Articles of Dissolution Ontario Form 10 2005

What is the Articles of Dissolution Ontario Form 10

The Articles of Dissolution Ontario Form 10 is a legal document used to formally dissolve a corporation in Ontario. This form is essential for businesses that have decided to cease operations and need to notify the government of their dissolution. It serves as an official record that the corporation is no longer in existence and must be filed with the appropriate governmental authority. Understanding the purpose and requirements of this form is crucial for ensuring compliance with local laws and regulations.

How to use the Articles of Dissolution Ontario Form 10

Using the Articles of Dissolution Ontario Form 10 involves several key steps. First, ensure that your corporation is eligible for dissolution, which typically requires that all debts and obligations have been settled. Next, gather all necessary information, including the corporation's name, registration number, and details about its directors. Once you have the required information, you can fill out the form accurately. After completing the form, it must be submitted to the appropriate government office, along with any required fees, to finalize the dissolution process.

Steps to complete the Articles of Dissolution Ontario Form 10

Completing the Articles of Dissolution Ontario Form 10 involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Verify that your corporation meets the eligibility criteria for dissolution.

- Collect all necessary documentation, including the corporation's registration details.

- Fill out the form carefully, ensuring all fields are completed with accurate information.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate government office, along with any applicable fees.

Key elements of the Articles of Dissolution Ontario Form 10

The Articles of Dissolution Ontario Form 10 includes several key elements that must be addressed for the form to be valid. These elements typically include:

- The name of the corporation as registered.

- The corporation's registration number.

- A statement confirming that the corporation has ceased operations.

- Details regarding the distribution of any remaining assets.

- Signatures of the directors or authorized representatives.

Legal use of the Articles of Dissolution Ontario Form 10

The legal use of the Articles of Dissolution Ontario Form 10 is critical for ensuring that a corporation is properly dissolved according to Ontario law. Filing this form not only serves to notify the government of the corporation's dissolution but also protects the directors and shareholders from future liabilities associated with the business. It is important to comply with all legal requirements when using this form to avoid potential penalties or legal complications.

Form Submission Methods

The Articles of Dissolution Ontario Form 10 can typically be submitted through various methods, including online filing, mailing, or in-person submission. Each method has its own requirements and processing times. Online submission is often the fastest and most efficient way to file, while mailing the form may take longer due to postal delays. In-person submission allows for immediate confirmation of receipt but may require an appointment or waiting in line.

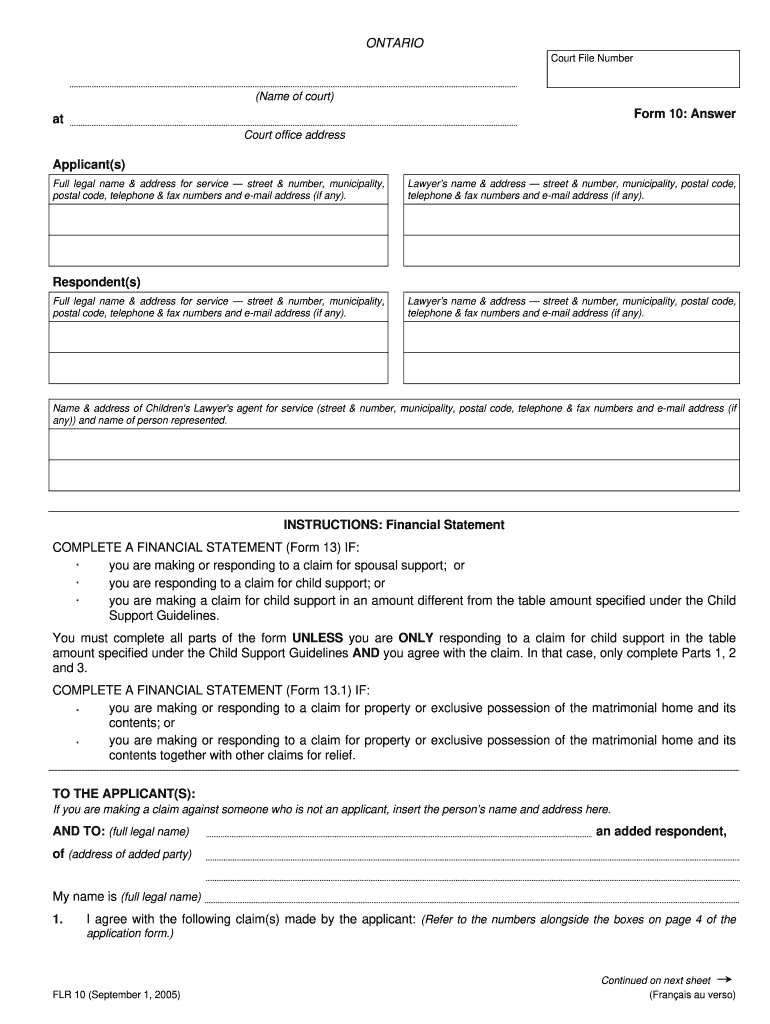

Quick guide on how to complete ontario 10 form answer

A brief overview on how to prepare your Articles Of Dissolution Ontario Form 10

Finding the appropriate template can be difficult when you need to provide official international documentation. Even when you possess the necessary form, it might be challenging to swiftly fill it out according to all the specifications if you utilize hard copies rather than managing everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming those obstacles. It allows you to select your Articles Of Dissolution Ontario Form 10 and promptly complete and sign it on-site without the need to reprint documents in case of an error.

Here are the steps you need to follow to prepare your Articles Of Dissolution Ontario Form 10 with airSlate SignNow:

- Click the Get Form button to instantly insert your document into our editor.

- Begin with the first empty field, provide the necessary information, and proceed with the Next tool.

- Complete the blank fields using the Cross and Check tools from the panel above.

- Select the Highlight or Line options to emphasize the most crucial information.

- Click on Image and upload one if your Articles Of Dissolution Ontario Form 10 requires it.

- Utilize the right-side panel to add extra fields for you or others to fill out if necessary.

- Review your entries and approve the document by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

Once your Articles Of Dissolution Ontario Form 10 is finished, you can distribute it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documentation in your account, organized in folders according to your preferences. Don’t spend time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct ontario 10 form answer

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

Create this form in 5 minutes!

How to create an eSignature for the ontario 10 form answer

How to create an electronic signature for the Ontario 10 Form Answer online

How to create an electronic signature for your Ontario 10 Form Answer in Chrome

How to make an eSignature for signing the Ontario 10 Form Answer in Gmail

How to make an eSignature for the Ontario 10 Form Answer straight from your smart phone

How to generate an electronic signature for the Ontario 10 Form Answer on iOS

How to generate an eSignature for the Ontario 10 Form Answer on Android

People also ask

-

What is the Articles Of Dissolution Ontario Form 10?

The Articles Of Dissolution Ontario Form 10 is a legal document used to officially dissolve a corporation in Ontario. This form is essential for businesses looking to cease operations and clear their legal standing. By filing this form, companies can ensure compliance with provincial regulations regarding corporate dissolution.

-

How can airSlate SignNow help with the Articles Of Dissolution Ontario Form 10?

airSlate SignNow simplifies the process of completing and submitting the Articles Of Dissolution Ontario Form 10. Our platform allows you to easily fill out the form, eSign it, and send it to the appropriate authorities in a streamlined manner, saving you time and effort.

-

What are the benefits of using airSlate SignNow for the Articles Of Dissolution Ontario Form 10?

Using airSlate SignNow for the Articles Of Dissolution Ontario Form 10 offers numerous benefits, including an intuitive interface, secure eSigning capabilities, and efficient document management. This ensures that you can handle your dissolution process swiftly and securely, minimizing any potential legal hiccups.

-

Is there a cost associated with using airSlate SignNow for the Articles Of Dissolution Ontario Form 10?

Yes, there is a cost associated with using airSlate SignNow, but we offer competitive pricing plans that cater to various business needs. Our affordable solutions provide excellent value, especially when you consider the time saved in managing the Articles Of Dissolution Ontario Form 10 and other documents.

-

Can I track the status of my Articles Of Dissolution Ontario Form 10 with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Articles Of Dissolution Ontario Form 10 in real-time. This feature ensures you stay informed about your document's progress and helps you manage your dissolution process effectively.

-

What integrations does airSlate SignNow offer for managing the Articles Of Dissolution Ontario Form 10?

airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your Articles Of Dissolution Ontario Form 10 alongside your other workflows. This flexibility enhances your productivity by connecting your document signing processes with tools you already use.

-

Is airSlate SignNow secure for submitting the Articles Of Dissolution Ontario Form 10?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform employs advanced encryption and compliance measures to ensure that your Articles Of Dissolution Ontario Form 10 and any associated data remain confidential and protected during submission.

Get more for Articles Of Dissolution Ontario Form 10

Find out other Articles Of Dissolution Ontario Form 10

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement