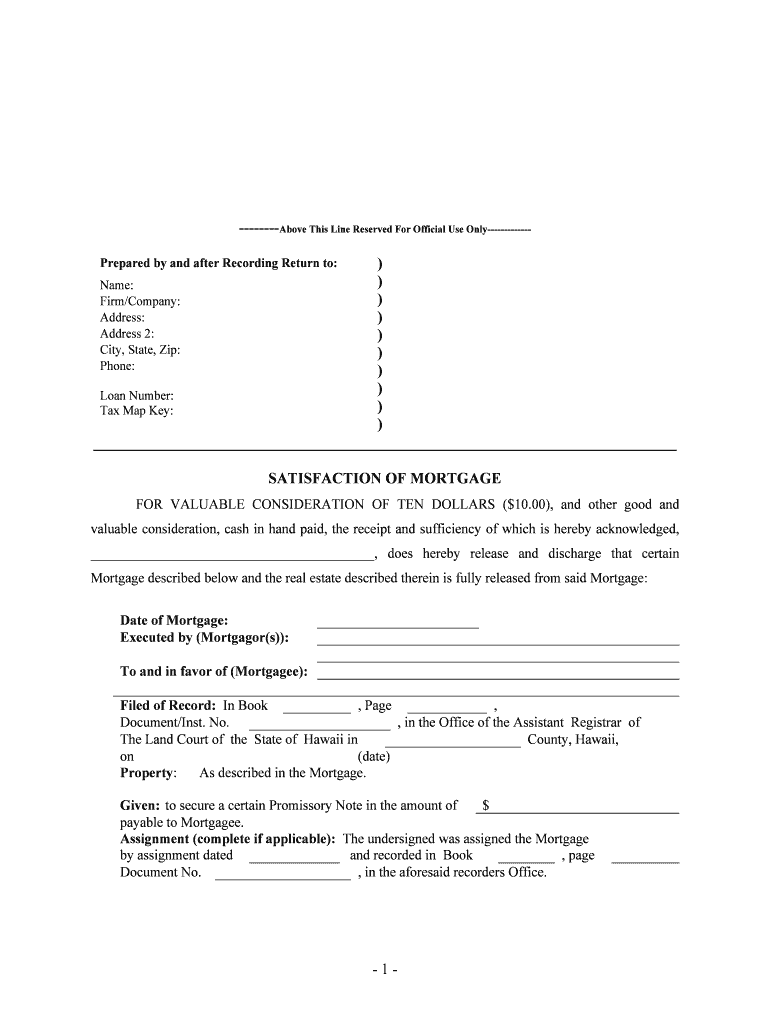

Tax Map Key Form

What is the Tax Map Key

The Tax Map Key (TMK) is a unique identifier assigned to parcels of land in the United States, primarily used for property tax purposes. Each TMK consists of a series of numbers that represent specific geographic and administrative divisions, allowing local governments to efficiently manage property records. This key is essential for assessing property taxes, tracking ownership, and facilitating land transactions.

How to obtain the Tax Map Key

To obtain a Tax Map Key, property owners or prospective buyers can contact their local county assessor's office or visit their website. Many counties provide online tools where users can search for property information using the address or owner's name. Additionally, some jurisdictions may require a formal request or application to access specific TMK details.

Steps to complete the Tax Map Key

Completing the Tax Map Key involves several important steps. First, gather all necessary information about the property, including its address, legal description, and any previous tax records. Next, access the local government’s property database or contact the assessor's office to find the TMK. Once located, ensure that all details are accurate and up to date, as discrepancies can lead to issues in tax assessments and property transactions.

Legal use of the Tax Map Key

The Tax Map Key serves a critical legal function in property transactions and tax assessments. It is used to verify ownership, assess property taxes, and ensure compliance with local zoning laws. In legal documents, the TMK must be accurately referenced to avoid disputes over property boundaries and ownership claims. It is advisable to consult with a legal professional when using the TMK in any formal agreements.

Key elements of the Tax Map Key

Understanding the key elements of the Tax Map Key is essential for property owners. The TMK typically includes the following components:

- District Number: Identifies the geographical area or district where the property is located.

- Tax Map Number: A unique number assigned to the specific parcel of land.

- Lot Number: Indicates the individual lot within the tax map, helping to pinpoint the exact location.

Examples of using the Tax Map Key

The Tax Map Key is utilized in various scenarios, including:

- Property tax assessments to determine the value of land for taxation.

- Real estate transactions, where the TMK is referenced in purchase agreements.

- Land use planning and zoning applications, ensuring compliance with local regulations.

Quick guide on how to complete tax map key

Complete Tax Map Key effortlessly on any device

Digital document management has become widely embraced by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the appropriate form and securely maintain it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Map Key on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Tax Map Key with ease

- Find Tax Map Key and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Tax Map Key and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tax Map Key?

A Tax Map Key (TMK) is a unique identifier assigned to parcels of land by a tax authority, used primarily for property tax assessment and management. Understanding your Tax Map Key helps in locating property details, ensuring proper tax documentation, and maintaining legal records effectively. Knowing how to use your Tax Map Key can enhance your real estate transactions.

-

How can airSlate SignNow help with documents related to Tax Map Keys?

airSlate SignNow allows you to easily eSign and manage documents associated with Tax Map Keys, such as property deeds and tax documents. Its user-friendly platform streamlines the signing process, ensuring that all parties can complete documents from anywhere, at any time. This efficiency can speed up property transactions linked to your Tax Map Key.

-

Is there a cost associated with using airSlate SignNow for Tax Map Key transactions?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Whether you are a small business or a larger organization, you can choose a plan that best suits your volume of transactions involving your Tax Map Key. This provides flexibility while ensuring you have access to all necessary features.

-

What features are included in airSlate SignNow for handling Tax Map Key paperwork?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and mobile accessibility, which are perfect for handling Tax Map Key documents. These tools simplify the signing process, enhance document management, and provide audit trails for compliance. Utilizing these features ensures your Tax Map Key-related transactions are efficient and secure.

-

How does airSlate SignNow ensure the security of Tax Map Key documents?

Security is a priority at airSlate SignNow; it employs encryption and advanced authentication to protect your documents, including those related to your Tax Map Key. With features like user permissions and audit logs, you can rest assured that your sensitive information is safeguarded. This is crucial for maintaining the integrity of any Tax Map Key transaction.

-

Can airSlate SignNow integrate with other tools for managing Tax Map Keys?

Yes, airSlate SignNow integrates seamlessly with numerous software applications that can help manage Tax Map Keys more effectively. This allows for synchronization of property data and streamlined workflows, improving overall efficiency in document management. Such integrations facilitate better collaboration and data sharing essential for transactions.

-

What benefits can I expect from using airSlate SignNow for Tax Map Key processes?

By using airSlate SignNow for Tax Map Key processes, you can expect increased efficiency, reduced turnaround times, and a more organized workflow. The ability to eSign documents remotely eliminates the need for physical paperwork, saving time and resources. Additionally, the intuitive interface ensures that users can easily navigate and manage their documents related to their Tax Map Keys.

Get more for Tax Map Key

- Pca skin professional price list form

- Blue badge application 650134480 form

- Acc 23 annual scientific session expo together congress of cardiology form

- Facility provider recredentialing facility provider recredentialing form

- Fillable online courts mi this form if fax email print

- Nc 100 petition for change of name change of name form

- Texas department of public safetyregulatory servi form

- Fillable online tvfc program vaccine transfer authorization form

Find out other Tax Map Key

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure