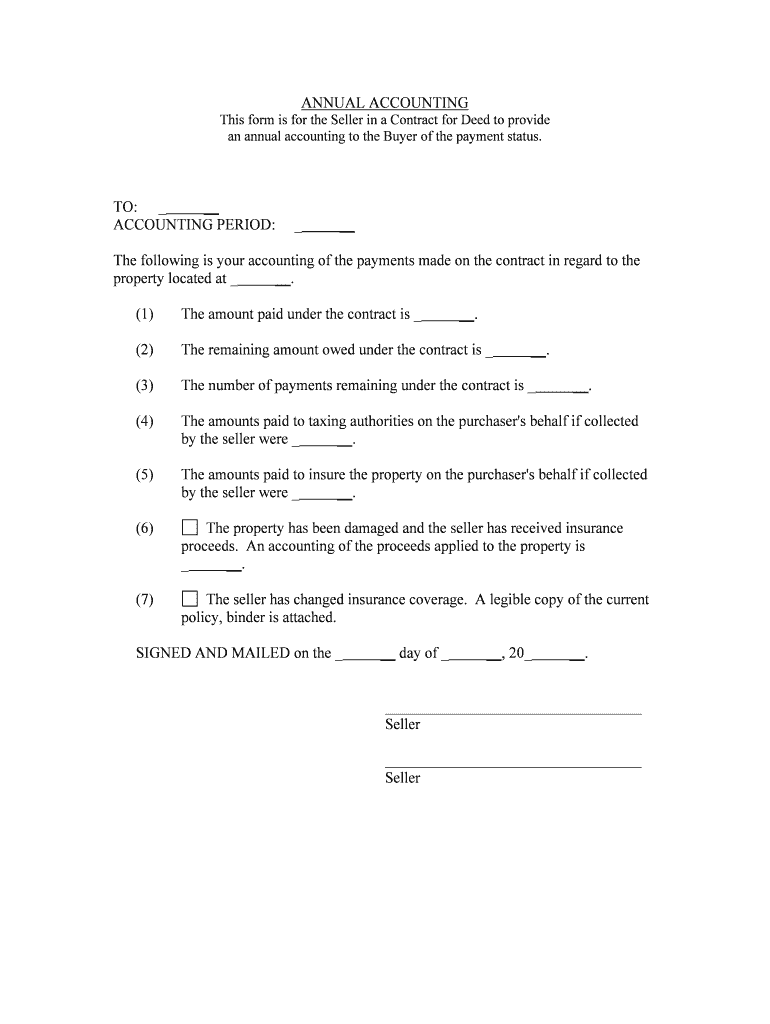

An Annual Accounting to the Buyer of the Payment Status Form

What is the An Annual Accounting To The Buyer Of The Payment Status

The An Annual Accounting To The Buyer Of The Payment Status is a crucial document that provides a comprehensive overview of the financial transactions and payment status between a buyer and a seller over the course of a year. This form is essential for maintaining transparency in business dealings and ensuring that both parties are aware of their financial obligations. It typically includes details such as payment dates, amounts, and any outstanding balances, serving as a formal record that can be referenced in future transactions or disputes.

Steps to complete the An Annual Accounting To The Buyer Of The Payment Status

Completing the An Annual Accounting To The Buyer Of The Payment Status involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial records, including invoices, receipts, and payment confirmations. Next, organize this information chronologically to create a clear timeline of transactions. Once organized, fill out the form with precise details, ensuring that all figures are accurate and reflect the true status of payments. After completing the form, review it for any errors or omissions before finalizing it for submission.

Legal use of the An Annual Accounting To The Buyer Of The Payment Status

The legal use of the An Annual Accounting To The Buyer Of The Payment Status is governed by various regulations that ensure its validity and enforceability. For the document to be legally binding, it must include accurate information and be signed by both parties involved in the transaction. Additionally, compliance with eSignature laws, such as the ESIGN Act and UETA, is necessary when submitting the form electronically. These regulations help protect the interests of both the buyer and seller, providing a legal framework for resolving any disputes that may arise.

Key elements of the An Annual Accounting To The Buyer Of The Payment Status

Several key elements must be included in the An Annual Accounting To The Buyer Of The Payment Status to ensure its effectiveness. These elements typically consist of:

- Transaction Dates: The specific dates when payments were made or received.

- Payment Amounts: The total amounts for each transaction, including any adjustments or refunds.

- Outstanding Balances: Any amounts that remain unpaid at the time of reporting.

- Contact Information: Details for both the buyer and seller, including names and addresses.

How to obtain the An Annual Accounting To The Buyer Of The Payment Status

The An Annual Accounting To The Buyer Of The Payment Status can typically be obtained through your accounting department or financial records management system. If you are a buyer, you may request this document directly from the seller. In some cases, businesses may also provide a template or form on their website for easier access. Ensure that you have all necessary information ready to facilitate a smooth request process.

Form Submission Methods (Online / Mail / In-Person)

Submitting the An Annual Accounting To The Buyer Of The Payment Status can be done through multiple methods, depending on the preferences of both parties involved. Common submission methods include:

- Online Submission: Many businesses now offer electronic submission options, allowing users to fill out and eSign the form digitally.

- Mail: The completed form can be printed and mailed to the appropriate party, ensuring that it is sent via a secure method.

- In-Person Delivery: For those who prefer a personal touch, delivering the form in person can provide immediate confirmation of receipt.

Quick guide on how to complete an annual accounting to the buyer of the payment status

Effortlessly prepare An Annual Accounting To The Buyer Of The Payment Status on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate template and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage An Annual Accounting To The Buyer Of The Payment Status on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign An Annual Accounting To The Buyer Of The Payment Status with ease

- Find An Annual Accounting To The Buyer Of The Payment Status and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choice. Adjust and eSign An Annual Accounting To The Buyer Of The Payment Status and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is An Annual Accounting To The Buyer Of The Payment Status?

An Annual Accounting To The Buyer Of The Payment Status is a comprehensive report detailing the payment activities throughout the year. This document ensures transparency and provides essential insights for both buyers and sellers. Businesses can utilize this to maintain clear communication and trust in their financial dealings.

-

How does airSlate SignNow facilitate An Annual Accounting To The Buyer Of The Payment Status?

With airSlate SignNow, creating An Annual Accounting To The Buyer Of The Payment Status is streamlined. Our platform allows for easy eSigning and document sharing, ensuring that all parties can access the necessary information anytime. This boosts efficiency and reduces turnaround times for crucial accounting documents.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when processing An Annual Accounting To The Buyer Of The Payment Status. You can choose from monthly or annual subscriptions, with options tailored to small businesses and large enterprises alike. Each plan includes the essential features to effectively manage your documentation.

-

What features does airSlate SignNow offer for managing payment statuses?

AirSlate SignNow provides features like automated reminders, real-time tracking, and customizable templates for An Annual Accounting To The Buyer Of The Payment Status. These tools help businesses stay organized and ensure that documents are processed efficiently and accurately. Moreover, the user-friendly interface allows for quick adaptations to your existing workflows.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting and business management software. This means you can easily pull data from your systems to create An Annual Accounting To The Buyer Of The Payment Status. Integration simplifies processes and allows for a more cohesive approach to document management.

-

What benefits does eSigning provide for An Annual Accounting To The Buyer Of The Payment Status?

eSigning simplifies the approval process for An Annual Accounting To The Buyer Of The Payment Status by eliminating the need for physical signatures. It speeds up contract turnaround times, enhances security, and provides a clear, audit-friendly trail of transactions. This helps businesses maintain compliance and improves overall efficiency in document handling.

-

Is airSlate SignNow secure for handling sensitive payment information?

Absolutely. AirSlate SignNow is designed with top-tier security measures to protect sensitive information related to An Annual Accounting To The Buyer Of The Payment Status. We implement encryption and compliance with leading data protection regulations, ensuring your documents and payment data are safe at all times.

Get more for An Annual Accounting To The Buyer Of The Payment Status

Find out other An Annual Accounting To The Buyer Of The Payment Status

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service