Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property Form

What is the Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

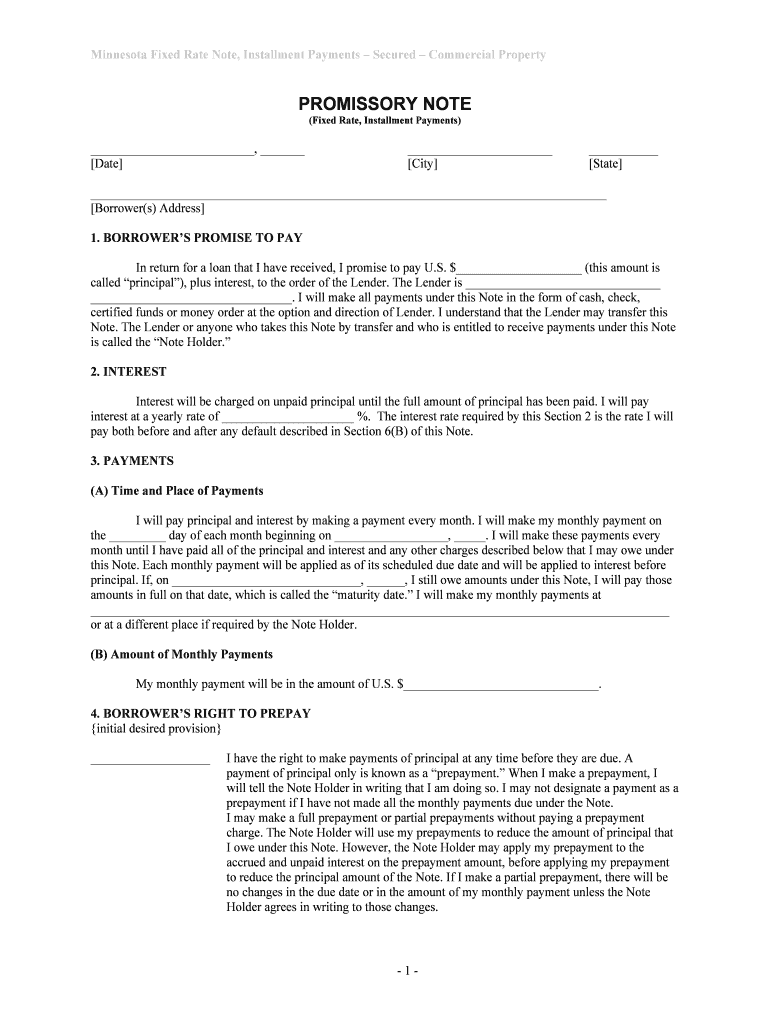

The Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property is a legal document that outlines the terms of a loan secured by commercial real estate. This note specifies the fixed interest rate, repayment schedule, and the obligations of the borrower. It serves as a binding agreement between the lender and borrower, ensuring that the lender has a claim against the property in case of default. This form is essential for businesses seeking financing for commercial property acquisitions or improvements.

Key elements of the Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

Understanding the key elements of this note is crucial for both lenders and borrowers. The essential components include:

- Principal Amount: The total amount borrowed, which must be clearly stated.

- Interest Rate: The fixed rate at which interest will accrue on the principal.

- Payment Schedule: Details on how and when payments will be made, including the frequency (monthly, quarterly, etc.).

- Loan Term: The duration of the loan, indicating when the final payment is due.

- Secured Property: A description of the commercial property that secures the loan, including its legal description.

- Default Terms: Conditions under which the lender can take action in the event of borrower default.

Steps to complete the Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

Completing the Minnesota Fixed Rate Note involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather Information: Collect all necessary details about the loan, including the principal amount, interest rate, and property information.

- Fill Out the Form: Enter the required information accurately in the designated fields of the note.

- Review Terms: Carefully review all terms and conditions to ensure they reflect the agreement between both parties.

- Sign the Document: Both the borrower and lender must sign the document, either physically or electronically, to validate the agreement.

- Store the Document: Keep a copy of the signed note in a secure location for future reference.

Legal use of the Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

The legal use of this note is governed by Minnesota state laws and federal regulations. To ensure its enforceability, the note must meet specific legal requirements, including:

- Proper Signatures: Both parties must sign the document to establish a legal obligation.

- Compliance with State Laws: The note must adhere to Minnesota's lending laws and regulations.

- Clear Terms: All terms must be clearly defined to avoid ambiguity and potential disputes.

How to use the Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

Using the Minnesota Fixed Rate Note effectively requires understanding its application in business transactions. This note is typically used in the following scenarios:

- Securing Financing: Businesses can use this note to secure loans for purchasing or refinancing commercial properties.

- Documenting Loan Agreements: It serves as a formal record of the loan terms agreed upon by both parties.

- Facilitating Legal Recourse: In case of default, the note provides legal grounds for the lender to pursue recovery through the secured property.

Quick guide on how to complete minnesota fixed rate note installment payments secured commercial property

Prepare Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property effortlessly on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any delays. Manage Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property with ease

- Obtain Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property?

A Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property is a financial instrument designed for real estate transactions. It allows borrowers to secure funds for purchasing commercial properties through a fixed interest rate, providing stability in repayment. This option is ideal for businesses looking to manage their cash flow effectively while acquiring valuable assets.

-

What are the advantages of using a Minnesota Fixed Rate Note?

The advantages of a Minnesota Fixed Rate Note include predictable payments and protection against interest rate fluctuations. Businesses benefit from a structured repayment plan, which helps with budget management. Additionally, these notes can be secured by real estate, providing lenders with added assurance.

-

How does airSlate SignNow facilitate the eSigning of Minnesota Fixed Rate Notes?

airSlate SignNow simplifies the eSigning of Minnesota Fixed Rate Notes by providing a user-friendly platform for all parties involved in the transaction. Users can electronically sign documents, ensuring a fast and efficient process. This not only reduces paperwork but also streamlines communication and transaction speed.

-

Are there any fees associated with a Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property?

Yes, there may be fees associated with obtaining a Minnesota Fixed Rate Note, including origination fees and document preparation costs. These fees can vary based on the lender and specific terms of the note. It's essential to review all conditions and expenses upfront to avoid surprises.

-

What types of commercial properties can be financed with a Minnesota Fixed Rate Note?

A Minnesota Fixed Rate Note can finance various types of commercial properties, including office buildings, retail spaces, and industrial facilities. The flexibility of this financial solution allows businesses to invest in different property types. As long as the property meets certain criteria, it can generally qualify for financing.

-

How do installment payments work with a Minnesota Fixed Rate Note?

Installment payments with a Minnesota Fixed Rate Note are structured as regular, scheduled payments over a specified term. These payments typically include both principal and interest, ensuring that the loan is paid off within the agreed timeline. This structure helps borrowers plan their budgets efficiently and manage their cash flow.

-

What integrations does airSlate SignNow offer for managing Minnesota Fixed Rate Notes?

airSlate SignNow offers various integrations with popular business applications, enabling seamless management of Minnesota Fixed Rate Notes. These integrations allow users to connect with CRM systems, accounting software, and document management platforms. This connectivity enhances efficiency and ensures that all information is synchronized across tools.

Get more for Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

- University of california san diego mouse histology form

- Transcript requestoffice of the registrargeorgia southern university form

- Proctor acceptance form workforce development

- National letter intent athletic form

- Criminal history disclosure form 407514776

- Distance learning proctor request form for csi cla

- Pdf transcript request form st thomas aquinas college

- Dept id state form

Find out other Minnesota Fixed Rate Note, Installment Payments Secured Commercial Property

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement