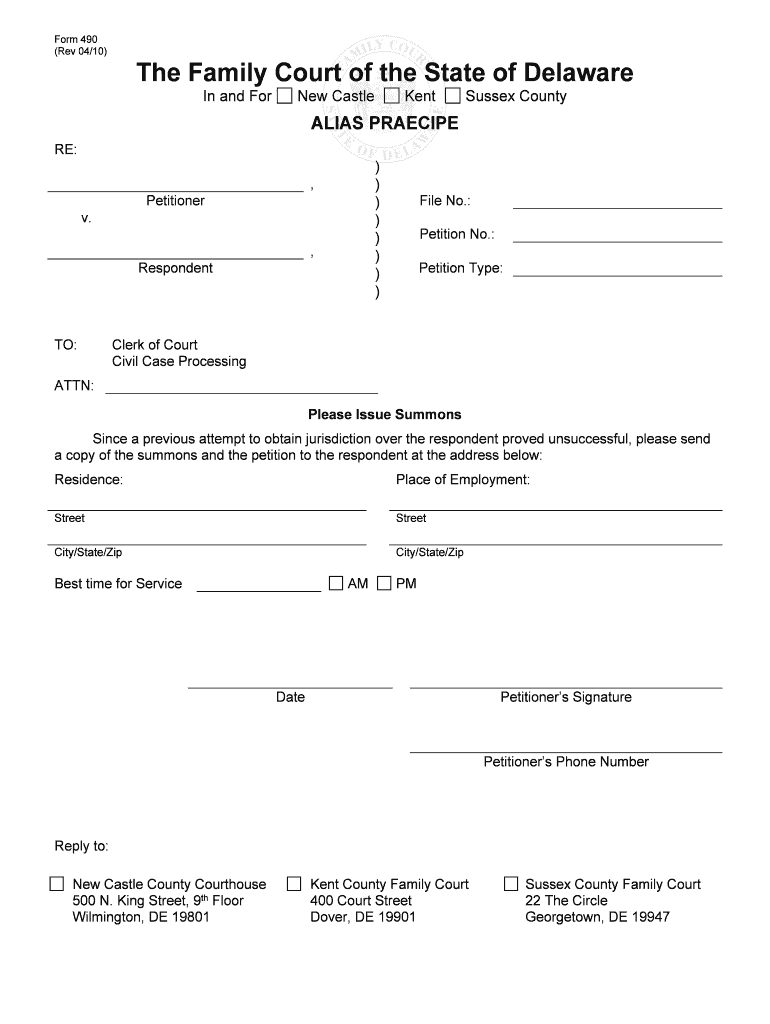

Form 490

What is the Form 490

The Form 490 is a specific document used primarily for tax-related purposes in the United States. It is designed to collect essential information from taxpayers, facilitating the reporting of income and deductions. This form is crucial for ensuring compliance with federal tax regulations and is often required for various financial transactions. Understanding the purpose and requirements of Form 490 is essential for individuals and businesses alike.

How to obtain the Form 490

To obtain the Form 490, individuals can visit the official IRS website, where the form is available for download. Additionally, taxpayers may request a physical copy through the mail by contacting the IRS directly. It is important to ensure that the version of the form is the most current, as tax laws and requirements may change. Keeping a copy of the form on hand can streamline the tax preparation process.

Steps to complete the Form 490

Completing the Form 490 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements and deduction records. Next, carefully fill out each section of the form, providing accurate information as required. It is advisable to double-check entries for errors before submission. Once completed, the form can be submitted electronically or mailed to the designated IRS address, depending on the taxpayer's preference.

Legal use of the Form 490

The legal use of Form 490 is governed by IRS regulations, ensuring that the information provided is accurate and truthful. Submitting this form under false pretenses can lead to penalties and legal repercussions. Therefore, it is essential for taxpayers to understand the legal implications of the information they provide. Compliance with IRS guidelines not only protects the taxpayer but also contributes to the integrity of the tax system.

Filing Deadlines / Important Dates

Filing deadlines for Form 490 are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year, aligning with the standard tax filing deadline. However, taxpayers should be aware of any extensions or specific circumstances that may alter this date. Keeping track of important dates related to Form 490 ensures timely compliance and helps avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

Form 490 can be submitted through various methods, providing flexibility for taxpayers. Online submission is often the quickest and most efficient option, allowing for immediate processing. Alternatively, taxpayers may choose to mail the completed form to the appropriate IRS address. In-person submission is also an option at designated IRS offices, although this may require an appointment. Understanding these submission methods can help streamline the filing process.

Quick guide on how to complete form 490

Complete Form 490 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Manage Form 490 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 490 effortlessly

- Obtain Form 490 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 490 while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 490 and how is it used in airSlate SignNow?

Form 490 is a specific type of document that can be easily created, sent, and signed using airSlate SignNow. It allows businesses to streamline their document workflows, ensuring that important papers are collected and processed efficiently.

-

What are the key features of the airSlate SignNow platform for handling Form 490?

airSlate SignNow offers robust features for managing Form 490, including customizable templates, automated workflows, and secure eSignature capabilities. These features facilitate a seamless signing process, making it easier for users to collect signatures on Form 490 quickly.

-

How does airSlate SignNow enhance the signing process for Form 490?

With airSlate SignNow, the signing process for Form 490 becomes hassle-free due to its intuitive interface. Users can initiate the signing process with just a few clicks, allowing recipients to sign documents anytime, anywhere, which speeds up completion times signNowly.

-

What integrations does airSlate SignNow offer for Form 490?

airSlate SignNow integrates seamlessly with various applications, which can help enhance how you manage Form 490. Tools like Google Drive, Dropbox, and Microsoft Office facilitate easy access to documents and storage, allowing for a smoother workflow.

-

Is airSlate SignNow a cost-effective solution for managing Form 490?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes in managing Form 490. With flexible pricing plans, companies can choose the option that best fits their needs while still benefiting from advanced document management features.

-

Can I track the status of Form 490 sent through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including Form 490. This feature allows users to monitor when documents are sent, viewed, and signed, ensuring complete visibility throughout the signing process.

-

How secure is my data when using airSlate SignNow for Form 490?

Security is a top priority for airSlate SignNow when handling Form 490. The platform utilizes robust encryption protocols and complies with legal standards to protect sensitive information, giving users peace of mind when sending and signing documents.

Get more for Form 490

- Capitulo 7b 4 answers form

- Cond rep jet ski doc form

- Math lab graphing quadratic equations in standard form answer key

- Tree proposal application including vegetation removal trimming tsra form

- Indemnity form for the trip to the water park 436143520

- Police department san jose california form

- Applications sample forms ampamp resources

- Anaheim police department request for city of anaheim anaheim form

Find out other Form 490

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors