The Frequency in Which You Receive Income from the Source; Form

What is the Frequency In Which You Receive Income From The Source

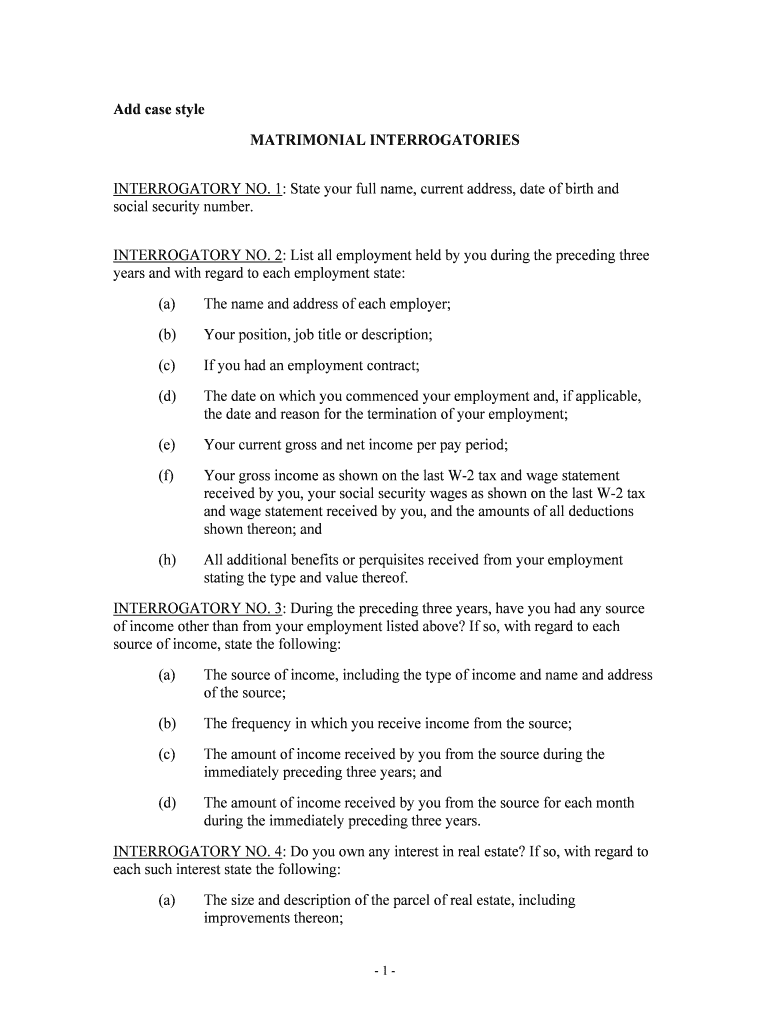

The Frequency In Which You Receive Income From The Source is a form used to document the intervals at which an individual or business receives payments. This form is essential for various tax and financial reporting purposes, as it helps to clarify income streams for both the recipient and the payer. Understanding this form is crucial for accurate financial management and compliance with tax regulations.

How to Use the Frequency In Which You Receive Income From The Source

To effectively use the Frequency In Which You Receive Income From The Source form, begin by gathering all necessary information regarding your income sources. This includes details about the payer, the amount received, and the frequency of payments. Once you have this information, fill out the form accurately, ensuring that all fields are completed. Review the form for any errors before submission, as inaccuracies can lead to complications with tax filings or financial records.

Steps to Complete the Frequency In Which You Receive Income From The Source

Completing the Frequency In Which You Receive Income From The Source involves several key steps:

- Collect information about your income sources, including payer details and payment amounts.

- Fill out the form with accurate information, ensuring all required sections are completed.

- Review the form for accuracy, checking for any potential errors or omissions.

- Submit the form as required, either electronically or via traditional mail, depending on your specific needs.

Legal Use of the Frequency In Which You Receive Income From The Source

The Frequency In Which You Receive Income From The Source is legally recognized when completed according to established guidelines. It is important to adhere to relevant tax laws and regulations to ensure the form is valid. This includes understanding the legal implications of the information provided and ensuring that it is used appropriately in financial reporting and tax filings.

Key Elements of the Frequency In Which You Receive Income From The Source

Key elements of the Frequency In Which You Receive Income From The Source include:

- Payer information: Name and contact details of the individual or entity providing income.

- Recipient information: Your name and identification details.

- Income details: Amount received and frequency of payments.

- Signature: Required to validate the form and confirm that the information is accurate.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how to report income accurately. Following these guidelines is essential for compliance and to avoid penalties. The IRS requires that all income, regardless of frequency, be reported accurately on tax returns. Familiarizing yourself with these guidelines will help ensure that you meet all necessary tax obligations.

Quick guide on how to complete the frequency in which you receive income from the source

Complete The Frequency In Which You Receive Income From The Source; effortlessly on any device

Web-based document management has become prevalent among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without hold-ups. Manage The Frequency In Which You Receive Income From The Source; on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest method to adjust and eSign The Frequency In Which You Receive Income From The Source; without hassle

- Locate The Frequency In Which You Receive Income From The Source; and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choice. Modify and eSign The Frequency In Which You Receive Income From The Source; and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the frequency in which you receive income from the source?

The frequency in which you receive income from the source depends on your payment structure and agreements. airSlate SignNow works with various payment plans to ensure that businesses can optimize their cash flow. Typically, income can be received monthly or annually based on the subscription you choose.

-

How does airSlate SignNow handle document security?

AirSlate SignNow prioritizes document security to ensure that sensitive information is protected. The platform uses advanced encryption methods and compliance measures to safeguard user data. As a result, businesses can confidently send and eSign documents, thereby maintaining the frequency in which you receive income from the source.

-

What pricing plans does airSlate SignNow offer?

AirSlate SignNow offers several pricing plans to cater to different business needs. These plans vary in features and user limits, providing flexibility to choose based on how frequently you need to send documents. Depending on the plan you select, you can optimize the frequency in which you receive income from the source.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow boasts numerous integrations with popular business applications. This makes it easy to streamline workflows and enhance productivity. By integrating with tools you're already using, you can improve the frequency in which you receive income from the source.

-

What are the key features of airSlate SignNow?

AirSlate SignNow offers features like eSigning, document templates, and automated workflows. These tools are designed to simplify the signing process and improve efficiency. By leveraging such features, businesses can positively affect the frequency in which they receive income from the source.

-

How can airSlate SignNow benefit small businesses?

Small businesses can benefit from using airSlate SignNow by reducing the time spent on manual paperwork. The platform streamlines the document signing process, enabling quicker transactions. This efficiency can lead to a favorable increase in the frequency in which you receive income from the source.

-

Is technical support available for airSlate SignNow users?

Yes, airSlate SignNow provides accessible technical support to assist users with any issues or questions. Support is available to help troubleshoot and optimize the service for best performance. By resolving issues promptly, you can maintain the frequency in which you receive income from the source.

Get more for The Frequency In Which You Receive Income From The Source;

- Form ms 35a bill of sale body corporate 658685310

- Project evaluation template 7 wordpdf documents project evaluation planning the general guidelinesproject evaluation planning form

- Gf 126 subpoena and certificate of service wicourts form

- Reset form2print formbond lodgement form 2 resid

- Claim as a nonresident for relief from uk tax unde form

- Sober living home form

- Environmental management prince william 211 virginia form

- How does adhs regulate sober living and residential form

Find out other The Frequency In Which You Receive Income From The Source;

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement