What Are the Procedures for Funding a Revocable Trust? Form

What is the procedure for funding a revocable trust?

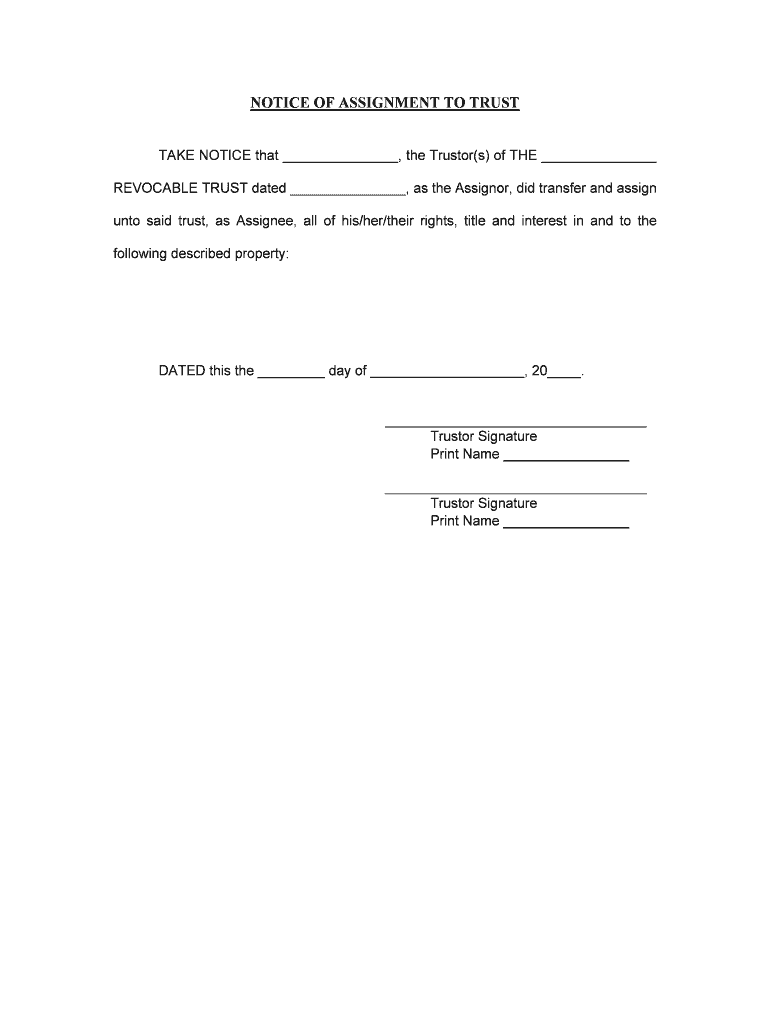

Funding a revocable trust involves transferring ownership of assets into the trust. This can include real estate, bank accounts, investments, and personal property. The process typically requires the following steps:

- Identify the assets you want to transfer into the trust.

- Change the title of real estate and other property to reflect the trust as the new owner.

- Contact financial institutions to update account ownership to the trust.

- Ensure all documents are properly executed and notarized where required.

Steps to complete the funding of a revocable trust

Completing the funding of a revocable trust involves several key steps to ensure that all assets are correctly transferred. Here are the essential actions to take:

- Review the trust document to confirm the terms and conditions.

- Gather all necessary documentation for each asset, such as deeds, titles, and account statements.

- Execute a deed transfer for real estate properties, if applicable.

- Contact banks and financial institutions to update account ownership.

- Keep records of all transfers for future reference and tax purposes.

Required documents for funding a revocable trust

To successfully fund a revocable trust, certain documents are necessary. These may include:

- The trust agreement, which outlines the terms of the trust.

- Deeds for real estate properties being transferred.

- Account statements from banks or investment firms.

- Any other legal documents related to the assets being transferred.

Legal use of a revocable trust

A revocable trust is a legal entity that allows individuals to manage their assets during their lifetime and specify distribution after death. Key legal aspects include:

- The trust can be amended or revoked by the grantor at any time before death.

- Assets in the trust avoid probate, making the transfer process smoother for beneficiaries.

- Trusts must comply with state laws, which can vary significantly.

State-specific rules for funding a revocable trust

Each state has its own regulations regarding revocable trusts. It is important to understand the specific rules that apply in your state, which may include:

- Requirements for executing trust documents, such as notarization or witness signatures.

- State tax implications for assets held in the trust.

- Procedures for transferring real estate titles and other property.

Examples of using a revocable trust

Revocable trusts can be utilized in various scenarios, including:

- Managing assets for minor children until they reach adulthood.

- Providing for a spouse or partner while ensuring assets are passed to children after both parents pass away.

- Maintaining privacy regarding asset distribution, as trusts do not go through probate.

Quick guide on how to complete what are the procedures for funding a revocable trust

Prepare What Are The Procedures For Funding A Revocable Trust? seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Manage What Are The Procedures For Funding A Revocable Trust? on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign What Are The Procedures For Funding A Revocable Trust? effortlessly

- Obtain What Are The Procedures For Funding A Revocable Trust? and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, monotonous form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Adjust and eSign What Are The Procedures For Funding A Revocable Trust? and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What Are The Procedures For Funding A Revocable Trust?

Funding a revocable trust involves transferring ownership of your assets into the trust. This process typically includes changing the title of your property, bank accounts, and any other assets to reflect the trust as the owner. It’s essential to follow the correct procedures to ensure that your assets are protected and easily managed according to your wishes.

-

Why is it important to fund a revocable trust?

Properly funding a revocable trust is crucial because it ensures your assets are managed according to your wishes during your lifetime and upon your death. If a trust is not funded correctly, assets may go through probate, defeating the purpose of establishing the trust in the first place. Therefore, understanding 'What Are The Procedures For Funding A Revocable Trust?' is key to effective estate planning.

-

What assets can be included when funding a revocable trust?

You can include various assets when funding a revocable trust, such as real estate, bank accounts, investments, and personal property. Each asset must be properly transferred to the trust to ensure it is managed according to your intentions. Consulting with a professional can help clarify 'What Are The Procedures For Funding A Revocable Trust?' for different asset types.

-

What are the costs associated with funding a revocable trust?

The costs for funding a revocable trust can vary depending on the complexity of the assets and the legal assistance needed. You might incur fees for title transfers, legal consultations, and document preparation. It's wise to inquire about these expenses when considering 'What Are The Procedures For Funding A Revocable Trust?' to budget accordingly.

-

How does airSlate SignNow assist in the funding process of a revocable trust?

airSlate SignNow simplifies the documentation process involved in funding a revocable trust. With our easy-to-use electronic signature and document management tools, you can efficiently sign and send required forms quickly. Understanding 'What Are The Procedures For Funding A Revocable Trust?' becomes easier when you have reliable tools at your disposal.

-

What potential challenges might I face when funding a revocable trust?

Challenges in funding a revocable trust can include complications in transferring title for certain properties or handling beneficiary designations. Additionally, mistakes in documentation can lead to legal issues down the line. Being informed about 'What Are The Procedures For Funding A Revocable Trust?' can help navigate these challenges effectively.

-

Can I make changes to my trust after it's funded?

Yes, one of the benefits of a revocable trust is that you can make changes at any time while you are alive. This includes adding or removing assets and altering beneficiaries. It’s important to consistently follow 'What Are The Procedures For Funding A Revocable Trust?' to ensure any changes are documented properly.

Get more for What Are The Procedures For Funding A Revocable Trust?

- General data protection regulation gdpr gap analysis form

- Employment verification form texas

- Roof condition certification form citizensflacom

- Form 101 hi home improvement contract lord tile

- Cayuga addiction recovery services carsnypushlarcom form

- Realty transfer certificate sanders county form

- Request for informal classification and appraisal review

- Spare parts supply agreement template form

Find out other What Are The Procedures For Funding A Revocable Trust?

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free