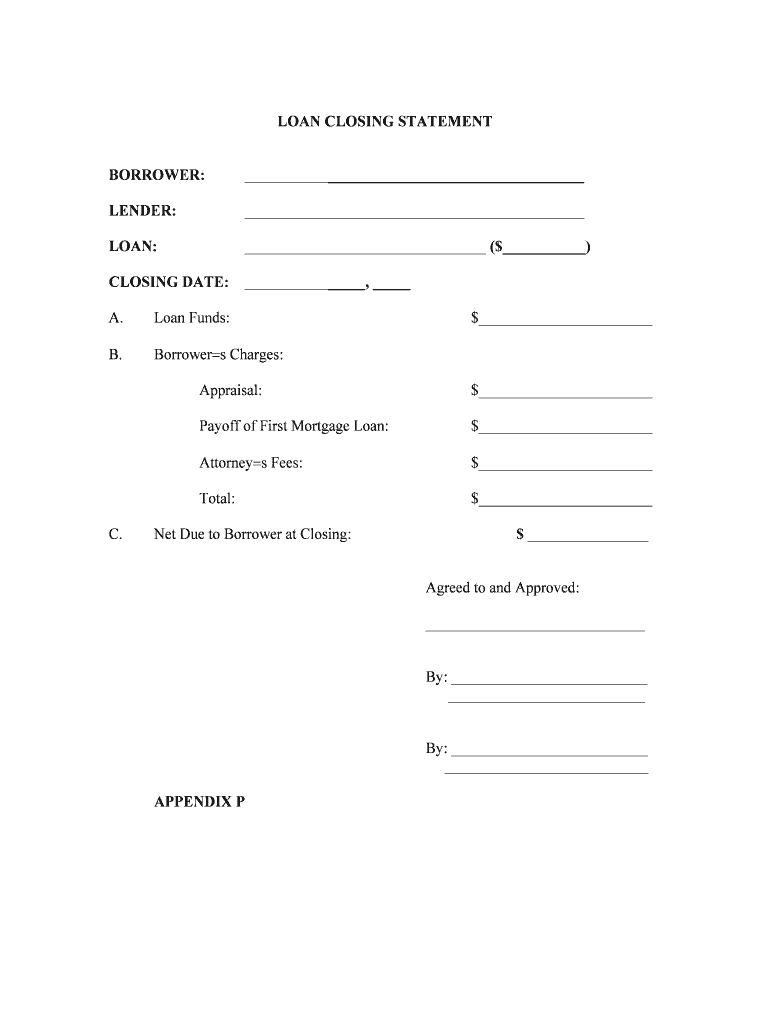

LOAN CLOSING STATEMENT Form

What is the loan closing statement?

The loan closing statement, often referred to as the closing disclosure, is a critical document in real estate transactions. It outlines the final terms of a loan, including the loan amount, interest rate, monthly payments, and closing costs. This document is designed to ensure that all parties involved have a clear understanding of the financial aspects of the transaction before the closing occurs. It is typically provided to the borrower at least three days before the closing date, allowing time for review and questions.

Key elements of the loan closing statement

A loan closing statement contains several essential components that provide clarity on the transaction. Key elements include:

- Loan details: Information about the loan amount, interest rate, and loan term.

- Closing costs: A breakdown of all fees associated with the closing process, including lender fees, title insurance, and appraisal costs.

- Escrow information: Details about any escrow accounts set up for property taxes and insurance.

- Monthly payment breakdown: A summary of the monthly payment amount, including principal, interest, taxes, and insurance.

Steps to complete the loan closing statement

Completing the loan closing statement involves several important steps to ensure accuracy and compliance. These steps typically include:

- Gathering necessary information: Collect all relevant financial documents, including income verification and credit reports.

- Reviewing loan terms: Carefully examine the terms of the loan as outlined in the statement.

- Calculating closing costs: Ensure all fees are accurately represented and understood.

- Signing the document: All parties must sign the closing statement to finalize the transaction.

Legal use of the loan closing statement

The loan closing statement serves as a legally binding document that outlines the terms of the loan agreement. It is essential for both lenders and borrowers to understand that this document can be used in legal proceedings if disputes arise regarding the terms of the loan or the closing process. Compliance with federal and state regulations is crucial to ensure that the closing statement meets all legal requirements.

How to obtain the loan closing statement

Borrowers typically receive the loan closing statement from their lender or mortgage broker. It is important to request this document well in advance of the closing date to allow for thorough review. Additionally, borrowers can access a copy of the loan closing statement through their online account with the lender or by contacting their loan officer directly.

Digital vs. paper version of the loan closing statement

With advancements in technology, many lenders now offer digital versions of the loan closing statement. Digital documents provide several advantages, including easier access, enhanced security, and the ability to eSign the document quickly. However, some borrowers may prefer a paper version for their records. Regardless of the format, it is essential that the information contained in the statement remains accurate and compliant with legal standards.

Quick guide on how to complete loan closing statement

Effortlessly Prepare LOAN CLOSING STATEMENT on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, edit, and eSign your documents without any holdups. Handle LOAN CLOSING STATEMENT on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

How to Edit and eSign LOAN CLOSING STATEMENT with Ease

- Obtain LOAN CLOSING STATEMENT and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the hassle of lost or mislaid documents, exhausting form searches, or mistakes requiring new document prints. airSlate SignNow streamlines all your document management needs in just a few clicks from your chosen device. Edit and eSign LOAN CLOSING STATEMENT and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a LOAN CLOSING STATEMENT?

A LOAN CLOSING STATEMENT is a crucial document that outlines the details of a mortgage transaction. It summarizes the final terms of the loan, including the amount borrowed, closing costs, and any adjustments made. Understanding this statement is essential for borrowers to verify the accuracy of loan terms before signing.

-

How can airSlate SignNow help with my LOAN CLOSING STATEMENT?

airSlate SignNow streamlines the process of handling your LOAN CLOSING STATEMENT by allowing users to send and eSign the document securely online. This eliminates the need for physical paperwork, making the process faster and more efficient. Our platform also ensures that your documents are stored safely and can be accessed anytime.

-

What are the features of airSlate SignNow for managing LOAN CLOSING STATEMENTS?

airSlate SignNow offers several features for managing LOAN CLOSING STATEMENTS, including secure eSigning, document templates, and collaboration tools. Users can easily customize documents and send them for signatures, all while tracking the progress in real-time. This functionality ensures a smooth, hassle-free closing process.

-

Is airSlate SignNow affordable for small businesses dealing with LOAN CLOSING STATEMENTS?

Yes, airSlate SignNow provides a cost-effective solution for small businesses handling LOAN CLOSING STATEMENTS. Our pricing plans are designed to be budget-friendly, offering various options to suit different needs. By saving time and reducing postage costs, businesses can enjoy signNow savings.

-

Can I integrate airSlate SignNow with other tools for LOAN CLOSING STATEMENTS?

Absolutely! airSlate SignNow can be integrated with various CRM and document management tools to enhance your workflow for LOAN CLOSING STATEMENTS. This integration allows you to manage documents seamlessly, reducing the hassle of switching between platforms and streamlining your operations.

-

What security measures does airSlate SignNow implement for LOAN CLOSING STATEMENTS?

airSlate SignNow prioritizes security for your LOAN CLOSING STATEMENTS by utilizing encryption and secure data storage. Our platform complies with industry standards and regulations to ensure that your sensitive information is protected. You can have peace of mind knowing that your documents are safe with us.

-

Can I access my LOAN CLOSING STATEMENTS from any device using airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility across multiple devices, including smartphones, tablets, and desktops. This means you can manage your LOAN CLOSING STATEMENTS on-the-go, making it convenient for busy professionals. With our user-friendly interface, signing and sending documents has never been easier.

Get more for LOAN CLOSING STATEMENT

- Energy commission of nigeria act form

- Nhf application form complete with ease

- Center for women veterans u s department of form

- County announces online lottery for housing choice form

- Nomination form

- J 16 juvenile case file access fillable pdf form

- Renewal application to serve as temporary judge form

- Family court services intake form

Find out other LOAN CLOSING STATEMENT

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer