Form 990 2008

What is the Form 990

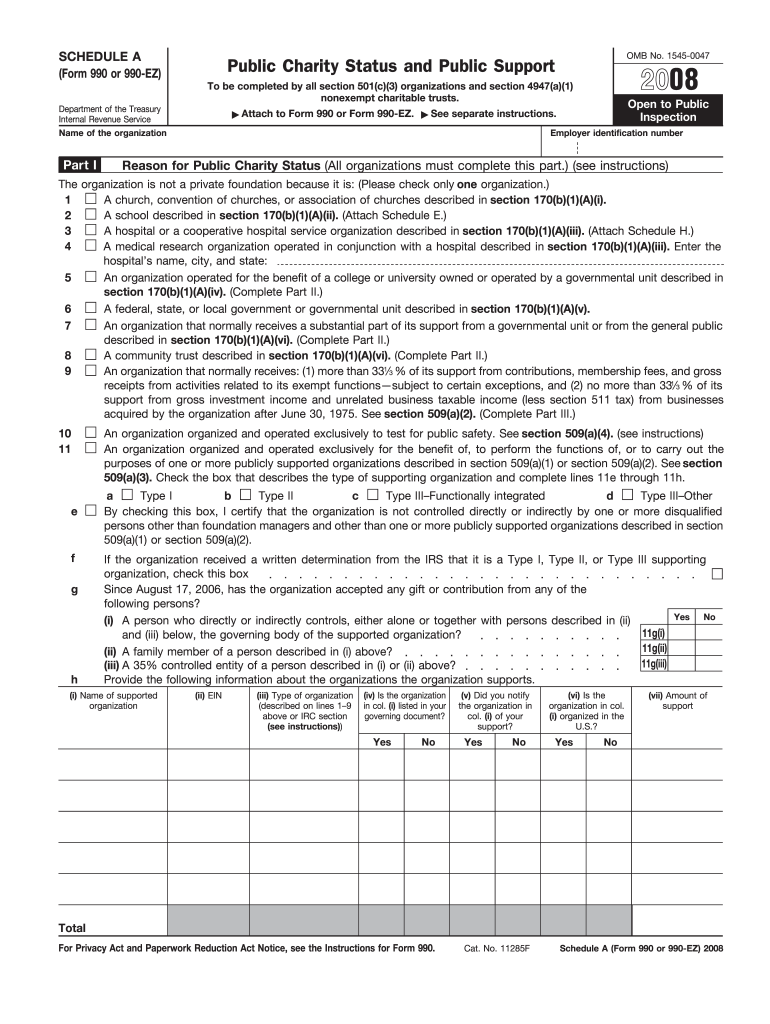

The Form 990 is a crucial tax document used by tax-exempt organizations, including charities and non-profits, to report their financial information to the Internal Revenue Service (IRS). This form provides transparency regarding the organization's income, expenses, and overall financial health. It is essential for maintaining tax-exempt status and ensuring compliance with federal regulations. The Form 990 comes in several variants, including the 990-EZ for smaller organizations and the 990-N for those with minimal revenue.

How to use the Form 990

Using the Form 990 involves several steps. Organizations must accurately report their financial activities, including revenue sources, expenditures, and program accomplishments. It's important to categorize expenses correctly and provide detailed information about the organization's mission and programs. The completed form must be filed annually with the IRS, and it is also made available to the public, which helps maintain transparency and trust with donors and the community.

Steps to complete the Form 990

Completing the Form 990 requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income statements, balance sheets, and previous tax filings.

- Fill out the basic information section, including the organization’s name, address, and Employer Identification Number (EIN).

- Report revenue sources and expenses in the appropriate sections, ensuring accuracy and completeness.

- Provide information about the organization’s mission, programs, and accomplishments.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 990

The legal use of the Form 990 is governed by IRS regulations. Organizations must file this form annually to maintain their tax-exempt status. Failure to file or inaccuracies in reporting can lead to penalties, including loss of tax-exempt status. Additionally, the information provided on the Form 990 is subject to public scrutiny, which emphasizes the importance of accuracy and transparency in reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 vary based on the organization’s fiscal year. Typically, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, the deadline is May 15. Extensions may be granted, but organizations must file Form 8868 to request an extension, which provides an additional six months to file.

Penalties for Non-Compliance

Organizations that fail to file the Form 990 on time or provide inaccurate information may face significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, repeated failures to file can result in the automatic revocation of tax-exempt status. It is vital for organizations to stay compliant to avoid these consequences and maintain their eligibility for tax benefits.

Quick guide on how to complete 2008 form 990

Complete Form 990 effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 990 from any device using airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The simplest method to modify and electronically sign Form 990 with ease

- Find Form 990 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight essential sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 990 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 form 990

Create this form in 5 minutes!

How to create an eSignature for the 2008 form 990

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 990 and why is it important for nonprofits?

Form 990 is an annual reporting return that tax-exempt organizations, including nonprofits, must file with the IRS. This form provides transparency about a nonprofit's finances, governance, and activities, making it crucial for maintaining tax-exempt status and gaining public trust.

-

How can airSlate SignNow help with the Form 990 filing process?

airSlate SignNow simplifies the Form 990 filing process by enabling users to send and eSign necessary documents securely. This streamlines collaboration among board members and accountants, ensuring that all signatures are collected efficiently before submission to the IRS.

-

What features does airSlate SignNow offer for managing Form 990 documents?

With airSlate SignNow, you can create templates for Form 990, track the signing process, and store completed documents securely in the cloud. These features help ensure that your Form 990 submissions are organized, accessible, and compliant with IRS regulations.

-

Is there a specific pricing plan for organizations needing to file Form 990?

Yes, airSlate SignNow offers flexible pricing plans tailored for organizations that need to file Form 990. Our cost-effective solutions provide nonprofit organizations access to essential eSigning features, ensuring that you can manage your filings without breaking the bank.

-

Can I integrate airSlate SignNow with other accounting software for Form 990 preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your workflow for Form 990 preparation. By connecting these tools, you can streamline data transfer and reduce the risk of errors in your filings.

-

What are the benefits of using airSlate SignNow for Form 990 submissions?

Using airSlate SignNow for Form 990 submissions offers numerous benefits, including faster processing times, enhanced security for sensitive documents, and simplified collaboration among stakeholders. This ensures that your nonprofit can focus more on its mission and less on paperwork.

-

How secure is airSlate SignNow when handling Form 990 documents?

AirSlate SignNow prioritizes security, utilizing bank-level encryption to protect your Form 990 documents. This ensures that all sensitive information remains confidential and secure during the eSigning process and beyond.

Get more for Form 990

- Unc health care occupational therapy burn residency application form

- Referral formsvital care rx

- Do not complete this page if you have previously provided this information to columbiadoctors

- Texas denied insurance claims and hail attorneys form

- Inspirit client intake form inspirit salon and spa

- Notifications for you ampamp your clientsacuity scheduling form

- Contact us american society of pediatric hematologyoncology form

- Hereditary cancer genetic testing form

Find out other Form 990

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF