Wells Fargo Ira Distribution Form 2007

What is the Wells Fargo IRA Distribution Form

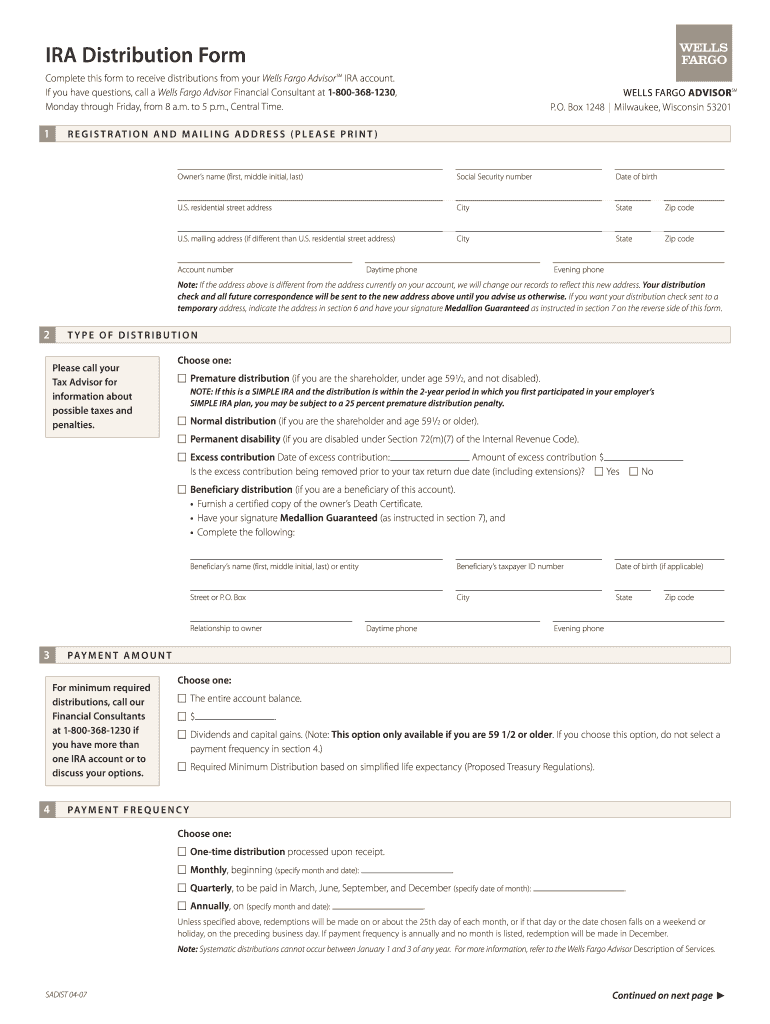

The Wells Fargo IRA Distribution Form is a crucial document used by individuals to request distributions from their Individual Retirement Accounts (IRAs) held at Wells Fargo. This form is essential for account holders who wish to withdraw funds, whether for retirement income, emergencies, or other financial needs. It ensures that the distribution is processed in compliance with IRS regulations and that the account holder acknowledges the tax implications associated with such withdrawals.

How to use the Wells Fargo IRA Distribution Form

To use the Wells Fargo IRA Distribution Form, account holders need to accurately complete the required sections, which typically include personal information, the type of distribution requested, and the amount to be withdrawn. It is important to specify whether the distribution is a one-time withdrawal or a recurring payment. After filling out the form, individuals should review it for accuracy before submitting it to Wells Fargo, either online or via mail. This ensures a smooth processing of the request.

Steps to complete the Wells Fargo IRA Distribution Form

Completing the Wells Fargo IRA Distribution Form involves several steps:

- Gather necessary personal information, including your account number and Social Security number.

- Indicate the type of distribution you are requesting, such as a lump-sum payment or periodic withdrawals.

- Specify the amount you wish to withdraw from your IRA.

- Review the tax implications and any penalties that may apply to early withdrawals.

- Sign and date the form to confirm your request.

- Submit the completed form to Wells Fargo through the preferred submission method.

Key elements of the Wells Fargo IRA Distribution Form

Important elements of the Wells Fargo IRA Distribution Form include:

- Account Holder Information: Personal details of the account holder, including name, address, and contact information.

- Distribution Type: Options for one-time or recurring distributions.

- Withdrawal Amount: The specific amount requested for distribution.

- Tax Withholding Options: Choices regarding federal and state tax withholding from the distribution.

- Signature: Acknowledgment of the request and understanding of the associated tax implications.

Legal use of the Wells Fargo IRA Distribution Form

The Wells Fargo IRA Distribution Form is legally binding once completed and submitted. It serves as a formal request for funds, ensuring that the account holder complies with IRS regulations regarding retirement account distributions. Proper use of this form protects both the account holder and Wells Fargo by documenting the request and the account holder's understanding of any tax consequences. It is advisable to keep a copy of the submitted form for personal records.

Form Submission Methods

The Wells Fargo IRA Distribution Form can typically be submitted through various methods to accommodate the preferences of account holders:

- Online Submission: Many account holders can complete and submit the form through Wells Fargo's online banking platform.

- Mail: The completed form can be printed and sent via postal mail to the designated Wells Fargo address.

- In-Person: Account holders may also choose to visit a local Wells Fargo branch to submit the form directly.

Quick guide on how to complete wells fargo ira distribution form

The optimal method to obtain and sign Wells Fargo Ira Distribution Form

On a company-wide scale, ineffective procedures related to paper approvals can consume a signNow amount of work hours. Signing documents such as Wells Fargo Ira Distribution Form is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement's lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your Wells Fargo Ira Distribution Form can be as straightforward and rapid as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it instantly without the need for third-party software installation on your device or printing out hard copies.

Steps to obtain and sign your Wells Fargo Ira Distribution Form

- Explore our collection by category or use the search bar to find the document you require.

- Check the form preview by clicking on Learn more to ensure it’s the correct one.

- Select Get form to begin editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Wells Fargo Ira Distribution Form.

- Choose the signature method that suits you best: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to manage your documents effectively. You can discover, complete, edit, and even send your Wells Fargo Ira Distribution Form all in one tab without any complications. Enhance your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct wells fargo ira distribution form

FAQs

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

How do I transfer my IRA from Wells Fargo to another bank?

There are two ways to go about this. The first is the preferred method as there is no chance of you being taxed for early withdrawal.Electronic Transfer from Wells Fargo to your new provider. You can have your new provider initiate or you can have Wells Fargo do so. You will need to have the new account established before the transfer, but it can be established with no money and then funded with the transfer.Have Wells Fargo give you a check for the entire amount, often referred to as a rollover. You the have 60 days to complete the transfer to the new account. If you don’t complete the transfer the entire amount will be taxed and if you are under 59 1/2 you will also get hit with a penalty. Some institutions may ask for the name of the institution you are transfer too and and make the check out in your name “for INSTITUTION NAME.” You would endorse the check and give to the new IRA holder. This is to prevent people from speculating with their savings in hopes of beating the market and then getting the money back into the IRA.

-

How do I find out if wells Fargo opened an account in my name?

In order to ensure that you are not a victim of the phony account scandal, the basic thing you can do is:Go through your monthly statements, look at the fees you have been charged, and any other charges for that matter. See if there are charges for a product or service you have not signet for.Login to your account, see what products and services are assigned to you. See if there is some product or services you should not have.Go to a Wells Fargo branch (other than the one you are constantly going), ask from the employee to give you a list of all products you have with the bank. See if their is something that you didn’t apply for.When doing this, look primarily at your deposit accounts as well as credit card accounts. See if you were paying any fees for this type of accounts. If yes, see if you have signed up for these accounts. Maybe, one of the reason that have resulted in the possibility for the phony accounts scandal is that we do not control what are we being charged for by the banks.

-

Is it good to open an IRA account with Wells Fargo?

There are really two question here:1) Should I open an IRA?2) Should I open an IRA with Wells Fargo?When you make the decision to open an IRA, you’re choosing to prepare for retirement.Consider this: When you’re ready to retire, only 1/3 of your personal wealth will come from the work you do every day. 2/3 of it will come from investment decisions!Given this, I’d say that opening an IRA is not just a good idea, but an imperative one!An illustration of the power of compounding here (just as an example):Now, you can open an IRA with most large financial institutions. Wells Fargo is just one among many choices available to you.But opening an IRA is not enough. What are you going to invest in once you have your IRA open? As you can see from the above image, achieving a good ‘growth rate’ is critical to growing your IRA!First, there are different kinds of IRAs.The two most popular types are traditional and Roth. The main difference between them is when/how you pay tax on the money you put into them. Taxes can make all the difference when it comes to having enough money saved for retirement.So take some time to figure out which IRA works best for you.This article breaks them down nicely:Differences between Traditional IRA & Roth IRASecond, when you choose a service for opening your IRA, it’s important that they can make the most of your savings.You don’t want it to get killed by fees, or plopped into some run of the mill, pie chart of the market portfolio.You want more investment options, transparency on what is your IRA being invested in and more control.I’m just going to leave this with:Active Management and IRAs go hand in hand because of the tax advantages in the IRA account!References:[1] Is a Roth IRA better than a traditional IRA?[2] Can you have a traditional IRA and Roth IRA at the same time?[3] Invest in Roth, Traditional, SEP IRA | qplumDisclaimer: All investments carry risk. This is not a solicitation to buy/sell securities. This is not an offer of personal financial advice or legal advice. Past performance is not indicative of future performance.

-

How do I allocate my money as Passive investor with wells fargo IRA?

One option would be to track the allocation of a target retirement fund. Let's just say you're looking to retire 34 years from now, which would put you at age 69. You can take a look at the asset allocation of Vanguard's target retirement 2050 fund. Vanguard publishes the asset allocation of this fund here: Vanguard Target Retirement 2050 Fund So it looks like Vanguard's fund is at about 90/10 for stocks/bonds.

-

I recently opened a Fidelity Roth IRA and it says my account is closed and I need to submit a W-9 form. Can anyone explain how this form relates to an IRA and why I need to fill it out?

Financial institutions are required to obtain tax ID numbers when opening an account, and the fact that it's an IRA doesn't exempt them from that requirement. They shouldn't have opened it without the W-9 in the first place, but apparently they did. So now they had to close it until they get the required documentation.

-

How do you order checks form Wells Fargo?

Simply log into your Wells Fargo online account and hover over “Accounts,” then “Checks & Deposit Tickets.” Or call 1–800-TO-WELLS to speak to a personal banker.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

Create this form in 5 minutes!

How to create an eSignature for the wells fargo ira distribution form

How to make an eSignature for your Wells Fargo Ira Distribution Form online

How to create an eSignature for your Wells Fargo Ira Distribution Form in Google Chrome

How to generate an eSignature for putting it on the Wells Fargo Ira Distribution Form in Gmail

How to make an electronic signature for the Wells Fargo Ira Distribution Form right from your smartphone

How to create an eSignature for the Wells Fargo Ira Distribution Form on iOS devices

How to generate an eSignature for the Wells Fargo Ira Distribution Form on Android

People also ask

-

What is the Wells Fargo Ira Distribution Form?

The Wells Fargo Ira Distribution Form is a document used to request distributions from an IRA account held at Wells Fargo. This form is essential for initiating withdrawals, rollovers, or transfers. Ensuring the form is filled out correctly can help streamline the distribution process.

-

How do I obtain the Wells Fargo Ira Distribution Form?

You can obtain the Wells Fargo Ira Distribution Form directly from the Wells Fargo website or by visiting a local branch. Additionally, airSlate SignNow allows you to fill out and eSign the form online, making it more convenient and efficient for your needs.

-

What information do I need to complete the Wells Fargo Ira Distribution Form?

To complete the Wells Fargo Ira Distribution Form, you will need personal identification details, account information, and specifics regarding your desired distribution type. Accurate completion of this form is crucial for a successful transaction.

-

Is there a fee associated with using the Wells Fargo Ira Distribution Form?

There may be fees associated with IRA distributions, depending on the terms set by Wells Fargo. However, using the Wells Fargo Ira Distribution Form itself through services like airSlate SignNow can help minimize costs by enabling electronic submission and eSignature.

-

Can I track the status of my Wells Fargo Ira Distribution Form?

Yes, you can track the status of your Wells Fargo Ira Distribution Form by logging into your Wells Fargo account or contacting customer service. Using airSlate SignNow, you can also receive notifications about the progress of your submitted form.

-

What are the benefits of using airSlate SignNow for the Wells Fargo Ira Distribution Form?

Using airSlate SignNow for the Wells Fargo Ira Distribution Form provides a cost-effective and user-friendly solution for signing and sending documents. It eliminates paperwork, allows for easy eSignature, and speeds up the distribution process.

-

Can I integrate airSlate SignNow with my existing workflow for the Wells Fargo Ira Distribution Form?

Absolutely! airSlate SignNow offers various integrations with popular platforms, allowing you to seamlessly incorporate the Wells Fargo Ira Distribution Form into your current workflow. This can enhance efficiency and ensure you have all necessary documentation in one place.

Get more for Wells Fargo Ira Distribution Form

- Application family member form

- Simple work plan template with exampleindeedcom form

- Shellpoint mortgage payoff request fax number form

- Printable vet forms

- Tenants right to break a rental lease in north carolina form

- Wwwprinceedwardislandca sites defaultapplication form agriculture research prince edward island

- Transcript request northwest arkansas community college form

- New zealand ministry health form

Find out other Wells Fargo Ira Distribution Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors