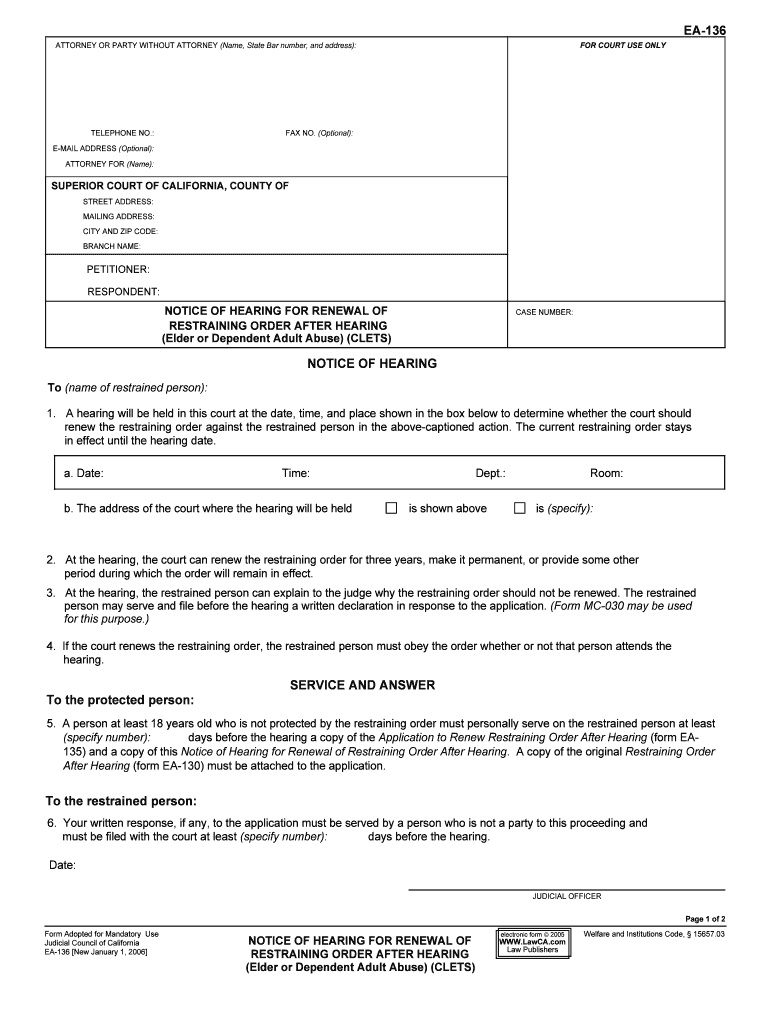

EA 136 Form

What is the EA 136

The EA 136 form is a tax-related document used by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form may be required for various purposes, including the reporting of income, deductions, or credits. Understanding the purpose of the EA 136 is essential for compliance with federal tax regulations.

How to use the EA 136

Using the EA 136 involves accurately filling out the required fields with relevant financial data. Users must ensure that all information is complete and correct to avoid delays or issues with processing. After completing the form, it can be submitted electronically or via traditional mail, depending on the specific requirements outlined by the IRS.

Steps to complete the EA 136

Completing the EA 136 requires several key steps:

- Gather necessary financial documents, such as income statements and tax records.

- Carefully fill out each section of the form, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate IRS address.

Legal use of the EA 136

The EA 136 form is legally binding when completed and submitted according to IRS guidelines. It is crucial to adhere to all regulations regarding eSignatures and document submission to ensure the form's validity. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and other relevant laws is essential for the legal acceptance of the form.

Filing Deadlines / Important Dates

Filing deadlines for the EA 136 vary depending on the specific circumstances of the taxpayer. Generally, forms must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. It is important to stay informed about any changes to these dates to avoid penalties or interest on late submissions.

Required Documents

To complete the EA 136, certain documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of deductions or credits being claimed.

- Previous tax returns for reference.

Who Issues the Form

The EA 136 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. It is important for users to ensure they are using the most current version of the form, as updates may occur periodically.

Quick guide on how to complete ea 136

Complete EA 136 effortlessly on any device

Online document management has gained widespread acceptance among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without setbacks. Manage EA 136 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign EA 136 without exerting effort

- Obtain EA 136 and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign EA 136 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is EA 136 and how does it relate to airSlate SignNow?

EA 136 is a regulatory framework that businesses may need to comply with when using electronic signatures. airSlate SignNow is fully compliant with EA 136, ensuring that your electronically signed documents are legally binding and secure. This means you can trust airSlate SignNow to fulfill your signing needs while remaining within the legal standards set by EA 136.

-

How much does airSlate SignNow cost for users focused on EA 136 compliance?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses focusing on EA 136 compliance. Various subscription tiers are available, ensuring you can choose the plan that fits your budget while accessing the features necessary for EA 136. For detailed pricing, please visit our website or contact sales.

-

What features of airSlate SignNow support EA 136 requirements?

airSlate SignNow includes essential features that support EA 136 compliance, such as secure storage, advanced authentication, and detailed audit trails. These features ensure that every document signed meets the highest security standards required by EA 136. With airSlate SignNow, you can confidently manage your electronic signatures while adhering to legal standards.

-

Can I use airSlate SignNow for teams that require EA 136 compliance?

Yes, airSlate SignNow is designed for teams of all sizes, including those needing EA 136 compliance. The platform allows team collaboration, ensuring all members can securely send and sign documents while meeting legal requirements. Our user-friendly interface also simplifies the process, making it accessible for all team members.

-

How does airSlate SignNow integrate with other tools for EA 136 compliance?

airSlate SignNow seamlessly integrates with various applications, allowing businesses to maintain EA 136 compliance across their workflow. Popular integrations include CRM systems, cloud storage solutions, and project management tools. These integrations make it easy to incorporate electronic signatures into your existing processes while staying compliant.

-

What are the benefits of choosing airSlate SignNow for EA 136 compliance?

Choosing airSlate SignNow for EA 136 compliance offers numerous benefits, such as enhanced security, reduced turnaround time for document signing, and cost-effectiveness. By utilizing airSlate SignNow, you ensure that your documents are signed legally and securely, which can improve efficiency and reduce legal risks. This makes it a smart choice for any business concerned about EA 136.

-

Is airSlate SignNow mobile-friendly for EA 136-related tasks?

Absolutely! airSlate SignNow provides a mobile-friendly platform, enabling users to manage EA 136-related tasks on-the-go. Whether signing documents or sending requests, the mobile app ensures that you can meet your needs anytime and anywhere while remaining compliant with EA 136. This flexibility enhances productivity and responsiveness.

Get more for EA 136

- Refers to para 16 d of sop form

- Driver list template 38912729 form

- Exponential function word problems form

- Delineation of privileges form

- Hano pbv program form

- Hsf 753a abnormal involuntary movement scale aims docx form

- Pilates new client form sample 389312994

- Form it 201 resident income tax return tax year 771988307

Find out other EA 136

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form