8938 Form 2015

What is the 8938 Form

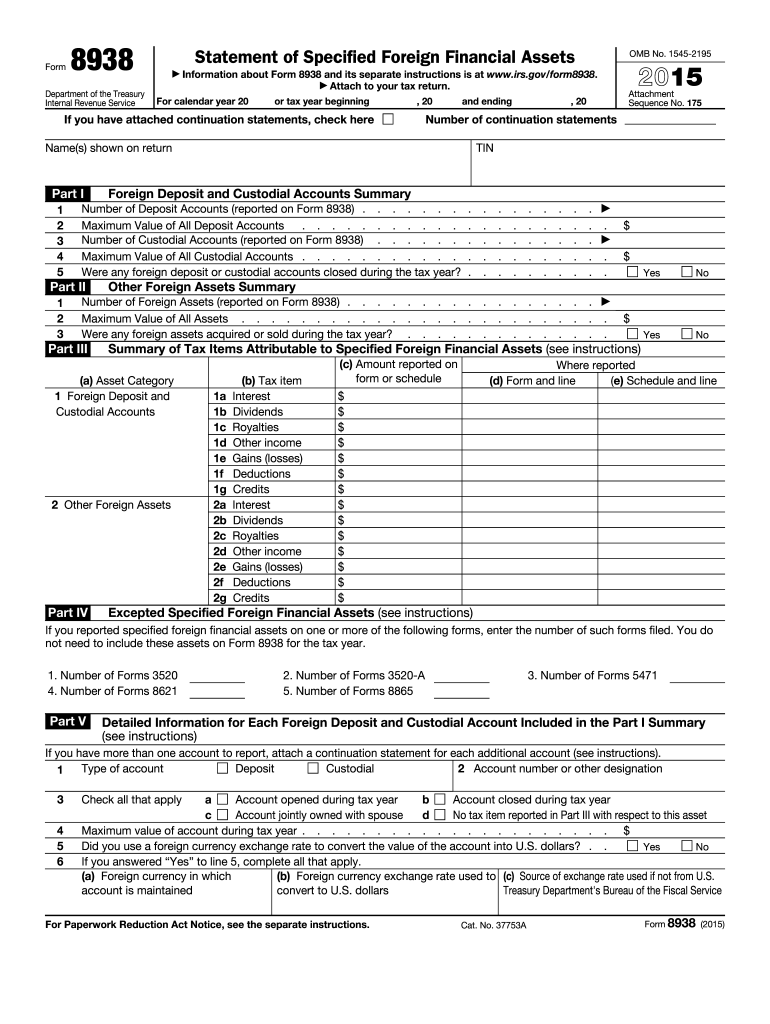

The 8938 Form, officially known as the Statement of Specified Foreign Financial Assets, is a tax form required by the Internal Revenue Service (IRS) for certain U.S. taxpayers. It is designed to report specified foreign financial assets, including bank accounts, stocks, and other financial instruments held outside the United States. Taxpayers must file this form if their foreign financial assets exceed certain thresholds, which vary depending on filing status and residency. The information collected helps the IRS combat tax evasion and ensure compliance with U.S. tax laws.

How to use the 8938 Form

Using the 8938 Form involves several key steps to ensure accurate reporting of foreign financial assets. First, determine if you meet the filing requirements based on your asset thresholds. Next, gather all necessary information about your foreign accounts and investments, including account numbers, financial institution names, and asset values. Once you have compiled this data, fill out the form accurately, providing details about each asset. Finally, submit the completed form along with your annual tax return to the IRS by the specified deadline.

Steps to complete the 8938 Form

Completing the 8938 Form requires careful attention to detail. Follow these steps for successful submission:

- Determine eligibility: Assess whether your foreign financial assets exceed the required thresholds.

- Gather documentation: Collect information about each foreign asset, including values and account details.

- Fill out the form: Enter the required information accurately, ensuring all assets are reported.

- Review for accuracy: Double-check your entries to avoid errors that could lead to penalties.

- Submit with tax return: Include the 8938 Form with your annual tax return by the due date.

Legal use of the 8938 Form

The 8938 Form is legally binding and must be completed in accordance with IRS regulations. Failure to accurately report foreign financial assets can lead to significant penalties, including fines and increased scrutiny from the IRS. It is essential to understand the legal implications of the form, including the requirement to disclose all specified foreign assets and the potential consequences of non-compliance. Using a reliable eSignature platform can help ensure that your submission is secure and meets legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the 8938 Form align with the annual tax return deadlines. Generally, the form must be submitted by April 15 of the following year, with an automatic extension available until October 15 if you file for an extension on your tax return. It is crucial to stay informed about any changes in deadlines, especially if you are living abroad or have unique circumstances that may affect your filing status.

Penalties for Non-Compliance

Non-compliance with the requirements of the 8938 Form can result in substantial penalties. If a taxpayer fails to file the form when required, the IRS may impose a penalty of up to $10,000 for each year of non-filing. Additionally, continued failure to file can lead to increased penalties, potentially reaching up to $50,000. Understanding these risks emphasizes the importance of timely and accurate reporting of foreign financial assets.

Quick guide on how to complete 2015 8938 form

Finalize 8938 Form easily on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage 8938 Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered procedure today.

How to modify and electronically sign 8938 Form effortlessly

- Locate 8938 Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your alterations.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 8938 Form and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8938 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8938 form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 8938 Form and why do I need it?

The 8938 Form is a tax form required by the IRS for U.S. taxpayers to report specified foreign financial assets. If you have foreign assets that exceed certain thresholds, filing the 8938 Form is crucial to comply with tax regulations and avoid penalties.

-

How can airSlate SignNow help me with the 8938 Form?

airSlate SignNow simplifies the process of completing and submitting the 8938 Form by allowing you to easily create, eSign, and share your documents online. With its user-friendly interface, you can ensure that your 8938 Form is filled out accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the 8938 Form?

Yes, airSlate SignNow offers various pricing plans that provide access to its features for managing documents like the 8938 Form. Depending on your needs, you can choose a plan that fits your budget while benefiting from an efficient eSigning solution.

-

What features does airSlate SignNow offer for completing the 8938 Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are all essential for completing the 8938 Form efficiently. These tools help ensure your form is properly filled out and sent securely.

-

Can I integrate airSlate SignNow with other software for my 8938 Form?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, allowing you to streamline your workflow when completing the 8938 Form. This integration capability can enhance efficiency by connecting your eSigning process with your existing systems.

-

How secure is airSlate SignNow when handling my 8938 Form?

airSlate SignNow prioritizes your data security with robust encryption and compliance with industry standards. When you use airSlate SignNow to manage your 8938 Form, you can be confident that your sensitive information is protected.

-

Can I access my completed 8938 Form from anywhere using airSlate SignNow?

Absolutely! airSlate SignNow is a cloud-based solution, which means you can access your completed 8938 Form from any device with internet connectivity. This flexibility allows you to manage your documents anytime, anywhere.

Get more for 8938 Form

- Chm form

- Spousal accident disability form

- Program intake formspecial education complete all

- C ampamp a intake form 5818docx

- Joinpediatric orthopaedic society of north america posna form

- Regapp 0130 121117 auth rep form for appeals

- Cryotherapy insurance application rhodes risk form

- 59206optum oncology enrollment form

Find out other 8938 Form

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document