GA DO 10A Form

What is the GA DO 10A

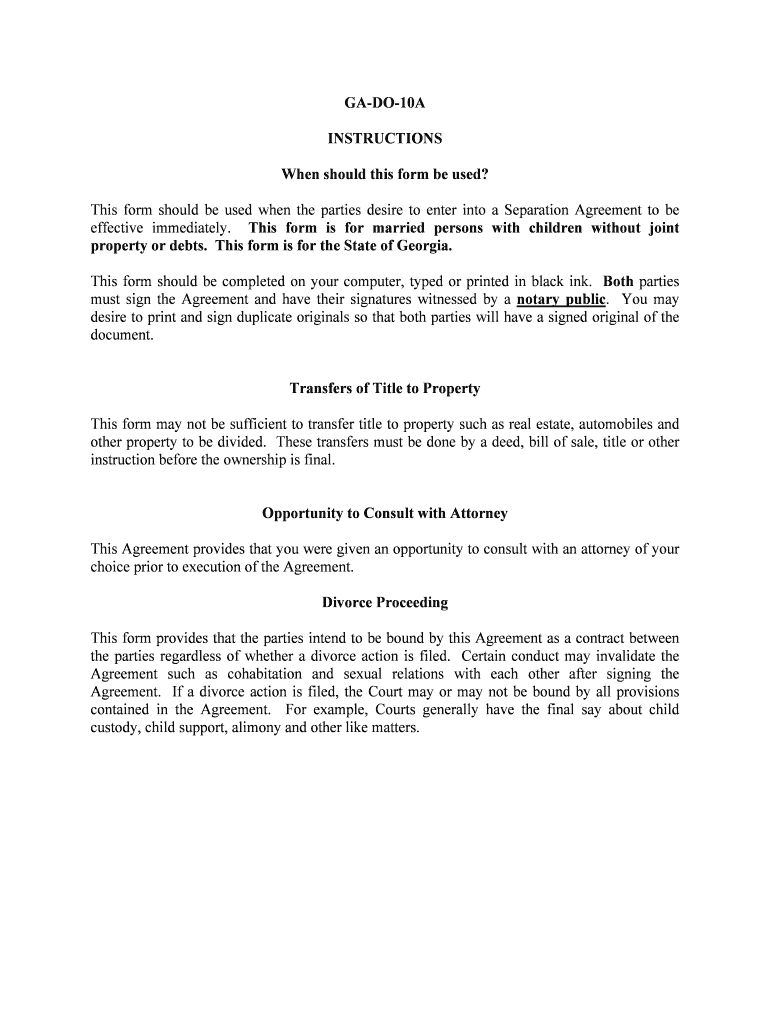

The GA DO 10A form is a document used in the state of Georgia for various purposes, primarily related to the Department of Revenue. This form is essential for individuals and businesses to report specific financial information, ensuring compliance with state regulations. It serves as a declaration of certain tax-related details, which can include income, deductions, and credits applicable to the filer. Understanding the purpose of the GA DO 10A is crucial for accurate tax reporting and avoiding potential penalties.

How to use the GA DO 10A

Using the GA DO 10A form involves several steps that ensure proper completion and submission. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, fill out the form accurately, providing all required information, including personal details and financial data. After completing the form, review it for accuracy before submission. Depending on your preference, you can submit the GA DO 10A electronically or via mail, ensuring you meet the filing deadlines established by the Georgia Department of Revenue.

Steps to complete the GA DO 10A

Completing the GA DO 10A form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documents, including income statements and receipts for deductions.

- Access the GA DO 10A form from the Georgia Department of Revenue website or through authorized channels.

- Fill in your personal information, including name, address, and Social Security number.

- Provide detailed financial information as required, ensuring all figures are accurate and supported by your documents.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, adhering to the specified filing deadlines.

Legal use of the GA DO 10A

The GA DO 10A form is legally recognized when completed and submitted according to Georgia state laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions, including fines or audits. Utilizing a reliable electronic signature solution, such as airSlate SignNow, can enhance the legal validity of your submission by providing a secure method for signing and storing the document. Compliance with the relevant tax laws is crucial to avoid penalties and ensure smooth processing of your form.

Required Documents

To complete the GA DO 10A form, certain documents are necessary to support the information provided. These documents may include:

- Income statements, such as W-2s or 1099s.

- Receipts for any deductions claimed.

- Previous tax returns for reference.

- Any additional documentation required by the Georgia Department of Revenue.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in your submission.

Filing Deadlines / Important Dates

Filing deadlines for the GA DO 10A form are crucial for compliance with state tax regulations. Typically, the form must be submitted by the due date for individual income tax returns in Georgia, which aligns with the federal deadline. It is important to stay informed about any changes to these deadlines, as they can vary from year to year. Mark your calendar with important dates to ensure timely submission and avoid penalties associated with late filings.

Quick guide on how to complete ga do 10a

Complete GA DO 10A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage GA DO 10A on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign GA DO 10A without difficulty

- Obtain GA DO 10A and then click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Edit and eSign GA DO 10A and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is GA DO 10A and how does it relate to airSlate SignNow?

GA DO 10A is a specific documentation requirement that businesses often encounter when dealing with electronic signatures. airSlate SignNow simplifies the process of fulfilling GA DO 10A requirements by offering an intuitive platform for sending and eSigning documents securely and efficiently.

-

How much does airSlate SignNow cost for GA DO 10A users?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing GA DO 10A documents. We offer different tiers that cater to businesses of all sizes, ensuring you find the right fit for your needs without exceeding your budget.

-

What features does airSlate SignNow offer for GA DO 10A compliance?

airSlate SignNow provides several features designed to support GA DO 10A compliance, including customizable templates, automatic reminders, and secure cloud storage. These features not only streamline the signing process but also ensure your documents meet all necessary standards.

-

Can I integrate airSlate SignNow with other tools for GA DO 10A?

Yes, airSlate SignNow seamlessly integrates with a variety of tools and platforms that can help manage GA DO 10A documents. Popular integrations include CRM systems, cloud storage services, and project management tools, allowing businesses to optimize their workflows.

-

What are the benefits of using airSlate SignNow for GA DO 10A?

Using airSlate SignNow for GA DO 10A provides numerous benefits, including enhanced efficiency, cost savings, and improved document security. With its user-friendly interface, businesses can quickly send, sign, and manage documents, ensuring compliance without the stress.

-

Is airSlate SignNow secure for handling GA DO 10A documents?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption and compliance measures to protect GA DO 10A documents. This ensures that your sensitive information remains confidential and secure during the signing process.

-

How does airSlate SignNow enhance the signing experience for GA DO 10A?

airSlate SignNow enhances the signing experience for GA DO 10A by providing a fast, reliable, and user-friendly platform. Users can easily track document status and receive notifications, which helps facilitate a smoother signing process and reduces turnaround times.

Get more for GA DO 10A

Find out other GA DO 10A

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney