CONSUMER LOAN APPLICATION L&C1 Form

What is the consumer loan application L&C1

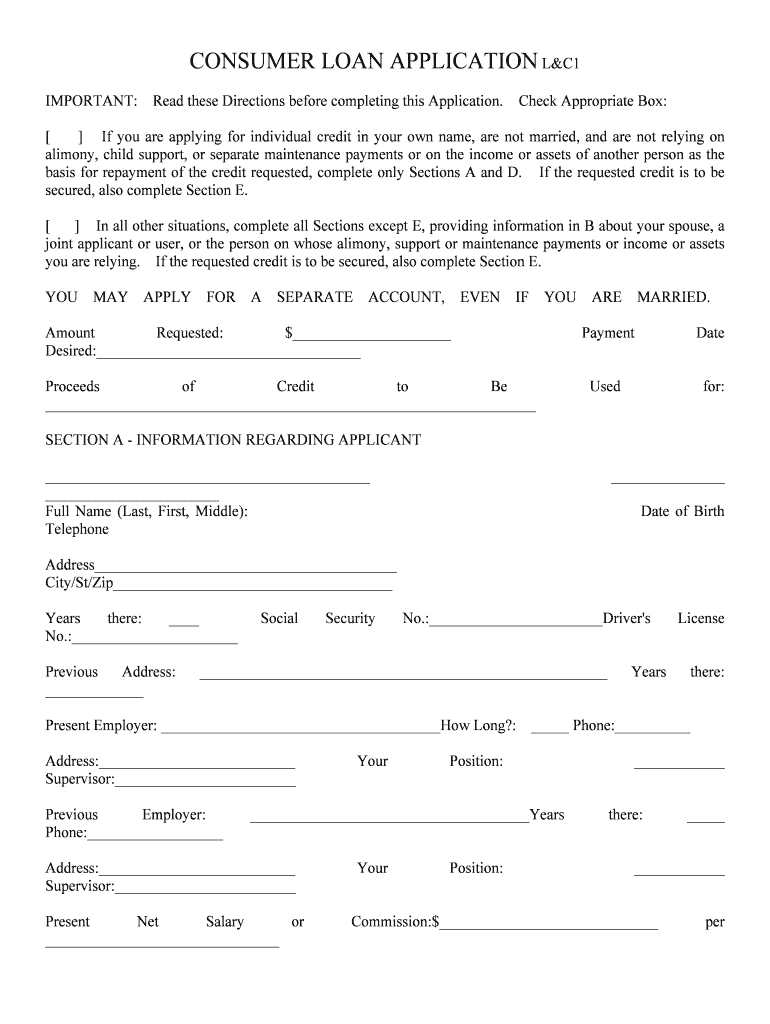

The consumer loan application L&C1 is a formal document used by individuals seeking financial assistance through loans. This form collects essential information about the applicant's financial status, employment history, and personal details. It serves as a foundational step in the loan approval process, allowing lenders to assess the applicant's eligibility and creditworthiness. Understanding the purpose and components of this form is crucial for a smooth application experience.

Steps to complete the consumer loan application L&C1

Completing the consumer loan application L&C1 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary personal information, including your Social Security number, income details, and employment history. Next, carefully fill out each section of the form, ensuring all fields are completed. Review the application for any errors or omissions before submission. Finally, sign and date the form to validate your application. This thorough approach helps streamline the approval process.

Legal use of the consumer loan application L&C1

The consumer loan application L&C1 must be completed in accordance with applicable laws and regulations. It is essential to ensure that the information provided is truthful and accurate, as misrepresentation can lead to legal consequences. The form is designed to comply with federal and state lending laws, which protect both the lender and the borrower. Understanding these legal frameworks can help applicants navigate the loan process more effectively.

Eligibility criteria for the consumer loan application L&C1

Eligibility criteria for the consumer loan application L&C1 typically include factors such as age, income level, credit history, and residency status. Most lenders require applicants to be at least eighteen years old and possess a stable source of income. Additionally, a positive credit history may enhance the chances of approval. Understanding these criteria can help applicants prepare their information and improve their likelihood of securing a loan.

Required documents for the consumer loan application L&C1

When completing the consumer loan application L&C1, applicants must provide several supporting documents to verify their identity and financial status. Commonly required documents include:

- Proof of identity (e.g., driver's license, passport)

- Income verification (e.g., pay stubs, tax returns)

- Employment history documentation

- Bank statements

Having these documents ready can expedite the application process and ensure that all necessary information is provided to the lender.

Application process & approval time for the consumer loan application L&C1

The application process for the consumer loan application L&C1 typically begins with the submission of the completed form and supporting documents. Once submitted, lenders review the application for completeness and accuracy. The approval time can vary based on the lender's policies, but applicants can generally expect a response within a few business days. Factors such as the applicant's creditworthiness and the volume of applications being processed may influence the timeline.

Quick guide on how to complete consumer loan application lampc1

Effortlessly Prepare CONSUMER LOAN APPLICATION L&C1 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage CONSUMER LOAN APPLICATION L&C1 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to Modify and eSign CONSUMER LOAN APPLICATION L&C1 with Ease

- Locate CONSUMER LOAN APPLICATION L&C1 and then click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method of submitting your form, be it via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to missing or misplaced documents, lengthy form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign CONSUMER LOAN APPLICATION L&C1 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow CONSUMER LOAN APPLICATION L&C1?

The airSlate SignNow CONSUMER LOAN APPLICATION L&C1 is a comprehensive e-signature solution designed specifically for the consumer loan application process. It enables businesses to send, sign, and manage loan documents efficiently while ensuring compliance and security.

-

How much does the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 cost?

Pricing for the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 varies based on the subscription model chosen. Our plans are designed to be cost-effective, providing great value for businesses of all sizes looking to streamline their loan application processes.

-

What features are included in the airSlate SignNow CONSUMER LOAN APPLICATION L&C1?

The airSlate SignNow CONSUMER LOAN APPLICATION L&C1 includes features such as customizable templates, bulk sending, and secure storage. Additionally, it offers advanced tracking capabilities and mobile compatibility, allowing users to handle applications seamlessly.

-

What are the benefits of using the airSlate SignNow CONSUMER LOAN APPLICATION L&C1?

Using the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 streamlines the loan application process, reducing paperwork and improving efficiency. This not only enhances customer experience but also speeds up loan approval times, ultimately benefiting your business.

-

Can the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 integrate with other software?

Yes, the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 seamlessly integrates with various CRM and financial software systems. This integration capability allows for a cohesive workflow, maintaining all your data in one place while enhancing productivity.

-

Is the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 secure?

Absolutely! The airSlate SignNow CONSUMER LOAN APPLICATION L&C1 prioritizes security, utilizing bank-level encryption and secure storage protocols to safeguard all sensitive information. This ensures that both businesses and customers can trust the e-signature process.

-

How can businesses get started with the airSlate SignNow CONSUMER LOAN APPLICATION L&C1?

Getting started with the airSlate SignNow CONSUMER LOAN APPLICATION L&C1 is easy! Simply sign up for an account, explore the features through a free trial, and start sending your consumer loan applications electronically in no time.

Get more for CONSUMER LOAN APPLICATION L&C1

Find out other CONSUMER LOAN APPLICATION L&C1

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors