Form 4626 2015

What is the Form 4626

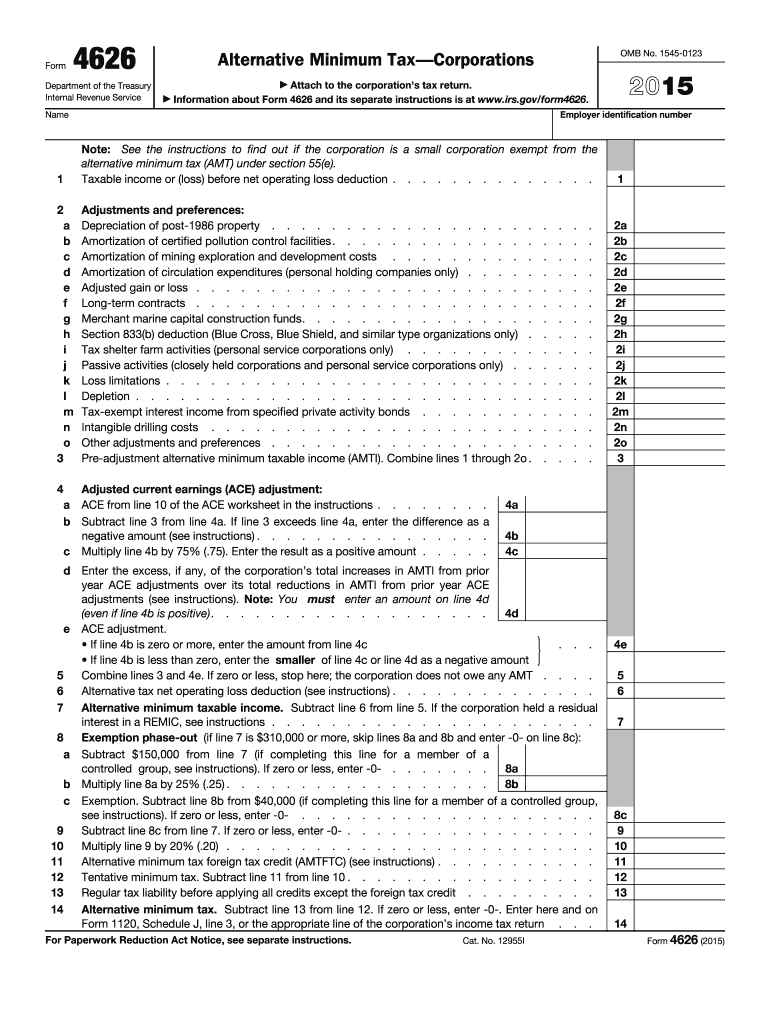

The Form 4626, officially known as the "Alternative Minimum Tax—Corporations," is a tax form used by corporations to calculate their alternative minimum tax (AMT) liability. This form is essential for corporations that may be subject to the AMT, which is designed to ensure that corporations pay a minimum amount of tax, regardless of deductions or credits. Understanding the Form 4626 is crucial for compliance with U.S. tax regulations and for accurate tax reporting.

How to use the Form 4626

Using the Form 4626 involves several steps, including gathering necessary financial information and completing the form accurately. Corporations must first determine if they are subject to AMT by assessing their taxable income and deductions. Once it is established that the AMT applies, the corporation should fill out the form by reporting income, deductions, and credits as specified. It is advisable to consult with a tax professional to ensure all calculations are correct and that the form is filled out in compliance with IRS guidelines.

Steps to complete the Form 4626

Completing the Form 4626 requires attention to detail and a clear understanding of the corporation's financial situation. The following steps outline the process:

- Gather financial statements, including balance sheets and income statements.

- Calculate adjusted taxable income by adding back certain deductions.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for errors or omissions before submission.

- Submit the form along with the corporate tax return by the due date.

Legal use of the Form 4626

The legal use of the Form 4626 is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted on time. Corporations should retain copies of the completed form and any supporting documentation for their records. Compliance with tax laws is critical, as failure to file the form or inaccuracies can result in penalties or audits.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 4626. Generally, the form is due on the same date as the corporation's tax return, which is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April fifteenth. It is important for corporations to mark their calendars and ensure timely submission to avoid penalties.

Required Documents

To complete the Form 4626 accurately, several documents are required. These include:

- Financial statements, such as income statements and balance sheets.

- Previous tax returns, which can provide context for the current year's calculations.

- Documentation of any tax credits or deductions being claimed.

- Records of any adjustments made to taxable income.

Form Submission Methods

The Form 4626 can be submitted through various methods, including:

- Online submission via the IRS e-file system, which is often the fastest and most efficient method.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring it is postmarked by the due date.

- In-person submission at designated IRS offices, although this is less common.

Quick guide on how to complete 2015 form 4626

Prepare Form 4626 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your papers quickly and without complications. Manage Form 4626 on any device using the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to edit and eSign Form 4626 with ease

- Obtain Form 4626 and press Get Form to commence.

- Take advantage of the tools we provide to complete your document.

- Emphasize important sections of your files or obscure sensitive details with the tools that airSlate SignNow specifically offers for that task.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4626 and guarantee exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 4626

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 4626

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 4626 and how can airSlate SignNow help?

Form 4626 is used to claim the credit for increasing research activities. With airSlate SignNow, you can easily eSign Form 4626 and manage your documents efficiently, ensuring compliance and accuracy in your submissions.

-

How can I eSign Form 4626 using airSlate SignNow?

To eSign Form 4626 with airSlate SignNow, simply upload your document, add the required signature fields, and send it for signing. The process is intuitive, allowing for quick and secure completion of Form 4626.

-

What features does airSlate SignNow offer for managing Form 4626?

airSlate SignNow provides features like document templates, automated workflows, and real-time tracking which streamline the process of managing Form 4626. These tools help you save time and reduce errors in your documentation.

-

Is airSlate SignNow a cost-effective solution for handling Form 4626?

Yes, airSlate SignNow is designed to be a cost-effective solution for eSigning documents like Form 4626. We offer flexible pricing plans that cater to businesses of all sizes, ensuring you get the best value for your investment.

-

Can airSlate SignNow integrate with my existing software for Form 4626?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage Form 4626 alongside your other workflows. This integration enhances efficiency and keeps your documentation organized.

-

What are the benefits of using airSlate SignNow for Form 4626?

Using airSlate SignNow for Form 4626 offers numerous benefits, including faster processing times, enhanced security, and a user-friendly interface. These advantages help ensure that your form submissions are both quick and reliable.

-

Is there customer support available for issues with Form 4626 in airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist you with any issues related to Form 4626. Our knowledgeable team is available via multiple channels to ensure you get the help you need promptly.

Get more for Form 4626

- A1c glycosylated hemoglobin form

- What to expect during underwriting american physical society form

- Free consultation a womans timea womans time form

- Globall primary care alexandria va primary care form

- Cigna evidence of insurability form

- Instructions this form is to be completed by providers to request a claim appeal for members enrolled in a plan

- As a medical student and future member of the form

- Allinurl online 07 form

Find out other Form 4626

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF