New Mexico Form PIT X Amended Return TaxFormFinder 2021

What is the New Mexico Form PIT X Amended Return?

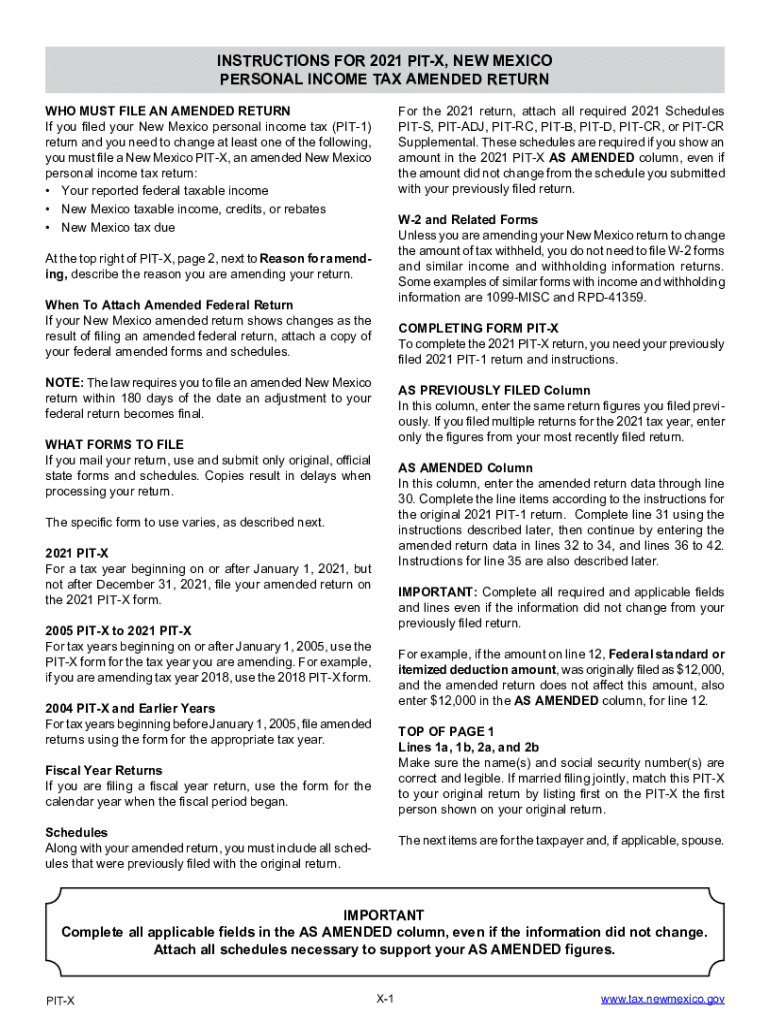

The New Mexico Form PIT X Amended Return is a tax document used by individuals to amend their previously filed personal income tax returns in New Mexico. This form allows taxpayers to correct errors or make adjustments to their income, deductions, or credits that were reported in their original returns. By submitting Form PIT X, taxpayers can ensure that their tax records are accurate and up to date, potentially leading to a refund or a reduction in tax liability.

How to Use the New Mexico Form PIT X Amended Return

To effectively use the New Mexico Form PIT X Amended Return, taxpayers should first gather all relevant documents, including the original return and any supporting documentation for the changes being made. The form requires detailed information about the taxpayer, including Social Security numbers and the tax year being amended. Once completed, the form must be submitted to the New Mexico Taxation and Revenue Department, either electronically or by mail, depending on the taxpayer's preference.

Steps to Complete the New Mexico Form PIT X Amended Return

Completing the New Mexico Form PIT X involves several key steps:

- Obtain the form from the New Mexico Taxation and Revenue Department website or through authorized channels.

- Fill in personal information, including name, address, and Social Security number.

- Indicate the tax year for which the return is being amended.

- Provide details of the changes being made, including any corrected income, deductions, or credits.

- Calculate the new tax liability or refund amount based on the amended information.

- Sign and date the form before submission.

Legal Use of the New Mexico Form PIT X Amended Return

The New Mexico Form PIT X is legally recognized for amending tax returns, provided it is completed accurately and submitted within the designated time frame. Taxpayers should ensure compliance with all state regulations regarding amendments to avoid penalties or legal issues. The form must be signed by the taxpayer or an authorized representative to be considered valid.

Filing Deadlines for the New Mexico Form PIT X Amended Return

Taxpayers must be aware of the filing deadlines associated with the New Mexico Form PIT X. Generally, the form should be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines is crucial to avoid any penalties and to ensure that any potential refunds are processed in a timely manner.

Form Submission Methods for the New Mexico Form PIT X Amended Return

Taxpayers have several options for submitting the New Mexico Form PIT X Amended Return. The form can be filed electronically through the New Mexico Taxation and Revenue Department's online portal. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address. In-person submissions may also be accepted at designated tax offices, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete new mexico form pit x amended return taxformfinder

Complete New Mexico Form PIT X Amended Return TaxFormFinder effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and efficiently. Manage New Mexico Form PIT X Amended Return TaxFormFinder across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

The simplest way to edit and electronically sign New Mexico Form PIT X Amended Return TaxFormFinder with ease

- Find New Mexico Form PIT X Amended Return TaxFormFinder and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign New Mexico Form PIT X Amended Return TaxFormFinder while ensuring seamless communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form pit x amended return taxformfinder

Create this form in 5 minutes!

People also ask

-

What is the New Mexico Form PIT X Amended Return TaxFormFinder?

The New Mexico Form PIT X Amended Return TaxFormFinder is a specialized form used to amend a previously filed personal income tax return in New Mexico. This form allows taxpayers to correct errors or make changes to their original tax return. Utilizing TaxFormFinder ensures that you have the latest version of the form and can file accurately.

-

How can airSlate SignNow assist in filing the New Mexico Form PIT X Amended Return TaxFormFinder?

airSlate SignNow provides an integrated platform that simplifies the process of filling out and submitting the New Mexico Form PIT X Amended Return TaxFormFinder. Our easy-to-use features enable users to eSign and send documents seamlessly, ensuring that your amended return is filed quickly and securely.

-

What are the pricing options for using airSlate SignNow with the New Mexico Form PIT X Amended Return TaxFormFinder?

airSlate SignNow offers a variety of pricing plans that are affordable and cater to different business needs. Our cost-effective solution includes options for individuals and businesses, allowing you to choose the best plan that suits your usage for the New Mexico Form PIT X Amended Return TaxFormFinder. Visit our website for details on specific pricing tiers.

-

What features does airSlate SignNow provide for eSigning the New Mexico Form PIT X Amended Return TaxFormFinder?

airSlate SignNow offers a robust set of features specifically designed for eSigning documents, including the New Mexico Form PIT X Amended Return TaxFormFinder. Users can easily create, send, and track documents, while ensuring secure sign-off with customizable workflows and templates. These features simplify the eSigning process and enhance efficiency.

-

Can I integrate airSlate SignNow with other software to help with the New Mexico Form PIT X Amended Return TaxFormFinder?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing your experience with the New Mexico Form PIT X Amended Return TaxFormFinder. Whether you are using CRM software, accounting tools, or cloud storage, our integrations can streamline your workflow and keep your documents organized.

-

What benefits does using the New Mexico Form PIT X Amended Return TaxFormFinder with airSlate SignNow provide?

Using airSlate SignNow for the New Mexico Form PIT X Amended Return TaxFormFinder simplifies the entire process by allowing users to complete, sign, and send documents electronically. This reduces paper usage and minimizes filing errors, helping you stay compliant with tax regulations efficiently and effectively.

-

Is it safe to use airSlate SignNow for the New Mexico Form PIT X Amended Return TaxFormFinder?

Absolutely! airSlate SignNow implements the highest security standards to protect your documents, including the New Mexico Form PIT X Amended Return TaxFormFinder. With advanced encryption and secure cloud storage, you can trust that your sensitive tax information is safe throughout the process.

Get more for New Mexico Form PIT X Amended Return TaxFormFinder

- Nevada unconditional final 497320734 form

- Nv lien 497320735 form

- Nv lien 497320736 form

- Business credit application nevada form

- Individual credit application nevada form

- Interrogatories to plaintiff for motor vehicle occurrence nevada form

- Interrogatories to defendant for motor vehicle accident nevada form

- Llc notices resolutions and other operations forms package nevada

Find out other New Mexico Form PIT X Amended Return TaxFormFinder

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT