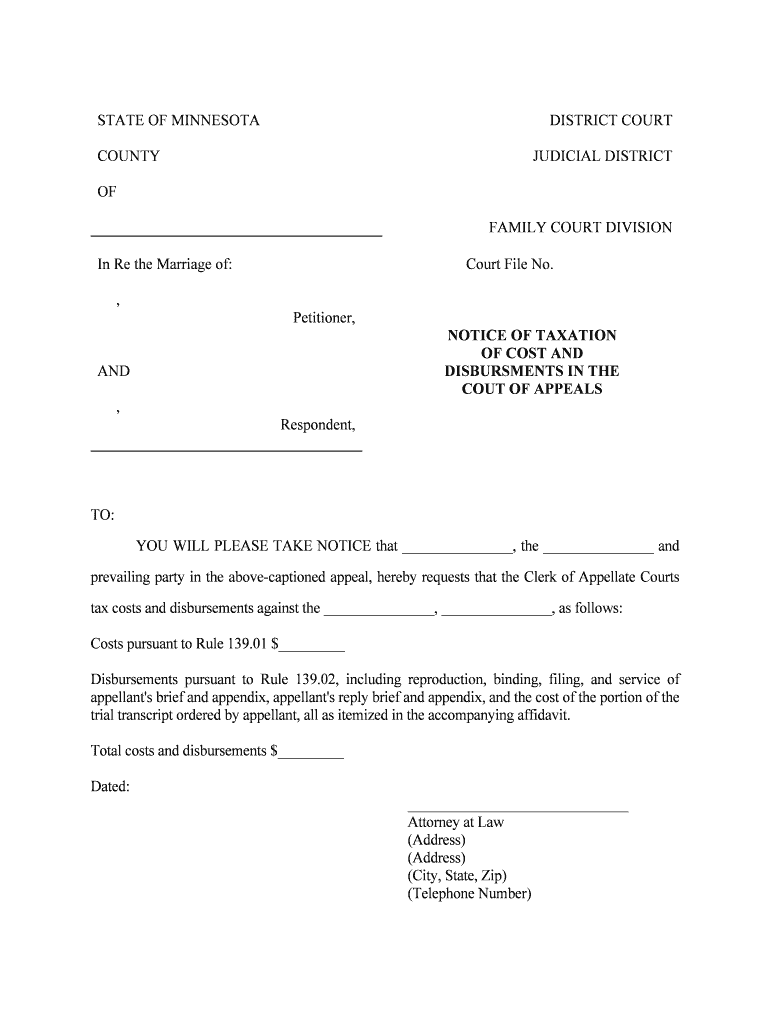

NOTICE of TAXATION Form

What is the NOTICE OF TAXATION

The Notice of Taxation is an official document issued by tax authorities to inform individuals or businesses about their tax obligations. This form outlines the amount of tax owed, the due date for payment, and any penalties for late payment. It serves as a formal notification that may include details about the specific tax year, the type of tax being assessed, and the legal basis for the taxation. Understanding this document is crucial for compliance and to avoid potential legal issues.

Steps to complete the NOTICE OF TAXATION

Completing the Notice of Taxation involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to your income and expenses for the relevant tax year. Next, carefully read the instructions provided with the notice to understand the specific requirements. Fill out the form by entering the required information, including your personal details and the tax amount owed. Double-check all entries for accuracy before submitting. Finally, retain a copy of the completed form for your records.

Legal use of the NOTICE OF TAXATION

The legal use of the Notice of Taxation is essential for both taxpayers and tax authorities. This document must comply with federal and state regulations regarding tax notifications. It is legally binding, meaning that failure to respond or comply with the notice can result in penalties or legal action. Taxpayers should ensure that they understand their rights and obligations as outlined in the notice, including any options for appeal or dispute resolution.

How to obtain the NOTICE OF TAXATION

Obtaining a Notice of Taxation typically involves contacting the relevant tax authority in your state or locality. Many tax agencies provide options to request a copy of the notice online, by mail, or in person. It's important to have your identification and any relevant tax information on hand when making the request. If you have not received a notice but believe you owe taxes, proactively reaching out to the tax authority can help clarify your situation.

Filing Deadlines / Important Dates

Filing deadlines associated with the Notice of Taxation are crucial for compliance. These dates vary by state and type of tax, so it's important to refer to the specific notice you received. Generally, taxpayers should be aware of the due date for payment, any deadlines for filing appeals, and the timeline for potential penalties. Keeping a calendar of these important dates can help ensure timely compliance and avoid unnecessary fees.

Examples of using the NOTICE OF TAXATION

Examples of using the Notice of Taxation can provide clarity on its application. For instance, a self-employed individual may receive a notice indicating the amount owed for self-employment taxes. In another scenario, a business may receive a notice detailing property taxes due on commercial real estate. Each example illustrates the importance of understanding the specific tax obligations and the implications of the notice.

Quick guide on how to complete notice of taxation

Effortlessly Create NOTICE OF TAXATION on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as a superb environmentally friendly substitute for conventional printed and signed materials, allowing you to access the correct format and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Handle NOTICE OF TAXATION on any device with the airSlate SignNow apps available for Android and iOS, and streamline any document-related process today.

The easiest way to modify and electronically sign NOTICE OF TAXATION with minimal effort

- Obtain NOTICE OF TAXATION and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether through email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form hunting, or errors that necessitate the printing of new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Modify and electronically sign NOTICE OF TAXATION to ensure excellent communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a NOTICE OF TAXATION and how can airSlate SignNow help?

A NOTICE OF TAXATION is an official document that notifies individuals or businesses of their tax obligations. With airSlate SignNow, you can easily send, eSign, and manage these important documents, ensuring compliance while simplifying the entire process.

-

Is there a cost associated with sending a NOTICE OF TAXATION using airSlate SignNow?

Yes, while airSlate SignNow offers competitive pricing, the cost of sending a NOTICE OF TAXATION will depend on your subscription plan. However, the platform is designed to provide a cost-effective solution for businesses of all sizes, making document management affordable.

-

What features does airSlate SignNow offer for managing a NOTICE OF TAXATION?

airSlate SignNow provides a variety of features for managing a NOTICE OF TAXATION, including templates for quick document creation, eSignature options, and automated workflows. This enhances efficiency by reducing the time spent on paperwork.

-

Can airSlate SignNow integrate with other tax management tools for issuing a NOTICE OF TAXATION?

Absolutely! airSlate SignNow integrates seamlessly with numerous tax management tools and software, allowing you to streamline the process of issuing a NOTICE OF TAXATION. This integration ensures that your document management is efficient and effective.

-

How can I ensure the security of a NOTICE OF TAXATION while using airSlate SignNow?

airSlate SignNow prioritizes security with features like data encryption, secure access controls, and compliance with industry standards. Sending a NOTICE OF TAXATION through our platform ensures that your sensitive tax information is protected at all times.

-

What is the benefit of using airSlate SignNow for electronic signatures on a NOTICE OF TAXATION?

Using airSlate SignNow for electronic signatures on a NOTICE OF TAXATION streamlines the signing process, reducing turnaround time signNowly. It also provides a legally binding signature, which makes your documents valid and recognized by authorities.

-

How does airSlate SignNow help with tracking status for a NOTICE OF TAXATION?

With airSlate SignNow, you can easily track the status of your NOTICE OF TAXATION. The platform offers real-time updates and notifications, enabling you to monitor document progress and ensure timely compliance.

Get more for NOTICE OF TAXATION

- Fill iotemporary outdoor seating permitfill fillable temporary outdoor seating permit city form

- Revenue delaware govbusiness licenses faqsbusiness licenses faqs division of revenue state of delaware form

- Il building zoning permit form

- Permit application form

- Town of ocean city maryland rental license application form

- Contact us maryland department of laboroffice of the commissioner of financial dllr state md usoffice of the commissioner of form

- 90 day rehabs near you3 month drug ampamp alcohol addiction treatment90 day transformation guide get ripped bigger leaner

- Home colonie org the official website of the town of colonie form

Find out other NOTICE OF TAXATION

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple