IRS Form 5471Information Return of U S Persons with 2023

What is the IRS Form 5471?

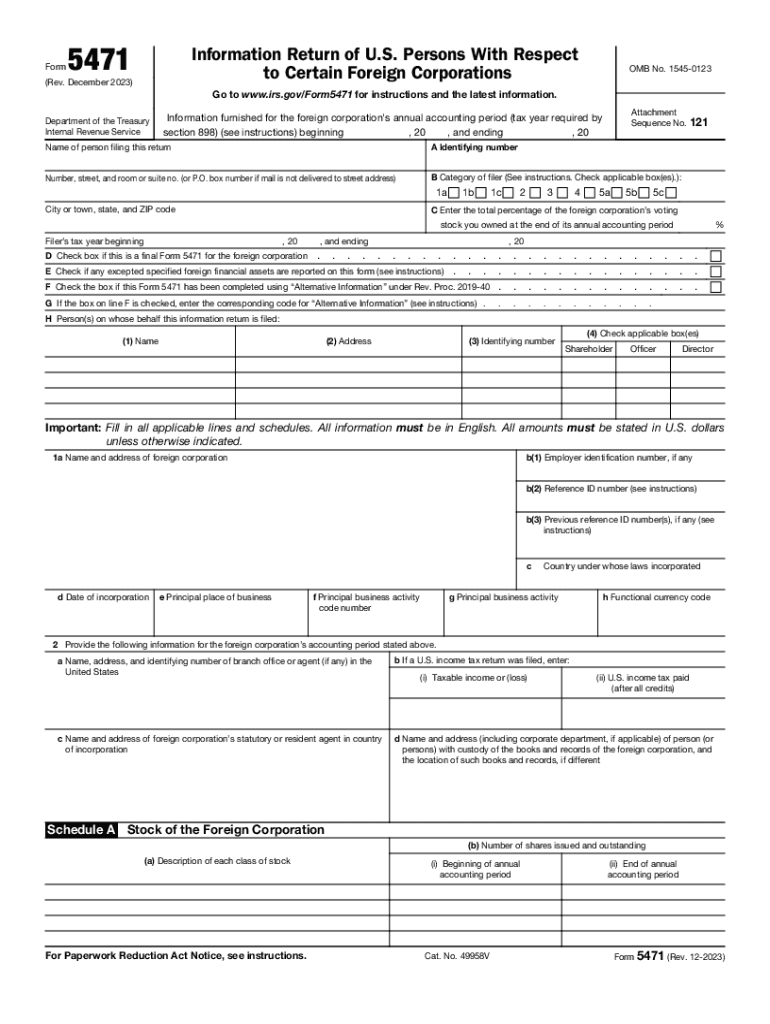

The IRS Form 5471 is an information return required for U.S. persons who are officers, directors, or shareholders in certain foreign corporations. This form is essential for reporting the activities, financial condition, and ownership of foreign entities. The purpose of Form 5471 is to provide the IRS with detailed information about these foreign corporations, ensuring compliance with U.S. tax laws. Failure to file this form can result in significant penalties.

Steps to complete the IRS Form 5471

Completing the IRS Form 5471 involves several key steps:

- Determine your filing requirement based on your ownership interest in the foreign corporation.

- Gather necessary documentation, including financial statements and details about the corporation's activities.

- Fill out the relevant sections of the form, which may include information about the corporation's income, assets, and shareholders.

- Review the completed form for accuracy and completeness.

- Submit the form by the appropriate deadline, ensuring it is included with your tax return.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 5471 typically aligns with the due date of your tax return, including any extensions. Generally, this means:

- For calendar year taxpayers, the form is due on April 15.

- If you file for an extension, you may have until October 15 to submit the form.

It is crucial to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file the IRS Form 5471 can lead to substantial penalties. These may include:

- A penalty of $10,000 for each failure to file.

- Additional penalties may apply for continued non-compliance, potentially increasing the total amount owed.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Key elements of the IRS Form 5471

The IRS Form 5471 consists of several key components that must be completed accurately:

- Identification Information: This includes the name, address, and taxpayer identification number of the U.S. person and the foreign corporation.

- Financial Information: Detailed reporting of the foreign corporation's income, expenses, and assets is required.

- Ownership Structure: Information about the ownership interests and relationships among shareholders must be disclosed.

Completing these elements correctly is vital for compliance and avoiding penalties.

How to obtain the IRS Form 5471

The IRS Form 5471 can be obtained directly from the IRS website, where it is available as a fillable PDF. Additionally, tax professionals and accountants often have access to this form through their software platforms. It is important to ensure that you are using the most current version of the form to comply with any updates in tax regulations.

Quick guide on how to complete irs form 5471information return of u s persons with

Effortlessly prepare IRS Form 5471Information Return Of U S Persons With on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Handle IRS Form 5471Information Return Of U S Persons With on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign IRS Form 5471Information Return Of U S Persons With with minimal effort

- Obtain IRS Form 5471Information Return Of U S Persons With and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign option, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign IRS Form 5471Information Return Of U S Persons With and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 5471information return of u s persons with

Create this form in 5 minutes!

How to create an eSignature for the irs form 5471information return of u s persons with

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 5471 form and why is it important?

The 5471 form is a crucial document used by U.S. citizens and residents to report information about certain foreign corporations. Filing this form is important for compliance with IRS regulations and to avoid potential penalties. Understanding the requirements of the 5471 form is essential for businesses involved in international transactions.

-

How can airSlate SignNow help with filing the 5471 form?

AirSlate SignNow offers a streamlined eSigning solution that can simplify the process of preparing and submitting your 5471 form. With our user-friendly interface, you can easily send, sign, and manage your documents securely. This ensures that your 5471 form is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 5471 form?

Yes, airSlate SignNow offers a variety of pricing plans that can fit different needs and budgets. Each plan provides access to features that enhance the preparation and submission of important documents like the 5471 form. You can choose the plan that best suits your business requirements.

-

What features does airSlate SignNow provide for handling the 5471 form?

AirSlate SignNow offers features such as customizable templates, real-time collaboration, and automatic reminders, which are particularly beneficial for managing the 5471 form. These tools help streamline the workflow and ensure that all participants are kept on track during the filing process. Additionally, our platform guarantees secure storage of your sensitive information.

-

Can I integrate airSlate SignNow with other tools for managing the 5471 form?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, enabling you to work more efficiently on your 5471 form. By connecting with your preferred CRM, accounting tools, or document management systems, you can enhance your workflow and minimize errors during the filing process.

-

How does airSlate SignNow ensure the security of my 5471 form?

We prioritize security at airSlate SignNow by employing advanced encryption protocols that safeguard your 5471 form and other sensitive documents. Our platform is compliant with industry standards, giving you peace of mind that your information remains protected throughout its entire lifecycle. You also have control over access permissions.

-

What are the benefits of using airSlate SignNow for the 5471 form compared to traditional methods?

Using airSlate SignNow for the 5471 form offers several advantages over traditional paper-based methods. Our eSigning solutions save time and reduce paperwork, allowing you to manage your filings more efficiently. Furthermore, the ability to access documents from anywhere provides greater flexibility for busy professionals.

Get more for IRS Form 5471Information Return Of U S Persons With

- Assignment of mortgage package maine form

- Assignment of lease package maine form

- Lease purchase agreements package maine form

- Satisfaction cancellation or release of mortgage package maine form

- Premarital agreements package maine form

- Painting contractor package maine form

- Framing contractor package maine form

- Foundation contractor package maine form

Find out other IRS Form 5471Information Return Of U S Persons With

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors