Form 1040 PR Espanol

What is the Form 1040 PR Espanol

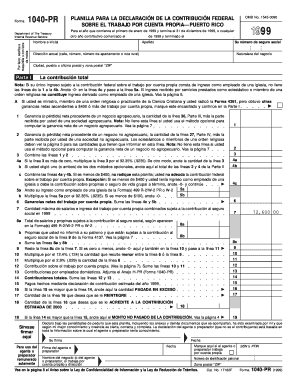

The Form 1040 PR Espanol is the Spanish-language version of the standard IRS Form 1040, used for individual income tax returns in Puerto Rico. This form allows Puerto Rican residents to report their income, claim deductions, and determine their tax liability in a language that is accessible to Spanish-speaking individuals. It is essential for ensuring that taxpayers in Puerto Rico can comply with tax regulations while understanding the requirements in their native language.

How to use the Form 1040 PR Espanol

Using the Form 1040 PR Espanol involves several steps to ensure accurate reporting of income and deductions. Taxpayers should first gather all necessary documentation, including W-2 forms, 1099 forms, and records of any other income. Next, individuals can fill out the form by entering personal information, income details, and any applicable deductions. Finally, the completed form must be submitted to the IRS by the designated deadline, ensuring that all information is accurate to avoid potential penalties.

Steps to complete the Form 1040 PR Espanol

Completing the Form 1040 PR Espanol requires careful attention to detail. Here are the key steps:

- Gather all income documents, such as W-2s and 1099s.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income on the form.

- Claim any deductions or credits for which you qualify.

- Review the form for accuracy before submission.

- Submit the form electronically or by mail to the IRS.

Legal use of the Form 1040 PR Espanol

The legal use of the Form 1040 PR Espanol is governed by IRS regulations. It is recognized as a valid document for filing taxes in Puerto Rico, provided that it is completed accurately and submitted on time. Taxpayers must ensure compliance with all IRS requirements to avoid issues such as audits or penalties. The form must be signed and dated, and electronic signatures are acceptable if using a compliant eSignature solution.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR Espanol align with those of the standard Form 1040. Typically, the deadline for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about any changes to deadlines and to file their returns on time to avoid late fees and penalties.

Required Documents

To complete the Form 1040 PR Espanol, taxpayers need to gather several key documents:

- W-2 forms from employers.

- 1099 forms for additional income sources.

- Records of any deductions, such as mortgage interest or medical expenses.

- Proof of identity, such as a Social Security card.

Having these documents ready will streamline the process of filling out the form and ensure accuracy in reporting income and deductions.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040 PR Espanol can be submitted through various methods. Taxpayers can file the form electronically using IRS-approved e-filing software, which may offer a more efficient process. Alternatively, individuals can print the completed form and mail it to the appropriate IRS address. In some cases, in-person filing may be available at designated IRS offices, but this option is less common. It is essential to choose a submission method that aligns with personal preferences and ensures timely processing.

Quick guide on how to complete 1999 form 1040 pr espanol

Complete Form 1040 PR Espanol effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Form 1040 PR Espanol on any platform using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Form 1040 PR Espanol without hassle

- Find Form 1040 PR Espanol and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 1040 PR Espanol and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1999 form 1040 pr espanol

How to make an eSignature for your 1999 Form 1040 Pr Espanol in the online mode

How to generate an electronic signature for the 1999 Form 1040 Pr Espanol in Google Chrome

How to make an electronic signature for putting it on the 1999 Form 1040 Pr Espanol in Gmail

How to make an eSignature for the 1999 Form 1040 Pr Espanol from your smartphone

How to make an eSignature for the 1999 Form 1040 Pr Espanol on iOS devices

How to create an electronic signature for the 1999 Form 1040 Pr Espanol on Android devices

People also ask

-

¿Qué es la 1040 y por qué es importante para los contribuyentes?

La 1040 es un formulario de impuestos utilizado por los ciudadanos estadounidenses para presentar su declaración de impuestos sobre la renta. Entender que es la 1040 es fundamental porque permite a los contribuyentes declarar sus ingresos y deducciones, asegurando el cumplimiento fiscal y la posibilidad de recibir reembolsos de impuestos.

-

¿Cómo puedo usar airSlate SignNow para firmar electrónicamente el formulario 1040?

Con airSlate SignNow, puedes cargar tu formulario 1040 directamente en la plataforma y enviarlo para la firma electrónica. Esto simplifica el proceso, garantizando que todas las firmas necesarias se obtengan de manera rápida y segura, satisfaciendo así las regulaciones fiscales.

-

¿Qué beneficios ofrece airSlate SignNow al manejar documentos como el 1040?

airSlate SignNow proporciona una solución de firma electrónica fácil de usar que acelera el proceso de envío y recepción de documentos como la 1040. Esto no solo ahorra tiempo sino que también reduce costos asociados con el manejo de documentos en papel y el envío físico.

-

¿Qué características de airSlate SignNow son útiles para la gestión de formularios fiscales como la 1040?

Entre las características destacadas de airSlate SignNow se encuentran la firma electrónica rápida, el almacenamiento seguro de documentos y la posibilidad de integrar otras aplicaciones fiscales. Estas funcionalidades ayudan a gestionar el formulario 1040 con mayor eficacia, asegurando un flujo de trabajo sin interrupciones.

-

¿Cómo se comparan los precios de airSlate SignNow con otras soluciones de firma electrónica para el 1040?

AirSlate SignNow ofrece precios competitivos que son ideales para empresas de todos los tamaños, especialmente al manejar documentos como la 1040. Con opciones de suscripción flexibles, puedes elegir un plan que se adapte a tus necesidades fiscales y de presupuesto.

-

¿Es seguro enviar el formulario 1040 a través de airSlate SignNow?

Sí, enviar el formulario 1040 a través de airSlate SignNow es seguro. La plataforma utiliza encriptación de nivel bancario y cumple con las regulaciones de seguridad necesarias, lo que garantiza que tus datos fiscales se mantengan protegidos durante todo el proceso.

-

¿Qué integraciones ofrece airSlate SignNow para facilitar el envío del formulario 1040?

airSlate SignNow se integra con una variedad de aplicaciones, incluyendo plataformas de contabilidad y gestión de documentos que son fundamentales para el manejo de la 1040. Estas integraciones aseguran que puedas enviar y recibir documentos de manera eficiente, optimizando el proceso fiscal.

Get more for Form 1040 PR Espanol

- Sales contracthealth guarantee ashbaker bullies form

- Fiduciary probate bonds application spino bonding form

- Tsa epap form

- Cf2r plb 03 e form

- Jansons history of art 8th edition pdf form

- Land division application scio township washtenaw county sciotownship form

- Pbis behavior referral formpdf windham schools

- Autism check list form from ari autism check list form from ari

Find out other Form 1040 PR Espanol

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast