Form 1120 F U S Income Tax Return of a Foreign Corporation 2023-2026

What is the Form 1120 F U S Income Tax Return Of A Foreign Corporation

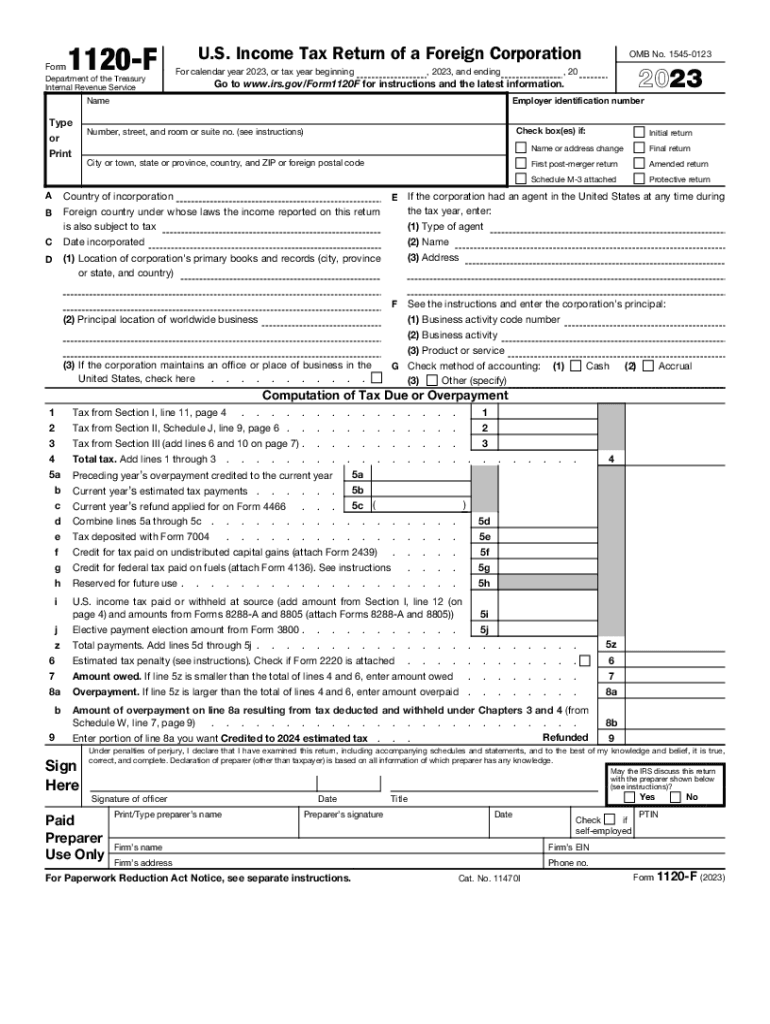

The Form 1120-F is the U.S. Income Tax Return for a Foreign Corporation. This form is specifically designed for foreign entities that engage in business activities within the United States. It allows these corporations to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). Understanding this form is crucial for compliance with U.S. tax laws, as it ensures that foreign corporations pay the appropriate amount of tax on their U.S.-sourced income.

Steps to complete the Form 1120 F U S Income Tax Return Of A Foreign Corporation

Completing the Form 1120-F involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, including the corporation's name, address, and Employer Identification Number (EIN).

- Report all U.S.-sourced income on the form, ensuring to categorize it correctly.

- Deduct any applicable expenses related to the income earned in the U.S.

- Calculate the tax liability based on the net income reported.

- Sign and date the form before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 1120-F. These guidelines include instructions on reporting income, claiming deductions, and understanding the tax obligations of foreign corporations. It is essential to refer to the latest IRS instructions to ensure compliance and to avoid potential penalties. The guidelines also outline the necessary documentation that should accompany the form, such as schedules and additional forms if applicable.

Filing Deadlines / Important Dates

The deadline for filing Form 1120-F typically falls on the 15th day of the sixth month after the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by June 15. Extensions may be available, but it is important to file for an extension before the original deadline to avoid penalties. Keeping track of these dates is crucial for maintaining compliance with U.S. tax regulations.

Required Documents

When completing Form 1120-F, several documents are necessary to ensure accurate reporting. These include:

- Financial statements detailing income and expenses.

- Records of any U.S. business activities.

- Documentation supporting claims for deductions.

- Any relevant schedules or additional forms required by the IRS.

Having these documents organized and accessible will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

Form 1120-F can be submitted in various ways. Corporations may choose to file electronically using authorized e-file providers, which can expedite the processing time. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not accepted for this form. It is advisable to check the IRS website for the latest submission guidelines and addresses.

Quick guide on how to complete form 1120 f u s income tax return of a foreign corporation

Complete Form 1120 F U S Income Tax Return Of A Foreign Corporation effortlessly on any device

Online document management has gained signNow traction with companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1120 F U S Income Tax Return Of A Foreign Corporation on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation without any hassle

- Find Form 1120 F U S Income Tax Return Of A Foreign Corporation and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 1120 F U S Income Tax Return Of A Foreign Corporation to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 f u s income tax return of a foreign corporation

Create this form in 5 minutes!

How to create an eSignature for the form 1120 f u s income tax return of a foreign corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form F 1120 and why do I need it?

Form F 1120 is a crucial tax return for corporations operating in the U.S. It helps businesses report their income, deductions, and tax liabilities to the IRS. Understanding how to accurately complete Form F 1120 is vital for compliance and ensures your business is maximizing its tax benefits.

-

How can airSlate SignNow help me with Form F 1120?

airSlate SignNow offers an intuitive platform for electronically signing and managing documents, including Form F 1120. By utilizing our eSigning capabilities, you can streamline the process, reduce errors, and ensure timely submission of your tax documents.

-

What features does airSlate SignNow provide for Form F 1120?

With airSlate SignNow, you can securely upload, edit, and send Form F 1120 for eSignature. Our platform offers templates, tracking, and audit trails, ensuring you and your team stay organized and compliant throughout the filing process.

-

Is airSlate SignNow cost-effective for submitting Form F 1120?

Yes, airSlate SignNow provides a cost-effective solution for businesses of all sizes needing to handle Form F 1120. Our pricing plans are designed to fit varying budgets while offering powerful eSignature and document management features.

-

Can I integrate airSlate SignNow with other software for Form F 1120?

Absolutely! airSlate SignNow offers integrations with various popular software tools that can help you manage your Form F 1120. Whether it’s accounting software or document management systems, our seamless integrations enhance your workflow.

-

What are the benefits of using airSlate SignNow for Form F 1120?

Using airSlate SignNow for Form F 1120 brings numerous benefits, including faster turnaround times for signatures and reduced paperwork hassle. Our solution enhances collaboration among team members and improves document accuracy, making the filing process smoother.

-

How secure is airSlate SignNow when managing Form F 1120?

airSlate SignNow takes security seriously. Our platform uses advanced encryption and compliance with industry standards to ensure that your Form F 1120 and other sensitive documents are protected from unauthorized access.

Get more for Form 1120 F U S Income Tax Return Of A Foreign Corporation

- Protecting minors from identity theft package maine form

- Maine identity form

- Maine deceased form

- Identity theft by known imposter package maine form

- Organizing your personal assets package maine form

- Essential documents for the organized traveler package maine form

- Essential documents for the organized traveler package with personal organizer maine form

- Postnuptial agreements package maine form

Find out other Form 1120 F U S Income Tax Return Of A Foreign Corporation

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors