RENUNCIATION and DISCLAIMER of PROPERTY Intestate Succession Form

What is the RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

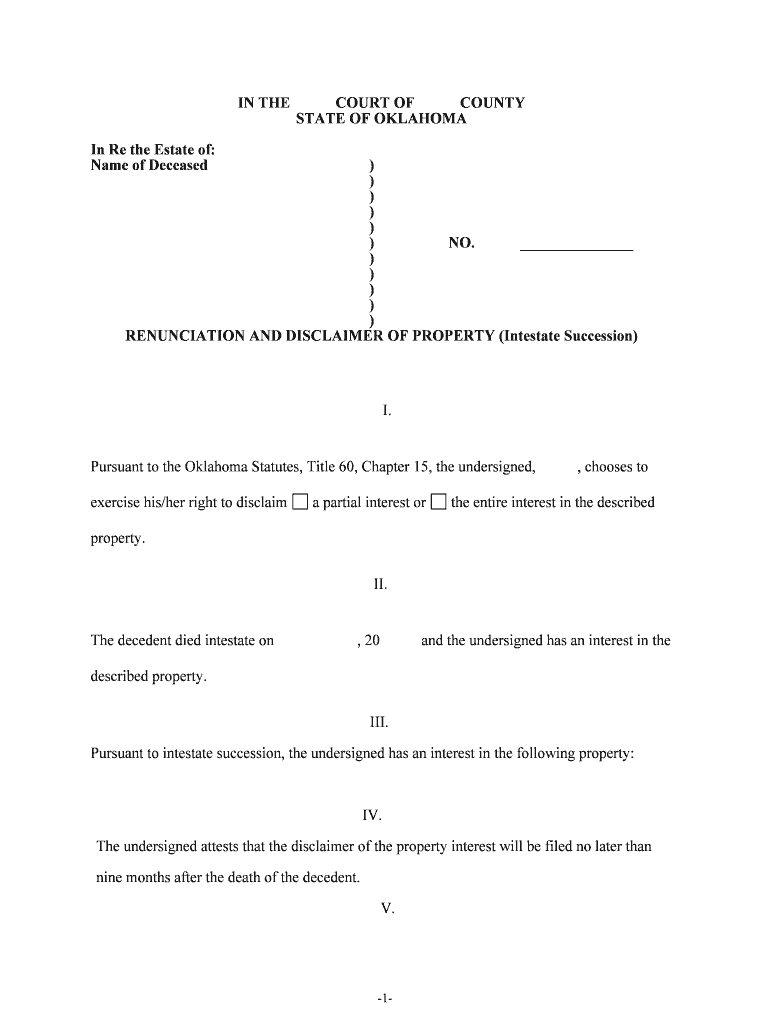

The renunciation and disclaimer of property intestate succession is a legal document that allows an individual to refuse inheritance of property when someone dies without a will. This form is crucial in intestate succession cases, where the distribution of assets is governed by state laws. By filing this document, an heir formally declines their right to inherit, ensuring that the property passes to other eligible heirs according to the state's intestacy laws. This process helps avoid potential disputes among family members and clarifies the distribution of assets.

Steps to complete the RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

Completing the renunciation and disclaimer of property intestate succession involves several key steps:

- Obtain the form: Access the appropriate form from your state’s probate court or legal resources.

- Provide personal information: Fill in your name, address, and relationship to the deceased.

- Detail the property: Clearly identify the property you are renouncing, including any relevant legal descriptions.

- Sign and date the form: Ensure you sign the document in the presence of a notary public, if required by your state.

- File the form: Submit the completed form to the relevant probate court or authority, adhering to local filing guidelines.

Legal use of the RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

This form serves a vital legal function in intestate succession cases. It allows heirs to formally renounce their rights to an inheritance, which can significantly impact the distribution of assets. When filed correctly, it is legally binding and prevents the renouncing party from claiming any rights to the property in question. This document must comply with state laws to ensure its validity, and it is often advisable to consult with a legal professional to navigate the complexities involved.

State-specific rules for the RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

Each state in the U.S. has specific laws governing the renunciation and disclaimer of property. These rules can vary significantly, including the time frame within which the renunciation must be filed and the necessary language that must be included in the document. It is essential to review your state's requirements carefully to ensure compliance and avoid any potential legal issues. Consulting state statutes or a legal expert can provide clarity on these specific regulations.

Examples of using the RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

There are various scenarios in which an individual might choose to file a renunciation and disclaimer of property intestate succession. For example:

- A sibling may renounce their right to inherit family property to allow their children to inherit instead.

- A spouse may decline an inheritance to simplify the estate division, especially if they have a separate agreement in place.

- An heir may renounce their interest to avoid tax liabilities associated with the inherited property.

Required Documents

To complete the renunciation and disclaimer of property intestate succession, you typically need the following documents:

- The completed renunciation and disclaimer form.

- A copy of the death certificate of the deceased.

- Any relevant estate documents, such as the probate petition or letters of administration.

- Identification to verify your identity, such as a driver's license or passport.

Quick guide on how to complete renunciation and disclaimer of property intestate succession

Effortlessly Prepare RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession Without Breaking a Sweat

- Find RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession?

RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession refers to the legal process where an heir or beneficiary officially declines their inheritance due to various reasons. This process ensures that the assets are redistributed according to the laws of intestacy, in the absence of a will. Understanding this concept is vital for individuals navigating estate planning or probate situations.

-

How can airSlate SignNow assist with RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession?

airSlate SignNow offers a streamlined process to help you manage RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession documents efficiently. With our electronic signature solutions, you can quickly create, send, and sign necessary documents remotely, facilitating a faster legal process. Our platform is designed for ease of use, making complex tasks simpler.

-

What are the features of airSlate SignNow that support property disclaimers?

airSlate SignNow provides features such as document templates, secure eSigning, and automated workflows that aid in managing RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession. These features help users save time and reduce errors in the documentation process. Our user-friendly interface ensures that even those unfamiliar with digital tools can navigate it effortlessly.

-

Is there a cost associated with using airSlate SignNow for RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession?

Yes, airSlate SignNow offers competitive pricing plans tailored to different business needs. Our subscription plans are cost-effective, especially for organizations needing to handle RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession documents frequently. Consider trying our free trial to see how our service can fit within your budget.

-

Can airSlate SignNow integrate with other tools for managing legal documents?

Absolutely! airSlate SignNow integrates seamlessly with various software applications such as Google Drive, Dropbox, and Microsoft Office, enhancing your workflow for RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession. These integrations allow for easy document sharing and management, making the entire process more efficient.

-

What are the benefits of using airSlate SignNow for legal documentation?

Using airSlate SignNow for RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession documentation provides numerous benefits, including enhanced security, compliance, and time-saving features. Our solution reduces the need for physical paperwork and in-person meetings, allowing you to handle legal matters from anywhere. This flexibility is essential in today's fast-paced environment.

-

Is it safe to store RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession documents on airSlate SignNow?

Yes, airSlate SignNow employs robust security measures such as encryption and secure cloud storage, ensuring your RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession documents are protected. We are committed to maintaining the privacy and security of all user data. You can trust that your sensitive information is in safe hands with us.

Get more for RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

- Department of human rights minnesotagov form

- Minnesota livestock breeders association scholarships scholarship applications form

- Download 2016 application minnesota livestock breeders form

- House campaign finance and public disclosure board form

- Existing subsurface sewage treatment systems ssts form

- Cnp 387 centerpoint energy form

- Missouri state fair camping 2016 2019 form

- Missouri local government financial 2014 2019 form

Find out other RENUNCIATION AND DISCLAIMER OF PROPERTY Intestate Succession

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors