FORM D Hawaii Gov

What is the FORM D Hawaii gov

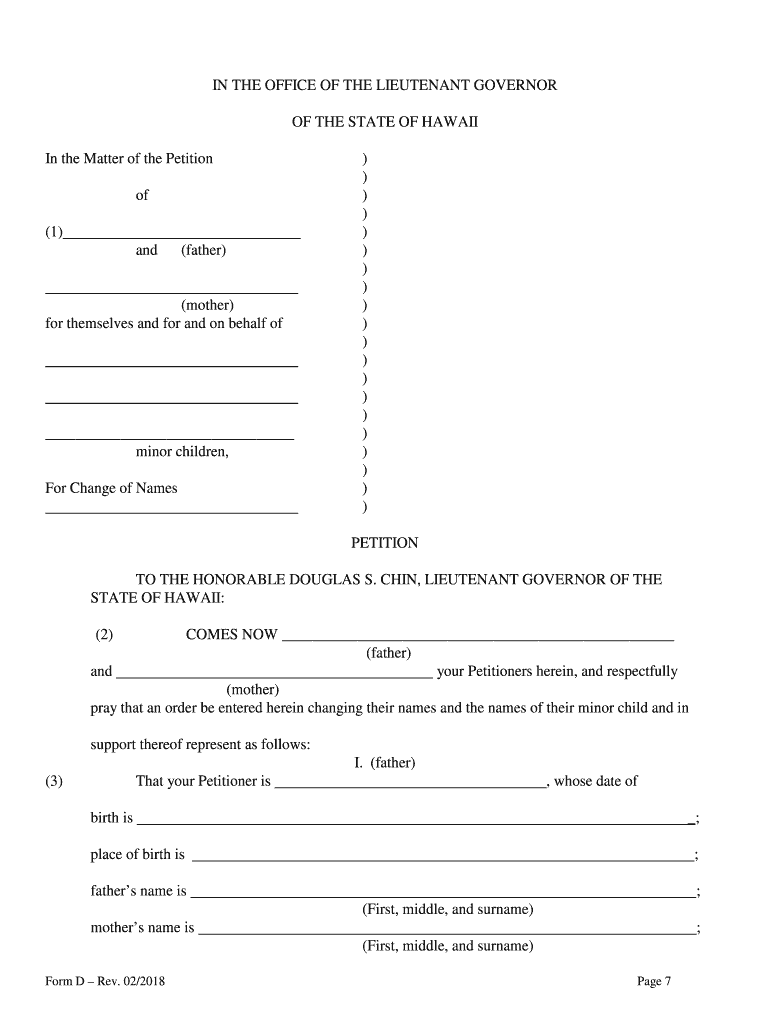

The FORM D Hawaii gov is a specific document used for filing certain types of information with the State of Hawaii. This form is typically associated with securities offerings and is essential for businesses looking to raise capital while complying with state regulations. It provides necessary details about the offering, including the type of security, the amount being offered, and information about the issuer. Understanding the purpose and requirements of this form is crucial for businesses operating in Hawaii.

How to use the FORM D Hawaii gov

Using the FORM D Hawaii gov involves several steps to ensure compliance with state regulations. First, businesses must gather all required information about the offering and the issuer. This includes details on the type of security being offered and the intended use of the funds. Once the form is completed, it must be filed with the appropriate state authority. It is important to review the form for accuracy and completeness before submission to avoid delays or penalties.

Steps to complete the FORM D Hawaii gov

Completing the FORM D Hawaii gov involves a systematic approach:

- Gather necessary information about the issuer and the offering.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form to the appropriate state agency, either online or by mail.

- Keep a copy of the submitted form for your records.

Legal use of the FORM D Hawaii gov

The legal use of the FORM D Hawaii gov is governed by state securities laws. To be considered valid, the form must be completed and filed in accordance with these laws. This ensures that the offering is compliant with regulations designed to protect investors. Failure to adhere to these legal requirements can result in penalties or the invalidation of the offering.

Key elements of the FORM D Hawaii gov

Key elements of the FORM D Hawaii gov include:

- Information about the issuer, including its name and address.

- Details of the offering, such as the type of security and the total amount being offered.

- Disclosure of the intended use of proceeds from the offering.

- Information on any related parties involved in the offering.

Form Submission Methods

The FORM D Hawaii gov can be submitted through various methods. Businesses can choose to file the form online via the state's official platform or submit it by mail. Each method has its own set of requirements and processing times, so it is important to select the one that best suits the needs of the business. Online submissions often provide quicker processing and confirmation.

Quick guide on how to complete form d hawaiigov

Effortlessly Prepare FORM D Hawaii gov on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Administer FORM D Hawaii gov across any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The Easiest Method to Edit and Electronically Sign FORM D Hawaii gov

- Find FORM D Hawaii gov and click Get Form to initiate the process.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure personal data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign FORM D Hawaii gov and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is FORM D Hawaii gov and how does it work?

FORM D Hawaii gov is a filing document that allows companies to report certain exempt offerings of securities in Hawaii. Utilizing airSlate SignNow, you can easily eSign and send your FORM D documents electronically, making the filing process streamlined and efficient.

-

How can airSlate SignNow help with FORM D Hawaii gov filings?

airSlate SignNow provides a user-friendly platform to manage and eSign your FORM D Hawaii gov documents securely. With features like templates and automated workflows, you can expedite your filings and ensure all necessary information is accurately submitted.

-

What are the pricing options for using airSlate SignNow for FORM D Hawaii gov?

airSlate SignNow offers various pricing plans tailored to fit different business needs. With each plan, you gain access to eSigning features that simplify your FORM D Hawaii gov filings, making the service not only effective but also budget-friendly.

-

Are there specific features of airSlate SignNow that benefit FORM D Hawaii gov users?

Yes, airSlate SignNow includes features such as customizable templates, real-time tracking, and integration capabilities which are beneficial for handling FORM D Hawaii gov filings. These functionalities help ensure that your documents are not only completed accurately but also submitted promptly.

-

Can I integrate airSlate SignNow with other tools for FORM D Hawaii gov processes?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing you to connect your existing tools with your FORM D Hawaii gov filing workflows. This integration enhances productivity and ensures a smoother document management experience.

-

What advantages does eSigning FORM D Hawaii gov provide?

ESigning your FORM D Hawaii gov documents using airSlate SignNow offers numerous advantages such as speed, convenience, and improved security. It eliminates the need for physical paperwork, drastically reducing turnaround time and making the filing process more efficient.

-

Is airSlate SignNow secure for handling sensitive FORM D Hawaii gov documents?

Yes, airSlate SignNow employs advanced security measures including encryption and secure servers to protect all your FORM D Hawaii gov documents. You can have peace of mind knowing that your sensitive information is well-guarded while you manage your filings.

Get more for FORM D Hawaii gov

Find out other FORM D Hawaii gov

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy