Hourly Rate If Applicable Form

What is the Hourly Rate if Applicable

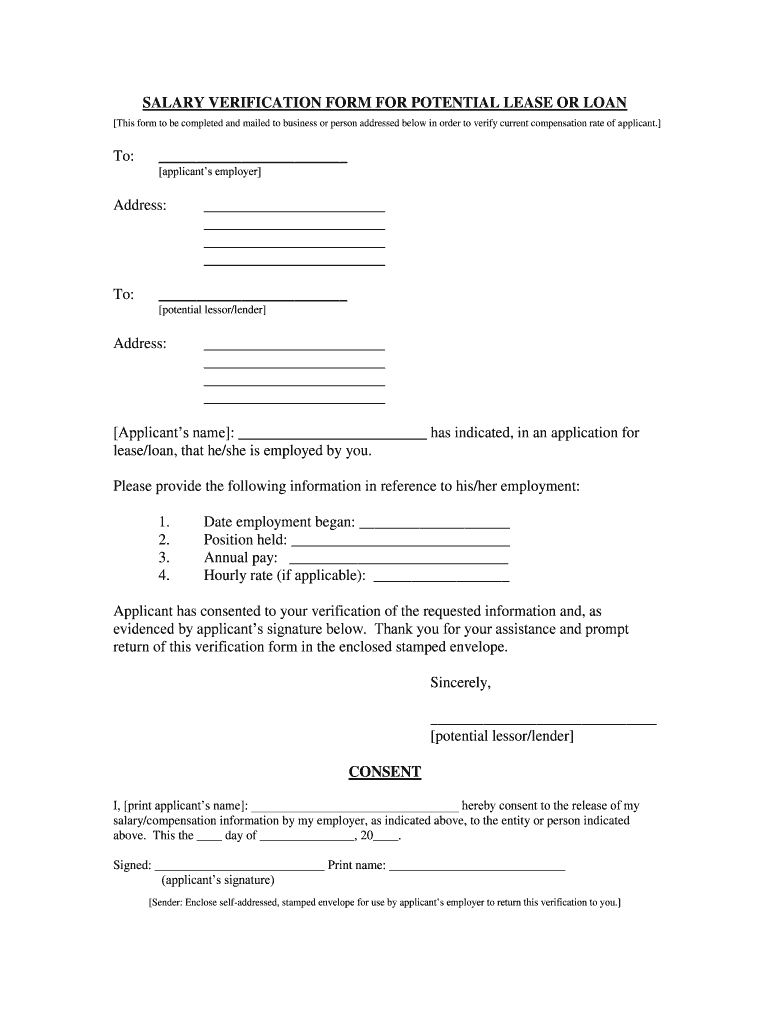

The Hourly Rate if Applicable form is a document used primarily in contractual agreements to specify the hourly compensation for services rendered. It is essential for freelancers, contractors, and employees who are compensated based on the time spent on tasks. This form outlines the agreed-upon rate, ensuring clarity and transparency between the parties involved. By detailing the hourly rate, both employers and service providers can avoid misunderstandings regarding payment expectations.

How to Use the Hourly Rate if Applicable

Using the Hourly Rate if Applicable form involves several straightforward steps. First, ensure you have the correct version of the form, which can be filled out electronically. Next, input the necessary information, including the name of the service provider, the hourly rate, and any relevant terms of service. After completing the form, it can be signed electronically to finalize the agreement. This process streamlines communication and ensures that both parties are on the same page regarding compensation.

Steps to Complete the Hourly Rate if Applicable

Completing the Hourly Rate if Applicable form requires attention to detail. Follow these steps for a successful submission:

- Gather all necessary information, including the service provider's details and the agreed hourly rate.

- Access the form through a reliable electronic signature platform.

- Fill in the required fields, ensuring accuracy in the hourly rate and any additional terms.

- Review the completed form for any errors or omissions.

- Sign the form electronically, ensuring that it meets legal standards for eSignatures.

- Save a copy of the signed form for your records.

Legal Use of the Hourly Rate if Applicable

The Hourly Rate if Applicable form is legally binding when completed correctly. For it to hold legal weight, it must meet specific criteria, including the inclusion of both parties' signatures and adherence to relevant eSignature laws, such as the ESIGN Act and UETA. These regulations ensure that electronic signatures are recognized as valid, providing protection for both the service provider and the employer in case of disputes.

Key Elements of the Hourly Rate if Applicable

Several key elements must be included in the Hourly Rate if Applicable form to ensure its effectiveness:

- Service Provider Information: Full name and contact details of the individual or business providing services.

- Hourly Rate: Clearly stated compensation rate for each hour of service.

- Terms of Service: Any specific conditions or expectations related to the work being performed.

- Signatures: Digital signatures from both parties to validate the agreement.

Examples of Using the Hourly Rate if Applicable

There are various scenarios in which the Hourly Rate if Applicable form can be utilized. For instance:

- A freelance graphic designer may use the form to outline their hourly rate for a project.

- A consultant can specify their hourly fees for advisory services in a business contract.

- Employers may require employees to fill out this form to formalize pay rates for temporary or part-time positions.

Quick guide on how to complete hourly rate if applicable

Complete Hourly Rate if Applicable seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly option to conventional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Hourly Rate if Applicable on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Hourly Rate if Applicable effortlessly

- Obtain Hourly Rate if Applicable and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, through email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Hourly Rate if Applicable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the hourly rate if applicable for using airSlate SignNow?

The hourly rate if applicable for using airSlate SignNow varies based on your specific requirements and usage. airSlate SignNow offers flexible pricing plans, which can include hourly rates depending on additional services or support you may need. For a tailored quote that includes an hourly rate if applicable, please contact our sales team.

-

How does airSlate SignNow ensure cost-effectiveness in its pricing?

airSlate SignNow ensures cost-effectiveness through transparent pricing and no hidden fees. By offering different pricing tiers, businesses can choose plans that best fit their needs, including options with an hourly rate if applicable for specific services. This way, you only pay for what you use, making it a budget-friendly choice.

-

What features are included in the airSlate SignNow pricing plans?

The pricing plans for airSlate SignNow include a variety of essential features such as document editing, templates, and eSignature capabilities. Additionally, if an hourly rate is applicable, you can access premium features like advanced integrations and custom workflows. These features help streamline your document management without overspending.

-

Are there any additional costs involved with airSlate SignNow?

While airSlate SignNow offers competitive pricing, some additional costs may be incurred based on optional add-on features or services. An hourly rate if applicable may apply if you choose to utilize dedicated support or customization services. It's advisable to review the pricing details and consult our team for a comprehensive understanding of the costs.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for users to explore the platform's features without commitment. During the trial period, you can assess how the service fits your needs and determine if an hourly rate is applicable for any additional services you might want to incorporate. Sign up today and start experiencing the benefits!

-

How does airSlate SignNow integrate with other software?

airSlate SignNow provides numerous integration options that enhance its functionality and streamline your workflow. Our platform can integrate with various tools, allowing you to maximize efficiency and productivity. If an hourly rate is applicable for custom integrations, our team will assist you in setting them up according to your requirements.

-

What benefits does airSlate SignNow offer for businesses?

By using airSlate SignNow, businesses can benefit from increased productivity through faster document turnaround times and reduced paperwork. The platform's user-friendly interface and reliable eSignature capabilities ensure a seamless experience. Exploring the potential hourly rates if applicable for custom features can further enhance your business operations.

Get more for Hourly Rate if Applicable

- Tricare service requestnotification form

- Employment verification form spectrum enterprises

- Section a 1 substitute w 9 form offeror registration raytheon

- Pre task plan example form

- V20 2 new user certification form

- Fillable medical invoice 17913590 form

- Virginia insurance card form

- Employment application k1 speed form

Find out other Hourly Rate if Applicable

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT