Td Mortgage Deferral Form

What is the TD Mortgage Deferral Form

The TD Mortgage Deferral Form is a legal document that allows homeowners to request a temporary postponement of their mortgage payments. This form is typically used during financial hardships, such as job loss or unexpected expenses, enabling borrowers to manage their finances more effectively. By submitting this form, homeowners can seek relief from immediate payment obligations while maintaining their mortgage account in good standing.

Steps to Complete the TD Mortgage Deferral Form

Completing the TD Mortgage Deferral Form involves several important steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your mortgage account number and details about your current financial situation. Next, fill out the form accurately, providing all required information. It is crucial to review the form for completeness and correctness before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by your lender.

Key Elements of the TD Mortgage Deferral Form

The TD Mortgage Deferral Form includes several key elements that must be addressed for successful processing. These elements typically encompass the borrower's personal identification information, the mortgage account details, the reason for requesting a deferral, and the desired duration of the deferral period. Additionally, borrowers may need to provide supporting documentation that verifies their financial hardship, such as pay stubs or bank statements.

Legal Use of the TD Mortgage Deferral Form

Using the TD Mortgage Deferral Form legally requires adherence to specific guidelines set forth by lenders and regulatory bodies. It is essential to ensure that all information provided is truthful and accurate, as submitting false information can lead to penalties. Borrowers must also be aware of the terms and conditions associated with the deferral, including any potential impact on their credit score or future payment obligations. Understanding these legal aspects can help borrowers make informed decisions regarding their mortgage payments.

Form Submission Methods

The TD Mortgage Deferral Form can typically be submitted through various methods, depending on the lender's policies. Common submission methods include online submission via the lender's website, mailing the completed form to the designated address, or delivering it in person at a local branch. Each method may have different processing times, so it is advisable to check with the lender for specific instructions and timelines to ensure timely consideration of the request.

Required Documents

When submitting the TD Mortgage Deferral Form, borrowers may need to provide additional documentation to support their request. Required documents often include proof of income, such as recent pay stubs or tax returns, and documentation of financial hardship, such as unemployment letters or medical bills. Having these documents ready can expedite the review process and increase the likelihood of approval for the deferral.

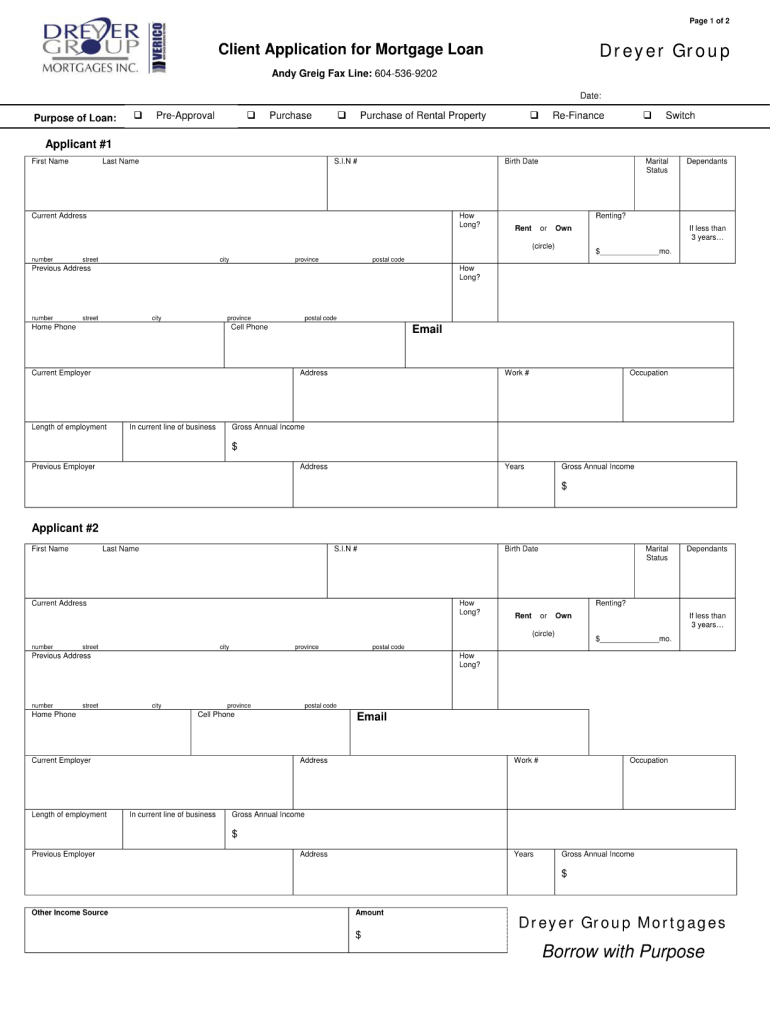

Quick guide on how to complete mortgage application form

A concise manual on how to assemble your Td Mortgage Deferral Form

Locating the correct template can prove to be a challenge when you need to submit official international documentation. Even if you possess the necessary form, it might be cumbersome to swiftly fill it out in accordance with all the specifications if you rely on printed copies instead of handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these obstacles. It allows you to obtain your Td Mortgage Deferral Form and promptly fill in and sign it on-site without the need to reprint documents each time you make an error.

Here are the actions you must take to prepare your Td Mortgage Deferral Form using airSlate SignNow:

- Click the Obtain Form button to import your document into our editor immediately.

- Begin with the first vacant field, enter details, and move on with the Next tool.

- Complete the empty fields utilizing the Cross and Check tools from the panel above.

- Select the Highlight or Line features to emphasize the most essential information.

- Click on Image and upload one if your Td Mortgage Deferral Form necessitates it.

- Make use of the right-side panel to add additional sections for yourself or others to complete if necessary.

- Review your entries and validate the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing the form by clicking the Completed button and selecting your file-sharing preferences.

When your Td Mortgage Deferral Form is prepared, you can share it as you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finalized documents in your account, organized in folders based on your preferences. Don’t spend time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

How does the bank verify that I can pay my employee his salary for the "verification of employment" on his mortgage application?

Just to keep it real, if one of my business clients came to me and the predicate of their question was whether they may have to prove what they say to a bank under penalty of perjury is truthful, we would go to the woodshed had have a very long talk.You seem to be saying that this individual is not an employee of yours at the time of completing a Verification of Employment, but that you anticipate him being employed by you at sometime in the future. Do I have that right? His two years of prior work experience, really is not relevant to the bank’s needs unless it was paid employment (although the failure to pay him may also be problematic under state and Federal wage and hour laws).The Bank will be requiring tax returns and W2s from him that will show both his earning history and his recent earnings. What you seem to be saying is that you have an intention and not a legal obligation and possibly not a current financial ability to hire him sometime in the future. I suppose you can say all of that, but itis unlikely that would be of much help on his application. It does have the advantage of being accurate.If he accurately reveals his actual wage history and the fact that he is not currently employed, it is doubtful that you can gild that drooping financial lilly and I would not try. This is likely an FHA (Federally guaranteed loan) and if something goes wrong that it when the lender starts looking more carefully at its basis for granting the loan. It would not be good for your company if you were later found to have provided inaccurate information. It would be a good idea of you don’t base your decision on Quora, and instead turn to your company lawyer and possibly the investor you’re waiting on.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

What is the process of a mortgage loan with SBI?

Dear VinodThe process of a mortgage with SBI is as simple as one with any other lender. In case you have an account with SBI, it becomes even easier. Follow the following steps to get a mortgage loan:Get all property documents (complete trail) from the very first allotment in case you are not the original allotee/ buyer photocopiedTake photo copies of your income documentsTake photo copies of your KYC documentsVisit the SBI branch and apply for the mortgage loanGenerally the above process shall suffice but the bank may ask you for some additional information or documentation if required.Trust this helps.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill the JEE (Main) application form?

This is a step by step guide to help you fill your JEE (Main) application form online brought to you by Toppr. We intend to help you save time and avoid mistakes so that you can sail through this whole process rather smoothly. In case you have any doubts, please talk to our counselors by first registering at Toppr. JEE Main Application Form is completely online and there is no offline component or downloadable application form. Here are some steps you need to follow:Step 1: Fill the Application FormEnter all the details while filling the Online Application Form and choose a strong password and security question with a relevant answer.After entering the data, an application number will be generated and it will be used to complete the remaining steps. Make sure your note down this number.Once you register, you can use this number and password for further logins. Do not share the login credentials with anyone but make sure you remember them.Step 2: Upload Scanned ImagesThe scanned images of photographs, thumb impression and signature should be in JPG/JPEG format only.While uploading the photograph, signature and thumb impression, please see its preview to check if they have been uploaded correctly.You will be able to modify/correct the particulars before the payment of fees.Step 3: Make The PaymentPayment of the Application Fees for JEE (Main) is through Debit card or Credit Card or E Challan.E-challan has to be downloaded while applying and the payment has to be made in cash at Canara Bank or Syndicate Bank or ICICI bank.After successful payment, you will be able to print the acknowledgment page. In case acknowledgment page is not generated after payment, then the transaction is cancelled and amount will be refunded.Step 4: Selection of Date/SlotIf you have opted for Computer Based Examination of Paper – 1, you should select the date/slot after payment of Examination Fee.If you do not select the date/slot, you will be allotted the date/slot on random basis depending upon availability.In case you feel you are ready to get started with filling the application form, pleaseclick here. Also, if you are in the final stages of your exam preparation process, you can brush up your concepts and solve difficult problems on Toppr.com to improve your accuracy and save time.

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

Create this form in 5 minutes!

How to create an eSignature for the mortgage application form

How to generate an eSignature for your Mortgage Application Form online

How to generate an electronic signature for the Mortgage Application Form in Chrome

How to make an electronic signature for putting it on the Mortgage Application Form in Gmail

How to create an electronic signature for the Mortgage Application Form from your smart phone

How to make an electronic signature for the Mortgage Application Form on iOS devices

How to make an eSignature for the Mortgage Application Form on Android OS

People also ask

-

What is the Td Mortgage Deferral Form?

The Td Mortgage Deferral Form is a document that allows homeowners to request a temporary deferral of their mortgage payments from TD Canada Trust. This form is designed to assist customers facing financial difficulties, enabling them to manage their payments more effectively during tough times.

-

How can I complete the Td Mortgage Deferral Form using airSlate SignNow?

You can easily complete the Td Mortgage Deferral Form using airSlate SignNow by uploading the document to our platform. With our user-friendly interface, you can fill out the form digitally, eSign it, and send it directly to TD Canada Trust, ensuring a smooth and efficient process.

-

Is there a fee to use the Td Mortgage Deferral Form with airSlate SignNow?

Using the Td Mortgage Deferral Form with airSlate SignNow is cost-effective. We offer various pricing plans to fit different business needs, and many users find that the efficiency and time savings justify the minimal fees associated with our service.

-

What benefits does airSlate SignNow offer for the Td Mortgage Deferral Form?

By using airSlate SignNow for the Td Mortgage Deferral Form, you benefit from a secure and streamlined eSigning process. Our platform guarantees document security, easy access on any device, and quick turnaround times, making it an ideal choice for managing important financial documents.

-

Can I track the status of my Td Mortgage Deferral Form submission?

Yes, airSlate SignNow allows you to track the status of your Td Mortgage Deferral Form submission in real time. You’ll receive notifications when your document is viewed and signed, helping you stay informed throughout the process.

-

What integrations does airSlate SignNow support for the Td Mortgage Deferral Form?

airSlate SignNow seamlessly integrates with various applications to enhance your experience with the Td Mortgage Deferral Form. Whether you use CRM tools, cloud storage solutions, or productivity apps, our integrations ensure a smooth workflow and easy access to your documents.

-

Is my information secure when using the Td Mortgage Deferral Form on airSlate SignNow?

Absolutely! When using the Td Mortgage Deferral Form on airSlate SignNow, your information is protected with state-of-the-art encryption and security protocols. We prioritize your privacy and ensure that all data is handled with the utmost care.

Get more for Td Mortgage Deferral Form

Find out other Td Mortgage Deferral Form

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document