Fields 35 Form

What is the Fields 35

The Fields 35 form is a specific document used primarily for reporting certain financial information to the Internal Revenue Service (IRS). It serves as a vital tool for individuals and businesses to ensure compliance with tax regulations. This form is particularly relevant for those who need to disclose specific financial transactions or income types that fall under IRS scrutiny. Understanding its purpose and requirements is essential for accurate reporting and avoiding penalties.

How to use the Fields 35

Using the Fields 35 form involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information that pertain to the transactions or income you need to report. Next, accurately fill out the form, ensuring that all details are correct and complete. Once the form is filled, review it for any errors before submission. Depending on your preference, you can submit the Fields 35 form electronically or via traditional mail. Utilizing digital tools can streamline this process, making it easier to manage your documentation.

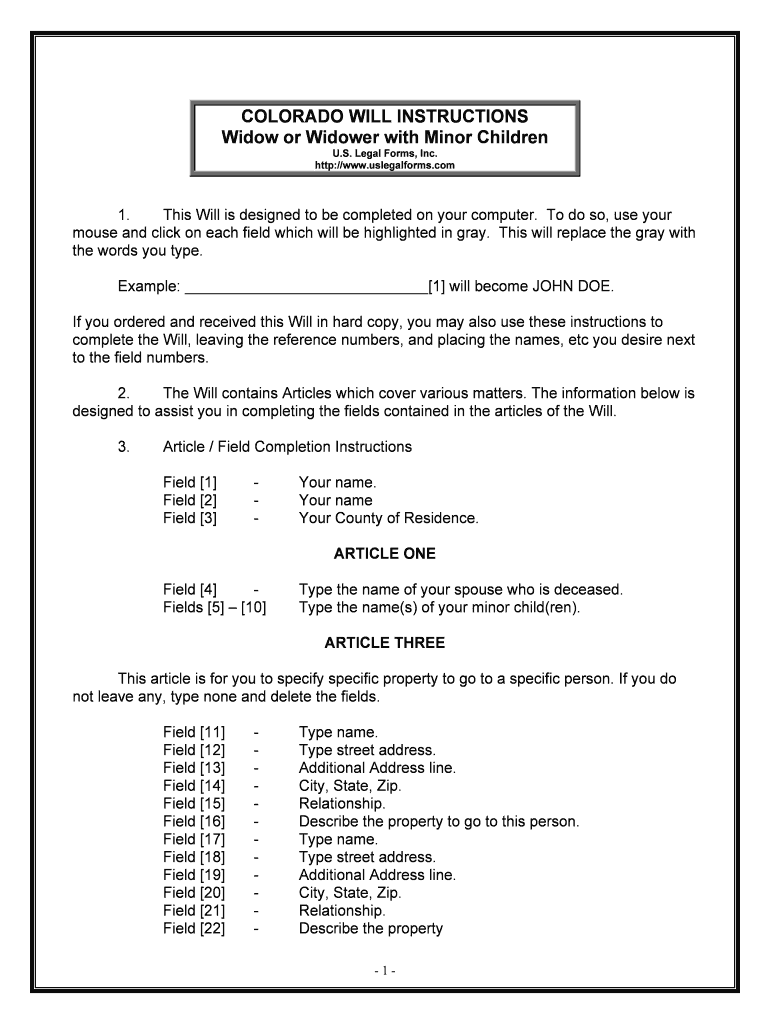

Steps to complete the Fields 35

Completing the Fields 35 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather relevant financial records, including income statements and transaction details.

- Obtain the latest version of the Fields 35 form from the IRS website or a trusted source.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check the information for accuracy, including names, amounts, and identification numbers.

- Choose your submission method: electronic filing or mailing a paper copy.

- Keep a copy of the completed form for your records.

Legal use of the Fields 35

The legal use of the Fields 35 form is governed by IRS regulations. It is crucial to ensure that the information reported is truthful and complete to maintain compliance with tax laws. Failure to accurately report information on this form may result in penalties or audits. The form must be submitted by the specified deadlines to avoid additional fines. Understanding the legal implications of using the Fields 35 form can help individuals and businesses navigate their tax responsibilities effectively.

Key elements of the Fields 35

Several key elements must be included when completing the Fields 35 form. These elements typically include:

- Taxpayer identification information, such as Social Security numbers or Employer Identification Numbers.

- Details of the financial transactions or income being reported.

- Amounts associated with each transaction or income type.

- Signatures or declarations confirming the accuracy of the information provided.

Ensuring all key elements are accurately reported is essential for compliance and successful processing of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Fields 35 form are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing season. It is important to keep track of these dates, as late submissions can incur additional fees and interest on any owed taxes. Marking your calendar with these important dates can help ensure timely compliance and avoid unnecessary complications.

Quick guide on how to complete fields 35

Effectively Prepare Fields 35 on Any Device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Fields 35 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and Electronically Sign Fields 35 with Ease

- Obtain Fields 35 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your files or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your document, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fields 35 and maintain exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Fields 35 in the context of airSlate SignNow?

Fields 35 refer to customizable fields that allow users to input specific data in their documents. With airSlate SignNow, you can create and manage these fields efficiently, ensuring that all necessary information is captured accurately during the eSignature process. This feature enhances document integrity and streamlines workflows.

-

How does airSlate SignNow handle pricing for Fields 35?

airSlate SignNow offers flexible pricing plans that include access to Fields 35. Depending on your chosen plan, you can utilize these fields to collect information at a competitive rate. Our pricing is designed to be cost-effective for businesses of all sizes, providing signNow value for eSigning needs.

-

What benefits do Fields 35 provide for my business?

Fields 35 in airSlate SignNow improve data accuracy and efficiency in document management. By utilizing these customizable fields, you can ensure that all required information is collected seamlessly, reducing turnaround times and enhancing overall productivity. This ultimately leads to better customer satisfaction.

-

Can I integrate Fields 35 with other applications?

Yes, airSlate SignNow allows integration of Fields 35 with various applications, enhancing your workflow capabilities. Whether you're using CRM systems, project management tools, or other software, you can create seamless connections to optimize data entry and document processing. This flexibility ensures that your business processes remain efficient.

-

Are Fields 35 easy to set up and use?

Absolutely! Fields 35 in airSlate SignNow are designed to be user-friendly and straightforward to set up. Users can easily create and customize fields without needing extensive technical skills, making it accessible for all team members to use effectively in their document workflows.

-

What types of documents can utilize Fields 35?

Fields 35 can be used in various document types, including contracts, agreements, and forms created with airSlate SignNow. This versatility allows you to tailor each document to your specific needs, ensuring that relevant information is captured regardless of the document type. This capability signNowly enhances your document management process.

-

How do Fields 35 enhance the eSignature process?

Fields 35 greatly enhance the eSignature process by allowing you to specify where signers need to input information. This clear guidance helps to reduce errors and ensures that all required fields are completed correctly, resulting in a smoother signing experience for all parties involved. This efficiency is critical in expediting document approval.

Get more for Fields 35

- Fraud requirements form

- Okdhs travel claims form

- Sodexo employment application form

- Zahlungsauftrag im aussenwirtschaftsverkehr leister vr dm form

- Electrical application form pdf hdb hdb gov

- Ampquot sleep comes down to soothe the weary eyesampquot paul form

- We are very excited about this permanency pacts and form

- Handbook of technical writing 9th edition academia edu form

Find out other Fields 35

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself