1 FEDERAL FILING STATUS Check Only One for Each Return2 CHECK IF on Federal Return Form

Understanding the Federal Filing Status

The federal filing status is a crucial aspect of the tax return process. It determines the tax rates and eligibility for various deductions and credits. There are five primary filing statuses recognized by the IRS: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Each status has specific criteria that must be met, impacting the overall tax liability for each individual or couple. It is essential to select the correct filing status to ensure compliance and optimize tax benefits.

Steps to Complete the Federal Filing Status Check

To check your federal filing status, follow these steps:

- Gather necessary documentation, including your previous year's tax return and any relevant financial records.

- Identify your current marital status and any dependents you may have, as these factors influence your filing status.

- Review the IRS guidelines for each filing status to determine which one applies to your situation.

- Use the IRS online tools or consult tax preparation software to confirm your filing status based on the information provided.

Legal Use of the Federal Filing Status Check

The federal filing status check is legally binding and must be accurate to avoid penalties. Misrepresenting your filing status can lead to issues with the IRS, including audits and fines. Understanding the legal implications of your chosen filing status is vital for compliance with tax laws. Ensure that all information is truthful and reflective of your current situation to maintain legal integrity in your tax filings.

Required Documents for Filing Status Verification

When checking your federal filing status, you will need several documents to ensure accuracy:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Previous year's tax return for reference.

- W-2 forms from employers, 1099 forms for additional income, and any other relevant income statements.

- Records of any deductions or credits you plan to claim.

IRS Guidelines for Filing Status

The IRS provides specific guidelines for determining your filing status. These guidelines outline the criteria for each status and offer resources for taxpayers to verify their eligibility. It is essential to consult the IRS website or official publications for the most current information and updates regarding filing statuses. Understanding these guidelines helps ensure that your tax return is filed correctly and efficiently.

Examples of Federal Filing Status Scenarios

Consider the following scenarios to clarify the application of federal filing statuses:

- A single individual with no dependents would typically file as single.

- A married couple filing jointly can combine their incomes and claim various tax benefits.

- A head of household filer must be unmarried and have a qualifying dependent, allowing for a higher standard deduction.

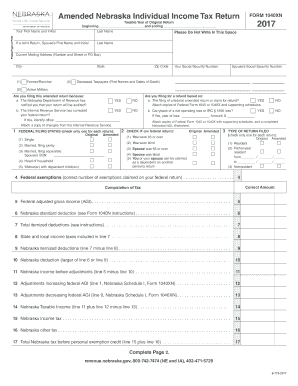

Quick guide on how to complete 1 federal filing status check only one for each return 2 check if on federal return

Complete 1 FEDERAL FILING STATUS check Only One For Each Return2 CHECK IF on Federal Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly with no hold-ups. Handle 1 FEDERAL FILING STATUS check Only One For Each Return2 CHECK IF on Federal Return on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to edit and eSign 1 FEDERAL FILING STATUS check Only One For Each Return2 CHECK IF on Federal Return with ease

- Find 1 FEDERAL FILING STATUS check Only One For Each Return2 CHECK IF on Federal Return and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Mark important parts of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or an invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your preference. Edit and eSign 1 FEDERAL FILING STATUS check Only One For Each Return2 CHECK IF on Federal Return and ensure excellent communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are some of the pragmatic solutions for preventing mass shootings in the US that both liberals and conservatives find mutually agreeable?

For the benefit of people who don’t have a lot of time to read, I’m going to list a short version of my proposals in bullet points after this paragraph. However, if you have the time, I strongly suggest reading this answer in its entirety because it explains the proposals in fairly granular detail. The proposals are nuanced because gun control is a complicated issue when looked at objectively.Standardize on a process which flags individuals in the FBI’s Terrorist Screening Database for a delay in the background check process when said individuals try to buy a gun. During the three day delay period, the FBI has the opportunity to investigate and take legal action against the individuals if necessary.Create a secure electronic background check system which is available to the public so individuals selling firearms to residents of the same state can know whether it is safe to proceed with a transaction.Require membership in the Civilian Marksmanship Program for the purchase of semiautomatic centerfire weapons and centerfire magazines with more than ten rounds of capacity.Create a national permitting process for carrying concealed handguns which overrides state laws.The Gun Control Act of 1968 mandated that manufacturers and commercial sellers of firearms had to obtain a Federal Firearms License (FFL). This was done under the guise of regulating interstate commerce, trade which crosses state lines. The federal government is generally not allowed to regulate intrastate commerce, trade which remains entirely within a state. In 1994, the Brady Handgun Violence Prevention Act mandated that FFL holders had to perform a background check on any firearm transferred through the FFL to a individual who does not hold an FFL. In 1998, this process was streamlined into the National Instant Criminal Background Check System (NICS).With that in mind, we’re going to look at how firearms are legally purchased currently so we can have a perspective on potential improvements to the process.When buying a gun through an FFL, buyers must fill out BAFTE form 4473. I strongly recommend readers view the form. Buyers must submit valid photo identification (usually a driver’s license) to the FFL holder to verify their identity and some of the information on their form 4473. There are three categories of firearm which can be bought through a standard FFL dealer: handguns, long guns (rifles and shotguns), and “other firearms”. Buyers must be 18 years of age to buy long guns and 21 years of age to buy handguns from an FFL. “Other firearms” are a weird category which includes receivers for firearms (which is generally the serialized portion of a firearm) or firearms which do not fit the legal definition of a handgun or long gun but are also not regulated by the National Firearms Act. If the “other firearm” can be made into a pistol, the buyer must be 21 years of age. After a buyer has completed their form 4473, the FFL holder calls NICS and relays the completed information to the FBI.Source: (NICS Process in Motion for the Gun Buyer Video Transcript)The FBI runs the information through the NICS database. If the buyer’s provided information has matches within the NICS database, this will generate a “hit”. At the moment, hits include indictments and convictions for felonies, indictments and convictions for domestic violence, indictments and convictions for other crimes which are punishable by one or more years of imprisonment, known fugitives, dishonorable discharges, adjudications which determined an individual to be mentally defective, restraining orders for children or intimate partners, renouncements of citizenship, unlawful users of controlled substances, illegal aliens, and resident aliens who do not meet very specific criteria.If no hits in the NICS database are generated, the FFL is told to “proceed” and the FFL may complete transferring the firearm at the business’s discretion. If the buyer’s provided information generates a hit, the call will be transferred to an FBI employee who will review the information and determine whether the hit matches the rest of the buyer’s provided information. If the hit is valid and the buyer is a prohibited purchaser, the FFL will be told to “deny” the transfer. If the FBI employee determines the hit is invalid, the FFL will be told to “proceed”. If the FBI employee can not immediately determine the validity of a hit, the FFL will be told to “delay” the transfer and the FBI will do more research to determine the validity of a hit. At this point, the FBI is allotted three business days to tell the FFL to “proceed” or “deny”. If those three business days pass without a final judgement, the FFL may proceed with the transfer at their discretion. The system is set up this way so the FBI can not delay a buyer they can not prove is a prohibited possessor of firearms indefinitely, essentially amounting to a denial without due process of law. Nevertheless, some FFL holders maintain a policy of not proceeding with transfers which have do not receive a definite “proceed”; that is the business’s prerogative.If at any point in this process the FFL holder or its employees believes a buyer is purchasing a firearm on behalf of another person, then the FFL will deny the transfer independent of any judgement made by the FBI. Purchasing a firearm on behalf of another person is illegal.Now what about “internet gun sales”?Websites in the business of selling firearms are legally required to acquire an FFL. Since the website which holds an FFL can not visually verify a buyer’s identity, this means the firearms they sell are legally required to be transferred to an FFL near the buyer. At the FFL which facilitates the transfer, the buyer will be required to complete a form 4473 and go through a background check as described above.On auction sites which deal with firearms, buyers and sellers who do not hold FFLs will submit the information of an FFL near each party and arrange for the firearm to be transferred. The seller’s FFL will ship the firearm to the buyer’s FFL and once again the buyer will complete a form 4473 and go through a background check.The final category would be classified websites which allow firearms to be posted for sale. These are essentially the 21st century equivalent of posting a classified advertisement in a newspaper. In these cases, a buyer contacts the seller who posted the advertisement and the two parties enter negotiations. If the buyer and seller legally reside within the same state and are able to meet face to face to conduct a transfer, the firearm in question may be legally bought under federal law without a background check being conducted provided the seller does not have reason to believe the buyer is a prohibited possessor. If any of those conditions are not met, or if state law prohibits intrastate commerce in this fashion, then FFL holders must once again be involved. These conditions apply to all private person to person sales. One noteworthy quirk, under federal law, persons between the ages of 18 and 21 are not prohibited from purchasing a handgun through a private sale. This is in fact one of the very few ways citizens in this age group can exercise their constitutional right to possess handguns.What about gun shows?If a person buys a firearm from an FFL participating in a gun show (this constitutes the majority of firearm sales at gun shows) then a 4473 is filled out as normal. If a person is buying a firearm from a private party, laws regarding private sales apply. Think of gun shows simply as a way for people who might be interested in buying or selling firearms to all be in the same place at the same time. There’s nothing sneaky or tricky about them, they literally happen in convention centers and on fairgrounds. Local police and BATFE agents are always present at gun shows.Now that we have all that basic information out of the way, we can talk about actual changes to federal law.First let’s take a look at prohibiting suspected terrorists from purchasing firearms. We can all agree we hate terrorists, but they still have due process rights. Fortunately, the FBI is in charge of both the Terrorist Screening Database (TSDB) and the NICS database. Prospective gun buyers with records that produce a match in the TSDB could generate a hit in the NICS database. The FBI could then investigate the hit and, assuming the hit actually matched the buyer in question, determine whether or not to tell the FFL to delay the transfer. Within the current three day delay window, the FBI could bring the case before a judge. Should the judge find probable cause, the transfer could be legally halted. At this point the buyer should be notified and be interviewed as part of the investigation. If charges are appropriate, the FBI can file charges in a timely manner. Otherwise, the suspect should be allowed to go about their business without further interference. That puts a lot of burden on the FBI, but it isn’t supposed to be easy to legally strip citizens’ rights in the United States. Remember, the burden of proof always lies upon the accuser, not the defendant.One rather common gun control proposal in the United States is that of universal background checks on all firearm sales, including private intrastate sales. On a practical level, compliance and enforcement of a universal background check would be very difficult without some kind of national firearm registry linking specific firearms to their owners. No national firearm registry exists for regular rifles, shotguns, or pistols at the moment and it’s actually illegal to create one because of the Firearm Owners Protection Act passed in 1986. There remains a visceral fear of a firearms registry among many conservatives; the concerned parties believe that all firearm registries are nothing more than a precursor to the total confiscation of all firearms. This belief is objectively refuted because numerous firearm registries in multiple US states and democratic countries as well as a national registry on firearms regulated by the National Firearms Act exist and have not been precursors to a total confiscation of all firearms. However, many conservatives latch onto the words of a select handful of extremist politicians who espouse a desire for confiscation as proof that confiscation is the inevitable result of all registries.With all that being said, what might be feasible as an alternative to a universal background check is creating an online version of form 4473 so the public could voluntarily conduct background checks without going to an FFL. This is actually something most gun owners want because, at the moment, there’s no way of conducting a background check for a private intrastate sale in most states without involving an FFL. Involving an FFL introduces a financial disincentive because FFLs are businesses and usually charge for their services. I’ll propose the best system I’ve thought of so far which allows for minimal fraud and abuse.First, create a secure electronic variant of the 4473. It should include the buyer and seller information along with contact information for both parties. Once the form is completed, a unique confirmation number is sent out to both parties using the provided contact information. Both parties enter their confirmation numbers, then the form is submitted to the FBI and run through the NICS database. A single transaction number is generated for the NICS check and provided to the buyer and seller. The parties then call a phone number for a NICS automated line and enter the transaction number along with their unique confirmation numbers. This transfers the call to a live operator who examines the results of the NICS check performed for the transaction. The operator then tells the seller to “proceed”, “delay”, or “deny” just as they would with an FFL.The idea behind the whole system is that it allows for an effective background check to be done while offering a reasonable measure of privacy for the buyer. Sure, somebody could abuse the system if they wanted to put in enough effort, but they wouldn’t get very much information. It also removes a financial disincentive; it only costs individuals time to do a check like this and the check and be performed virtually anywhere, not just at FFL locations.Now, let’s discuss assault weapons and magazines which hold more than ten rounds. The problem with the Federal Assault Weapons Ban of 1994 was that it didn’t do anything except drive up prices on the magazines and weapons described by the ban. There was no measurable impact on crime during the ten years the Assault Weapons Ban was in effect.Here is how assault weapons were defined in 1994:Semi-automatic rifles able to accept detachable magazines and two or more of the following:Folding or telescoping stockPistol gripBayonet mountFlash suppressor, or threaded barrel designed to accommodate oneGrenade launcher mountSemi-automatic pistols with detachable magazines and two or more of the following:Magazine that attaches outside the pistol gripThreaded barrel to attach barrel extender, flash suppressor, handgrip, or suppressorBarrel shroud safety feature that prevents burns to the operatorUnloaded weight of 50 oz (1.4 kg) or moreA semi-automatic version of a fully automatic firearm.Semi-automatic shotguns with two or more of the following:Folding or telescoping stockPistol gripDetachable magazine.All of those things are cosmetic features that can be designed around. In fact, they frequently were and are designed around. Even today in states with more stringent feature based assault weapon bans, like California, there exist so called “featureless” firearms which are perfectly legal and not objectively worse for killing people than assault weapons. Now we could try an assault weapon ban again and again have no impact on crime… or we could recognize that semiautomatic centerfire weapons are undeniably the arms of choice in a militia. Police and military forces all over the world use semiautomatic (or fully automatic) centerfire weapons almost exclusively. As such, it makes more sense to more stringently regulate all semiautomatic centerfire weapons, not just a certain subset with specific cosmetic features. At the same time, we can breathe new life into the militia concept described by the Second Amendment to the United States Constitution, even make the militia well regulated.In the United States, we currently have an organization called the Civilian Marksmanship Program, a federally chartered corporation whose purpose is:To instruct citizens of the United States in marksmanship;To promote practice and safety in the use of firearms;To conduct competitions in the use of firearms and to award trophies, prizes, badges, and other insignia to competitors.Among numerous other things, the CMP sells M1 Garand rifles. The Garand is a .30–06 semiautomatic battle rifle roughly twice as powerful as common AR-15 or Kalashnikov rifles. The Garand was the primary infantry rifle of the US military during the Second World War and the Korean War. The CMP literally sells them so people can practice target shooting with a weapon of war.Image by Curiosandrelics - Own work, CC BY-SA 3.0, File:M1-Garand-Rifle.jpg - Wikimedia CommonsLet’s take a look at eligibility requirements for the CMP:REQUIREMENTS FOR PURCHASEBy law, the CMP can sell surplus military firearms, ammunition, parts and other items only to members of CMP affiliated clubs who are also U.S. citizens, over 18 years of age and who are legally eligible to purchase a firearm.PROOF OF U.S. CITIZENSHIP:You must provide a copy of a U.S. birth certificate, passport, proof of naturalization, or any official government document (When using a military ID to prove citizenship, must be an E5 or above) that shows birth in the U.S. or states citizenship as U.S.PROOF OF AGE:You must provide proof of age. Usually proof of citizenship also provides proof of age. In those cases where it may not, a driver’s license is sufficient.MEMBERSHIP IN CMP AFFILIATED ORGANIZATION:You must provide a copy of your current membership card or other proof of membership. This requirement cannot be waived. The CMP currently has over 2,000 affiliated organizations located in many parts of the country. CMP Club Member Certification Form- If your CMP affiliated club does not issue individual membership cards, please have the club fill out the CMP Club Member Certification Form and return it with your order.Membership in many of these organizations costs $25.00 or less and can be accomplished online. A listing of affiliated organizations can be found by clicking on our Club Search web page at http://ct.thecmp.org/app/v1/inde.... If you have any difficulty in locating a club, please contact the CMP at 256-835-8455 or by emailing CMP Customer Service. We will find one for you. In addition to shooting clubs, the CMP also has several special affiliates. Membership in these organizations satisfies our requirement for purchase. These special affiliates include: Congressionally chartered veterans' organizations such as the VFW, AL, DAV, MCL, etc. U.S. Military services (active or reserves), National Guard, to include retirees. Professional 501(c)3 law enforcement organizations and associations such as the FOP, NAPO, NSA, etc. The Garand Collector's Association is a CMP Affiliated Club. You can download a Garand Collector's Association Application Form.Note: Club membership IS required for purchase of rifles, parts, and ammunition.Club membership is NOT required for instructional publications or videos or CMP memorabilia.MARKSMANSHIP OR OTHER FIREARMS RELATED ACTIVITY:You must provide proof of participation in a marksmanship related activity or otherwise show familiarity with the safe handling of firearms and range procedures. Your marksmanship related activity does not have to be with highpower rifles; it can be with smallbore rifles, pistols, air guns or shotguns. Proof of marksmanship participation can be provided by documenting any of the following:Current or past military service.Current or past law enforcement serviceParticipation in a rifle, pistol, air gun or shotgun competition (provide copy of results bulletin).Completion of a marksmanship clinic that included live fire training (provide a copy of the certificate of completion or a statement from the instructor).Distinguished, Instructor, or Coach status.Concealed Carry License.Firearms Owner Identification Cards that included live fire training. - FFL or C&R license.Completion of a Hunter Safety Course that included live fire training.Certification from range or club official or law enforcement officer witnessing shooting activity. Complete the CMP Marksmanship Form to signNow your range firing and the required marksmanship related activity for an individual to purchase from the CMP.No proof of marksmanship required if over age 60. Proof of club membership and citizenship required for all ages. NOTE: Proof of marksmanship activity is not required for purchase of ammunition, parts, publications or memorabilia.BE LEGALLY ELIGIBLE TO PURCHASE A FIREARM:The information you supply on your application will be submitted by the CMP to the FBI National Instant Criminal Check System (NICS) to verify you are not prohibited by Federal, State or Local law from acquiring or possessing a rifle. Your signature on the Purchaser Certification portion of the purchase application authorizes the CMP to initiate the NICS check and authorizes the FBI to inform CMP of the result. IMPORTANT: If your State or locality requires you to first obtain a license, permit, or Firearms Owner ID card in order to possess or receive a rifle, you must enclose a photocopy of your license, permit, or card with the application for purchase.As you can see, the CMP eligibility process is quite a bit more involved than the background check system we have now. It seems to have worked for keeping the powerful semiautomatic Garand rifles out of the hands of mass murderers. The last mass shooting on US soil that I know of which involved an M1 Garand was the Kent State massacre and that involved the Ohio National Guard shooting anti-war protesters, not civilians who were sold rifles through the CMP. I haven’t been able to find any records of crimes committed with guns sold through the CMP. I’m sure it has happened at one point in time or another, but the occurrence is so rare that there hasn’t been any documentation. My point is that the CMP has a really great track record in the United States for making sure guns don’t go to bad guys.Since the Assault Weapons Ban of 1994 didn’t have any measurable impacts on crime and the CMP has great results, I propose we extend the CMP eligibility requirements to all semiautomatic centerfire firearms and centerfire magazines with more than ten rounds of capacity. This means only people who meet the listed criteria will be able to buy the types of weapons most useful in a militia which are also the weapons we primarily see used in mass shootings from an FFL. The proposal also effectively introduces a mandatory training and basic competency requirement before individuals can purchase semiautomatic centerfire weapons from a gun store. The inclusion of CMP eligibility for the purchase of centerfire magazine over ten rounds creates a strong incentive for existing gun owners and individuals who purchase firearms through private intrastate sales to get training and join the CMP if they want easy access to centerfire magazines over ten rounds.The word centerfire is really important because there is another class of firearms which use rimfire cartridges.A collection of rimfire and centerfire cartridges, left to right: .22lr (rimfire), .22WMR (rimfire), .357 magnum (centerfire), .30–06 Springfield (centerfire), 12 gauge shotshell (centerfire)Rimfire cartridges aren’t very powerful; they’re mostly used for small game hunting and target shooting. Most countries allow ownership of semiautomatic rimfire rifles with only basic licensing; countries like Canada and the UK don’t even have restrictions on magazine capacity for rimfire rifles. Could they be used by a mass shooter? Sure, anything could, but semiautomatic rimfire firearms just aren’t a threat compared to semiautomatic centerfire firearms or even non-semiautomatic centerfire firearms. Wounds caused by bullets fired from rimfire cartridges are almost always less severe than wounds caused by bullets fired from centerfire cartridges. Very precise shot placement is required for rimfire weapons to instantly kill a person and mass shooters are unlikely to take the time to precisely place their shots.Seen above are four rimfire rifles made by Marlin.Regulating firearms in this way allows new gun owners to hunt, shoot targets, and defend themselves using semiautomatic rimfire or manually operated firearms. If new gun owners want easy access to semiautomatic centerfire firearms which are useful in a militia context, they can join the CMP, effectively becoming a member of a well regulated militia, after demonstrating themselves to be competent and well trained.I have some final thoughts on the CMP related proposal before moving on to the next topic. CMP eligibility introduces additional layers of human interaction between people and semiautomatic centerfire weapons and centerfire magazines over ten rounds. Barring major advances in mental healthcare and adjudication in the United States, layers of human interaction are the best way for red flags to be raised about somebody who might want to kill large numbers of people with a firearm. Additional layers of human interaction also introduce a larger hurdle for straw purchasers, people who buy firearms for people who can’t pass background checks because they’re ineligible to own firearms. Additional layers of human interaction make law enforcement investigations slightly easier as well.At the moment, laws, standards, and permits for carrying concealed handguns vary wildly. Some states have no requirements while other states functionally don’t allow anybody except police officers to carry handguns in any way. While the percentage of the US population which actually carries handguns regularly, concealed or openly, is relatively small, those who do carry handguns regularly can often face great legal peril for no particularly good reason when crossing state lines. At the same time, it would be good for the public to know that people carrying concealed handguns are actually competent and not a hazard to the public. In essence, a balance would be preferable to the extremes which currently exist.I propose creating an national permit for carrying concealed handguns in any state. Police officers already enjoy something similar to this. The permitting process should include a standardized class which can be taught by police officers or other qualified instructors. Before attending the class, applicants should undergo a background check. Among other things, the class should cover the legal use of deadly force, safe firearms handling practices, and conflict deescalation practices. Then applicants should be given a written test on the subjects. If the applicants pass, they should then undergo a practical handgun handling and shooting competency test. If applicants are able to both handle handguns safely and shoot accurately, they will then be issued a carry permit which is valid for a certain number of years; three to five years seems reasonable. If applicants fail either test then they go home without a permit and can retake the whole class the next time it is offered if they still wish to carry a concealed handgun.

-

What is the prison experience like for a Paul Manafort or Michael Cohen?

Michael Cohen’s Days in PrisonIntakeMichael Cohen will self report and surrender to Federal prison on May 6, 2019. Most probably no later than 2 PM. If he misses the deadline, he will be considered a fleeing felon. US Marshals will come after him with a warrant.Most likely, he will step in through the front door of the Federal Correctional Institute in Otisville, New York. FCI Otisville was requested by Cohen’s attorneys and recommended by the Judge in Cohen’s sentencing memorandum.Otisville is a Medium Security Prison with a detention center, and an adjacent Minimum Security Satellite Prison Camp, which is home to about 117 men. The Camp is where Cohen will serve his time.Traditionally, the Federal Bureau of Prisons (BOP) was not bound by Judges’ requests. But typically they would honor a Judge’s recommendation. The First Step Act, signed into law in December of 2018, now actually requires the BOP to assign a convicted felon to a facility within 500 driving miles of home.It is possible that due to his close association with the current President of the United States, and for his safety, the Bureau of Prisons may decide to assign Cohen to another facility rather than Otisville. We shall see.If Cohen ends up at Otisville, from my personal experience, there will probably be many lawyers serving time there. As well as doctors, politicians and business executives. Michael Cohen should have plenty of company and feel right at home. He’s going to be with a lot of people just like him.FCI Otisville meets the needs of a Jewish inmate population, offering Seders in the cafeteria among other accommodations. In general, Low Security Prison Camps are not as restrictive as higher security prisons. But contrary to popular belief, they are by no means “Club Fed”. In the final analysis, it’s a Federal prison.Doors are locked and Cohen doesn’t have the key.Cohen will probably enter through the same door visitors and guests use to enter the prison. He will have to surrender any jewelry and other personal effects, except for a wedding ring, and religious artifacts such as a mezuzot, and for Christians, a chain with a cross. Other religious artifacts, such as kufis, headbands, yarmulkes and other materials will be available for purchase in the prison commissary.But what he can bring in, including money, will be entirely up to the particular prison and intake corrections officer (CO). That will be Cohen’s first encounter with BOP authority and rule. Nothing after this first encounter has to or will make any logical or humanistic sense. It just has to make BOP sense. Or even more restrictively, CO sense.Now, according to the FCI Otisville Inmate Handbook, Cohen is:INTRODUCTION — You are now in the custody and care of Federal Bureau of Prisons staff of the Federal Correctional Institution, Otisville, New York.Once he is escorted from the non-secure waiting room, through the heavy, imposing security door that can only be unlocked by COs behind bullet proof dark glass, his life changes. He moves from the free world, to a world where he has lost the vast majority of his freedoms.Many of the niceties of life, the little things he once enjoyed will be gone for the length of his stay. He may have researched all of this himself, or have been counseled by his white-collar crime specialist attorneys. Or he may have even purchased or been given a copy of The Federal Prison Handbook.Any and all of those sources will give you some idea of what is in store for you. But the fact is, you don’t know what you don’t know, and won’t, until you actually know.The proof is in the serving and living of a jail sentence…The rest of Cohen’s intake will go down like this:Fingerprinting, Photograph/Mug Shot, DNA SwabDisrobing — his clothing and shoes will be returned to a person and address of his choice — in my case my wife received the package with my clothing and shoes. She left the package unopened for 33 and 1/2 months. She could not bear to even look at it.Body search and cavity check. They don’t touch you, but you have to “drop trou’” and spread. A humiliating episode. The first of many.Assignment of ill fitting temporary clothing and shoes, plus bedding, towel and toiletries. He may not actually get any toiletries. They seem to “miraculously” disappear from intake.Otisville winters are cold. So the clothing may be warmer than a thin white t-shirt, skimpy pants and thin-soled sneakers like those issued during my intake. This temporary clothing will be all Cohen gets until the next time the Camp laundry opens, and until he is able to establish a prison account and purchase commissary items.Cohen will receive a cursory orientation and will be referred to or may even be provided a copy of the FCI Otisville Camp Admissions & Orientation Handbook. Click on that link for some interesting reading.After his intake process is completed you will be able to look up Michael Dean Cohen in the BOP Inmate Locator and find his inmate (Register) number, Prison location, age, race, and sex, and that all-important estimated release date. The actual date will be based on a number of factors that will play out during his sentence.You can look him up now, but this is what you will see:Michael Cohen’s BOP Record Locator Search ResultsHow do I know that is his actual record? The last 3 digits of his Register Number are for the Southern District of New York. And the number 86067 is an indication that he is a relatively new assignee. 86,066 have gone before him.Plus he is not in BOP custody yet, and his release date is unknown. Until he self surrenders and is processed, he won’t be in BOP Custody and his release date will remain “unknown”.With respect to his release date, the First Step Act provides for credits an inmate can earn while serving time. These credits can be used for early release to a Half Way House or to Home Confinement. It remains to be seen how this will impact Cohen’s sentence.After processing, Cohen will take his bedding and other things he was given, and will be walked over to the minimum security Camp by the CO where he will be assigned a bunk and left on his own. Now it will be up to him and his new “bunk mates” as to what happens next.Typical Living and Sleeping Accommodations in a Federal Minimum Security Prison CampFirst Afternoon and CountCohen will likely be assigned a bunk before the 4 PM daily count. He will have to learn how to make that bunk bed properly. It varies prison by prison. In the camp where I served the majority of my time the Warden insisted on “hospital corners”. Why? Recall what I said about BOP rules and logic. Just because.Here is more about daily counts from the Otisville Camp Prison Handbook:“Ordinarily, there are five counts during the week, and six counts on weekends and holidays. During the week, counts are held at 12 midnight, 3 AM, and 5 AM, 4 PM, 10 PM. On weekends and holidays, a 10 AM count is added. Notwithstanding this schedule, additional counts may occur at any time.”This is how the BOP determines that every one of the inmates they are responsible for is present and accounted. They count noses as their “fail safe” method ensuring no one has escaped. It is a manual count. No clickers, iPads, handhelds or anything even closely resembling the 20th or 21st century. No writing anything down until the entire count is complete.Yep. The CO goes down the rows of bunks counting, with index finger extended, out loud or under their breath: One, two, three. Sometimes they hold a pencil to point and count with. This is why you can’t talk during the count, lest you confuse the counting CO. It is easy to confuse COs. They are easily distracted and confused.During my stay with the BOP there were many counts that had to be redone in mid-count. Because the CO got confused or lost track. Maybe he or she (yes there are female COs in Male prisons) was thinking about all those inmate toiletries they had squirreled away in their locker and they lost concentration.I saw some recounts as well, after the total count, when the actual numbers didn’t match what was expected. As a result, the whole count had to begin from scratch. Pissed COs, and the inmates are pissed as well.So to provide the right “environment” for the COs you must stand for most of the counts, and remain totally silent. The midnight and 3 AM counts are the exception, since they are taken while you sleep. But your head must be uncovered and visible.What happens if you talk during a count? Besides confusing the CO? It will probably get you a strong warning and may even earn you a “shot”. This a black mark on your record. Shots are tracked by the BOP Prison Counselor.Too many “shots” and you end up in the Special Housing Unit (SHU) which is a much more restrictive area. It is indeed a special place.Too many of those SHU visits and you may end up being transferred to a higher security even more restrictive facility.Understatement: This would be a really bad thing!More on the special’ness of the Special Housing Unit later.Once the 4 PM count is over, Cohen will be able to have his first prison meal at the Camp Cafeteria. It will behoove him to have made some cursory acquaintances by then. Because there are inmate rules and norms, especially kitchen, cafeteria and food related. For instance, where you sit, and who you sit with.These are best learned from other inmates and by first hand careful observation. Not from having inadvertently and unknowingly violated them.Meals and FoodMeals at Otisville are served at the following times:Monday — FridayBreakfast 6:00 am Lunch 11:00 am Dinner 4:15 pmSaturday, Sunday, and HolidaysBreakfast 7:00 am Lunch 11:00 am Dinner 4:15 pmSupposedly the food at the Otisville Camp is “good”.I’ve eaten at 7 different prisons. Federal and State. I’m not a hardened criminal or anything like that. I just got to travel a lot BOP style. Did a lot of undesired travel on “Con Air” with US Marshal escorts toting shotguns and automatic weapons.The US Marshals are no laughing matter…As a result of my travels, I got a chance to sample the fare at many prison facilities. And I also got to eat quite a few bologna sandwiches.I’m not sure what other people’s definition of “good” is. I wouldn’t exactly label any of the Prison food I ate as “good”. Passable is as far as I would go. In some cases, the food is downright inedible.A rare exception was the food at the Strafford County Department of Corrections in Dover, New Hampshire, a privately run prison where I served 4 months. The food was surprisingly good. And plentiful.And the issue with prison food is not just the ingredients. It’s also the way the food is prepared. A few examples of both types of issues…Undersized chicken sold cheaply to the BOP because no other food distribution outlets will accept itBoiled canned collard greens, unseasoned and bitter. Served regularly. To this day I can’t even look at collard greens without gaggingMystery meat. No further comment neededWatery, unsalted canned green beansWatery coffee, often with grounds. In the camp I was in, coffee was made in a big stove top boiler and then siphoned off into plastic dispensersOn the plus side of food, prison breakfast is usually good. Cereal, oatmeal, and eggs on the weekend. Sometimes pancakes.Fruit is always a popular item. Bananas are highly prized, although not always offered on a daily basis. Apples are a regular offering. Oranges are frequent. At one prison where I served time, we had a 4 week run of Peaches that were huge, juicy and outstanding, I thought I was in heaven.And milk. Milk is always available. A good source of protein. I would drink 3 or 4 glasses a day for the protein. Especially important when I began to work out regularly and lose weight.Those inmates that can afford it, supplement cafeteria food with purchases from the commissary. They become Masters of the Microwave and can prepare tasty, if not downright elegant meals. Rice. Beans. Chicken. Salmon. Tuna. Mackerel. Beef.There is a Prison combo microwave meal called “Batch”, which is made up of rice, beans, a protein, such as chicken, beef or fish, and whatever spices can be purchased from the commissary or “borrowed” from the kitchen. It’s tasty.Some inmates make and sell “burritos” from the Batch. Price? One pouch of Tuna or Mackerel. Tuna and Mackerel pouches are prison currency. As are stamps.A haircut is usually one pouch of Tuna or Mackerel. Want your bed made up nice? With those hospital corners? A pouch.By the way, the burritos are awesome!Inmates without the culinary inclination and with the means, may “hire” another inmate to cook for them. Often times these meals made from commissary items are supplemented with contraband items either smuggled in to the prison or stolen from the cafeteria. Onions. Peppers. Chicken. Tomatoes. And the ever popular bananas.Though I was never inclined to hire a prison “Chef”, and could not afford one even if I had been, I’ve tasted meals cooked up by these entrepreneurs. Unbelievably good. Actually, incredible. I had a piece of prisoner made Flan once that rivaled any I’ve had in good Miami restaurants.Once during my time at FCI Miami, an inmate who was a former Chef at a well known Miami restaurant made me a meal to thank me for help I provided him. It was INSANELY good. I couldn’t believe what he had accomplished with just the Microwave. Even the presentation was great.Just to make clear though, I much prefer to dine on excellent food as a free man, at an actual restaurant, and with loved ones…First NightAfter Cohen eats his first BOP provided meal there will be a few hours for recreation, personal hygiene, hobbies, phone calls to family, letters, reading or sending emails, reading scripture, attending classes, listening to music, or engaging in personal reflection before the 10 PM count and lights out.However most likely, he will be too disoriented, unfocused and confused. Plus, his available resources will be severely limited to engage in any meaningful activity.As an example, since a portable radio is required to listen to Camp TVs, he will not have access to one unless someone lends it to him. Possible, but unlikely.He won’t be able to call anyone, including family members for at least several days. No telephone account and codes will have been established for him yet. And he won’t have any money in his account with which to pay for calls. Even if he brought cash with him, it was taken, to be deposited into an account under his name.Feeling altruistic? You can send money to Cohen’s account. He can buy Tuna and Mackerel pouches and get a haircut or have his clothes pressed for visits.Perhaps due to his “celebrity” status, many Camp inmates will seek Cohen out. Just to talk. Size him up. Or exploit and intimidate him. He’s going to be a hero to some, a goat to others, and an anti-Christ to the Trump supporters.He’ll have to eventually reconcile with all of this. Most assuredly, he will. It’s inevitable. Soon the celebrity status fades, and then Cohen will be old news.Tonight though, he is merely trying to make sense of it all. And to survive his first day and night. He is “trying on” this new persona. And slowly learning how to act, talk, adapt, behave. He is slowly processing and defining who THIS version of Michael Cohen is right now, and who he will become in the months to come.When the 10 PM count is over, the lights go out, he lays on that ridiculously thin mattress, and his head hits that BOP-issued poor excuse for a pillow, he will most likely have trouble falling asleep. He will stare at either the ceiling above if assigned the top bunk, or the bunk bottom directly above him.Reality has set in. And In prison, reality is a true and relentless bitch…First Wake UpHas Michael Cohen been an early riser throughout his life? Well, he is now.The day at Otisville Camp begins with a 5 AM count. Rise and shine. Stand at your bunk. Mouth shut. Until the count is over.Establishing a sustainable morning routine is essential. Typically you would want to have one for weekdays, and one for weekends. In my case, on weekdays, I was up, hygiene tasks done, dressed, out the door, and in line at the cafeteria. Not the first in line, but definitely not in the last 3/4 of the line.The weekend would necessitate a slightly different schedule, for reasons I will elaborate below.Breakfast at Otisville Camp starts at 6 AM. If there are bananas or other highly coveted items, you’d best be in line and in the cafeteria before they run out.Stand in line. File in once the doors are open. Walk your tray through the line. Get your breakfast. Sit with your usual crowd. Finish up and get out. Time for a few minutes to get the day together in your head and it’s time for “work”.Cohen’s WorkThe prison work day starts at 7:30 AM. Cohen most likely won’t have a job on his first day at the Otisville Camp. Jobs are assigned by Counselors. A Counselor is a glorified CO. I met very few Counselors that I would actually consider the counseling type. For the most part, in my experience, Counselors were arrogant, rude, ignorant, and mean spirited. But they wield immense power. Don’t piss off a counselor.So Cohen will most probably be given some busy work, such as policing the grounds, until the counselor is able to assign him to a work detail. Typical first work detail assignments for a newbie would be in the camp cafeteria.Entry level cafeteria tasks would include preparing the room for meals, washing trays and dishes, and cleaning up after meals are served. No cooking or meal prep at first. That is left to more experienced kitchen-assigned prisoners. Besides, Cohen doesn’t seem the type to want to cook.Cafeteria duty is not all bad, if the right CO is in charge. You tend to eat more and better than your fellow inmates. Although the early shift typically begins at 4 AM, to get the prep done. And that takes some getting used to.In my case, the FCI Miami Cafeteria CO was sadistic and cruel. And he treated the inmates in accordance with his mean streak. I could not wait to fulfill my cafeteria duty, and then move on to other prison jobs. Maybe Cohen will be lucky and get to skip that whole ordeal.First WeekCohen’s first week will be more of the same as his first day. Except that he will probably get issued his regular prison clothes (a nice Khaki color in Otisville), undergarments, shoes, and standard bed roll consisting of two sheets, 1 pillowcase, 2 towels, and 2 wash cloths.The undergarments leave a lot to be desired. Tin Miami, they were threadbare and stained. With worn out elastic. And plenty of holes. Maybe Otisville will be more fashion-conscious.Cohen will be well advised to purchase a few T-Shirts, underwear, socks and a towel at the Commissary. I could not afford to buy any of these until family and friends were able to put together funds and deposit them in my account.As such, I used the prison issued underwear and towels for about 6 months. This experience molds and shapes you. Especially if you have become accustomed to expensive clothing, custom shirts and suits, silk ties, bespoke shoes and the like.Cohen’s focus for this first week should be to settle in, get his financial account established and funds deposited so he can purchase essentials at the Prison commissary, make phone calls and send emails.He will have to establish phone privileges as well. This means he will have to list and register the numbers he wants to call with the Camp Counselor.Cohen will be allowed 300 calling minutes per month which can be used for either direct or collect calls. Any minutes remaining at the end of the month will not carry over to the next month. Extra minutes are given during months with major holidays.There is a 15 minute maximum per call and you must wait 30 minutes between calls. There is usually a line to use the telephones. After a call, it could be several hours before you can use the phones again. The cutoff is 10 PM every night. So typically, you are going to get one chance at a call per day.All calls are recorded and monitored by Prison administration so Cohen must be careful what he and the people he calls, say to each other. You don’t talk to your lawyer on a regular prison phone. Those calls are made with permission and in the counselor’s office.Cohen must track his phone time carefully. Once he exceeds the monthly 300 minute limit, he can make no more calls until the following month.Do the math…300 minutes per month in a 30 day month is 10 minutes of calling per day. It’s not hard to use up your time quickly, especially at first when separation anxiety sets in and you want to speak to many family members.By the way, each call Cohen makes is announced to the recipient as a call originating from an inmate at a Federal Correctional Facility. The called party must acknowledge and accept that call.If the recipient rejects the call, either by accident or on purpose, the called telephone number is taken off the allowed call list. Getting it re-established in the system will require a trip to the counselor’s office.First MonthBy now, Cohen will be receiving visits from people on his approved visitors list. He will need to place people on his list and request they be approved by the Camp Counselor. There is a limit. As I recall, no more than 12 visitors. The BOP will perform a background check and will vet the requested visitors before approving. This is a hassle for potential visitors.The whole VISITING experience is a big hassle.You’ve got to really want to visit someone who is serving time in a Federal prison to put up with the hoops you must jump through…Cohen will be allocated 12 visit points per month. A weekday visit is one point. weekend or holiday visits are 2 points. He must alternate weekend days, and can have no more than 4 weekend visits at 2 points each for a total of 8 points. That leaves 4 points for weekday visits. Cohen must keep track of this as well.You can’t just show up to visit someone in Federal prison as the mood strikes you…The BOP has no flexibility when it comes to these rules.That first visit will be a big milestone of Cohen’s prison stay to date.These are the FCI Otisville visiting hours. But as mentioned earlier, not both Saturday and Sunday. Prisoners are assigned a day that alternates. One week, it’s Saturday, the next week its Sunday, and so on.Monday 8:00 am — 2:45 pmFriday 8:00 am — 2:45 pmSaturday 8:00 am — 2:45 pmSunday 8:00 am — 2:45 pmHolidays 8:00 am — 2:45 pmIf Cohen is going to be like most inmates I served with, he will make sure to look his best for visits. Well groomed, Hair cut and combed. Clothes clean and pressed. With a small application of prison-approved fragrance oil (no alcohol, naturally).The goal is to put your loved ones at ease when they realize you are taking care of yourself and you exhibit a positive frame of mind.MailNo surprise, there are many rules. As you might well imagine.The most important rule to know — All mail, incoming and outgoing, is opened and read by a CO.This is how they control contraband, illicit photographs, questionable materials, and how they “snoop” on you.Mail is distributed at a daily/nightly mail call.If you are not there, you don’t get your mail until the next mail call. Some COs will relax these rules, and give you mail outside of mail call. Or even let someone collect it for you. I wouldn’t count on that, until you see it consistently practiced.What you can receive is tightly controlled.No surprise, there is an 8 page Bureau of Prisons policy on incoming publications. You can find it HERE . In most cases, certain types of publications, such as books and newspapers, and some magazines, can only be received if they are sent directly from a publisher or distributor.From the policy:At all Bureau institutions, an inmate may receive hardcover publications and newspapers only from the publisher, from a book club, or from a bookstore.The BOP states:Publications determined detrimental to the security, good order, or discipline of the institution or that may facilitate criminal activity, or are otherwise prohibited by law, will be excluded from Bureau facilitiesAnd their policy goes on to state:The Warden may not establish an excluded list of publications. This means the Warden shall review the individual publication prior to the rejection of that publication. Rejection of several issues of a subscription publication is not sufficient reason to reject the subscription publication in its entirety.Mail is important in prison, It is a vital way of keeping in touch with loved ones. And an important part of staying connected to what is going on in the outside world, through newspapers, periodicals, and books. And a major factor in staying busy, productive, educated and fulfilled.Suffice to say, Cohen won’t be able to assume he will be able to “legally” receive and read whatever he wants. There will be limits. Just one more in a long list of freedoms lost.Cohen’s “Permanent“ Prison JobMost certainly by this time, Michael Cohen will have landed his full time prison gig. He will be paid anywhere between 0 (yes, zero. Some jobs pay NOTHING) to 40 cents per hour, based on the job and where he is assigned.Although there are a few prisons that have Industry jobs that pay higher.Did you know there is a BOP policy for Inmate Work and Performance Pay? Of course there is.Cohen will most probably change jobs multiple times while serving his sentence. It is pretty common, especially since the first job or two is usually in one of the less desirable work environments.Suffice to say, he won’t be “making ends meet” in the style to which he is accustomed on Federal Inmate prison pay.Medical CarePerhaps I should title this section Lack of Medical Care. Although I found that most of the health care employees that work in the BOP have good hearts and want to do the right thing. The issue is, their hands are tied by policy and a lack of freedom, scarcity of medication, and very few actual treatments they can prescribe and dispense.The psychologists and drug program counselors that I met and worked with, were extremely dedicated and competent. So if Cohen has to address any of these types of issues, and the prison he is eventually sent to is staffed with these people, he will be in competent hands.However some of the doctors I encountered in the BOP are just plain hacks.Cohen should be careful what kinds of diagnoses he receives and remedies he is prescribed by BOP doctors.Run of the mill issues like hypertension and diabetes are dealt with in a pretty straightforward manner. Although I did see some diabetics experiencing wild swings in their blood sugar levels and being rushed out of their cells suffering from hypo or hyperglycemia.And the BOP does a decent job of ensuring that those inmates that suffer from dependency to substances get their daily doses of or whatever other medication they require. These are strictly controlled during “sick call”.If any other serious health issues are experienced by an inmate, they will usually be sent to a local hospital, clinic or specialist. This the rare exception, and is not easy to get accomplished. It usually takes persistence and consistent “noise” on the part of the inmate until the BOP doctor agrees.Some inmates who suffer from chronic conditions that are not treatable in a regular BOP prison medical facility may be transferred to a BOP special medical prison, such as Butner in North Carolina.Butner “is the Bureau’s largest medical complex, which operates a drug treatment program and specializes in oncology and behavioral science.[1]Among its inmates is Bernie Madoff. — from WikipediaButner, NC Federal Medical ComplexAt least at these types of facilities, an inmate can expect a higher level of medical care than they can get at a regular prison.Suffice to say, Cohen should do any and everything in his power to stay healthy and not require medical treatment beyond the more regular types of ailments. He should also look to the commissary for over the counter medications that are allowed for purchase and use to address any specific minor ailments.First YearThe first year tends to crawl by slowly. In Cohen’s case, with less than 3 years to serve, it will seem to move more quickly. Although each missed set of holidays while in prison tend to cause one to experience the slow ticking of the clock.As such, it will behoove Cohen to not “count the days”. Counting days is “counter productive” in prison. Not at all recommended. Your experienced and senior fellow Cons will tell you that immediately if they see you counting.You serve your sentence one day at a time. But you don’t count those days…If Cohen stays busy, occupying his waking hours with interesting and worthwhile activities, time will move briskly for him.Unless…he messes up…The SHUIf Cohen commits any violations, or earns enough “shots” even for minor infractions, he could serve time in the Special Housing Unit. This is a place akin to Solitary Confinement, although you will typically share a confined cell, complete with it’s own toilet and sink, with a fellow inmate.Just think for a brief moment about the logistics of a small, confined cell with a shared toilet which is out in the open and connected to the wash basin.2 Inmate SHU — It is Indeed SPECIAL!Private SHU Accommodations!A stay at the SHU also comes with a resplendent and complementary orange jumpsuit to differentiate Cohen from the regular population.No TV in the SHU. And a very limited supply of well worn paperbacks wheeled by once a week. You must select no more than two books through the pass through in the door.No magazines or newspapers are allowed.And you get a choice once a week between a shower, or recreational time. One or the other.But not both.Recreation time is an hour confined to chain link holding cells with no roof, within a concrete structure. You get to see a piece of sky while pacing back and forth.And the shower? Supervised the whole time by a CO. No privacy.The food is similar but not the same as the regular prison food. Plus it is cold by the time it gets to those in The SHU.I spent 2 weeks in the SHU. Needless to say, not at all an enjoyable experience.If Cohen stays within the rules, he will never experience the friendly confines of the Otisville SHU.He will fall into the rhythm of regular Federal prison life and just do his time.Perhaps he will begin working on that book we all know he is going to write!Fast Forward to the Last YearThat last year is a longish seeming stretch of time. Again, not focusing on time itself is a wise ting to do. If Cohen listens to his more successful fellow felons, in this last year of his sentence, he will intensify efforts towards activities, perhaps even involving himself in a few new ones.A new hobbyLearning a new skill (musical instrument, for example)Taking some additional coursesPicking up some additional books to readStepping up his exercise and physical activitiesPreparing a Life Plan — what to do with the rest of his lifeAs before, the trick is, to fill those days to the brim with stuff to do.Idle hands are the devil’s workshop…Last MonthIf Cohen has kept his nose clean all this time, he is in the home stretch. His good time calculation has reduced his sentence by a certain percentage, and he is not having to serve the entire 3 years. Soon, Prison staff will call him in to the office and provide him with a calculated release date for the halfway house. At this time, they will also tell him what facility he will be assigned to.Now he should be focusing on the following release-related activities:Preparing a plan for the immediate next 6 monthsLining up potential employmentFilling out required formsArranging for personal property to be mailed back — on his dimeDeciding what personal property to leave behind and give away to his inmate buddies — food, clothing, toiletries, headphones, radio, etc.Last DaysIt will be hard to focus as the magical date nears. Again, executing the items on his release To Do list should be his entire focus.Cohen needs to concentrate and keep his eyes focused squarely on the prize —Which is his RELEASE!Last NightI couldn’t sleep the night before my release. Understandable, right?This is probably the night Cohen gives away all his stuff.He will also say all of his goodbyes, and pledge to keep in touch.Except for a few rare exceptions, he most probably won’t.I have kept in touch with a handful of people I met during my time. We were there for each other, and I saw and continue to see them as reformed, contrite and positive people who have turned their lives around. It will be up to Cohen to make the decision as to who is worth keeping in touch with, and who is worth forgetting about forever.Day of ReleaseThe day of release is a whirlwind of activity. Cohen will probably be ready to go even before lights-on in anticipation of his departure from Otisville.He will bathe, and dress in the clothing he will wear to the half way house. Strip his bed and take it to the on duty CO. Empty his locker if he hasn’t already done so, and wait for his name to be called over the PA system, or for a CO to come get him.I distinctively remember how that went for me:“Fiallo. Report to the Main Building for Release.”Sweet music to my ears…Slaps on the back. Shaking of hands, and a short walk to the same place where the original intake was done. As I walked those steps, I never looked back. Cohen will probably do the same.Once in the main facility, the CO performs the following ritual:Form to be signedInstructions for reporting to the halfway house, including how much time you have been given to get thereInventory of anything you are taking with youEscorting to the main entrance by the CO, where it is verified that you are who you are supposed to beThen that massive iron door is opened, and you step outAnd Cohen is finally out…Again, I never looked back, and most probably, neither will Cohen.Whoever is picking him up will meet him in the parking lot where a happy reunion outside the confines of the BOP, will take place. And he is off to the half way house.In my case, I had enough time to first stop home and greet family before the eventual trip to the halfway house.Releases vary from prison to prison. A lot will depend on Cohen’s actual and specific circumstances. But how I described is probably how it will go down.Half Way HouseHalf-Assed House, or Prison Lite, is what I’ve heard these facilities called by the residents.I’m honestly trying to be very objective here.Half Way Houses are designed to facilitate re-entry from the stark reality of prison to the “real” reality of street life.They go by other fancy names as well. Such as Residential Re-entry Facility.An Actual Residential Re-Entry FacilityFrom Wikipedia:In criminology the purpose of a halfway house is generally considered to be that of allowing people to begin the process of reintegration with society, while still providing monitoring and support. This type of living arrangement is often believed to reduce the risk of recidivism or relapse when compared to a straight release directly into society.From the artificial reality of prison life to the real reality of normal life…In reality, the Half Way House is not that much different than prison. In fact, you can argue that it is worse, because in many cases, the people having dominion over you are for the most part, minimum wage employees who can’t get any kind of real law enforcement jobs. And there is little to no real or valuable support and assistance for residents to aid in their re-entry.Some of the workers lord their positions over the residents constantly and treat them like second class citizens. I would submit that this is counterproductive to creating an environment where someone who has served their sentence can successfully re-enter society.That being said, I don’t know how Michael Cohen will fare with his half way house experience. I am sure there are some half way houses in this country that do a great job. In my experience, talking to many inmates and looking at the facts as objectively as possible, many do not.Typical Half Way House Sleeping ArrangementsThis is probably what Cohen will experience:His entire stay will be closely monitored. That, they do a great job atLeaving for work, arriving at work, leaving work to return, and arriving back will be tracked and loggedCohen will not be allowed any stops to and from work, without express written permissionHe will not be allowed to go out to lunch while at work. He will take a lunch packed and provided by the halfway houseCohen’s work supervisor at his first job, will be initially interviewed and will also be periodically asked how Cohen is doingHe will be periodically checked up on at the job by a halfway house employee, in personCohen will have an assigned Half Way House work detail, in addition to his regular day job — kitchen detail, cleaning bathrooms, general cleaning, yard work, etc.He will eat three square meals a day at the Half Way House until he is placed on home confinementCohen will have to get permission and formal approval for any other “excursions”, such as — haircuts, doctor’s visits, trips to the DMV or Social Security Office — the time it will take to get there and back will be calculated and Cohen will be tracked and expected to call in when he arrives, and when he leaves to returnCohen will have to “drop urine” on demand. Even after home confinement, when called, he will have a prescribed amount of time to return and “drop”Cohen will be subjected to breathalyzer tests — usually upon returning. Alcohol is strictly forbidden while under Half Way House jurisdictionCohen will experience random searches for contraband, which is any item or material not allowed in your possession by the Half Way House. His locker will be “tossed” while he is away.Most likely, Cohen will not be allowed to have a cell phone while at the Half Way House. His specific facility may have relaxed this ruleA monthly financial statement will need to be prepared and submitted by Cohen, detailing income and expenses. The Half Way House takes 20% of his gross pay every weekFamily visits will be administered similar to when in prisonCounseling sessions will most likely be prescribed and are mandatoryCohen won’t be allowed to drive unless his license is current and he has a clean record. He will have to show proof of insurance, and that he owns the vehicle, or that the owner has allowed him to use it. The car will be thoroughly inspected, and will undergo random inspections as wellCohen will meet with his probation officer at least once during his Half Way House timeOn the plus side, the food in the halfway house will most probably be good, although not necessarily plentiful. After all, there are many mouths to feed.A Half Way House Food Line — this one was good!Residents BewareAny violations of rules may result in his Half Way House term being violated and he will be returned to prison to serve the remaining time.One Saturday morning, as I was having breakfast at the Half Way House before being released to home confinement, the US Marshals showed up. They took one of the guys at our table back to prison, in handcuffs, to serve out the remainder of his sentence. The Marshals were not happy campers and showed it. They’d much rather be chasing fugitives ala Tommy Lee Jones…His violation? He had stopped on his way back to the Half Way House from work to buy an ice cream cone.They mean business…Home ConfinementSoon after arriving at the Half Way House, Cohen should be doing all he can to receive “home confinement” status. Assuming his family agrees to take him back in the home (not always a slam dunk), this should be Cohen’s primary objective in order to reclaim some semblance of normalcy in his life.Half Way House time sucks. Big time.The quicker you leave, the better off you are.A job is the primary requirement to earn home confinement status. If he has one already lined up before he arrives, then he is “half way” home (excuse the intended pun).The other requirements are:Continue to obey all Half Way House and BOP rules. One needs to remember, even while at a Half Way House, you are still under BOP jurisdiction. You are serving out the last 6 (or less) months of your sentenceStay clean and soberAttend prescribed individual or group counseling sessions if applicableMaintain your work statusInstall a separate land line in your home with no call forwarding, so that the Half Way House can always signNow you. And you can’t “fool” them by forwarding that line to wherever you may “unauthorizedly” beReport to the Half Way House immediately when called for any reasonAnswer the separate land line when they call — in my case, they would call at least twice a day, every day, with one at 2 AM every morningPay the Half Way House 20% of your pay once you start a job, for the duration of your termContinue to submit monthly financial statementsDo not associate with anyone having a criminal record. Report any encounter to the Half Way HouseReport any encounter with law enforcementDo not drive a motor vehicle unless you have been authorized to do soRequest written permission for any time to be away from home or work — including haircuts, attending religious ceremonies, or doctor visits. Once granted an excursion, you must abide by the times allotted for the trips. And you must call when you leave, call when you arrive, call again when you are departing for home, and call when you arrive homeAll of these restrictions and requirements continued for me even after I was put on home confinement. For the whole 6 months of my term. It’s possible that rules have changed or have been relaxed by the time Cohen begins his home confinement.Back to the Real worldMichael Cohen was disbarred by the New York state Supreme Court in Manhattan on February 28th. Having lost his law license, he will most probably never get it back and will no longer be able to practice his trade. He could try, but chances are, he will not prevail.I know many disbarred attorneys under similar circumstances, that have tried to get their licenses reinstated. Despite obtaining many letters of support from other attorneys and people in the community, they have not succeeded.Life after a felony conviction is different. Obvious, right? There are many things you most definitely won’t ever be able to do, and others that you can’t do, either temporarily, or until some action is taken to remove the restriction.For example:Voting — some states allow felons to vote, others require a petitionOwning a gun — at the present time, only a Presidential pardon or commutation can restore this Constitutional rightHolding certain offices — I don’t know the specifics of his sentence, but he may not be able to run for, or hold certain offices. The terms of my conviction bar me from ever becoming a Corporate officer or serving as a member of the board for a public companyBeing hired by certain companies — some opportunities will be forever closed to you. Some companies maintain a policy of not employing convicted felons. Period.Some will tell you that a felony conviction does not immediately disqualify you, but the reality is, you get nowhere when you try to seek employment with these companiesRejection by social or community groups, associations, and clubsDisapproval for certain financial transactions or for creditAs he faces these, and encounters other difficulties related to the stigmatization associated with being a convicted felon, he will be serving the other terms of his conviction.Being snubbed by former acquaintances and “friends” is something else Cohen should be prepared for. There are people that were close “friends”, of the fair weather variety, while you were flying high. Now they won’t have anything to do with you. For the most part, Cohen will be better off not having these kinds of people as “friends”.The terms of Cohen’s sentence includes a probationary period where he will have to report weekly to a parole officer, more commonly, a Probation Officer.Missouri Department of Corrections — A PO Meeting With a ParoleeAnd let’s not forget about the $1.39 million in restitution, $500,000 in forfeiture and $100,000 in fines. Those are obligations he must meet, if he hasn't already.By the way, during the time he is BOP custody, Cohen will most assuredly have to make agreed upon restitution payments. These will be taken out of his commissary account.Cohen’s probationary period was set at three years of supervised release. This time will be overseen by Cohen’s assigned US Probation Officer. It is likely that he will have different POs during his supervised release period.He may have community service to perform as well. I was sentenced to 200 hours of community service which took me a year and a half to complete.At the end of the first year, if he has kept all the rules and the Probation Officer has no objections, Cohen could apply for a shorter Probationary Period. There are no guarantees of getting that approved.During the probationary period, Cohen will continue to file financial reports, and must also report any encounter with law enforcement and with other convicted felons. He may also be required to attend prescribed group or individual counseling.To maintain good standing with his “PO” during the entire period, he will have to continue to be gainfully employed.It’s important to note that a violation could land him in jail, potentially to serve out the rest of his probationary period. For example, if Cohen were to lose his job, he would have to find alternative employment rather quickly or risk violating the terms of parole, and ending up in prison again.Cohen should do every and anything he can to stay on the narrow path and on the good side of his PO.Where the Rubber Meets the RoadFor Cohen, this is complete transition time now. The end game.A new life. Unless he forgot all about what earned him a prison sentence in the first place, he will have made or at least begun the transition from high flying huckster lawyer/fixer to convicted felon while serving his sentence.If he didn’t change his ways, his prison stay definitely will afford him the opportunity to keep shucking and jiving, bragging, wheeling and dealing, continuing to be a total asshole, and to actually refine and hone these skills.If he has the right attitude and resolve, the full transition he has to make is from Federal Inmate to regular human being.Is he capable of that?We are all capable. But for numerous reasons, some of us succeed and some of us fail. We continue the same foolhardy mistakes over and over.Groundhog day…Given the high rate of recidivism among Federal Felons (anywhere from 16% to over 80% depending on factors such as age, education and type of crime), some fall again. And they return to the warm, cozy confines of jail.It will be up to Cohen, and Cohen alone which way his life goes, and which path he decides to take.In the end, perhaps now, Michael Cohen will find peace.Finding that peace is totally up to him.Just like it was to me…“It is the bungled crime that brings remorse.” ― P.G. WodehouseThis is how Michael Cohen will experience prison…Visit my blog at Enrique Fiallo – Mediumor my web site at The Way - Practical and Simple Life Coaching

-

How do people work with fake social security number (SSN)?

Employers have no means of verifying whether or not a SSN is legitimate. The INS form that employers must keep on file is little more than an exercise is paper compliance since there is no one who sees the documents other than the employer. The glitch is that people who have fake IDs/SSNs sometimes get a number that belongs to a REAL individual. Then the IRS steps in because the W-2 that is issued to a worker doesn't match the amount of money sent to the government for withholding taxes. For workers who are paid as "independent contractors" another form is submitted by contract "employers". The copy of that is also part of the individual's IRS 1040 tax return. The forms the worker must file must match up with the forms the employer must file. The reality is that in many cases, it is not ICE, the illegal worker must fear, but the IRS. Most famous major criminals do not get arrested for robbery, murder etc, but get caught by the IRS for unreported income. Al Capone was one of the most famous - he was jailed for income tax evasion. The IRS will look at possessions compared to income - how did you pay for those towels if you didn't work? And the jewelry? And the shoes? Car?Once the IRS is involved, ICE can and does get involved - a person who overstayed a visa can be permanently barred from returning to the USA for not reporting income...