Multistate Fixed Rate Note, Installment Payments Secured Form

What is the Multistate Fixed Rate Note, Installment Payments Secured

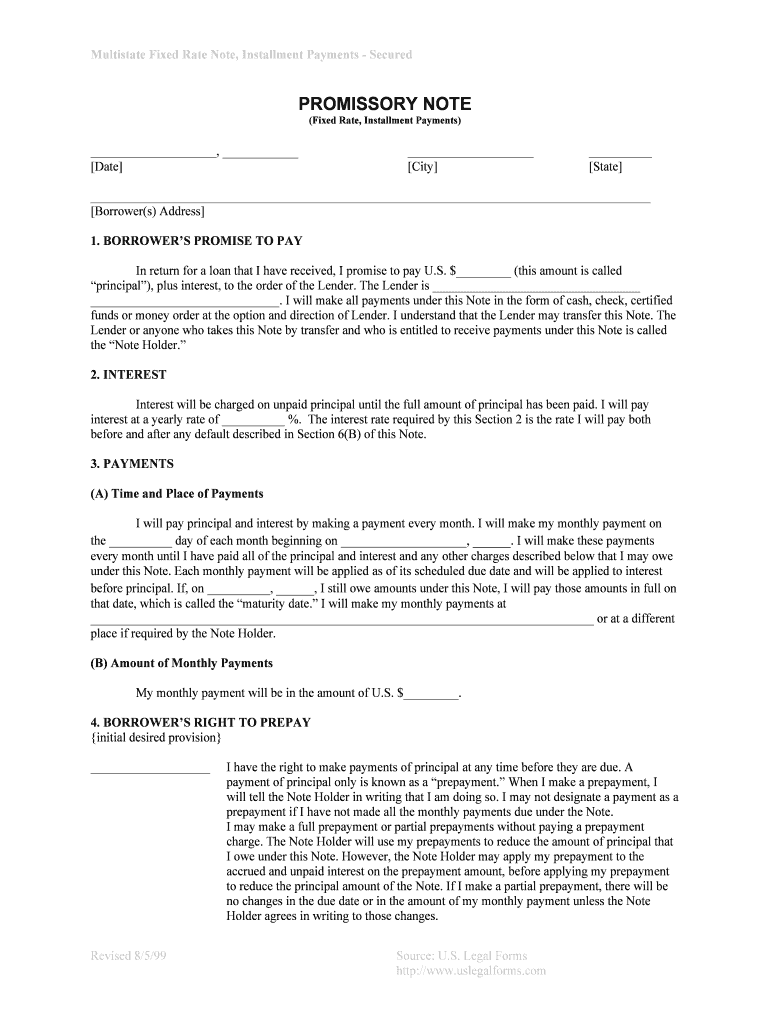

The Multistate Fixed Rate Note, Installment Payments Secured is a legal document used primarily in the context of secured lending. It outlines the terms of a loan where the borrower agrees to repay the lender in fixed installments over a specified period. This note is designed to be compliant with regulations across multiple states, ensuring that it adheres to local laws while providing a standardized framework for both parties involved. The secured aspect means that the loan is backed by collateral, which offers protection to the lender in case of default.

How to use the Multistate Fixed Rate Note, Installment Payments Secured

Using the Multistate Fixed Rate Note involves several key steps. First, both the borrower and lender must agree on the loan terms, including the interest rate, payment schedule, and collateral details. Once these terms are established, the document must be filled out accurately, ensuring all necessary information is included. After completing the form, both parties should sign it, ideally using a secure electronic signature solution to enhance legality and security. This process ensures that the agreement is binding and enforceable under applicable laws.

Steps to complete the Multistate Fixed Rate Note, Installment Payments Secured

Completing the Multistate Fixed Rate Note requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including borrower and lender details, loan amount, interest rate, and payment schedule.

- Clearly define the collateral securing the loan.

- Fill out the note, ensuring all fields are completed accurately.

- Review the document for any errors or omissions.

- Both parties should sign the document, preferably using an electronic signature for added security.

- Store the completed note in a secure location for future reference.

Legal use of the Multistate Fixed Rate Note, Installment Payments Secured

The legal use of the Multistate Fixed Rate Note is contingent upon compliance with relevant state laws and regulations. This document serves as a legally binding agreement that outlines the rights and obligations of both the borrower and lender. To ensure its enforceability, it must meet specific legal requirements, including proper signatures and adherence to any state-specific provisions. Utilizing a reliable electronic signature platform can help maintain compliance with laws such as the ESIGN Act and UETA, which govern electronic transactions.

