Form 709 1993

What is the Form 709

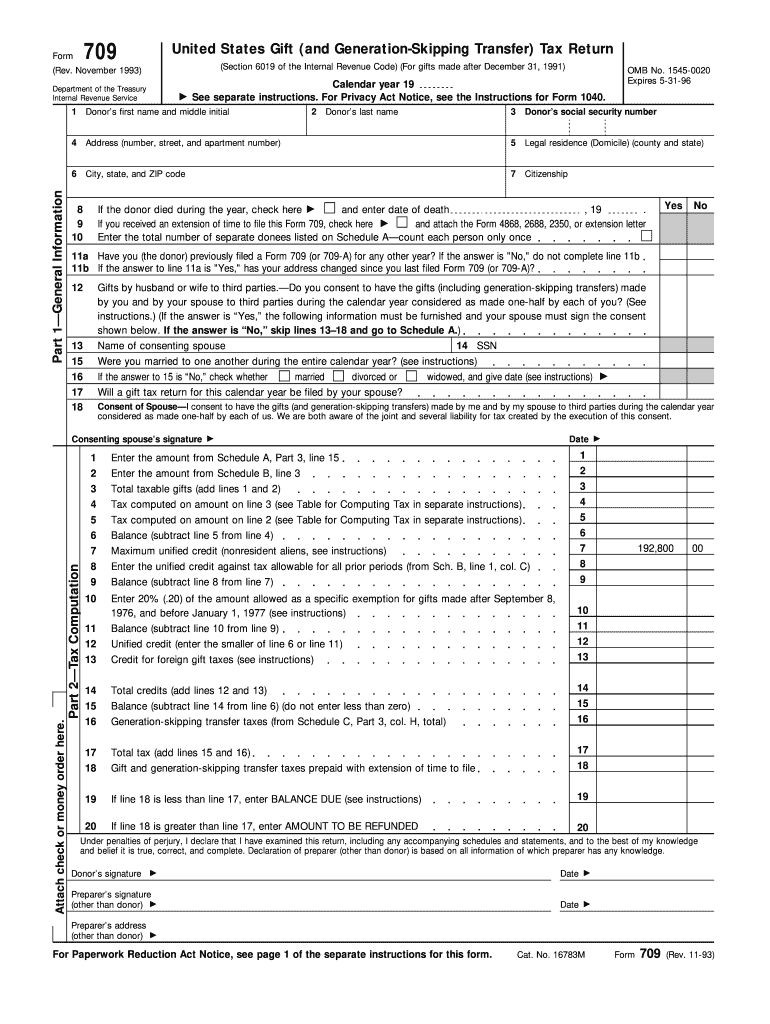

The Form 709, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax document used to report gifts made by an individual during a calendar year. This form is essential for individuals who give gifts exceeding the annual exclusion amount, which is set by the IRS. The form helps the IRS track taxable gifts and ensures compliance with federal tax laws regarding gift taxation.

How to use the Form 709

To use the Form 709 effectively, individuals must first determine if their gifts exceed the annual exclusion limit. If so, the form must be completed and filed with the IRS. The form requires detailed information about the donor, recipient, and the nature of the gifts. It is crucial to accurately report all gifts to avoid penalties and ensure proper tax treatment.

Steps to complete the Form 709

Completing the Form 709 involves several steps:

- Gather necessary information about the gifts, including their value and recipients.

- Fill out the donor's information, including name, address, and Social Security number.

- Detail each gift on the form, specifying the recipient and the fair market value at the time of the gift.

- Calculate any applicable exclusions and exemptions.

- Sign and date the form before submission.

Legal use of the Form 709

The legal use of the Form 709 is governed by IRS regulations. Properly completed, the form serves as a declaration of gifts and ensures compliance with federal tax laws. It is essential to file the form by the due date to avoid penalties. The IRS requires that all gifts be reported accurately, and failure to do so can lead to legal consequences.

Filing Deadlines / Important Dates

The Form 709 must be filed by April fifteenth of the year following the year in which the gifts were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to keep track of these deadlines to avoid late filing penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

The Form 709 can be submitted to the IRS through various methods. While electronic filing is not available for this form, it can be mailed directly to the appropriate IRS address based on the donor's location. It is advisable to send the form via certified mail to ensure it is received by the IRS. In-person submission is not typically an option for this form.

Quick guide on how to complete 1993 form 709

Effortlessly Prepare Form 709 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Handle Form 709 on any device using airSlate SignNow’s Android or iOS applications, and enhance any document-driven workflow today.

How to Alter and eSign Form 709 with Ease

- Obtain Form 709 and click Get Form to initiate the process.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and eSign Form 709 to guarantee remarkable communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1993 form 709

Create this form in 5 minutes!

How to create an eSignature for the 1993 form 709

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 709 and why do I need it?

Form 709 is the United States Gift (and Generation-Skipping Transfer) Tax Return, used to report gifts made during the tax year that exceed the annual exclusion amount. If you're gifting signNow assets, understanding how to complete Form 709 is crucial to comply with tax regulations and avoid penalties. Using airSlate SignNow can simplify the eSignature process for Form 709, allowing you to send and sign documents securely.

-

How does airSlate SignNow help with Form 709?

airSlate SignNow offers an easy-to-use platform that allows you to fill out, send, and eSign Form 709 efficiently. With its intuitive interface, you can manage your documents from anywhere, ensuring that your gift tax returns are submitted accurately and on time. This streamlines the process, making tax compliance much more manageable.

-

Is there a cost associated with using airSlate SignNow for Form 709?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost depends on the features you choose, but the platform is designed to be cost-effective while providing full functionality for handling documents like Form 709. Check our pricing page for more detailed information about the plans.

-

Can I integrate airSlate SignNow with other software for Form 709 management?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, such as CRM systems and cloud storage services. This means you can easily manage Form 709 alongside your other business operations, enhancing workflow efficiency and document organization.

-

What security measures does airSlate SignNow have for Form 709 documents?

Security is a top priority for airSlate SignNow. We employ robust encryption protocols and secure cloud storage to ensure that your Form 709 documents are protected from unauthorized access. You can confidently eSign and share sensitive information without compromising data security.

-

Can I customize Form 709 templates in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize templates for Form 709, making it easier to reuse the document for future tax years. Custom templates help streamline the eSignature process, saving you time and ensuring consistency in your filings.

-

What devices can I use to complete Form 709 with airSlate SignNow?

airSlate SignNow is compatible with a wide range of devices, including desktops, tablets, and smartphones. This flexibility allows you to complete and eSign Form 709 anytime, anywhere, making it convenient for users on the go.

Get more for Form 709

- 701 n cass st jefferson texas 75657 hha 903 742 4139 fax form

- Meningitis immunization request for extension form meningitis immunization extension

- Impact mobile ail form

- Welldynerx prior authorization form

- Claim inquiry form

- Patient medical record doctors community hospital lanham md form

- Medical records firelands regional medical center form

- The personal information sheet is used to obtain information necessary to establish an appointment with

Find out other Form 709

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer