Quarterly Wage Entry Help State of South Dakota Form

What is the Quarterly Wage Entry Help State Of South Dakota

The Quarterly Wage Entry Help State Of South Dakota form is a crucial document used by employers to report wages paid to employees within a specific quarter. This form ensures compliance with state labor laws and aids in the accurate calculation of unemployment insurance contributions. It is essential for maintaining proper records and fulfilling state reporting requirements.

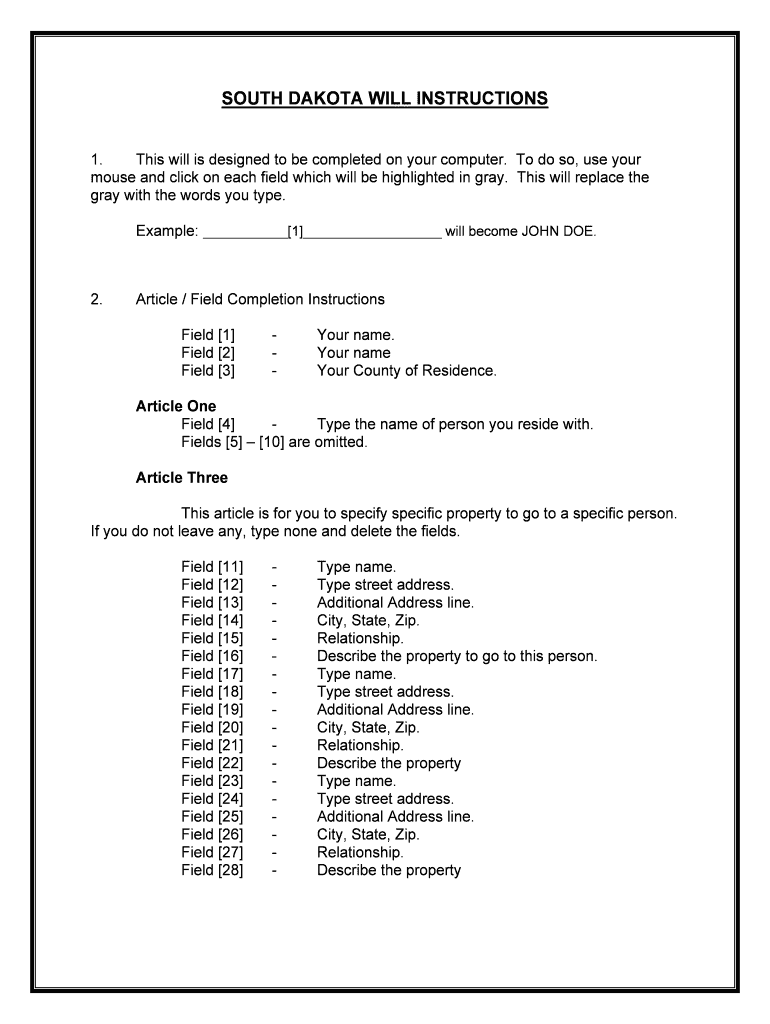

Steps to complete the Quarterly Wage Entry Help State Of South Dakota

Completing the Quarterly Wage Entry Help State Of South Dakota form involves several key steps:

- Gather employee wage information for the reporting quarter.

- Access the form through the appropriate state resources or platforms.

- Fill in the required fields, including employee names, social security numbers, and total wages paid.

- Review the information for accuracy to avoid potential penalties.

- Submit the completed form electronically or via mail, depending on your preference and state guidelines.

Legal use of the Quarterly Wage Entry Help State Of South Dakota

The legal use of the Quarterly Wage Entry Help State Of South Dakota form is governed by state labor laws and regulations. This form must be completed accurately to ensure compliance and avoid legal repercussions. Employers are required to submit this form within specified deadlines to maintain good standing with state authorities.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Quarterly Wage Entry Help State Of South Dakota form. Typically, the form is due within a month following the end of each quarter. It is crucial to stay informed about these deadlines to avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Quarterly Wage Entry Help State Of South Dakota form can be submitted through various methods:

- Online: Many employers prefer electronic submission for its convenience and speed.

- Mail: The form can be printed and sent via postal service to the designated state office.

- In-Person: Employers may also choose to deliver the form directly to state offices, ensuring immediate receipt.

Key elements of the Quarterly Wage Entry Help State Of South Dakota

Key elements of the Quarterly Wage Entry Help State Of South Dakota form include:

- Employer identification information, such as name and address.

- Employee details, including names and social security numbers.

- Total wages paid during the reporting quarter.

- Signature of the employer or authorized representative to validate the submission.

Quick guide on how to complete quarterly wage entry help state of south dakota

Finish Quarterly Wage Entry Help State Of South Dakota effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without unnecessary delays. Manage Quarterly Wage Entry Help State Of South Dakota on any platform with airSlate SignNow mobile applications for Android or iOS and streamline any document-related process today.

How to edit and eSign Quarterly Wage Entry Help State Of South Dakota with ease

- Obtain Quarterly Wage Entry Help State Of South Dakota and select Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Quarterly Wage Entry Help State Of South Dakota and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Quarterly Wage Entry Help in the State of South Dakota?

Quarterly Wage Entry Help in the State of South Dakota refers to the assistance provided for accurately reporting employee wages on a quarterly basis. This process is vital for businesses to remain compliant with state regulations and avoid penalties. At airSlate SignNow, we make this process straightforward by offering essential tools to streamline documentation and ensure compliance.

-

How can airSlate SignNow assist with Quarterly Wage Entry Help in South Dakota?

airSlate SignNow offers an intuitive platform that simplifies the documentation process for Quarterly Wage Entry Help in South Dakota. Our solution allows users to easily create, send, and eSign necessary forms, ensuring that your wage data is submitted accurately. Automated reminders and templates help keep your business organized and compliant.

-

Is airSlate SignNow cost-effective for small businesses needing Quarterly Wage Entry Help in South Dakota?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses requiring Quarterly Wage Entry Help in South Dakota. With competitive pricing plans, you can access essential features without breaking the bank. Our service provides excellent value, helping you save time and reduce the cost of compliance.

-

What features does airSlate SignNow provide for managing Quarterly Wage Entry in South Dakota?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage, all tailored for Quarterly Wage Entry Help in South Dakota. These functionalities ensure that you can efficiently handle payroll documentation. Additionally, our platform provides compliance monitoring and reporting tools to simplify your quarterly filings.

-

Are there integrations available with airSlate SignNow for reporting Quarterly Wage Entries in South Dakota?

Absolutely! airSlate SignNow integrates with various payroll and accounting software, making it easier for businesses to manage their Quarterly Wage Entry Help in South Dakota. These integrations allow for seamless data transfer, reducing the likelihood of errors and ensuring accurate reporting.

-

What benefits can businesses expect from using airSlate SignNow for Quarterly Wage Entry Help?

Using airSlate SignNow for Quarterly Wage Entry Help in South Dakota enables businesses to enhance their efficiency and compliance. Automated workflows and document management save time and reduce manual errors. Furthermore, the eSigning option allows for quicker approvals, ensuring that your submissions are timely.

-

How secure is airSlate SignNow when handling sensitive wage information for South Dakota?

Security is a top priority at airSlate SignNow, especially when handling sensitive wage information for Quarterly Wage Entry Help in South Dakota. We utilize advanced encryption protocols and comply with industry-leading standards to ensure that your data remains safe and confidential. Our platform is regularly audited to maintain a secure environment.

Get more for Quarterly Wage Entry Help State Of South Dakota

Find out other Quarterly Wage Entry Help State Of South Dakota

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form