Employment Verification Form

What is the Employment Verification Form

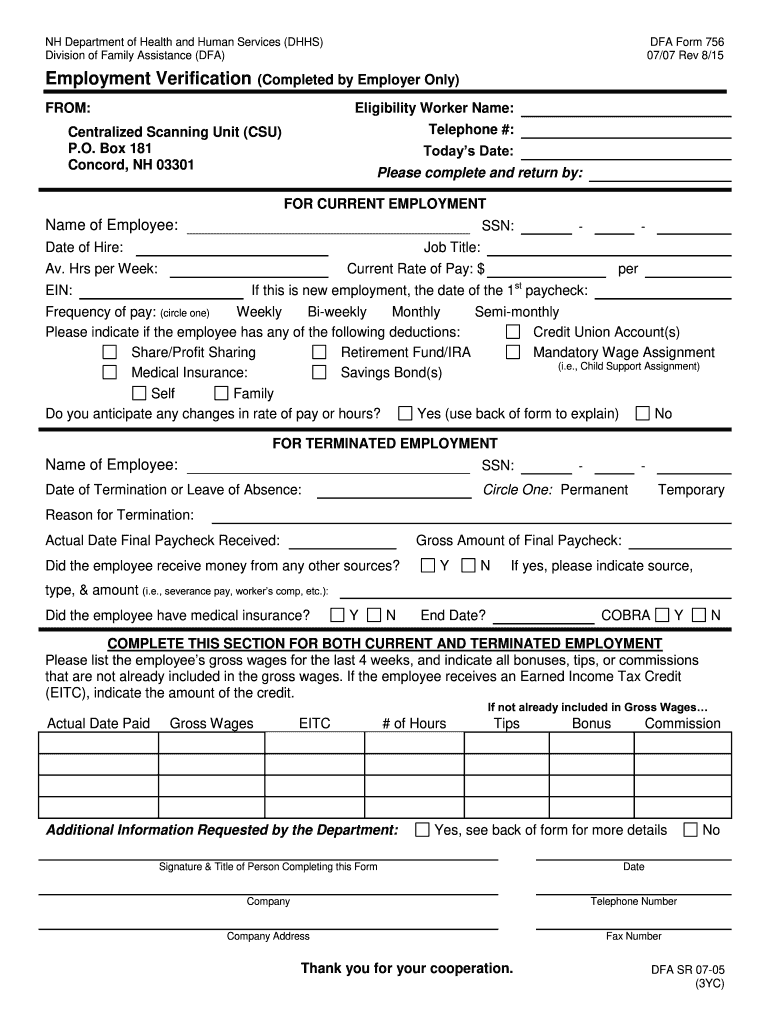

The employment verification form is a document used by employers to confirm an individual's employment status, job title, and duration of employment. This form is crucial for various purposes, including loan applications, rental agreements, and background checks. It typically requires information such as the employee's name, the employer's details, and specific employment dates. The NYC employment verification form serves as a standardized way to provide this essential information, ensuring that it meets local and federal requirements.

How to Use the Employment Verification Form

Using the employment verification form involves several steps. First, the employee must request the form from their employer, who will then fill it out with accurate details regarding the employee's work history. Once completed, the form can be submitted to the requesting party, such as a landlord or financial institution. It is important to ensure that all information is correct, as inaccuracies can lead to delays or complications in the verification process.

Steps to Complete the Employment Verification Form

Completing the employment verification form requires attention to detail. Here are the steps involved:

- Gather necessary information, including the employee's full name, job title, and dates of employment.

- Fill out the form clearly, ensuring that all sections are completed accurately.

- Include the employer's contact information for verification purposes.

- Review the form for any errors before submission.

- Submit the form to the requesting party as directed.

Legal Use of the Employment Verification Form

The employment verification form is legally recognized as a valid document when completed correctly. It serves as a formal declaration of employment status and can be used in legal contexts, such as court proceedings or disputes. To ensure its legal standing, the form must be filled out truthfully and accurately, and it may need to be accompanied by additional documentation, such as pay stubs or tax forms, depending on the requirements of the requesting entity.

Key Elements of the Employment Verification Form

Several key elements are essential for the employment verification form to be effective and valid. These include:

- Employee Information: Full name, job title, and employment dates.

- Employer Information: Company name, address, and contact details.

- Verification Statement: A statement confirming the accuracy of the information provided.

- Signature: The signature of the employer or authorized representative, along with the date.

Who Issues the Form

The employment verification form is typically issued by the employer or human resources department of a company. In some cases, third-party verification services may also provide this form. It is important for the issuing party to ensure that the information is accurate and up to date, as this affects the credibility of the verification process.

Quick guide on how to complete work verification form

Complete Employment Verification Form effortlessly on any gadget

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Employment Verification Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Employment Verification Form with ease

- Find Employment Verification Form and click Get Form to initiate.

- Use the tools we provide to fill out your document.

- Highlight important sections of your files or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the information and select the Done button to save your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, monotonous form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Employment Verification Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is the best thing you've looked forward to in your life?

Getting my medical license.The process is so painful that sometimes I feel like stabbing myself in the heart and gouging my eye out, and jumping off a bridge at the same time. And the most frustrating part of it is that there’s not a single thing I can do to speed things up.The website isn’t very user friendly.They request way too many documents. Like, you need to submit 6 different things to prove your citizenship. Can’t it be assumed that if the Federal Government gave me a passport, they know that it’s because I’m a citizen? Can’t it also safely be assumed that if I graduated from a residency program, I must have graduated from a medical school at some point?The website doesn’t tell you everything you need to send. After you’ve filled out the application online, there is a PDF you’re supposed to find somewhere. The PDF was the old application form. You’d fill it out by hand or by editing the PDF. If you did that, you’d see an number of appendices that told you what other documentation you were supposed to supply. But if you apply online, there’s nothing to let you know what you’re missing. So, you have to call them. When you do, they tell you that you need a bunch of stuff you’d never have guessed: a background check, forms you’re supposed to submit to your residency programs, etc. Why not put that in the online application?Then, after you do all that, you might wonder if your file is complete. So, you call. They’ll tell you that your application hasn’t been processed yet. How long till it gets processed? 3 to 4 weeks! So, they won’t even look at your file for 3 to 4 weeks. And, 3 to 4, of course, means 4. Then, when they look at your file, it might even be week 5 by the time they respond to you. At that point, they’ll tell your that your file is missing some stuff.You ask for clarification about the missing stuff, because you’re pretty sure you’ve already sent it. You hear nothing back for a week. You call them, only to hear that they thought they’d emailed you what you were supposed to fill out… You submit what they’re asking for, having wasted another week waiting. Then, they tell you that your file has been submitted for final approval. YAY!Then you’re told that, since you used to be a nurse, you should also submit a nursing license verification. Okay, no biggie, you think. You did a similar thing for Iowa a few years back. You’ll just go online and have the state of Michigan send the state of Tennessee some information about the nursing license that expired 6 years ago.You get on the Michigan website, and things are so disorganized that you can’t for the life of you figure out how to submit the verification request. Oh, and the process has changed. In 2015, you could use the Nursys verification site. But Michigan has pulled out of this process, because… just because. Now, you have to call during business hours, realize that you’re supposed to download and fill out a form, attach a money order (you can’t pay online anymore), and mail it to a P.O. Box.You do that, sending it by express mail. You call the next day to see if it’s been received. Now you’re told that if you want to send things by express mail, there’s another address you should have sent it to, an address that was never communicated to you when you talked to the Michigan people on the phone. You learn that sending mail to the P.O. Box means that it will sit there for a week, after which it will be processed by the Cashier’s office/Finance office/Treasury office, then slowly make its way to the Bureau of Licensing… this process might take 2 weeks. At this point, you’ve sent your initial application 8 weeks before. You wonder why it is that the process couldn’t be more streamlined. Why couldn’t they be a uniform process for all states? Why couldn’t they at least be a central database where healthcare providers could send their documentation, so that whenever they apply for licensing in a new state, that state can immediately receive all the relevant documentation. You’re powerless. You try to think of other things you might do.You remember that Iowa must have a copy of your nursing verification license. You wonder if you could talk to them and see if they’d share it with you. You’re told that they will emphatically not release the document to you. Why? Who knows. Anyway, they might consider releasing it to the Tennessee people if they are contacted directly by their Medical Board. You sheepishly ask the people in Tennessee if they’d be willing to contact Iowa, giving them a phone number, email, and fax number, knowing full well that it will be to no avail.You decide that maybe, if you were to track down the cashier’s office in Michigan, you could fly there and make the payment in person, in a bid to speed up the processing of your license verification request. It’s after hours now, so you can’t be sure. There’s a plane early in the morning. You could fly to Detroit, rent a car, drive to Lansing, and give it a shot. But… what if it doesn’t work? You decide to wait until the morning and call the office to see if getting there in person would make a difference. You are told that it is impossible to make a payment in person, because… rules. There’s literally not a damn thing you can do.And that, my friends, is the story of my life right now. The most frustrating part of this saga is that not only can I not work, but I’m sort of homeless right now. Let me explain. A while back, I bid on a house. I used what is called a physician loan. What my lender did not tell me is that you need an active medical license. So, we were a week from the closing date before I learned this. At this point, I had three options:Walk away from the home purchase and rent. This wouldn’t have been a terrible idea.Prolong my temporary lease at the place I was renting. I would not do this because I hated, hated, hated them with their nickle-and-diming tactics.Wait for my license.I opted for number 3, because I thought it couldn’t take much longer until I’d get my license. My belongings are currently in storage. I’m staying with my sister in Florida. It’s not the worst thing that’s ever happened to anyone in human life, but it’s still really frustrating. The only bright spot is that I get to spend time with my family. I have a nephew and two nieces here that I hadn’t seen in 9 months. They’re growing so very fast. I am constantly peppering them with mental math questions, but they seem to love me for some reason. So, all in all, things could be worse.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can we fight against the NRA regarding gun control?

Are you sure that the NRA is the problem?Oh, I know that the media and the talking heads are all making them out to be some 500 lb gorilla and the reason psychos shoot up school yards, but have you ever bothered to look into the matter beyond the headlines?I’ll give you an example. In 2017, the push was for a “Universal Background Check”. The idea was to be sure that people buying guns were not criminals. Believe it or not, the NRA wholly supports this and in fact was involved with creating the current NICS (National Instant Check System) that is used.But the bill that was proposed was not what you heard in the media. First, it would not plug any “Gunshow Loophole” because there is no such thing. The only sales at a gun show that the bill covered was private sales. Of course, private sales can occur anywhere, not just gun shows.But the bill didn’t make the NICS easier for private sales. They just required all private sales to be conducted through a licensed dealer. Had this actually passed, a gun show would be an ideal location for such sales as there would be access to many dealer. In effect, you would greatly increase the number of private sales at a gun show by this law.So, what is involved with a sale through a dealer? Well, the dealer would have to do the following:1) Record the transfer in their bound book. This is a book where all the transactions of a firearm is recorded via that dealer. The book is auditable by the BATF and many dealers have faced fines for poorly kept records, so many dealers go to great pains to keep their book neat and accurate.2) Fill out the federal form 4473. This is required by all dealer sales of both new and used guns. It asks for the buyer’s name, address, the make and model of the gun, serial number, and then asks a bunch of questions. The dealer can get fined if the person fills out the form wrong. For example, answering a question with “Y” or “N” instead of “Yes” or “No” is a BATF violation. So the dealer has to carefully examine the form for errors and have the person fill out another if errors are found.3) The dealer then calls into the NICS. NICS can come back with a “Proceed”, “Denied” or “Delay”. A delay can take up to 3 days. Typically this is a name that appears similar to a Prohibited Person and requires some research. If this happens, the transfer is on hold. The dealer has no idea when the result of the research is likely to finish. If you are at a gun show, the show could be over before the approval is made.4) All this paperwork, verification, etc takes time. Time is money. So dealers charge for this service. It is typical for a dealer to charge $25-$40 per gun, but sometimes multiple guns get a discount because the dealer can process up to 4 on a single form, but when more than one gun is transferred, the dealer has to fill out Form 3310 which is supposed to help with gun trafficking.All of this is well and good if you are buying a gun from someone you don’t know and many people will require sales be conducted at a dealer for the piece of mind such protections provide. But friends and family typically do not bother with the hassle and expense.One thing you need to realize is that to get a gun dealer license is not an easy process. Since the federal government cracked down on so called “kitchen table” dealers back in the 1980’s, you now must show a commercially zoned storefront with posted business hours to qualify. Many communities don’t want gun shops, and use zoning laws to make them difficult or unattractive. For example the city of Boston does not have any dealers. In fact, the nearest dealer is 3 towns away. Many rural areas don’t have the traffic to keep a dealer in business and you’ll find they are typically only open in the evening or on a Saturday as they work another full time job. Keep this in mind as we get into the next issue.But the bill didn’t stop at sales. It stated that ALL transfers had to be done in this manner. No exceptions. So, two friends out on a hunt would need to go through the whole process listed above just to swap guns for the afternoon. Oh, and they would have to do it all again to give the gun back. It is very common on a range to try out other people’s guns - such a thing would also require the full transfer and back process. Demo guns at a national event by manufacturers? Same thing.Basically any time a gun were to swap hands, the law would apply. There are private shooting clubs where guns are treated like library books and members take whatever they want. Families regularly swap guns. Heck, some shooting courses provide guns for students to use. All of these events would have been impacted by these new transfer requirements.The NRA balked at this. Essentially the rule would curtail many of the traditions and practices that are very common and virtually never result in any kind of criminal activity. In essence it would criminalize things that simply are not crimes.Not only would it create criminals where no criminal intent existed, but the cost to manage the volume of temporary transfers, the staffing needed to take the calls and do the checks would have cost millions each year. All money that would not go toward actually dealing with criminals.When the issue was brought up, many members of Congress agreed the requirements were too restrictive and the whole bill failed to pass. The supporters of the bill did not even attempt to listen to the complaints and work out a manageable fix.Did you hear any of that in the media?But what about catching criminals?Well, the bill didn’t change anything in regards to enforcing the rules to make sure the people who should not own guns were properly entered into NICS. In fact, other than maybe getting fired, there is NO PENALTY for failing to report a person. We have laws that will jail a teacher or coach that fail to report bullies. We have laws that put priests in prison who fail to report potential inappropriate behaviors in other clergy. But we do not have any laws that punish law enforcement agents that fail to do their job and make sure that dangerous people are reported to the background system. And this bill made no effort to change that.NICS is not open to anyone but federally licensed gun dealers. The left are so worried that the system might be used to check people for things other than guns that they refuse to create a means to allow people to verify someone they are selling a gun to. It would be easy to create an app that takes a photo of the buyer and seller’s ID (or just their faces and type in some data) and then return a simple “Proceed” or “Deny” with no other details. You’d have plenty of information to audit for illegal use. And if someone didn’t have an ID, they could then use a dealer. Heck, you can’t file taxes on-line without submitting some kind of ID, so this isn’t anything unique.And yet, the bill did nothing to address the issue of accessing the NICS for easier private sales.Here is the thing. We have 20,000 gun laws in this country. On the federal side, a prohibited person touching a gun could see them in prison for a minimum of 5 years. And yet, we still see cities with high violent crime rates that have virtually no federal cases. Why isn’t law enforcement using those stiff federal laws to get the violent people off the streets? Such a program called “Project Exile” worked wonders in Richmond, VA to reduce violent crime dramatically.OK, back to the “Universal Background Check” bill.I spent a lot of words above explaining what the bill would have required of people and why the situation would have been a nightmare. You never saw any of this in the news and the media pretty much ignored the issue.When the bill was defeated, it was never reported that a “terrible bill that would have cost millions and made criminals out of the innocent was defeated”, instead, all you ever heard was“The NRA used its influence to defeat the Universal Background Check bill that would have closed the gunshow loophole”Almost everything about that statement is false.So, be careful what you want to “Fight Against”. I suspect that most of what you think about the NRA is highly biased due to the way the organization is treated in the media. When you look at the actual facts, many times their concerns are quite valid. And, they have a lot of rank and file law enforcement on their side which helps them represent real world situations. I’ve found their positions in many cases very well presented. Most of the arguments you get on TV news are highly edited and taken out of context to promote an agenda, not facilitate a debate.Make sure you know what you are fighting for. You might be surprised.

-

How do I get a transcript from Gujarat University?

I studied through Gujarat Arts & Commerce College and some 15 days back i.e. 9th March,2018, I received my transcript verified with the respective marksheet and Degree in a sealed cover, which i submitted on 15th Feb, 2018 totaly exactly 23 days. I have also been able to attach the snaps of these receipts for better understanding.It's not tough, but the total process is very time consuming so patience is the ONLY key.Start..Directly go to the Degree section at the 1st floor at the Admin Block of Gujarat University Campus. Find out Mr. Bhuva ask for transcript for your degree / masters. It will just take 1 day for the typing in the format and he will mail it on your mail id (he will charge a typing fee of 200 INR).Now, kindly verify the transcript with the your marksheets. (Please expect some typo errors)Go to your college, find out the transcript issuing section and get the form in 3 copies and fill it up by attaching 3 copies of your marksheet, transcript and degree. Pay a fees of Rs. 300 and get the 2nd year copy of your marksheet along with the transcript duly signed and sealed from the Principal of the College.Go back to Mr. Bhuva, with the signed and sealed copies of the marksheet and transcipt. He will ask you to pay up Rs. 200 at the Cash Counter, Ground Floor of the same building of the University for the Verification of the 2nd year marksheet, the challan has to be kept very safe as its needed in near future to get this copy back in a sealed cover.Proceed to 2nd floor of the same admin block, just above the degree section. There is only one window and its only for transcript.Find out and read the information notice carefully. There are 3 different type of forms available in this section. You will need 3 sets of all certificates for attachments.Transcript Verification FormMarksheet Verification FormDegree Verification FormFill out all of three forms and dont forget to mention the WES reference number in every form. Typically the questions are a serious repetition, so dont just worry, your first thought is always right.Show the forms and attachment to the counter staff for verifying, later they will sign on the top corner of every form asking your to proceed to the Cash Counter in the Ground Floor. The Verification Charges are Rs. 50 for each marksheet, Rs. 500 for degree, Rs. 200 for Transcript and finally Rs. 500 for Sealed Cover. (Incase, if your a emergency and a Immigration Office/Officer has sent you a mail, then Rs. 500 for tatkal services) The last charge is applicable for urgency and needs an official letter to proove it.Show the cash receipts to the verifying staff at the 2nd floor counter. She will retain everything except the copy of Original Cash Receipt. She will ask you to come after 30 working days for the sealed cover. (YES! 30 working days. Insane!)15 days later, by showing the original challan just try checking if its ready. May be if you are lucky enuf, they might say “YES”.Go to the 2nd floor and get your 2nd year verified marksheet copy. They will ask you to go to counter no.2 for entry number registry. The counter staff on the same 1st floor does it in a minute. Share it to the staff sitting next to Mr. Bhuva in degree section for re-entry in computer system. He finally hands over your Form that you filled in your college for the sign of Principal (Refer Point No.3).Take the form along to the 2nd floor Transcript Counter Staff with all the original cash receipt.They will ask you to wait for 10 minutes and once they are done, they will call you to ascertin and check the attachments before sealing the cover. The cover gets sealed then and there addressing WES, Toronto / the transcript requesting agency.Happy Moments! Sealed cover seems like an achievement in itself. You are now suppose to send this cover by your own to Totonto Canada. The best referred courier company is DHL, that delivers in 3 days charging Rs. 1800, Wherein, Indian Speed Post Charges Rs. 1392/- and does not delivers in even 10 days.The End…!

-

How can I port from Vodafone postpaid to prepaid?

Going a bit more specific to what @Jai Veer mentioned -Visit your nearest Vodafone store (not the mini stores).Mention that you want to port your postpaid number to prepaid.They will mention that you need to clear out the dues. Accordingly they will get it calculated and share it with you. You can do the payment with card/cash.Once you clear the dues, they ask you to fill-up the prepaid form. Fill-in all the required details attaching it with the hard copy of your Aadhar Card (any other alternatives like driving license, passport, etc. with address on it will also work).Once done with previous step, you will receive the due clearance receipt, along with the new prepaid sim.The porting process takes upto 48 hours. Once you see the network disappear for your postpaid number, replace it with your new prepaid sim.Call 59059 for tele-verification and once successfully verified, your prepaid sim activates in the next 15 minutes.

-

I'm the founder of a new startup and recently I heard that when I employ someone, I need to fill out form I-9 for them. The employee needs to fill it out, but I also need to check their identity and status. Is it true that I am required to do that? Is it true that all companies, even big companies that employ thousands of people, do this?

In addition to both you and the employee filling out the form, you need to do it within a certain time period, usually the first day of work for the employee. And as mentioned, you do need to keep them on file in case of an audit. You need to examine their eligibility documents (most often their passport, or their driver's license and social security card, and the list of acceptable documents is included on the form). You just need to make sure it looks like it's the same person and that they aren't obvious fakes.You can find the forms as well as instructions on how to fill them out here: Employment Eligibility Verification | USCIS On the plus side, I-9's aren't hard or time-consuming to do. Once you get the hang of it, it only takes a few minutes.

-

How do I change a registered mobile number in HDFC bank?

You can change registered mobile number in HDFC Bank account online by following the steps given below:Step-1: Go to official website of HDFC BankStep-2: Login to HDFC Net Banking PageStep-3: Click on Update Email ID and Landline NumberStep-4: Edit the number you want to changeStep-4: Confirm the number by typing it once againAfter following the steps mentioned in above articles, you can change or update mobile nimber registered in your HDFC Bank Account Online without visiting the bank branch.Your New Mobile Number will be Updated within 24 Hours!!!Point to be NotedIt is true that you can change your mobile number in HDFC Bank Account online still I recommend you to get this done personally by visiting the bank branch. It will eliminate risk( although very rare) of hacking confidential information.Hope this works for you.

Create this form in 5 minutes!

How to create an eSignature for the work verification form

How to create an eSignature for the Work Verification Form in the online mode

How to create an electronic signature for your Work Verification Form in Google Chrome

How to create an electronic signature for putting it on the Work Verification Form in Gmail

How to create an eSignature for the Work Verification Form straight from your mobile device

How to generate an eSignature for the Work Verification Form on iOS devices

How to create an electronic signature for the Work Verification Form on Android OS

People also ask

-

What is an Employment Verification Form?

An Employment Verification Form is a document used by employers to confirm an individual's employment status, job title, and income. It serves as a crucial tool for background checks and loan applications. By using airSlate SignNow, you can easily create and send Employment Verification Forms that can be securely signed electronically.

-

How does airSlate SignNow simplify the Employment Verification Form process?

airSlate SignNow streamlines the Employment Verification Form process by allowing users to create, send, and eSign documents quickly and efficiently. The platform eliminates the need for paper documents, reducing processing time and increasing overall productivity. With automated reminders and tracking features, you can ensure timely responses to your Employment Verification Forms.

-

Is there a cost associated with using an Employment Verification Form in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to features for creating and managing Employment Verification Forms. The cost is competitive and designed to be cost-effective for businesses of all sizes. You can choose a plan that best fits your needs and budget while taking advantage of our powerful eSigning capabilities.

-

Can I customize my Employment Verification Form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to fully customize their Employment Verification Forms. You can add your company logo, adjust the layout, and include specific fields to gather all necessary information. This customization ensures that your Employment Verification Form aligns with your brand and meets your unique requirements.

-

What benefits does electronic signing provide for Employment Verification Forms?

Electronic signing for Employment Verification Forms offers numerous benefits, including faster turnaround times and enhanced security. With airSlate SignNow, you can ensure that your Employment Verification Forms are securely signed and stored, reducing the risk of fraud. Additionally, digital signatures provide a legally binding agreement, ensuring compliance with various regulations.

-

Does airSlate SignNow integrate with other HR tools for Employment Verification Forms?

Yes, airSlate SignNow seamlessly integrates with various HR tools and software, enhancing the Employment Verification Form process. This integration allows you to automate workflows, sync data, and manage documents more efficiently. By connecting airSlate SignNow with your existing HR systems, you can streamline verification processes and improve overall efficiency.

-

How can I track the status of my Employment Verification Forms in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Employment Verification Forms in real-time. The platform provides notifications when forms are viewed, signed, or completed, helping you stay informed throughout the process. This feature ensures that you can efficiently manage your Employment Verification Forms without any delays.

Get more for Employment Verification Form

- Wwwmassgovdocmassachusetts application forhow to apply massachusetts form

- 2021 schedule a form 8804 penalty for underpayment of estimated section 1446 tax by partnerships

- Wwwgsagovunited states tax exemption formunited states tax exemption formgsa

- Irs schedule d 1065 formpdffiller

- Form 8594 rev november 2021 asset acquisition statement under section 1060

- Requesting a compromiseminnesota department of revenue form

- Fillable online to claim this credit you must be a full form

- Fillable form 599 request for copy of income tax return

Find out other Employment Verification Form

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed