The Amount of Income Received by You from the Source for Each Month Form

What is the Amount of Income Received By You From The Source For Each Month

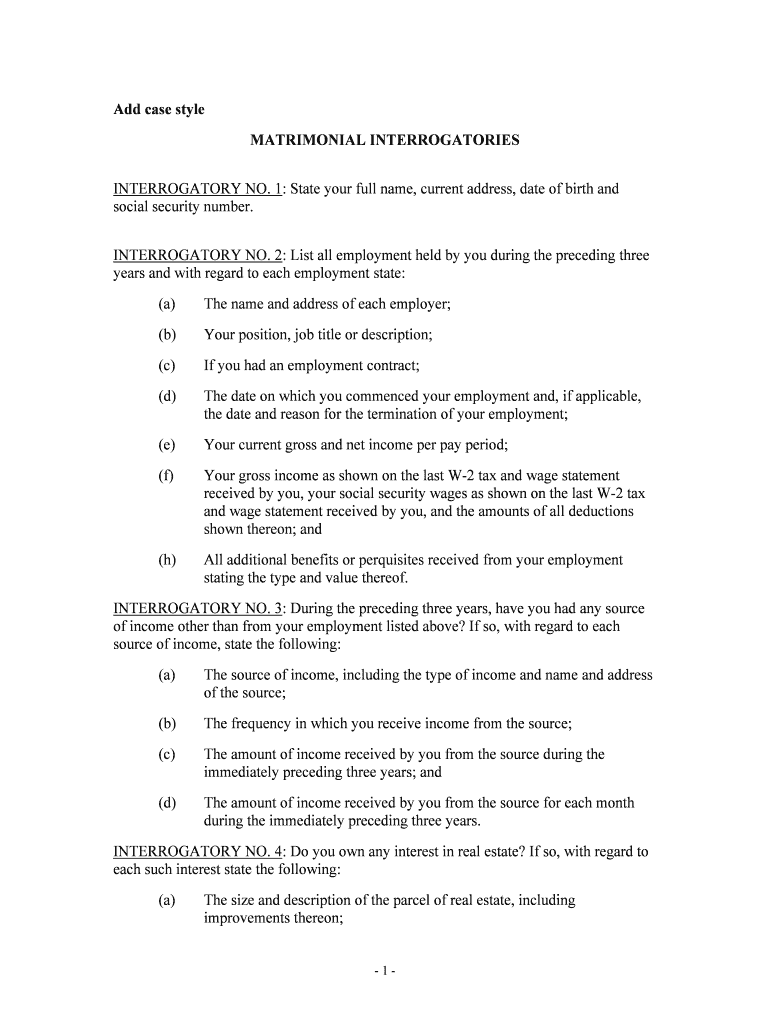

The Amount of Income Received By You From The Source For Each Month form is a crucial document used to report monthly income from various sources. This form is particularly relevant for individuals who need to provide a detailed account of their income for tax purposes or financial assessments. It is commonly utilized by freelancers, self-employed individuals, and those receiving regular payments from different entities. Accurately completing this form ensures compliance with tax regulations and provides a clear financial overview.

Steps to Complete the Amount of Income Received By You From The Source For Each Month

Completing the Amount of Income Received By You From The Source For Each Month form involves several key steps:

- Gather necessary information: Collect all relevant income details for the month, including pay stubs, invoices, or bank statements.

- Fill in personal information: Enter your name, address, and any identification numbers required by the form.

- Detail income sources: List all sources of income received during the month, specifying the amount from each source.

- Review for accuracy: Double-check all entries to ensure that the information is correct and complete.

- Sign and date the form: Ensure you sign and date the document to validate it.

Legal Use of the Amount of Income Received By You From The Source For Each Month

The Amount of Income Received By You From The Source For Each Month form holds legal significance, especially in the context of tax reporting and financial transparency. When filled out correctly, it serves as a formal declaration of income, which can be used in various legal and financial situations. Compliance with IRS regulations is essential, as inaccuracies or omissions can lead to penalties. It is advisable to keep copies of submitted forms for personal records and future reference.

Examples of Using the Amount of Income Received By You From The Source For Each Month

This form can be utilized in several scenarios, including:

- Freelancers: A freelancer may use this form to report income from multiple clients, providing a clear summary of earnings.

- Self-employed individuals: Those running their own businesses can document monthly income from various streams, aiding in tax preparation.

- Rental income: Landlords can report monthly rental payments received, ensuring compliance with tax obligations.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Amount of Income Received By You From The Source For Each Month form is essential for compliance. Generally, this form should be submitted by the end of the month following the reporting period. For instance, income received in January should be reported by the end of February. Keeping track of these dates helps avoid late submissions and potential penalties.

Who Issues the Form

The Amount of Income Received By You From The Source For Each Month form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. It is essential to use the correct version of the form as specified by the issuing authority to ensure compliance with current regulations. Always check for updates or changes in the form requirements before submission.

Quick guide on how to complete the amount of income received by you from the source for each month

Effortlessly Prepare The Amount Of Income Received By You From The Source For Each Month on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your paperwork quickly and without delays. Manage The Amount Of Income Received By You From The Source For Each Month on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to Edit and eSign The Amount Of Income Received By You From The Source For Each Month with Ease

- Locate The Amount Of Income Received By You From The Source For Each Month and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important segments of your papers or obscure sensitive information with tools that airSlate SignNow specifically offers for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your alterations.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign The Amount Of Income Received By You From The Source For Each Month and ensure superb communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for tracking The Amount Of Income Received By You From The Source For Each Month?

airSlate SignNow provides advanced features such as customizable templates and automated workflows that help you easily track The Amount Of Income Received By You From The Source For Each Month. This allows for efficient documentation and ensures you have an organized record of all income sources each month.

-

How does airSlate SignNow ensure the security of my financial documents related to The Amount Of Income Received By You From The Source For Each Month?

With bank-level security features, airSlate SignNow prioritizes the protection of your financial documents. You can trust that all records concerning The Amount Of Income Received By You From The Source For Each Month are stored securely and that access is controlled through multi-factor authentication.

-

What pricing plans does airSlate SignNow offer for businesses tracking The Amount Of Income Received By You From The Source For Each Month?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Each plan provides comprehensive features that support tracking The Amount Of Income Received By You From The Source For Each Month, ensuring you find an option that meets your financial documentation needs.

-

Can airSlate SignNow integrate with my existing financial software to help manage The Amount Of Income Received By You From The Source For Each Month?

Yes, airSlate SignNow offers seamless integrations with popular financial software. This connectivity aids in tracking The Amount Of Income Received By You From The Source For Each Month more efficiently, allowing you to sync your financial data for better management.

-

How can airSlate SignNow benefit my business when tracking The Amount Of Income Received By You From The Source For Each Month?

airSlate SignNow streamlines the process of managing documents, saving you time and reducing errors when tracking The Amount Of Income Received By You From The Source For Each Month. Its user-friendly interface ensures that all team members can easily access and manage necessary documents.

-

Is there a mobile app for airSlate SignNow to track The Amount Of Income Received By You From The Source For Each Month?

Yes, airSlate SignNow offers a mobile app that allows you to manage and track documents on the go. This feature is particularly useful for keeping tabs on The Amount Of Income Received By You From The Source For Each Month, even when you're away from your desk.

-

How does airSlate SignNow handle customer support for inquiries about The Amount Of Income Received By You From The Source For Each Month?

airSlate SignNow provides excellent customer support to assist you with any inquiries regarding The Amount Of Income Received By You From The Source For Each Month. You can access support through live chat, email, or phone to resolve any issues quickly and efficiently.

Get more for The Amount Of Income Received By You From The Source For Each Month

- Sc1040 instructions 2017 form

- Calculation policy st blaise ce primary school achieving bb st blaise oxon sch form

- Surf sports coach of the year application form surflifesaving sportal com

- Practicum form application for sports training certification sotx

- Antrag auf beurkundung einer auslandsgeburt im geburtenregister form

- Download rental application delta wave communications inc form

- Wisconsin dept of revenue wage assignment reduction request 2017 form

- Adopt a stepchild or relative form

Find out other The Amount Of Income Received By You From The Source For Each Month

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney