Amended and Restated Deed of Trust Securing a Debt between Individuals Form

What is the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

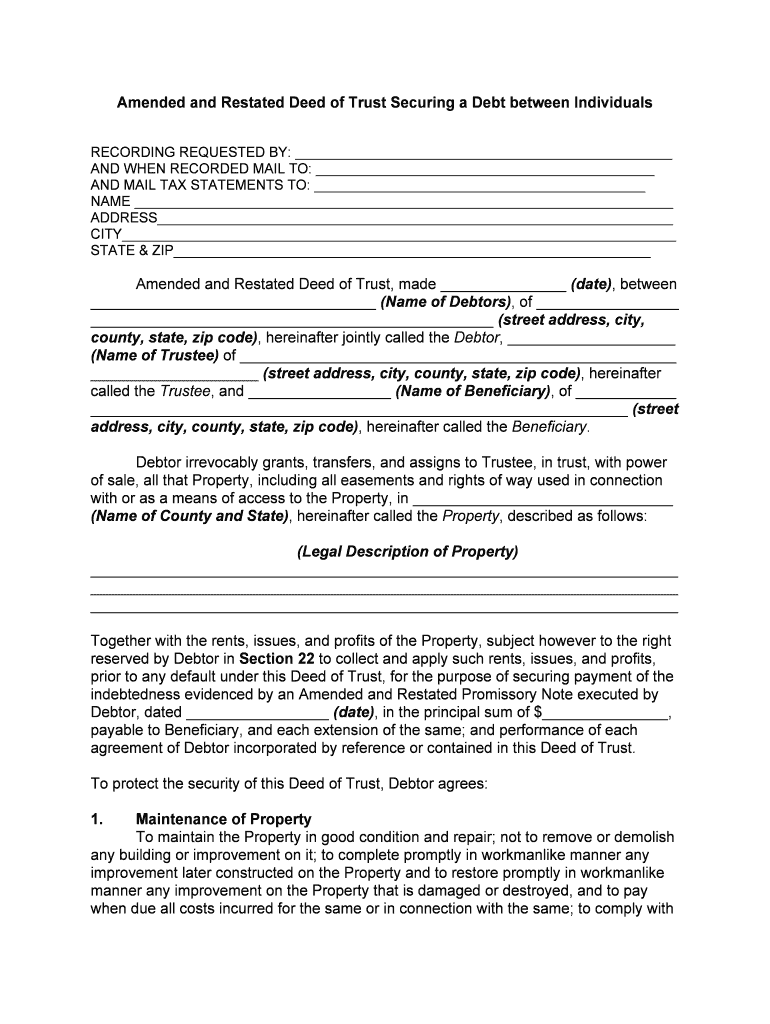

The Amended and Restated Deed of Trust Securing a Debt Between Individuals is a legal document that modifies and updates an existing deed of trust. This form serves to secure a loan or debt obligation between individuals, typically involving real estate as collateral. It outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedules, and the rights and responsibilities of both the borrower and the lender. By amending and restating the original deed of trust, parties can clarify their intentions and ensure that all terms are current and enforceable under the law.

Key Elements of the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

Several critical components must be included in the Amended and Restated Deed of Trust. These elements ensure that the document is comprehensive and legally binding:

- Parties Involved: Clearly identify the borrower and lender, including their legal names and addresses.

- Loan Details: Specify the loan amount, interest rate, and repayment terms to avoid any ambiguity.

- Property Description: Provide a detailed description of the property being used as collateral, including legal descriptions and any relevant identifiers.

- Default Provisions: Outline the conditions under which the lender may declare a default and the remedies available to them.

- Governing Law: Indicate the state laws that will govern the deed of trust, ensuring compliance with local regulations.

Steps to Complete the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

Completing the Amended and Restated Deed of Trust involves several steps to ensure accuracy and legal compliance. Here is a straightforward process to follow:

- Gather Information: Collect all necessary details about the loan, parties involved, and the property.

- Draft the Document: Use a template or legal software to create the amended deed, ensuring all key elements are included.

- Review the Document: Have all parties review the draft for accuracy and completeness.

- Sign the Document: Ensure that all parties sign the document in the presence of a notary public, if required by state law.

- Record the Deed: Submit the signed document to the appropriate county recorder’s office to make it official.

Legal Use of the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

The Amended and Restated Deed of Trust is legally recognized as a binding contract once executed properly. It provides legal protection for the lender by establishing a claim against the property in case of default. The document must comply with state laws regarding deeds of trust to ensure enforceability. Additionally, it is advisable to consult with a legal professional to confirm that all terms are clear and that the document adheres to applicable regulations.

How to Use the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

This form is primarily used in situations where individuals are borrowing money and securing the loan with real estate. Once completed, it serves as a formal agreement that outlines the obligations of both parties. The lender can rely on this document to enforce their rights in the event of a default. It is essential for both parties to keep a copy of the signed deed for their records and to refer to it in case of any disputes regarding the loan.

State-Specific Rules for the Amended And Restated Deed Of Trust Securing A Debt Between Individuals

Each state in the U.S. has its own laws governing deeds of trust, which can affect how the Amended and Restated Deed is executed and enforced. It is important to understand any state-specific requirements, such as notarization, witness signatures, and recording procedures. Some states may have additional disclosures or requirements that must be included in the document. Consulting with a local attorney or real estate professional can provide clarity on these regulations and ensure compliance.

Quick guide on how to complete amended and restated deed of trust securing a debt between individuals

Complete Amended And Restated Deed Of Trust Securing A Debt Between Individuals effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your papers promptly without delays. Manage Amended And Restated Deed Of Trust Securing A Debt Between Individuals on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Amended And Restated Deed Of Trust Securing A Debt Between Individuals with ease

- Find Amended And Restated Deed Of Trust Securing A Debt Between Individuals and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of your documents or blacklist sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious document searches, or errors that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Amended And Restated Deed Of Trust Securing A Debt Between Individuals and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

An Amended And Restated Deed Of Trust Securing A Debt Between Individuals is a legal document that modifies and reaffirms the original terms of a trust deed. This document outlines the obligations of the parties involved and secures the repayment of the debt in question. It is essential for ensuring clarity and compliance with updated terms between borrowers and lenders.

-

How does airSlate SignNow help in creating an Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

airSlate SignNow simplifies the process of creating an Amended And Restated Deed Of Trust Securing A Debt Between Individuals by providing user-friendly templates and editing tools. Users can easily modify existing documents to reflect updated terms and conditions, ensuring they meet legal requirements efficiently. This saves time and reduces the risk of errors, making the document creation process seamless.

-

What are the costs associated with using airSlate SignNow for legal documents?

The pricing for airSlate SignNow varies based on the subscription plan chosen, offering affordable options for businesses of all sizes. Users can benefit from features that cater to document management, including the Amended And Restated Deed Of Trust Securing A Debt Between Individuals. By investing in airSlate SignNow, you gain access to an invaluable tool for managing important legal agreements at a cost-effective rate.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a range of features designed to enhance the document signing experience. Key features include customizable templates, secure eSigning, real-time tracking, and automated reminders for signers. These features are particularly beneficial for managing documents like the Amended And Restated Deed Of Trust Securing A Debt Between Individuals, ensuring timely execution and compliance.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow supports integrations with various software tools that can enhance your workflow. This includes CRM platforms, project management tools, and cloud storage solutions, making it easier to manage the Amended And Restated Deed Of Trust Securing A Debt Between Individuals within your existing systems. These integrations help streamline processes and improve overall efficiency.

-

What are the benefits of using an Amended And Restated Deed Of Trust Securing A Debt Between Individuals?

Using an Amended And Restated Deed Of Trust Securing A Debt Between Individuals can clarify obligations and protect the interests of both parties involved. It allows for the updating of terms, which can better reflect changes in financial situations or agreements. Having a well-drafted document reduces the risk of disputes and provides legal protection for both the borrower and lender.

-

How secure is airSlate SignNow for signing documents?

airSlate SignNow prioritizes the security of all documents, including the Amended And Restated Deed Of Trust Securing A Debt Between Individuals. The platform uses encryption to protect sensitive information, ensuring that only authorized users can access documents. This level of security helps provide peace of mind when handling important legal agreements.

Get more for Amended And Restated Deed Of Trust Securing A Debt Between Individuals

Find out other Amended And Restated Deed Of Trust Securing A Debt Between Individuals

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease