5001 EN CALCULATION of WITHHOLDING TAX on Dividend 2022

Understanding Form 5001: Calculation of Withholding Tax on Dividends

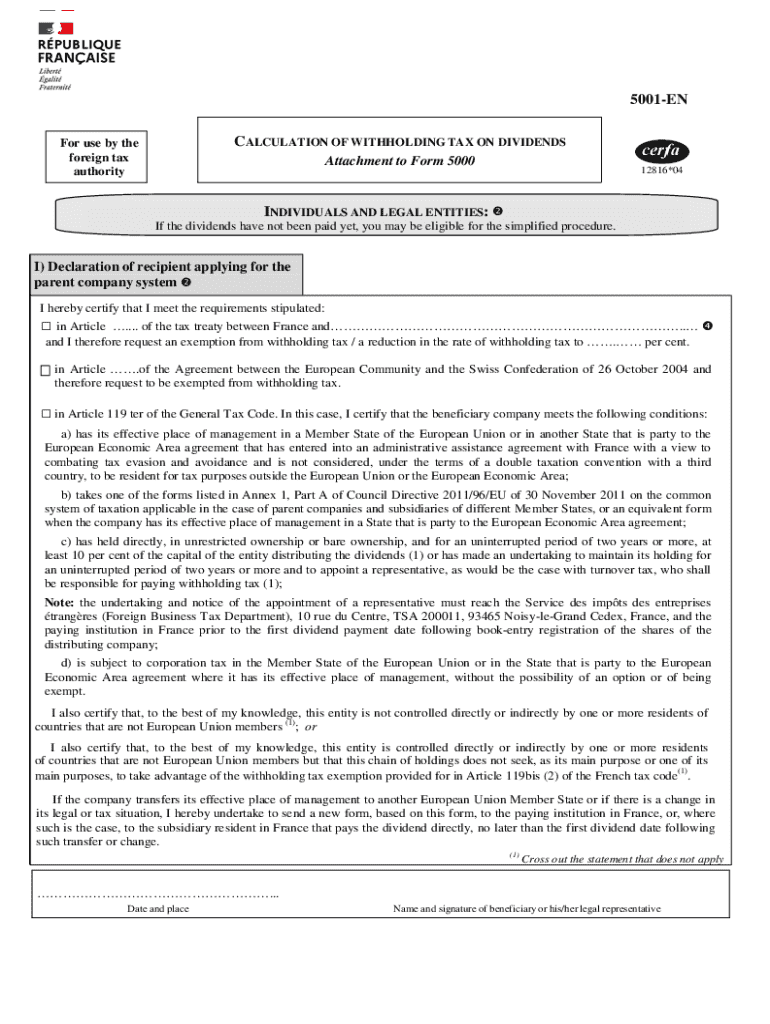

Form 5001 is specifically designed for the calculation of withholding tax on dividends. This form plays a crucial role in ensuring that the correct amount of tax is withheld from dividend payments made to shareholders. It is essential for businesses and individuals who receive dividends to understand how this form functions, as it directly impacts their tax obligations and compliance with federal regulations.

Steps to Complete Form 5001

Completing Form 5001 involves several key steps:

- Gather necessary information, including the taxpayer's identification details and dividend amounts.

- Calculate the appropriate withholding tax based on the applicable tax rate for dividends.

- Fill out the form accurately, ensuring all sections are completed with the correct figures.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate tax authority by the specified deadline.

Legal Use of Form 5001

Form 5001 is legally required for businesses distributing dividends to shareholders. It ensures compliance with tax laws and helps avoid penalties associated with improper withholding. Understanding the legal implications of this form is essential for maintaining good standing with tax authorities.

Key Elements of Form 5001

The key elements of Form 5001 include:

- Taxpayer identification information, including name and taxpayer identification number.

- Details of the dividend payments, including amounts and dates.

- Calculation of the withholding tax based on the applicable rates.

- Signature of the authorized representative certifying the accuracy of the information provided.

Filing Deadlines for Form 5001

It is important to adhere to the filing deadlines for Form 5001 to avoid penalties. Typically, the form must be submitted by the end of the month following the quarter in which the dividends were paid. Keeping track of these deadlines can help ensure timely compliance.

Examples of Using Form 5001

Form 5001 can be utilized in various scenarios, such as:

- A corporation distributing dividends to its shareholders must calculate and report the withholding tax.

- An individual receiving dividends from multiple sources may need to consolidate their withholding tax calculations using this form.

IRS Guidelines for Form 5001

The IRS provides specific guidelines regarding the use of Form 5001, including instructions on how to calculate the withholding tax and the necessary documentation required for submission. Familiarizing oneself with these guidelines ensures compliance and accuracy in tax reporting.

Quick guide on how to complete 5001en calculation of withholding tax on dividend

Effortlessly Prepare 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely save it on the internet. airSlate SignNow equips you with all the necessary tools to create, amend, and electronically sign your documents swiftly without delays. Manage 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend on any device with the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The Easiest Way to Modify and Electronically Sign 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend with Ease

- Obtain 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5001en calculation of withholding tax on dividend

Create this form in 5 minutes!

How to create an eSignature for the 5001en calculation of withholding tax on dividend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5001 and how can airSlate SignNow help?

Form 5001 is a crucial document for various business processes. airSlate SignNow simplifies the management of form 5001 by allowing users to create, send, and eSign the document seamlessly, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing form 5001?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning specifically for form 5001. These tools enhance productivity and ensure that your documents are processed quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for form 5001?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that support the management of form 5001, making it a cost-effective solution for businesses of all sizes.

-

How does airSlate SignNow ensure the security of form 5001?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance with industry standards. This ensures that your form 5001 and other sensitive documents are protected throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for form 5001?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for form 5001. This means you can connect with tools you already use, enhancing efficiency and collaboration.

-

What are the benefits of using airSlate SignNow for form 5001?

Using airSlate SignNow for form 5001 provides numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. These advantages help businesses save time and resources while ensuring compliance.

-

How can I get started with airSlate SignNow for form 5001?

Getting started with airSlate SignNow for form 5001 is easy. Simply sign up for an account, choose a pricing plan, and begin creating and sending your form 5001 documents for eSigning in minutes.

Get more for 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend

Find out other 5001 EN CALCULATION OF WITHHOLDING TAX ON Dividend

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure