Report of Payment Supplemental Form

What is the Report Of Payment Supplemental

The Report Of Payment Supplemental is a crucial document used primarily for reporting additional payments made to individuals or entities, often in the context of tax reporting. This form serves to provide detailed information regarding payments that may not be captured in regular reporting forms, ensuring compliance with tax regulations. It is particularly relevant for businesses and organizations that need to account for various types of payments, such as bonuses, commissions, or other compensations that require separate reporting to the Internal Revenue Service (IRS).

How to use the Report Of Payment Supplemental

Using the Report Of Payment Supplemental involves several key steps. First, gather all necessary information regarding the payments that need to be reported. This includes the recipient's details, the amount paid, and the purpose of the payment. Next, accurately fill out the form, ensuring that all fields are completed correctly to avoid delays or issues with processing. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements of the IRS or relevant state authorities.

Steps to complete the Report Of Payment Supplemental

Completing the Report Of Payment Supplemental requires careful attention to detail. Follow these steps for a smooth process:

- Collect necessary documents, including payment records and recipient information.

- Access the form through the appropriate channels, either online or in print.

- Fill in the recipient's name, address, and taxpayer identification number (TIN).

- Detail the payment amount and specify the type of payment being reported.

- Review the completed form for accuracy and completeness.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Report Of Payment Supplemental

The legal use of the Report Of Payment Supplemental is essential for maintaining compliance with federal and state tax laws. When properly completed and submitted, this form serves as an official record of payments made, which can be crucial in the event of an audit. It is important to ensure that the information reported is accurate and that the form is submitted within the designated time frames to avoid penalties or legal complications.

Key elements of the Report Of Payment Supplemental

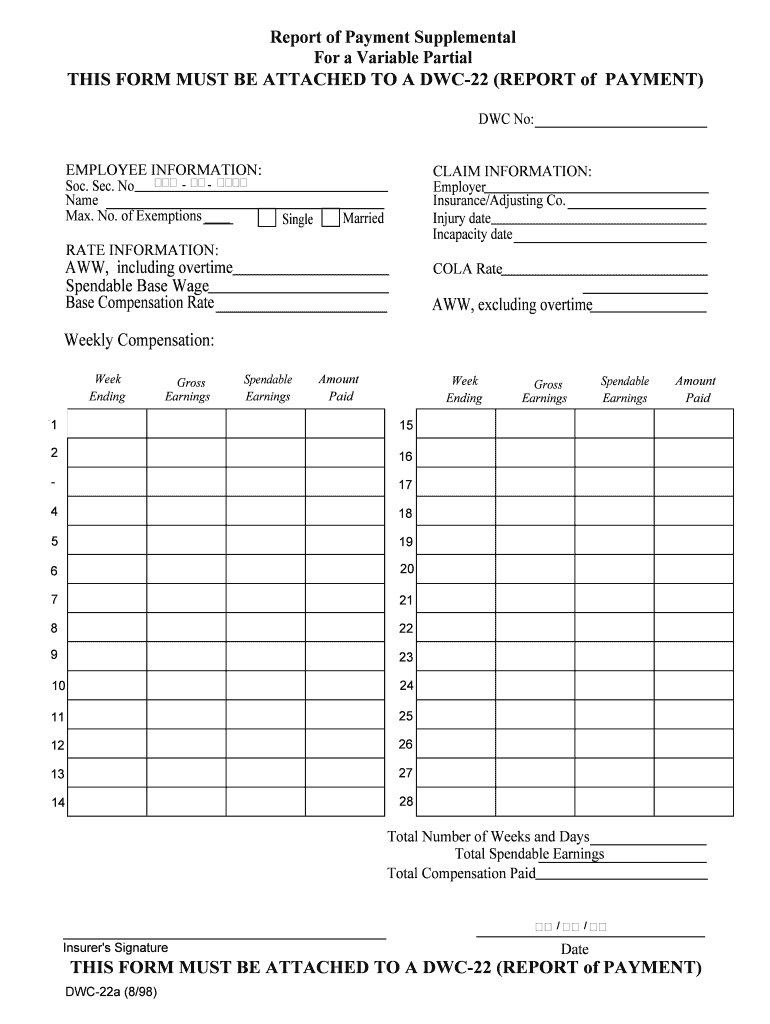

Several key elements must be included in the Report Of Payment Supplemental to ensure its validity:

- Recipient Information: Name, address, and TIN of the individual or entity receiving the payment.

- Payment Details: Amount paid and the nature of the payment, such as wages, bonuses, or commissions.

- Reporting Period: The time frame during which the payment was made.

- Signature: Required signatures from authorized personnel to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Report Of Payment Supplemental are critical to avoid penalties. Typically, the form must be submitted by January thirty-first of the year following the payment. It is advisable to check specific IRS guidelines for any updates or changes to these deadlines, as well as any state-specific requirements that may apply.

Quick guide on how to complete report of payment supplemental

Complete Report Of Payment Supplemental seamlessly on any gadget

Digital document organization has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Report Of Payment Supplemental on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest method to edit and eSign Report Of Payment Supplemental effortlessly

- Locate Report Of Payment Supplemental and click on Get Form to initiate.

- Utilize the tools we supply to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Report Of Payment Supplemental and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Report Of Payment Supplemental?

A Report Of Payment Supplemental is a document that helps businesses track and manage payment-related transactions. It provides detailed information on payments made, ensuring transparency and aiding in financial analysis. This report can be generated using airSlate SignNow’s user-friendly eSigning platform.

-

How can airSlate SignNow help with generating a Report Of Payment Supplemental?

airSlate SignNow simplifies the creation of a Report Of Payment Supplemental by allowing users to easily access payment data and generate reports directly from the platform. The intuitive interface ensures that even non-technical users can create accurate reports quickly. It is tailored to streamline your payment documentation process.

-

What features does airSlate SignNow offer for managing payment reports?

With airSlate SignNow, users can customize their Report Of Payment Supplemental with various templates and features like automated reminders and notifications. Enhanced tracking and eSignature capability ensure that all documents are secure and legally binding. These features contribute to improved efficiency in payment management.

-

Is airSlate SignNow cost-effective for generating payment reports?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. The pricing plans are flexible and provide excellent value considering the comprehensive features available, including report generation like the Report Of Payment Supplemental. It minimizes administrative costs by automating document-related tasks.

-

Can I integrate airSlate SignNow with other financial software for my payment reports?

Absolutely! airSlate SignNow offers seamless integrations with several financial software solutions. This allows users to enhance their Report Of Payment Supplemental by pulling data from various sources, ensuring accuracy and consistency in financial reporting. Integration makes payment management more efficient and streamlined.

-

What are the benefits of using airSlate SignNow for payment documentation?

Using airSlate SignNow for payment documentation provides numerous benefits, including faster processing times and improved accuracy. The ability to create a Report Of Payment Supplemental easily enhances your financial oversight, while the secure eSignature feature ensures compliance. Businesses can also benefit from reduced turnaround times and better collaboration.

-

How secure is airSlate SignNow for handling payment-related documents?

Security is a top priority for airSlate SignNow when managing payment-related documents. The platform uses advanced encryption and compliance measures to protect sensitive financial information. When generating a Report Of Payment Supplemental, users can trust that their documents are safe from unauthorized access.

Get more for Report Of Payment Supplemental

- 2015 michigan schedule 1 2017 2019 form

- 2014 mi 1041 form

- 2015 michigan schedule 1 form

- 2016 michigan schedule 1 form

- Form 3676 affidavit attesting that qualified state of michigan

- Form 3676 2014

- Michigan department of treasury 4640 rev 12 10 2018 2019 form

- X26031 vocal loudness exercises aurora health care ahc aurorahealthcare form

Find out other Report Of Payment Supplemental

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document