Morgage Morgage Application Form in Richmond Bc

What is the Morgage Morgage Application Form in Richmond BC

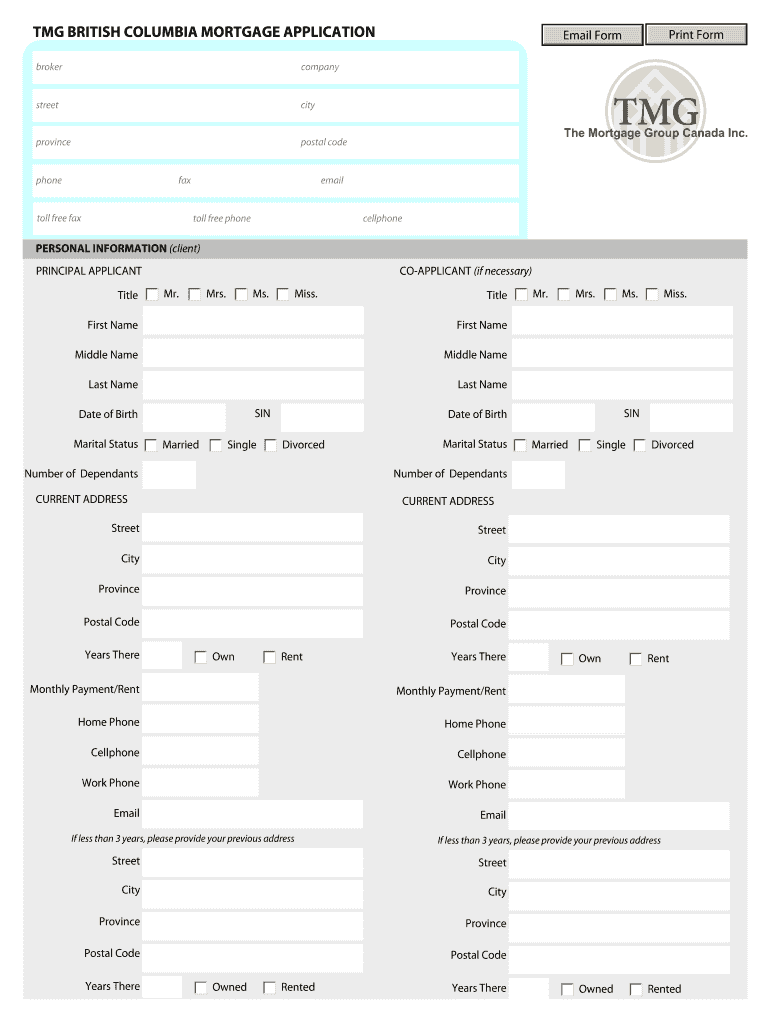

The Morgage Morgage Application Form is a crucial document for individuals seeking to secure a mortgage in Richmond, BC. This form collects essential information about the applicant's financial status, employment history, and property details. It serves as a formal request to lenders for mortgage financing and is a key step in the home-buying process. Understanding the purpose and requirements of this form is vital for a smooth application experience.

Steps to Complete the Morgage Morgage Application Form in Richmond BC

Completing the Morgage Morgage Application Form involves several important steps:

- Gather necessary documents, including proof of income, credit history, and identification.

- Provide accurate personal information, such as your name, address, and Social Security number.

- Detail your employment history, including current and past employers.

- Disclose your financial obligations, including existing loans and debts.

- Submit the completed form electronically or in person, depending on lender requirements.

Ensuring that all information is accurate and complete will help expedite the approval process.

Legal Use of the Morgage Morgage Application Form in Richmond BC

The Morgage Morgage Application Form must adhere to specific legal standards to be considered valid. In the United States, eSignatures are legally binding under the ESIGN Act and UETA, provided that certain conditions are met. It is important to ensure that the form is signed using a compliant electronic signature solution, which offers an audit trail and secure storage of the document. This legal framework protects both the lender and the borrower during the mortgage process.

Key Elements of the Morgage Morgage Application Form in Richmond BC

Several key elements are essential for a complete Morgage Morgage Application Form:

- Personal Information: Full name, contact details, and Social Security number.

- Employment History: Current and previous employers, job titles, and duration of employment.

- Financial Information: Income sources, existing debts, and monthly expenses.

- Property Details: Information about the property being purchased, including its address and estimated value.

- Signature: A legally binding signature, either electronic or handwritten, is required to validate the application.

How to Obtain the Morgage Morgage Application Form in Richmond BC

The Morgage Morgage Application Form can typically be obtained through various channels:

- Directly from lenders or banks that offer mortgage services.

- Online through lender websites, where you can often fill out the form electronically.

- In-person at local branches of financial institutions.

- Through mortgage brokers who can assist in the application process.

It is advisable to ensure that you are using the most current version of the form to avoid any delays in processing.

Application Process & Approval Time

The application process for a mortgage typically involves several stages:

- Submission: After completing the Morgage Morgage Application Form, submit it to your chosen lender.

- Review: The lender will review your application, verify your information, and assess your creditworthiness.

- Approval: If approved, you will receive a loan estimate detailing the terms of the mortgage.

- Closing: Upon acceptance of the terms, the final paperwork will be prepared for closing on the property.

The approval time can vary based on the lender and the complexity of your application, but it generally ranges from a few days to several weeks.

Quick guide on how to complete morgage morgage application form in richmond bc

Complete Morgage Morgage Application Form In Richmond Bc effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Morgage Morgage Application Form In Richmond Bc on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Morgage Morgage Application Form In Richmond Bc effortlessly

- Find Morgage Morgage Application Form In Richmond Bc and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Morgage Morgage Application Form In Richmond Bc and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How many application forms does a person need to fill out in his/her lifetime?

As many as you want to !

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the MHT-CET MBA exam application form in detail?

DTE Maharashtra has discharged MHT CET 2018 application form as on January 18 in online mode, can be filled by competitors by following the means said in how to fill MHT CET application frame 2018. Applicants who need to enlist themselves for the selection test should take after the means as given in how to fill MHT CET 2018 application form to maintain a strategic distance from oversights and entire method to go smooth and bother free. The means to fill the application type of MHT CET 2018 incorporates enlistment, filling of required subtle elements, transferring of filtered reports, instalment and affirmation page download. Hopefuls are required to fill the application type of MHT CET 2018 painstakingly to stay away from dismissal by the specialists. It is essential to take the application shape filling methodology of MHT CET genuinely on the grounds that exclusive those hopefuls who will present their structures effectively will get concede cards. Such applicants who will have legitimate MHT CET 2018 concede cards will be permitted to show up in the exam.Competitors must read the means offered underneath to fill and submit MHT CET 2018 application frame in a sorted-out way:Stage 1 – RegistrationApplicants should enrol themselves and give the required details. Candidate should concur whether he or she is an Indian resident or not.Proceeding onward, they will be required to fill the accompanying individual subtle elements:Full name (as showing up on the announcement of characteristics of SSC tenth or proportional exam), Father’s name, Mother’s first name, Last name, Gender, Contact Information, Address for correspondence, House No/Street, Area Name, Town/City , State, District, Pin code, Country, Mobile Number, Primary Email Id (Email will be sent to this email ID), Alternate Email Id (Parent’s Email ID, if accessible), Contact Telephone No. (with STD Code), Permanent Residence in Village/Town/City, Domicile of Maharashtra/Disputed Maharashtra Karnataka Border (MKB)/Outside Maharashtra, Reservation, Category of competitor (Caste perceived in Maharashtra state), Candidates having a place with SC, ST, VJ(A), NT(B), NT(C), NT(D), OBC and SBC classes must have their individual standing authentications, Candidates having a place with Non Creamy Layer (NCL) should create substantial testament upto March 31, 2019, Other DetailsRegardless of whether the candidate has a place with – PWD class or not (competitors qualified who are qualified under this classification ought to have under 40% incapacity), visually impaired, low vision. Orthopedically debilitated and competitors influenced with Cerebral Palsy and Dyslexia, who are not in a situation to compose, can benefit a copyist/author for the MHT-CET 2018 examRegardless of whether the applicant is a J&K vagrant or notReligionOther placement tests that applicant has enrolled for (JEE Main/NEET/None)Add up to Annual Family IncomeAadhaar NumberFinancial balance DetailsName of the record holder according to Bank recordName of the BankName of the Bank BranchKind of Account (Savings/Current)Financial balance NumberIFSC CodePoints of interest of HSC (twelfth/Equivalent Examination)Regardless of whether hopeful has passed/showed up for confirmation in Pharmacy (just for Biology applicants)Place from where hopeful has finished HSC (twelfth)/proportional exam showing up/Passed from school/Jr. School arranged (Maharashtra/Outside Maharashtra)Subtle elements required for MHT-CET 2018Subjects for CET examination (Physics, Chemistry, Mathematics, Biology)Dialect for the exam (English, Marathi, Urdu)Enter secret keyCompetitors should make a secret word (least 8 and most extreme 15 characters and should have one capitalized, one lower case and one numeric)In the wake of entering the secret key, competitors should affirm it. This secret word will be utilized for future logins.Statement by the hopefulApplicants should read the revelation composed and after that tap on “I Agree”Applicants need to enter the security key as gave and after that tap on “Next” catchStage 2 – Confirmation and SubmissionIn the wake of filling the previously mentioned subtle elements, hopefuls will have the capacity to check the data filled and alter certain things in the application frame.Applicants can backpedal and change or alter the accompanying particulars (as noticeable in green shading) before accommodation:Exam focusSubjects pickedDialect of the examIndividual with handicap choiceIn any case, there are particulars (as unmistakable in blue shading) that can’t be altered at this stage once submitted:Father’s nameLast nameDate of birthVersatile numberEmail IDSubsequent to rolling out the improvements, if required, hopefuls should present the shape.Stage 3 – Application number gotApplicants will get a message on the screen in regards to effective enlistment for MHT CET 2018 with their application number. A similar number will be sent to them gave email ID. Competitors can see and check their entered data in this progression.Stage 4 – Edit and Upload photo and markApplicants will have the capacity to alter the points of interest they have filled in the application frame. In any case, regardless they won’t have the capacity to alter their full name, father’s name, last name, date of birth, versatile number and email ID. In the event that candidates would prefer not to alter any points of interest, they can move to the subsequent stage of transferring their photo and mark in the arrangement recommended by the experts.Stage 5 – Uploading photo and markApplicants should transfer their current identification estimate shading photo and mark in the configuration given in the table underneath. On the off chance that, applicants are not ready to transfer the right photographs/marks, they should reload the right records and afterward transfer.Stage 6 – VerificationCompetitors will get a message on their screens with respect to fruitful transferring of photo and mark. They will likewise have the capacity to see a connection saying ” Click here to make payment “. Applicants should tap on the connection to enter the instalment entryway.Stage 7 – Payment gatewayHopefuls will have the capacity to see every one of the subtle elements filled by them alongside their transferred photo and mark on their screens. The application expense sum will likewise be noticeable in this progression, which they should pay in the wake of perusing the revelation. It is to noticed that competitors will have the capacity to change their subjects they are applying for.Applicants will have the capacity to influence application to charge payment through credit/check card, net saving money, plastic (ATM PIN), wallets and then some. They should influence instalment of the application to sum with comfort charge and expense.After instalment of utilisation charge, competitors will have the capacity to see a message on their screen with respect to accomplishment of exchange. Applicants must remove a print from this page.Stage 8 – Acknowledgment pageCompetitors must take a print from the affirmation page and keep it securely for some time later.Hope this Helps!!

-

What percentage do I have to fill out in the KVPY application form?

If you are from CBSE Board and are appearing for KVPY SX or SA stream, then you have to multiply a CGPA in class 10 with 9.5 to get the percentage.

Create this form in 5 minutes!

How to create an eSignature for the morgage morgage application form in richmond bc

How to make an electronic signature for your Morgage Morgage Application Form In Richmond Bc in the online mode

How to create an electronic signature for the Morgage Morgage Application Form In Richmond Bc in Chrome

How to create an electronic signature for putting it on the Morgage Morgage Application Form In Richmond Bc in Gmail

How to generate an eSignature for the Morgage Morgage Application Form In Richmond Bc right from your smartphone

How to create an electronic signature for the Morgage Morgage Application Form In Richmond Bc on iOS

How to generate an electronic signature for the Morgage Morgage Application Form In Richmond Bc on Android devices

People also ask

-

What steps should I take to get a mortgage using airSlate SignNow?

To get a mortgage using airSlate SignNow, start by preparing your documents for eSigning. Upload your mortgage application and any required documentation to the platform. Next, send the documents for signatures, making the process efficient and secure, ensuring you can get a mortgage without any hassle.

-

How does airSlate SignNow help streamline the mortgage signing process?

airSlate SignNow streamlines the mortgage signing process by allowing you to send multiple documents for eSignature at once. Its intuitive interface helps users navigate the signing tasks seamlessly, enabling you to get a mortgage faster. With real-time tracking, you can also monitor the status of your documents.

-

What are the costs associated with using airSlate SignNow to get a mortgage?

The cost of using airSlate SignNow can vary based on your plan and the number of documents you process. However, its pricing remains competitive, making it a cost-effective solution to get a mortgage. You can compare different plans to find one that best fits your needs and budget.

-

What features does airSlate SignNow offer that are beneficial for getting a mortgage?

airSlate SignNow offers features like document templates, bulk sending, and secure storage that are all beneficial for getting a mortgage. With these features, you can save time, reduce errors, and ensure compliance during the mortgage process. Additionally, its mobile-friendly design allows you to manage documents on the go.

-

Is it safe to use airSlate SignNow for getting a mortgage?

Yes, it is safe to use airSlate SignNow for getting a mortgage. The platform employs advanced encryption and security measures to protect your sensitive information. With airSlate SignNow, you can confidently manage your mortgage documents without compromising your data security.

-

Can I integrate airSlate SignNow with other applications to facilitate getting a mortgage?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and document management software, to facilitate getting a mortgage. These integrations help create a more streamlined workflow, allowing you to manage client information and documents all in one place.

-

What is the turnaround time for getting a mortgage with airSlate SignNow?

The turnaround time for getting a mortgage can vary, but with airSlate SignNow, the eSigning process is typically expedited. By minimizing paperwork and reducing delays associated with traditional signatures, you can signNowly speed up your mortgage approval process. With quick access to signed documents, you’re on your way to getting a mortgage sooner.

Get more for Morgage Morgage Application Form In Richmond Bc

Find out other Morgage Morgage Application Form In Richmond Bc

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF