Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate or Other Non Hourly Pay Form

What is the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

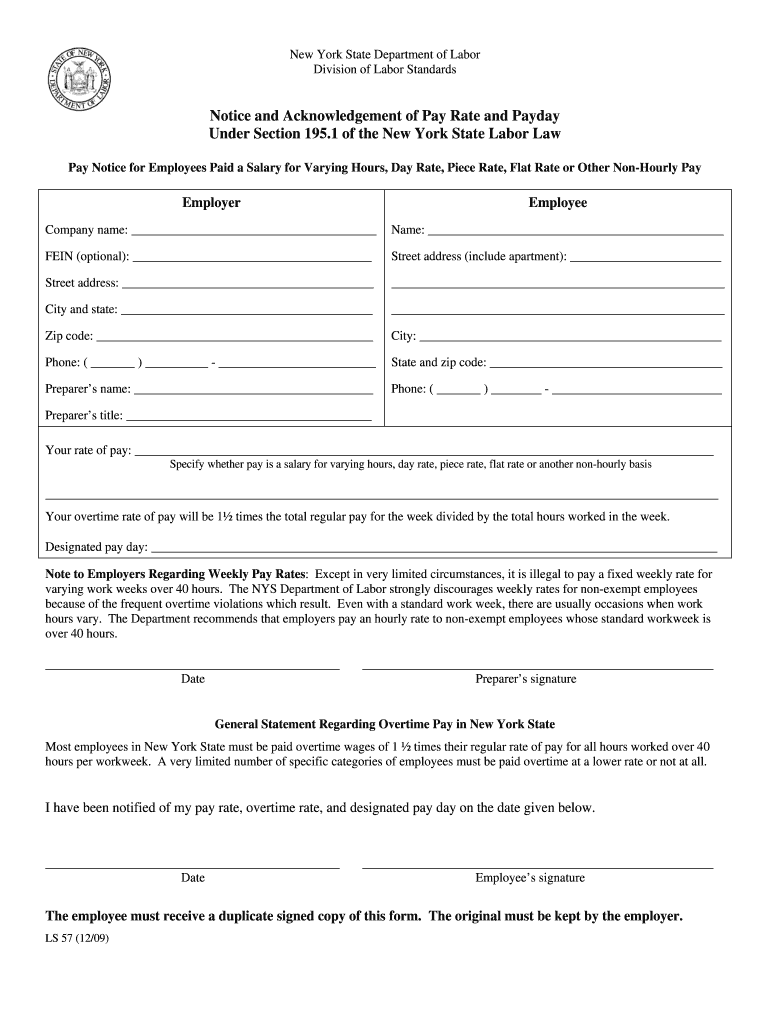

The Pay Notice for Employees Paid a Salary for Varying Hours, Day Rate, Piece Rate, Flat Rate, or Other Non Hourly Pay is a crucial document that informs employees about their compensation structure. This notice outlines how their pay is calculated, ensuring transparency and compliance with labor laws. It is essential for employers to provide clear details regarding the payment method, frequency, and any applicable deductions. Understanding this notice helps employees know their rights and the basis of their earnings, fostering a trusting relationship between employers and employees.

How to use the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

Using the Pay Notice effectively involves several steps. First, employees should review the notice to understand their pay structure. This includes the specific rates applicable to their work hours or tasks. Next, employees should keep a copy for their records, as it serves as a reference for any future pay-related inquiries. Employers should ensure that this notice is distributed promptly and stored securely, making it accessible for both current and former employees. This practice not only enhances communication but also helps in resolving any potential disputes regarding pay.

Steps to complete the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

Completing the Pay Notice requires careful attention to detail. Start by gathering all necessary information about the employee’s pay structure. This includes the agreed-upon salary, day rates, piece rates, or flat rates. Next, fill out the notice with accurate figures and ensure that all calculations are correct. After completing the notice, it should be signed by both the employer and the employee to signify agreement. Finally, provide a copy to the employee while retaining one for the employer’s records. This process ensures that both parties are on the same page regarding compensation.

Legal use of the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

The legal use of the Pay Notice is governed by federal and state labor laws. Employers must comply with regulations that require clear communication of pay structures to employees. This document serves as a legal record of the agreed terms between the employer and employee. It is essential that the notice is accurate and reflects the actual compensation practices to avoid potential legal disputes. Employers should also be aware of state-specific requirements that may dictate additional information that must be included in the notice.

Key elements of the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

Key elements of the Pay Notice include the employee’s name, job title, and pay rate. It should also specify the method of payment, whether it is a salary, hourly rate, or commission-based. Additionally, the notice must outline the pay period, detailing how often the employee will receive payment. Any deductions or withholdings should be clearly stated to avoid confusion. By including these elements, the notice provides a comprehensive overview of the employee's compensation, ensuring clarity and compliance.

Examples of using the Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

Examples of using the Pay Notice can vary by industry and job type. For instance, a construction company may use it to inform workers about their piece rates for completed tasks. In contrast, a consulting firm might issue the notice to detail salaries for employees who work varying hours based on project needs. Each example highlights the importance of clear communication regarding pay structures, helping employees understand how their earnings are calculated based on their specific roles and responsibilities.

Quick guide on how to complete pay notice for employees paid a salary for varying hours day rate piece rate flat rate or other non hourly pay

Effortlessly Prepare Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay on Any Device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and Electronically Sign Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay with Ease

- Find Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Pay Notice for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay?

A Pay Notice for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay is a document that provides detailed information regarding an employee's compensation structure. It ensures compliance with labor laws and helps employees understand their pay by outlining how their salaries are calculated based on various pay methods.

-

How does airSlate SignNow assist with creating Pay Notices?

airSlate SignNow simplifies the process of creating Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay by providing customizable templates. Users can easily fill in necessary details and electronically sign documents, ensuring that all parties have a clear understanding of pay structures.

-

What features are included in your service for Pay Notices?

Our service includes features like customizable templates, secure eSigning, and real-time tracking for Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay. These features enhance the efficiency of document management and ensure compliance with legal requirements.

-

How can I ensure compliance while using airSlate SignNow?

Using airSlate SignNow for Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay is designed to help ensure compliance with federal and state labor laws. Our templates are regularly updated to reflect current regulations, and our platform maintains a complete log of all transactions.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow supports integrations with various HR and payroll management systems, allowing seamless data transfer for Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay. This integration helps streamline your documentation processes and enhances operational efficiency.

-

What is the pricing structure for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. Our fees for creating and managing Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay are competitive and provide excellent value for your eSigning needs.

-

Can airSlate SignNow handle high volumes of Pay Notices?

Absolutely! airSlate SignNow is designed to handle high volumes of transactions efficiently, making it ideal for businesses that need to issue numerous Pay Notices for Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay. Our platform ensures quick turnaround times without sacrificing security or compliance.

Get more for Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

- Eagle scout letter of recommendation huguenot trail district form

- Whats new in ibm content manager enterprise edition v8 7 form

- Form 1065 x rev october

- Form 15111 rev 3

- Form 3903 moving expenses 1040 com knowledge base

- Notice 797 rev september form

- Well mail you the scannable forms and any other products you order

- Form 1099 h

Find out other Pay Notice For Employees Paid A Salary For Varying Hours, Day Rate, Piece Rate, Flat Rate Or Other Non Hourly Pay

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed