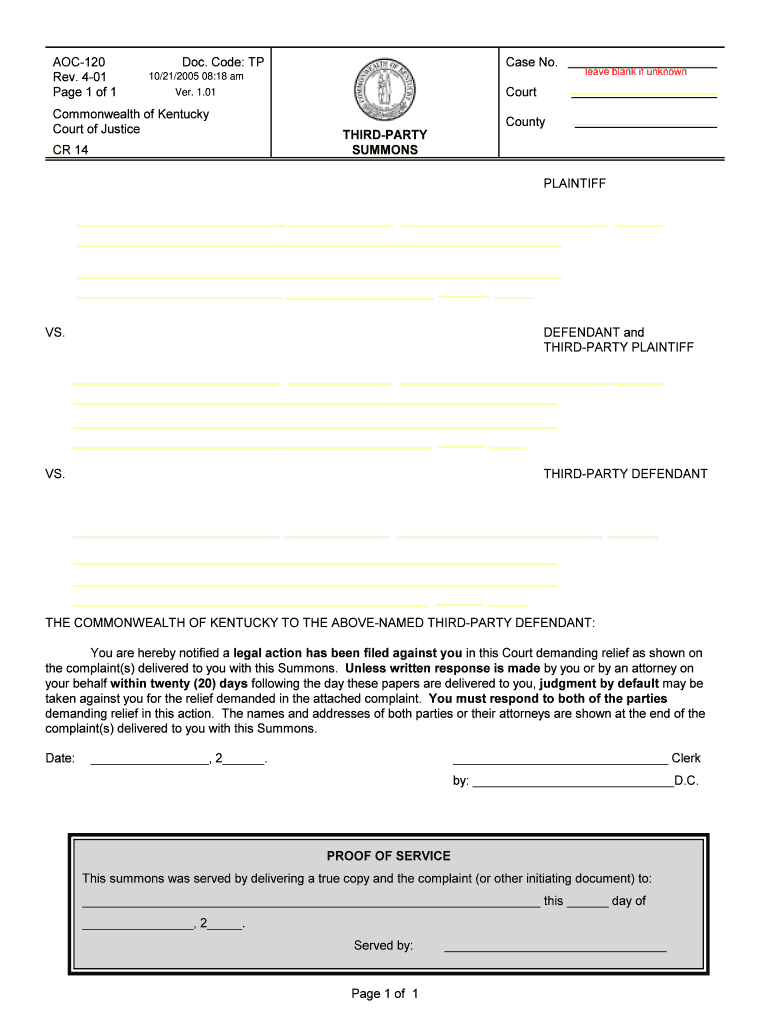

Code TP Form

What is the Code TP

The Code TP is a specific form used primarily for reporting certain types of income and tax-related information to the Internal Revenue Service (IRS). It serves as a crucial document for taxpayers, ensuring compliance with federal tax regulations. The form is essential for individuals and businesses alike, as it helps in accurately reporting earnings and fulfilling tax obligations. Understanding the Code TP is vital for maintaining good standing with tax authorities.

How to use the Code TP

Using the Code TP involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents that pertain to the income being reported. This may include pay stubs, bank statements, and other relevant records. Next, fill out the form carefully, ensuring that all information is correct and complete. After completing the form, review it for any errors before submission. Finally, submit the Code TP to the IRS by the designated deadline to avoid any penalties.

Steps to complete the Code TP

Completing the Code TP requires a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant financial documents.

- Obtain the latest version of the Code TP from the IRS website.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the information for any mistakes or omissions.

- Submit the completed form to the IRS by the required deadline.

Legal use of the Code TP

The legal use of the Code TP is governed by IRS regulations, which stipulate how the form must be filled out and submitted. It is essential that taxpayers use the form correctly to avoid legal complications. The form must be completed truthfully, as any inaccuracies can lead to penalties or audits. Compliance with IRS guidelines ensures that the Code TP is recognized as a valid document for tax reporting purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Code TP are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of the year following the tax year being reported. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these deadlines, as failure to file on time can result in penalties and interest on unpaid taxes.

Required Documents

To complete the Code TP accurately, several documents are required. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract work.

- Bank statements showing interest or dividends.

- Records of any other income sources.

Having these documents ready will facilitate a smoother filing process and help ensure that all income is reported accurately.

IRS Guidelines

The IRS provides specific guidelines for completing the Code TP, which must be followed to ensure compliance. These guidelines include instructions on how to fill out each section of the form, what types of income need to be reported, and the penalties for non-compliance. Familiarizing oneself with these guidelines is essential for accurate reporting and avoiding potential issues with the IRS.

Quick guide on how to complete code tp

Effortlessly prepare Code TP on any device

Digital document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Code TP on any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to edit and eSign Code TP with ease

- Locate Code TP and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Code TP and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Code TP in airSlate SignNow?

Code TP in airSlate SignNow refers to a unique identifier assigned to documents that need to be tracked and executed electronically. This code enables users to streamline their document management processes and ensures easy access to critical information within the platform. Understanding how to use Code TP effectively can help your business accelerate its signing workflows.

-

How does airSlate SignNow pricing work with Code TP?

The pricing for airSlate SignNow is flexible and offers various plans based on the features you need. Each plan allows access to the Code TP functionality, which is essential for managing documents securely and efficiently. By choosing a plan that fits your business needs, you can make full use of Code TP and other valuable features without overspending.

-

What features related to Code TP does airSlate SignNow offer?

airSlate SignNow offers several features that leverage Code TP, such as document tracking, automated reminders, and customizable templates. These features allow businesses to manage their documents seamlessly and keep everyone involved in the signing process updated. Utilizing Code TP can greatly enhance your team's productivity and ensure compliance.

-

What are the benefits of using Code TP in airSlate SignNow?

Using Code TP in airSlate SignNow brings numerous benefits, including improved document tracking, faster signing processes, and enhanced collaboration. The unique identifier ensures that all stakeholders can easily access the specific documents they need while maintaining security. Overall, Code TP helps businesses to streamline their operations and reduce the time spent on paperwork.

-

Can I integrate Code TP with other applications?

Yes, airSlate SignNow allows integrations with various applications, enabling Code TP to be utilized across different platforms. By integrating with CRM systems or project management tools, you can automate workflows and enhance the usability of Code TP. This seamless connection helps in consolidating business processes and improving overall efficiency.

-

Is there a mobile app for Code TP functionality?

Absolutely! airSlate SignNow provides a mobile app that includes full functionality for managing Code TP and signing documents on-the-go. This means you can access and execute documents, track their status, and utilize features related to Code TP from your mobile device. The app ensures you stay productive, no matter where you are.

-

How can Code TP enhance document security?

Code TP enhances document security by providing a unique identifier for each document, ensuring that only authorized users can access and manage them. With airSlate SignNow, you can establish secure channels for documenting transactions and esigning securely with the Code TP system. This protects sensitive information and enhances your compliance with legal standards.

Get more for Code TP

Find out other Code TP

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online