Key elements of the Multistate Fixed Rate Note, Installment Payments Secured

Several key elements are essential to the Multistate Fixed Rate Note. These include:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue.

- Payment Schedule: Details on how and when payments will be made.

- Collateral Description: A clear description of the asset securing the loan.

- Signatures: Required signatures from both the borrower and lender to validate the agreement.

Examples of using the Multistate Fixed Rate Note, Installment Payments Secured

Examples of using the Multistate Fixed Rate Note include personal loans secured by real estate, business loans backed by inventory, or vehicle loans where the car serves as collateral. In each case, the note provides a clear framework for repayment and outlines the consequences of default. This clarity helps both parties understand their rights and obligations, fostering a more secure lending environment.

Quick guide on how to complete multistate fixed rate note installment payments secured

Prepare Multistate Fixed Rate Note, Installment Payments Secured easily on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Multistate Fixed Rate Note, Installment Payments Secured on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Multistate Fixed Rate Note, Installment Payments Secured effortlessly

- Locate Multistate Fixed Rate Note, Installment Payments Secured and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Multistate Fixed Rate Note, Installment Payments Secured and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Multistate Fixed Rate Note, Installment Payments Secured?

A Multistate Fixed Rate Note, Installment Payments Secured is a financial instrument that allows borrowers to repay loans in fixed installments over a specified period. This structure offers stability in payments, making it easier to manage budgets. It’s particularly popular for securing loans across multiple states, ensuring compliance with local regulations.

-

How does airSlate SignNow facilitate the execution of a Multistate Fixed Rate Note, Installment Payments Secured?

airSlate SignNow simplifies the process of executing a Multistate Fixed Rate Note, Installment Payments Secured through its user-friendly eSignature platform. Users can easily upload their documents, get them signed digitally, and securely store them. This streamlines the transaction process, saving time and reducing paperwork.

-

What are the benefits of using a Multistate Fixed Rate Note, Installment Payments Secured?

One of the key benefits of a Multistate Fixed Rate Note, Installment Payments Secured is the predictability it offers in loan repayments. Borrowers can budget their finances with confidence, knowing their payment amounts will remain constant. Additionally, this structure may provide better loan terms and lower rates compared to variable rate options.

-

Are there any fees associated with using a Multistate Fixed Rate Note, Installment Payments Secured through airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document signing, specific fees related to the Multistate Fixed Rate Note, Installment Payments Secured depend on the terms set by the lender. It’s advisable to review your loan agreement and consult with your financial institution regarding any additional fees for processing or notarization.

-

Can I customize the terms of my Multistate Fixed Rate Note, Installment Payments Secured?

Yes, users can customize key terms of their Multistate Fixed Rate Note, Installment Payments Secured, including payment schedules, interest rates, and durations. airSlate SignNow allows for adjustments in the document drafting phase, helping you tailor the agreement to your specific needs before finalizing it with eSignatures.

-

How secure is the signing process for a Multistate Fixed Rate Note, Installment Payments Secured through airSlate SignNow?

The signing process for a Multistate Fixed Rate Note, Installment Payments Secured on airSlate SignNow is highly secure. The platform employs advanced encryption technologies and complies with strict security standards to protect your documents and signatures. This ensures that sensitive financial information remains confidential throughout the transaction.

-

What integrations does airSlate SignNow offer for managing Multistate Fixed Rate Note, Installment Payments Secured?

airSlate SignNow offers various integrations with popular platforms such as CRM systems, project management tools, and cloud storage solutions. This allows users to seamlessly manage their Multistate Fixed Rate Note, Installment Payments Secured alongside existing workflows, enhancing overall efficiency. Integrations can automate tracking and document management for better visibility.

Get more for Multistate Fixed Rate Note, Installment Payments Secured

- Ziplogix promo code form

- Adeverinta angajat form

- Youth event registration form

- Credit card authorization form akbar travels akbartravels

- Mark site designation form

- Application for a place on the ballot for a general election for a city school district or other political subdivision form

- Cooling tower efficiency program annual inspection form

- Senior field trip forms north east independent school

Find out other Multistate Fixed Rate Note, Installment Payments Secured

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online