Utah State Ownership Statement Form 2011

What is the Utah State Ownership Statement Form

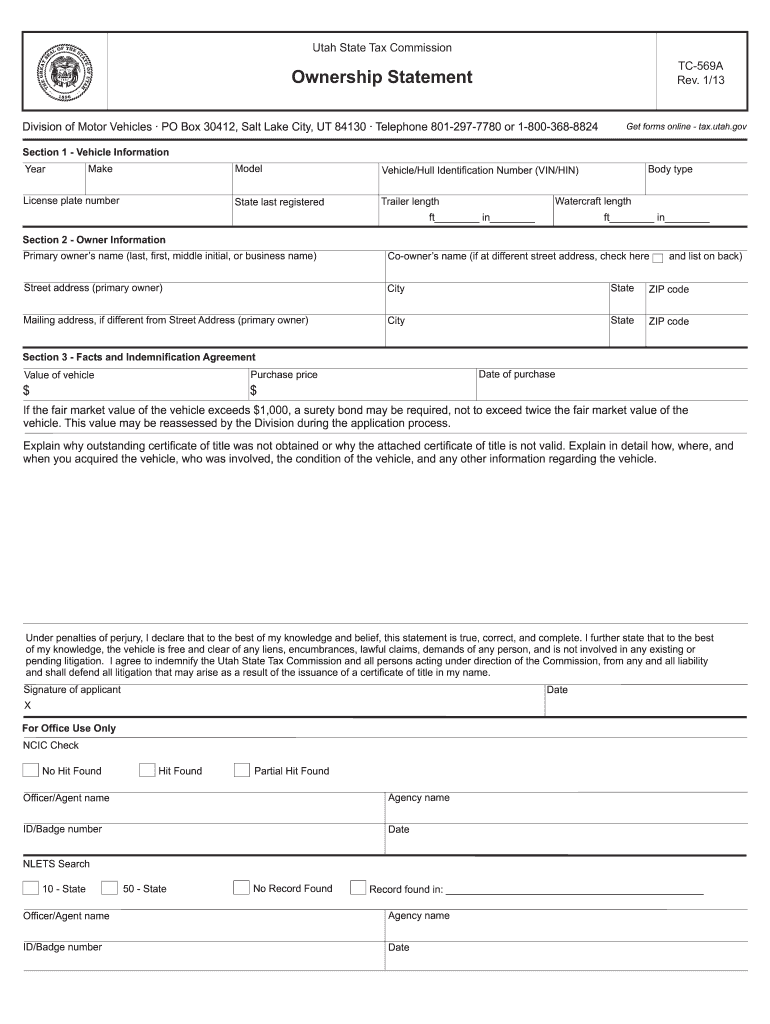

The Utah State Ownership Statement Form is a legal document used to declare ownership of property or assets in the state of Utah. This form is essential for individuals and businesses to establish their rights to specific properties, ensuring that ownership is legally recognized. It is particularly relevant in cases of real estate transactions, asset transfers, and inheritance claims. Understanding the purpose and implications of this form is crucial for anyone involved in property ownership in Utah.

Steps to complete the Utah State Ownership Statement Form

Completing the Utah State Ownership Statement Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including details about the property or asset, the owners, and any relevant transaction dates. Next, fill out the form with precise information, ensuring that all fields are completed as required. Once the form is filled out, review it for any errors or omissions. After confirming that the information is accurate, sign the form, and date it appropriately. Finally, submit the completed form to the relevant state authority, following any specific submission guidelines provided.

Legal use of the Utah State Ownership Statement Form

The legal use of the Utah State Ownership Statement Form is vital for establishing and protecting ownership rights. This form serves as a formal declaration that can be used in legal proceedings, property disputes, or when transferring ownership. It is recognized by courts and governmental agencies, making it an essential document for anyone looking to assert their ownership legally. Additionally, proper use of this form can help prevent future disputes regarding property ownership, ensuring clarity and transparency in transactions.

Who Issues the Form

The Utah State Ownership Statement Form is issued by the Utah State Tax Commission or relevant local government offices. These authorities oversee property ownership records and ensure compliance with state laws. It is important for individuals and businesses to obtain the form from these official sources to ensure that they are using the most current and legally accepted version. This helps maintain the integrity of ownership declarations and supports the legal framework surrounding property rights in Utah.

Required Documents

When completing the Utah State Ownership Statement Form, certain documents may be required to support the ownership claim. Typically, these documents include proof of identity, such as a driver's license or state ID, and any existing titles, deeds, or legal documents that pertain to the property or asset in question. Additionally, if the ownership is being transferred, documents related to the transaction, such as sales agreements or inheritance papers, may also be necessary. Having these documents ready can facilitate a smoother completion and submission process.

Form Submission Methods

The Utah State Ownership Statement Form can be submitted through several methods, depending on the preferences of the individual or business completing it. Common submission methods include online filing through the Utah State Tax Commission's website, mailing a physical copy of the form to the appropriate office, or delivering it in person to a local government office. Each method has its own guidelines and processing times, so it is advisable to choose the one that best fits the circumstances and needs of the filer.

Penalties for Non-Compliance

Failing to properly complete and submit the Utah State Ownership Statement Form can lead to various penalties. Non-compliance may result in legal disputes over property ownership, potential fines, or complications in future transactions involving the property. Additionally, without a properly filed ownership statement, individuals may face challenges in asserting their rights in court or during tax assessments. It is crucial to adhere to all requirements associated with this form to avoid such consequences.

Quick guide on how to complete utah state ownership statement 2011 form

Your assistance manual on how to prepare your Utah State Ownership Statement Form

If you’re curious about how to complete and send your Utah State Ownership Statement Form, here are a few concise instructions to simplify the tax submission process.

To get started, you just need to sign up for your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, create, and finalize your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and revisit to update information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Utah State Ownership Statement Form in no time:

- Establish your account and start editing PDFs swiftly.

- Utilize our catalog to access any IRS tax form; explore different versions and schedules.

- Click Get form to open your Utah State Ownership Statement Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Examine your document and correct any discrepancies.

- Save changes, print your version, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper format can lead to increased errors and delayed refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct utah state ownership statement 2011 form

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

What happens after I call the police because I saw people destroying a car in the street? They asked me to go to the police station to fill out a form. Thinking about it, I don’t want to do it. Is it mandatory to fill out a form and give a statement?

If you don't want to take your time and money to go to the police station to make a formal report, don’t do it. There will be a call card in their system that someone reported the incident. If they don't care enough to take a phone report or to send an officer to you, then you are not obligated to go to them. If you didn't see the person who did it, it is not likely to make much difference in finding them. The person who is the victim will still be claiming on their insurance or paying for repairs out of pocket.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

Create this form in 5 minutes!

How to create an eSignature for the utah state ownership statement 2011 form

How to make an electronic signature for the Utah State Ownership Statement 2011 Form online

How to make an eSignature for your Utah State Ownership Statement 2011 Form in Chrome

How to generate an electronic signature for putting it on the Utah State Ownership Statement 2011 Form in Gmail

How to make an eSignature for the Utah State Ownership Statement 2011 Form right from your mobile device

How to make an eSignature for the Utah State Ownership Statement 2011 Form on iOS

How to create an electronic signature for the Utah State Ownership Statement 2011 Form on Android

People also ask

-

What is the Utah State Ownership Statement Form?

The Utah State Ownership Statement Form is a document required by business owners to declare the ownership of a business entity within the state of Utah. It plays a crucial role in maintaining transparency and legal compliance. Properly filling out this form ensures that your business ownership is officially recognized by the state.

-

How can airSlate SignNow help with the Utah State Ownership Statement Form?

airSlate SignNow provides an intuitive platform for completing and eSigning the Utah State Ownership Statement Form. With easy document management and streamlined workflows, you can efficiently fill out and send the form without any hassles. Our solution enhances productivity by reducing paperwork and simplifying approval processes.

-

Is there a cost associated with using airSlate SignNow for the Utah State Ownership Statement Form?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. Each plan includes features that facilitate the completion of crucial documents such as the Utah State Ownership Statement Form. Explore our pricing page for more details on how you can find a suitable plan for your business.

-

Are there any additional features when using airSlate SignNow for the Utah State Ownership Statement Form?

Yes, airSlate SignNow comes packed with features including templates, document tracking, and multi-party eSigning capabilities. These features make the process of filling out the Utah State Ownership Statement Form quicker and more efficient. Plus, our user-friendly interface ensures that anyone can navigate the platform with ease.

-

Can I integrate airSlate SignNow with other software when completing the Utah State Ownership Statement Form?

Absolutely! airSlate SignNow offers various integrations with popular tools such as Google Drive, Dropbox, and CRM systems. This means you can seamlessly manage your documents while completing the Utah State Ownership Statement Form without interrupting your existing workflows.

-

How secure is my information when using airSlate SignNow for the Utah State Ownership Statement Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption technology and complies with strict data protection regulations to safeguard your information. You can confidently complete the Utah State Ownership Statement Form knowing your data is secure.

-

Can I access the Utah State Ownership Statement Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to fill out and eSign the Utah State Ownership Statement Form on the go. Our mobile app ensures that you have all the features you need at your fingertips, enhancing flexibility and convenience in document management.

Get more for Utah State Ownership Statement Form

Find out other Utah State Ownership Statement Form

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself