Executor'sAdministrator's Accounting New Hampshire Form

What is the Executor's Administrator's Accounting New Hampshire

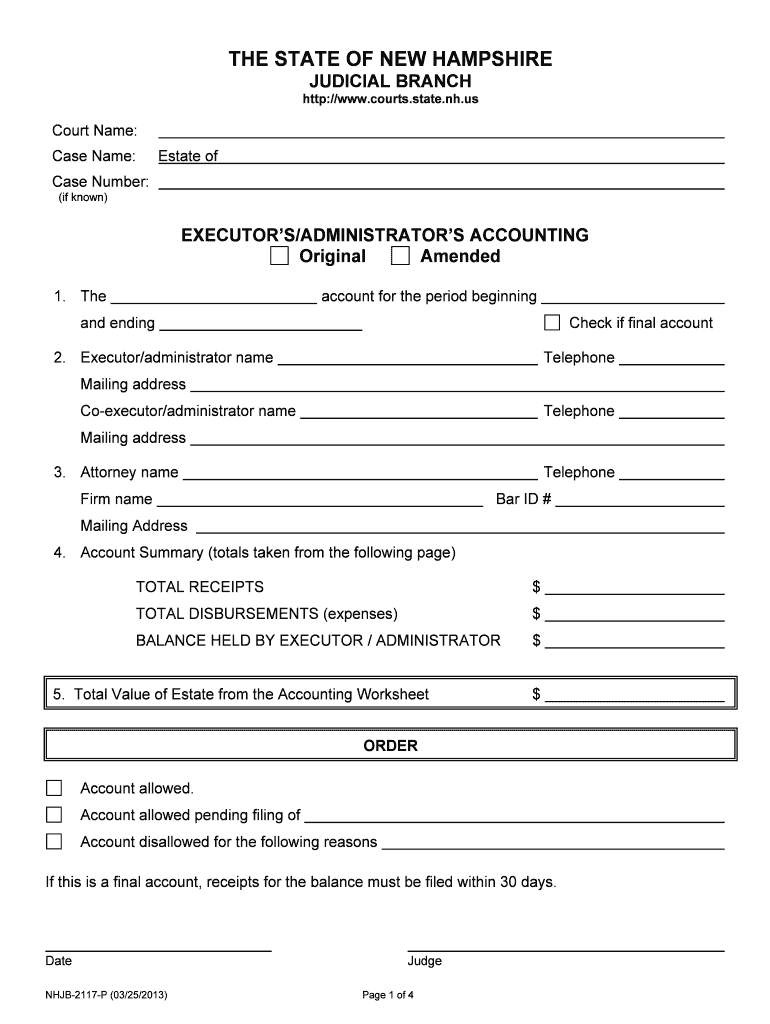

The Executor's Administrator's Accounting in New Hampshire is a formal document that provides a detailed financial report of an estate's administration. This accounting is crucial for ensuring transparency and accountability in the management of the deceased's assets. It typically includes information about income, expenses, distributions to beneficiaries, and any debts settled during the probate process. Executors or administrators are legally obligated to prepare this accounting to keep beneficiaries informed and to comply with state laws.

Steps to complete the Executor's Administrator's Accounting New Hampshire

Completing the Executor's Administrator's Accounting involves several key steps:

- Gather Documentation: Collect all relevant financial documents, including bank statements, receipts, and invoices related to the estate.

- List Assets and Liabilities: Create a comprehensive list of the estate's assets, such as real estate, bank accounts, and personal property, alongside any outstanding debts.

- Calculate Income and Expenses: Document all income generated by the estate, such as rental income or dividends, and itemize expenses incurred during the administration.

- Prepare the Accounting Report: Organize the information into a clear and concise report, ensuring that it accurately reflects the financial status of the estate.

- Review and Revise: Have the report reviewed for accuracy and completeness, making any necessary adjustments before finalizing.

- Submit the Accounting: File the completed accounting with the probate court and provide copies to all beneficiaries.

Legal use of the Executor's Administrator's Accounting New Hampshire

The Executor's Administrator's Accounting is legally binding and serves as a formal record of the estate's financial activities. It is essential for fulfilling fiduciary duties and protecting the executor or administrator from potential legal disputes. By accurately documenting all transactions and providing transparency to beneficiaries, the accounting helps ensure compliance with New Hampshire probate laws. Failure to provide a proper accounting can lead to legal repercussions, including potential removal from the position of executor or administrator.

Key elements of the Executor's Administrator's Accounting New Hampshire

Key elements that must be included in the Executor's Administrator's Accounting are:

- Inventory of Assets: A detailed list of all assets belonging to the estate, including their estimated values.

- Income Details: A summary of all income received by the estate during the administration period.

- Expense Breakdown: A comprehensive list of all expenses incurred, including funeral costs, legal fees, and administrative expenses.

- Distributions to Beneficiaries: Information on any distributions made to beneficiaries, including amounts and dates.

- Final Balances: A closing statement that summarizes the financial position of the estate at the end of the accounting period.

Filing Deadlines / Important Dates

In New Hampshire, the Executor's Administrator's Accounting must be filed within a specific timeframe to comply with state regulations. Generally, the accounting is due within one year of the appointment of the executor or administrator. However, this period may vary based on the complexity of the estate and any court orders. It is important to stay informed of any deadlines to avoid penalties or complications in the probate process.

Form Submission Methods (Online / Mail / In-Person)

The Executor's Administrator's Accounting can be submitted through various methods in New Hampshire. Executors or administrators may choose to file the accounting:

- By Mail: Sending the completed form and any required attachments to the appropriate probate court.

- In-Person: Delivering the accounting directly to the court clerk's office during business hours.

- Online: Utilizing any available electronic filing systems offered by the state, if applicable.

Quick guide on how to complete executorsadministrators accounting new hampshire

Prepare Executor'sAdministrator's Accounting New Hampshire effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, edit, and electronically sign your documents quickly without delays. Manage Executor'sAdministrator's Accounting New Hampshire on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest method to modify and electronically sign Executor'sAdministrator's Accounting New Hampshire with ease

- Find Executor'sAdministrator's Accounting New Hampshire and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or black out sensitive information using tools that airSlate SignNow specially provides for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your updates.

- Choose how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Executor'sAdministrator's Accounting New Hampshire and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Executor's Administrator's Accounting in New Hampshire?

Executor's Administrator's Accounting in New Hampshire refers to the process by which executors or administrators of estates provide a detailed financial report of the estate's transactions. This accounting is crucial for transparency and legal compliance, ensuring that all assets and liabilities are properly documented before distributing the estate.

-

How can airSlate SignNow assist with Executor's Administrator's Accounting in New Hampshire?

airSlate SignNow offers a user-friendly platform that allows executors and administrators to easily manage, sign, and send important accounting documents securely and efficiently. With eSignature capabilities, you can streamline the process, ensuring that all parties have access to necessary documents in a timely manner.

-

What are the pricing options for using airSlate SignNow for Executor's Administrator's Accounting in New Hampshire?

airSlate SignNow provides flexible pricing plans designed to fit various business needs. Our cost-effective solutions allow you to choose a plan that suits your Executor's Administrator's Accounting workflow, ensuring access to essential features without breaking the bank.

-

What features does airSlate SignNow offer for Executor's Administrator's Accounting in New Hampshire?

Our platform includes features such as customizable templates, secure cloud storage, and real-time collaboration tools specifically for Executor's Administrator's Accounting in New Hampshire. These tools simplify document management and ensure that all stakeholders are aligned throughout the process.

-

What are the benefits of using airSlate SignNow for Executor's Administrator's Accounting in New Hampshire?

Using airSlate SignNow for Executor's Administrator's Accounting in New Hampshire enhances efficiency by reducing paperwork and minimizing errors. The ease of electronic signatures and the ability to track document status in real-time means you can focus more on estate management and less on logistical issues.

-

Can airSlate SignNow integrate with other tools for Executor's Administrator's Accounting in New Hampshire?

Yes, airSlate SignNow offers integrations with various third-party applications that can enhance your Executor's Administrator's Accounting process in New Hampshire. These integrations allow for seamless data flow between systems, simplifying tasks such as invoicing and record-keeping.

-

Is airSlate SignNow secure for Executor's Administrator's Accounting in New Hampshire?

Absolutely, airSlate SignNow prioritizes security and compliance, providing a safe environment for managing sensitive Executor's Administrator's Accounting documents in New Hampshire. Our platform uses advanced encryption methods, ensuring that all data remains protected throughout the signing process.

Get more for Executor'sAdministrator's Accounting New Hampshire

Find out other Executor'sAdministrator's Accounting New Hampshire

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online