Chase Homeowner Information Packet 2011-2026

What is the Chase Homeowner Information Packet

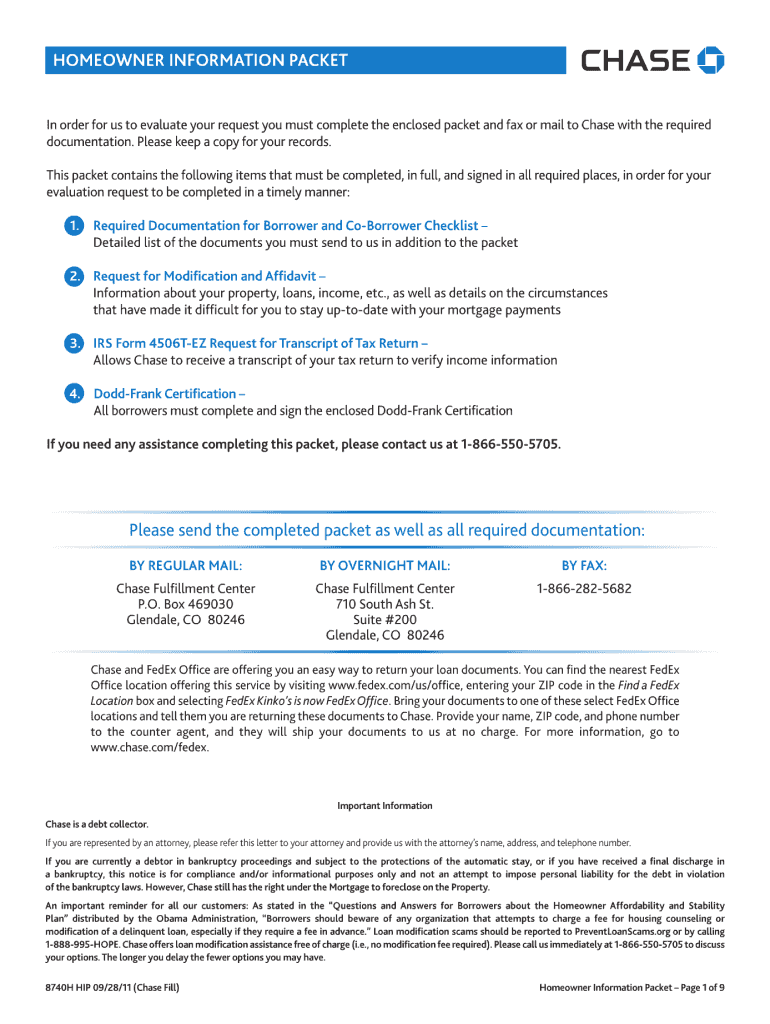

The Chase Homeowner Information Packet is a comprehensive collection of documents and resources designed for homeowners who have a mortgage with Chase Bank. This packet typically includes essential information regarding mortgage terms, payment options, and available assistance programs. It serves as a guide to help homeowners navigate their mortgage responsibilities and understand their rights and options in various situations, such as refinancing, selling, or facing financial difficulties.

Key elements of the Chase Homeowner Information Packet

The Chase Homeowner Information Packet contains several critical components that homeowners should be aware of:

- Mortgage Agreement Details: Information about the terms of the mortgage, including interest rates, payment schedules, and any applicable fees.

- Payment Options: Various methods available for making mortgage payments, including online payment systems and mailing options.

- Assistance Programs: Details about programs that may assist homeowners facing financial hardship, such as loan modification or forbearance options.

- Contact Information: Important contact details for customer service and support, allowing homeowners to seek help when needed.

Steps to complete the Chase Homeowner Information Packet

Completing the Chase Homeowner Information Packet involves several straightforward steps:

- Gather Required Information: Collect necessary documents, such as identification, income statements, and mortgage details.

- Fill Out the Packet: Carefully complete each section of the packet, ensuring all information is accurate and up to date.

- Review for Accuracy: Double-check all entries to avoid errors that could delay processing or cause complications.

- Submit the Packet: Follow the instructions for submission, whether online, by mail, or in person, as specified in the packet.

Legal use of the Chase Homeowner Information Packet

The Chase Homeowner Information Packet is designed for legal use in managing mortgage obligations. Homeowners should ensure that they understand the legal implications of the information contained within the packet. This includes recognizing their rights under federal and state laws, as well as understanding the consequences of failing to comply with mortgage terms. Proper use of this packet can aid in maintaining good standing with Chase Bank and avoiding potential legal issues.

How to obtain the Chase Homeowner Information Packet

Homeowners can obtain the Chase Homeowner Information Packet through several methods:

- Online Access: Visit the Chase Bank website and log into your account to download the packet directly.

- Customer Service: Contact Chase customer service for assistance in obtaining the packet, either by phone or through online chat.

- Branch Visit: Visit a local Chase branch to request a physical copy of the packet from a representative.

Examples of using the Chase Homeowner Information Packet

The Chase Homeowner Information Packet can be utilized in various scenarios, including:

- Refinancing: Homeowners can refer to the packet for guidelines on refinancing options and the necessary documentation required.

- Short Sales: The packet provides information on how to navigate short sales, including required forms and processes.

- Financial Hardship: Homeowners facing financial difficulties can find resources and assistance programs within the packet to help manage their mortgage.

Quick guide on how to complete chase homeowner information packet

The optimal method to obtain and sign Chase Homeowner Information Packet

On a company-wide scale, ineffective procedures concerning paper approvals can eat up substantial work hours. Signing documents such as Chase Homeowner Information Packet is a routine aspect of business operations, which is why the effectiveness of each contract’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your Chase Homeowner Information Packet can be as straightforward and rapid as possible. You’ll discover on this platform the latest version of nearly any form. Even better, you can sign it directly without needing to install external applications on your computer or print anything as physical copies.

How to obtain and sign your Chase Homeowner Information Packet

- Browse our collection by category or use the search bar to find the document you require.

- Check the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and insert any required information using the toolbar.

- Once finished, click the Sign tool to sign your Chase Homeowner Information Packet.

- Choose the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to handle your documents efficiently. You can find, fill out, edit, and even send your Chase Homeowner Information Packet all in one tab without any fuss. Simplify your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How many packets are required to fill 20 4 by 5 litres of curd so that each packet contains 4 by 6?

《8》(204×5)/(4×6)=5×15/6=75/6=25/3=8+(1/3)

-

How many Taco Bell sauce packets would it take to fill up a super soaker?

Probably about a thousand packets, but why do that?If you want something for self defense, you can buy a can of pepper spray for about $25 at Amazon. It's a good affordable price.Or you could just fill up the water gun with pickled pepper juice. It'll definitely work.

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

Create this form in 5 minutes!

How to create an eSignature for the chase homeowner information packet

How to create an eSignature for the Chase Homeowner Information Packet online

How to generate an electronic signature for your Chase Homeowner Information Packet in Google Chrome

How to create an eSignature for putting it on the Chase Homeowner Information Packet in Gmail

How to create an eSignature for the Chase Homeowner Information Packet from your mobile device

How to make an electronic signature for the Chase Homeowner Information Packet on iOS

How to create an electronic signature for the Chase Homeowner Information Packet on Android devices

People also ask

-

What is included in the Chase Homeowner Information Packet?

The Chase Homeowner Information Packet includes essential documents and details that help homeowners understand their mortgage options, insurance requirements, and property management guidelines. By reviewing this packet, you can make informed decisions regarding your home ownership, ensuring you are fully aware of your responsibilities and resources available.

-

How can I access the Chase Homeowner Information Packet?

You can easily access the Chase Homeowner Information Packet online through the Chase website or by contacting your local Chase branch. This packet is designed to provide comprehensive information at your fingertips, making it simple for you to gather all necessary documentation related to your home.

-

Is there a cost associated with obtaining the Chase Homeowner Information Packet?

There is no cost to obtain the Chase Homeowner Information Packet. Chase offers this packet as a free resource to assist homeowners in understanding their mortgage and home management requirements, ensuring that you have the information you need without any financial burden.

-

How does the Chase Homeowner Information Packet benefit new homeowners?

The Chase Homeowner Information Packet is especially beneficial for new homeowners as it outlines crucial information regarding mortgage payments, maintenance tips, and financial planning. With this comprehensive guide, new homeowners can navigate their responsibilities confidently and avoid common pitfalls associated with home ownership.

-

Can the Chase Homeowner Information Packet be customized for individual needs?

While the Chase Homeowner Information Packet provides standardized information, it can often be tailored to fit specific homeowner needs upon request. By discussing your unique situation with a Chase representative, you can receive personalized insights that complement the general information provided in the packet.

-

What features make the Chase Homeowner Information Packet user-friendly?

The Chase Homeowner Information Packet is designed with user-friendliness in mind, featuring clear headings, concise information, and easy navigation. This ensures that homeowners can quickly locate the information they need, making it a valuable resource for understanding their mortgage and property management.

-

Are there any digital tools available with the Chase Homeowner Information Packet?

Yes, the Chase Homeowner Information Packet often includes links to online tools and resources that assist homeowners in managing their mortgages and home-related tasks. These digital tools complement the information in the packet, making it easier to stay organized and informed throughout the homeownership journey.

Get more for Chase Homeowner Information Packet

Find out other Chase Homeowner Information Packet

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online