Administering the Revocable Living Trust in California Form

What is the Administering The Revocable Living Trust In California

The revocable living trust is a legal entity created to hold an individual’s assets during their lifetime and facilitate the transfer of those assets upon their death. In California, administering this trust involves managing the assets, paying any debts or taxes, and distributing the remaining assets to the beneficiaries as outlined in the trust document. This process allows for a smoother transition of assets without going through probate, which can be time-consuming and costly.

Steps to Complete the Administering The Revocable Living Trust In California

Administering a revocable living trust in California involves several key steps:

- Review the Trust Document: Understand the terms and conditions laid out in the trust.

- Gather Assets: Collect all assets included in the trust, such as real estate, bank accounts, and investments.

- Notify Beneficiaries: Inform all beneficiaries about the trust and their respective shares.

- Pay Debts and Taxes: Settle any outstanding debts and tax obligations before distributing assets.

- Distribute Assets: Transfer the remaining assets to the beneficiaries according to the trust's instructions.

Legal Use of the Administering The Revocable Living Trust In California

The legal framework governing revocable living trusts in California allows individuals to create and manage these trusts during their lifetime. The trust remains revocable, meaning the grantor can alter or dissolve it at any time before their death. Upon the grantor's passing, the trust becomes irrevocable, and the trustee must follow the terms set forth in the trust document. This legal structure provides clarity and security for asset distribution while avoiding the complexities of probate.

State-Specific Rules for the Administering The Revocable Living Trust In California

California has specific regulations regarding the administration of revocable living trusts. These include:

- Trustee Responsibilities: The trustee must act in the best interest of the beneficiaries and manage trust assets prudently.

- Notice Requirements: California law requires trustees to notify beneficiaries of the trust's existence and their rights.

- Tax Considerations: Trust income may be subject to state income tax, and the trustee must handle tax filings appropriately.

Examples of Using the Administering The Revocable Living Trust In California

Common scenarios for utilizing a revocable living trust in California include:

- Estate Planning: Individuals use trusts to ensure their assets are distributed according to their wishes after death.

- Asset Protection: Trusts can protect assets from creditors and lawsuits during the grantor's lifetime.

- Minimizing Probate: Trusts allow for the direct transfer of assets to beneficiaries, avoiding the lengthy probate process.

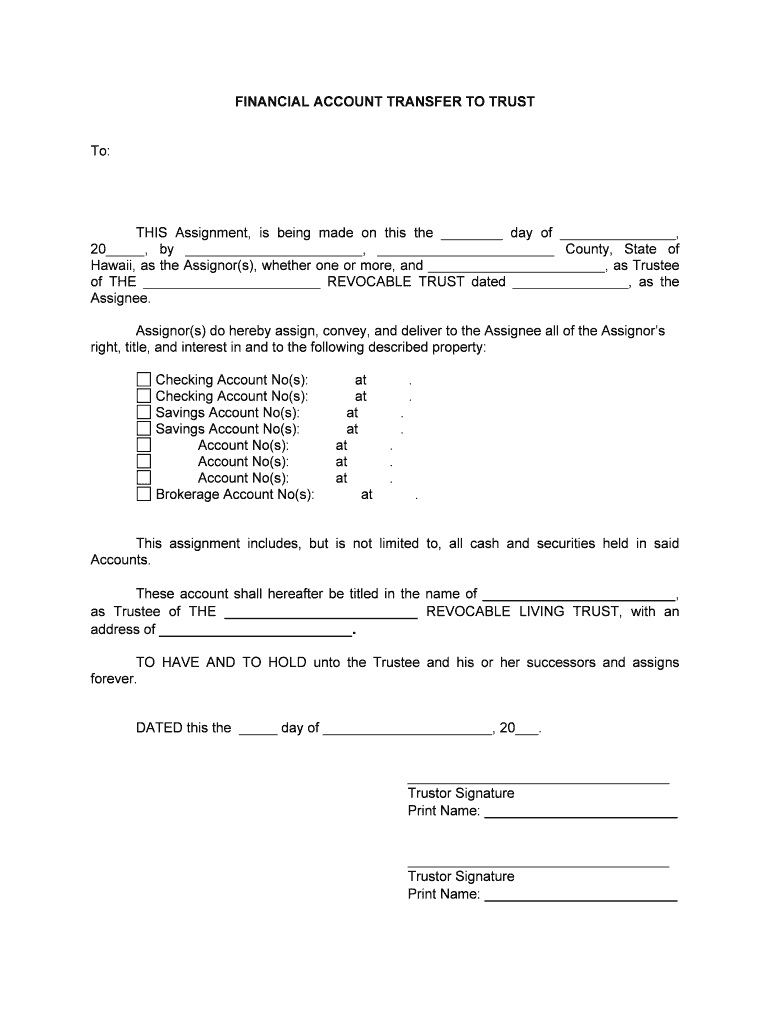

Required Documents for Administering The Revocable Living Trust In California

To effectively administer a revocable living trust in California, certain documents are necessary:

- Trust Document: The original trust agreement outlining the terms and conditions.

- Asset Deeds: Documentation proving ownership of assets held in the trust.

- Financial Statements: Bank and investment account statements related to trust assets.

- Tax Returns: Previous tax returns for the trust, if applicable, to ensure compliance with tax obligations.

Quick guide on how to complete administering the revocable living trust in california

Complete Administering The Revocable Living Trust In California seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the correct form and securely store it in the cloud. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Administering The Revocable Living Trust In California on any platform utilizing airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to modify and eSign Administering The Revocable Living Trust In California effortlessly

- Locate Administering The Revocable Living Trust In California and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your method of delivering your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or mistakes requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Administering The Revocable Living Trust In California and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocable living trust, and why is it important in California?

A revocable living trust is a legal entity that allows you to manage your assets during your lifetime and distribute them after your death. Administering The Revocable Living Trust In California provides advantages such as avoiding probate, which can save time and money for your beneficiaries. It's an important tool for estate planning in California, ensuring your wishes are honored.

-

How does airSlate SignNow assist with administering the revocable living trust in California?

AirSlate SignNow simplifies the process of administering The Revocable Living Trust In California by providing an easy-to-use platform for eSigning and managing documentation securely. Our solution enables you to streamline the paperwork involved and collaborate efficiently with your trustees and beneficiaries, ensuring compliance with California laws.

-

What are the costs associated with administering a revocable living trust in California?

The costs for administering The Revocable Living Trust In California can vary widely depending on the complexity of your estate and the professionals you choose to hire. Utilizing airSlate SignNow can reduce some administrative costs through its affordable eSigning solutions, thereby helping you manage expenses more effectively.

-

What features does airSlate SignNow offer for managing revocable living trusts?

AirSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, making it easier to manage The Revocable Living Trust In California. These tools ensure that your documents are organized, accessible, and legally binding, facilitating smoother administration.

-

Can I collaborate with my attorney while administering a revocable living trust in California using airSlate SignNow?

Yes, airSlate SignNow allows for seamless collaboration with your legal team when administering The Revocable Living Trust In California. You can share documents, obtain signatures, and get real-time updates, making communication and management tasks more efficient.

-

Are there any specific benefits to eSigning documents related to revocable living trusts in California?

ESigning documents related to administering The Revocable Living Trust In California can accelerate the process and reduce the need for physical paperwork. This method is not only convenient but also secure, complying with California laws on electronic signatures, ensuring that your trust documents are valid.

-

What integrations does airSlate SignNow provide for better trust administration?

AirSlate SignNow offers various integrations with popular applications and services, enhancing your ability to administer The Revocable Living Trust In California. You can connect with tools like Google Drive and Salesforce, which streamlines document management and keeps everything in one place.

Get more for Administering The Revocable Living Trust In California

- 800 303 8353 form

- Wisconsin homestead printable rent certificate form

- Employment application form ramada amp days hotel

- Water reconnaissance report da form 1712 r may apd army

- E iwo employer profile prefill form acf hhs

- What is psp number usaa form

- Tech agreement template form

- Technical assistance agreement template form

Find out other Administering The Revocable Living Trust In California

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form