Hawaii Tax Forms by Category Department of Taxation

What is the Hawaii Tax Forms By Category Department Of Taxation

The Hawaii Tax Forms By Category Department Of Taxation is a comprehensive collection of tax-related documents organized by specific categories. These forms are essential for individuals and businesses operating in Hawaii to comply with state tax laws. They cover various tax obligations, including income tax, property tax, and general excise tax. Understanding these forms is crucial for accurate tax reporting and ensuring compliance with state regulations.

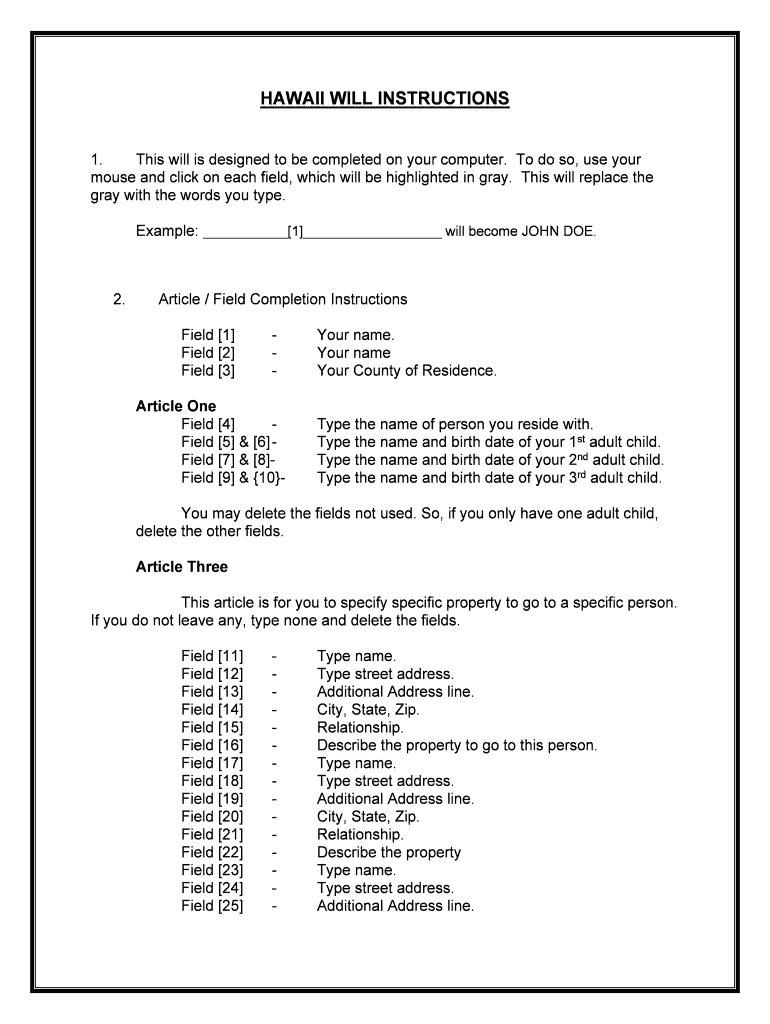

How to use the Hawaii Tax Forms By Category Department Of Taxation

Using the Hawaii Tax Forms By Category Department Of Taxation involves identifying the appropriate form based on your tax situation. Each category is tailored to different tax needs, such as personal income tax or business taxes. Once you select the correct form, you can fill it out either digitally or by hand. It is important to follow the instructions provided with each form to ensure accurate completion and submission.

Steps to complete the Hawaii Tax Forms By Category Department Of Taxation

Completing the Hawaii Tax Forms involves several key steps:

- Identify the correct form based on your tax category.

- Gather all necessary documentation, such as income statements and deductions.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form by the specified deadline, either online or via mail.

Legal use of the Hawaii Tax Forms By Category Department Of Taxation

The Hawaii Tax Forms are legally binding documents when completed and submitted in accordance with state regulations. To ensure their legal standing, it is essential to provide accurate information and follow the specific filing procedures outlined by the Department of Taxation. Electronic submissions are accepted and are considered valid as long as they comply with eSignature laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Tax Forms vary depending on the type of tax and the specific form. Generally, individual income tax returns are due on April 20 each year, while business tax deadlines may differ. It is important to check the Department of Taxation’s official calendar for any updates or changes to these deadlines to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

Hawaii Tax Forms can be submitted through various methods to accommodate different preferences:

- Online: Many forms can be completed and submitted electronically through the Department of Taxation's website.

- Mail: Completed forms can be printed and sent via postal service to the appropriate tax office.

- In-Person: Taxpayers may also deliver forms directly to designated tax offices during business hours.

Quick guide on how to complete hawaii tax forms by category department of taxation

Complete Hawaii Tax Forms By Category Department Of Taxation effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the appropriate form and securely archive it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without any holdups. Manage Hawaii Tax Forms By Category Department Of Taxation on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Hawaii Tax Forms By Category Department Of Taxation without any hassle

- Find Hawaii Tax Forms By Category Department Of Taxation and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Select your preferred method to share your form: via email, text message (SMS), or an invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and eSign Hawaii Tax Forms By Category Department Of Taxation and maintain effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of the airSlate SignNow platform for managing Hawaii Tax Forms By Category Department Of Taxation?

The airSlate SignNow platform offers a user-friendly interface, robust document management tools, and seamless eSignature capabilities, all designed for handling Hawaii Tax Forms By Category Department Of Taxation. Users can easily upload, send, and sign documents, ensuring compliance and efficiency. Additionally, the platform supports various integrations that enhance productivity.

-

How can airSlate SignNow help streamline the filing of Hawaii Tax Forms By Category Department Of Taxation?

By utilizing airSlate SignNow, businesses can effortlessly manage and submit Hawaii Tax Forms By Category Department Of Taxation. The platform simplifies the process by providing templates and automated workflows, minimizing human error and saving time. With real-time tracking, users can easily verify the status of their submissions.

-

Is there a free trial available for airSlate SignNow when dealing with Hawaii Tax Forms By Category Department Of Taxation?

Yes, airSlate SignNow offers a free trial that allows users to explore the features specifically suited for managing Hawaii Tax Forms By Category Department Of Taxation. This includes access to all the essential tools needed for eSigning and document management. Take advantage of this opportunity to see how effectively airSlate SignNow can meet your needs.

-

What types of Hawaii Tax Forms By Category Department Of Taxation can be handled using airSlate SignNow?

airSlate SignNow supports a wide range of Hawaii Tax Forms By Category Department Of Taxation, including income tax returns, business registration forms, and more. Users can easily select the appropriate templates for their needs and customize them as required. This flexibility makes it ideal for both individuals and businesses.

-

How secure is the airSlate SignNow platform for handling sensitive Hawaii Tax Forms By Category Department Of Taxation?

Security is a top priority at airSlate SignNow, especially when managing sensitive documents such as Hawaii Tax Forms By Category Department Of Taxation. The platform employs advanced encryption and compliance with industry standards to protect user data. You can trust that your information is safeguarded throughout the document management process.

-

What integrations does airSlate SignNow offer for enhancing management of Hawaii Tax Forms By Category Department Of Taxation?

airSlate SignNow seamlessly integrates with various applications and services, including popular cloud storage solutions and productivity tools. This broad range of integrations simplifies the process of managing Hawaii Tax Forms By Category Department Of Taxation by allowing users to connect their existing workflows. Enhance your efficiency with tailored integration solutions.

-

What benefits can businesses expect when using airSlate SignNow for Hawaii Tax Forms By Category Department Of Taxation?

Using airSlate SignNow for Hawaii Tax Forms By Category Department Of Taxation offers several benefits, including increased efficiency, reduced processing times, and improved accuracy. The ability to eSign documents enhances workflow and ensures timely submissions. Additionally, the platform's ease of use minimizes training time for employees.

Get more for Hawaii Tax Forms By Category Department Of Taxation

- Root cause analysis blank form pdf

- Social security loan application form

- Exercise chart printable exercise chart to create a weekly exercise plan form

- Rdf reasons form

- Bravo wellness appeals form primeviewplanscom

- Motor expired form

- Type group form

- Superannuation salary sacrifice agreement template form

Find out other Hawaii Tax Forms By Category Department Of Taxation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word